The Fund declined by 17.3% in US dollars in the second quarter of 2022 (Q2-22). There were several drivers behind this very disappointing performance, including weak global equity markets (the MSCI World Index was down 16.2% in US dollars in the quarter) as the world continues to grapple with elevated inflation, impacting consumer confidence and leading to elevated recession risks.

We are acutely aware of the more recent poor absolute returns generated by the Fund, but we believe that the collection of assets it holds still offers extremely compelling long-term, risk-adjusted returns with which to deliver on its goal of compounding capital well ahead of inflation. It is worth noting that, in order to deliver on this long-term goal, investors in the Fund can expect periods of underperformance as has been the case before. And often these periods of underperformance are followed by periods of significant outperformance. With this in mind, the Fund’s weighted average equity upside is currently 114%, which is one of the highest levels since inception nearly 23 years ago. Using the rand-denominated Fund’s long-term track record (expressed in US dollars) as proxy*, the portfolio has generated a flat return of -0.3% per annum (p.a.) over five years, 3.7% p.a. over 10 years, and 7.7% p.a. since inception over 20 years ago.

There is an evident level of fear in the market today, driven by increasing uncertainty of the future and rampant inflation across the world, especially developed countries where inflation hasn’t been experienced at these levels in decades. In environments such as these, it becomes even more important to ensure your investments generate real returns to protect your purchasing power. While equities have performed poorly in the short term, they remain a critical tool in generating inflation-beating returns against this backdrop of higher inflation. However, the need to be selective becomes even more important, and we think the current environment is well suited to stock picking. This is further supported by the fact that synchronised selling frequently occurs in times of stress and often provides very attractive opportunities, as it rarely makes sense for the value of