Investment views

This is a tale of Davids and Goliaths

Bloated merchant acquirers face disruption in the Brazilian market spac

- Cielo and Rede have dominated the Brazilian merchant acquiring industry for years

- These two Goliaths have exploited their duopoly by overcharging and underserving merchants

- Brazilian merchants have thus generally preferred cash over cards

- Government levelled the playing field by removing card exclusivity rights

IN THIS STORY, the Goliaths are Cielo and Rede, two companies that have enjoyed and abused a cosy duopoly in the Brazilian merchant acquiring* space.

The first giant, Cielo, enjoyed exclusive rights to process Visa cards, while the second giant, Rede, had exclusive rights to process MasterCard.

Cielo is jointly owned by Banco do Brasil and Banco Bradesco (the largest and fourth-largest banks in Brazil, respectively), while Rede is majority owned by Itaú Unibanco (the second largest), which further cemented their position of strength. Together the two companies enjoyed a 90% market share of the merchant acquiring market in Brazil.

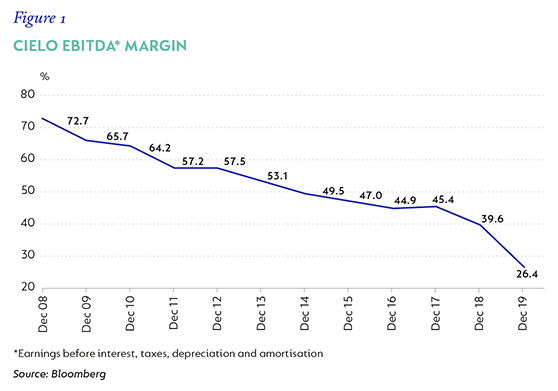

Like all bullies, they didn’t play fair – both exploited their exclusivity by charging merchants extortionate fees while delivering very little value to their clients. As a listed company, Cielo was a market darling, as its extremely high margins resulted in strong returns for shareholders (Figure 1).

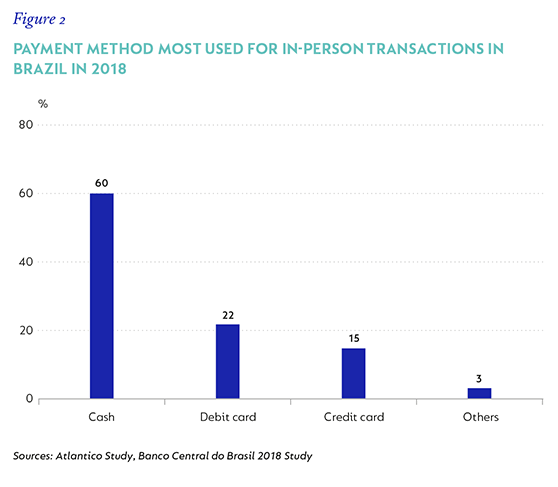

Cash has always been the preferred means of payment in Brazil, and under the reign of Cielo and Rede, there was little incentive for merchants to encourage the use of cards instead. All-in fees for accepting card payment were extremely high, and merchants had to lease or purchase the point-of-sale device from the merchant acquirer at a further cost. In fact, they had to lease or purchase two point-of-sale devices – one from Cielo and one from Rede – if they wanted to accept both Visa and MasterCard.

OTHER HEADWINDS

The structure of the Brazilian card market is a further prohibiting factor to card acceptance. In most countries, the merchant acquirer settles the transaction within 48 hours, while in Brazil, card transactions are only settled after 30 days. Furthermore, due to consumer affordability constraints, the Brazilian market has evolved to allow payments in interest-free instalments for everything from clothing to fuel to white goods. The merchant may tier its pricing to compensate for the implied financing it is offering the client, but this places a substantial working capital burden on the merchant who sells a product today and may only receive full payment in 12 months.

Together, these anomalies have caused a general reluctance to accept cards and, as a result, card usage has remained extremely low in Brazil, with credit card usage particularly low (Figure 2).

TOPPLING THE GIANTS

To foster competition in the merchant acquiring sector, the Brazilian government put an end to these exclusive rights in July 2010. This paved the way for the emergence of new competitors and enabled a rapid disruption of the status quo. New entrants have succeeded by solving many of the pain points of accepting cards – high fees, poor service and a large working capital outlay.

We own two of these new competitors, the Davids in this story, Stone and PagSeguro. Stone was founded in 2012, and primarily targets the small, medium and micro enterprise (SMME) market in Brazil. The company’s key selling point at launch was a better quality (and cheaper) point-of-sale device (that accepted both Visa and MasterCard), lower merchant discount rates and superior service levels. Merchants are serviced via hubs located around the country, staffed by Stone agents. Besides better service, Stone’s key differentiator is the software add-ons that merchants can use for order and sales management, invoicing, inventory management, cash and payments management, customer relationship management, logistics and e-commerce integration. Instead of merely facilitating payments, Stone’s offering empowers businesses to perform better and enables all-important e-commerce integration.

Stone also prepays the yet-to-be-received instalments to the merchants at affordable funding rates, and merchants can elect to have transactions settled immediately rather than only after 30 days, allowing businesses to manage their cash flow and grow faster. At the same time, this provides a valuable and risk-free revenue stream for Stone, which has the balance sheet to fund this prepayment.

PagSeguro entered the micro-merchant space in 2013 with a similarly differentiated approach. Its proposition is a very simple and affordable point-of-sale device, with transparent and standardised pricing for all clients. PagSeguro’s offering is entirely digital, and all processes are standardised, allowing the company to keep costs low and hence offer compelling pricing to clients. This has allowed micro-merchants to accept card payments at a reasonable cost. PagSeguro also prepays the instalment sales and offers merchants immediate settlement to assist them with cash flow.

There is some risk that the structure of the market changes to a shorter settlement period, removing an important revenue source for both companies; however, we believe that merchant discount rates would increase to compensate, converging with the rate they currently charge for immediate settlement.

INNOVATION AND AGILITY

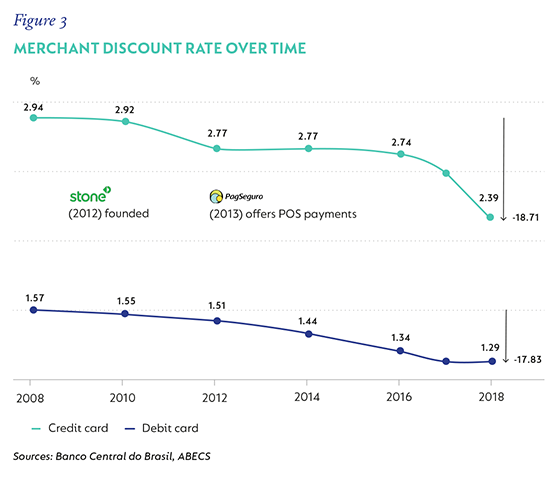

Both Stone and PagSeguro were able to gain market share quickly as a result of their differentiated propositions and their lower pricing, which has resulted in a reduction of the merchant discount rate for the country as a whole (Figure 3).

As they’ve grown, they’ve also evolved to offer more services to enhance customer stickiness. Stone recently launched a basic banking product enabling electronic transactions, bill payments, and cash in and out, as well as working capital loans. As of 30 June 2020, 48% of Stone’s merchants had subscribed for a bank account and 9% for credit. Stone continues to add software capabilities it believes will help clients, and the company is the preferred bidder for Linx, Brazil’s largest software company, specialising in omnichannel retail.

PagSeguro launched PagBank, a full-spectrum digital bank, to enhance its ecosystem. The bank has proved immensely popular, and the take-up by both merchants and external consumers has been impressive. PagBank has already amassed 4.9 million customers since launch a year ago.

TOO LITTLE, TOO LATE

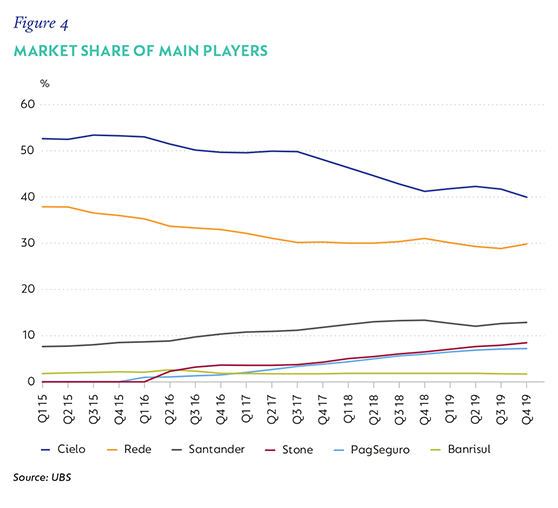

The primary incumbents (Cielo and Rede) are now left with a conundrum. They previously each enjoyed a monopoly over their card network and hence had no need to invest in product or innovation or service. Their cost bases became as bloated as their revenue bases. As a result, they are now in a position where they cannot afford to cut pricing. They are also owned by their respective banks and hence do not offer the entire ecosystem of acquiring, banking and credit, as this would result in them competing with their parents. These companies have realised too late that it’s better to disrupt yourself than be disrupted by others. Cielo, in particular, has been slow to improve its offering and has lost substantial market share (Figure 4).

Stone and PagSeguro’s runway for growth is extremely long. They are well positioned to continue taking market share from the two incumbents. More importantly, the pie is also growing quickly. Card usage remains low in Brazil, but accelerated due to Covid-19 when a large proportion of personal consumption expenditure moved online – a habit we believe will continue even after the pandemic. We believe that the cash-to-card conversion is set to accelerate further, providing a structural tailwind for both these companies.

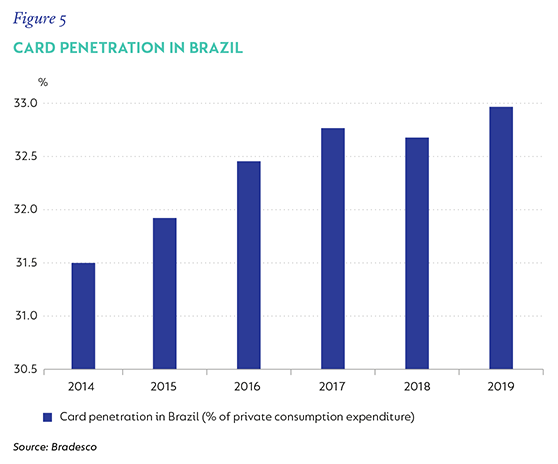

Our estimates assume that card penetration will increase from 33% to 56% over the next 10 years (Figure 5).

Consequently, we are excited about the prospects for these two companies, which are managed by smart and innovative teams. Both shares have performed well over recent months; however, we believe that they remain attractively valued over a longer-term horizon.

We feel that the market is overlooking the strength of their ecosystems and the length of their runways for growth. As such, we are confident that these Davids will topple the two Goliaths of Brazil’s merchant acquiring industry.

* These enable retailers to accept card payments.

Disclaimer

United States - Institutional

United States - Institutional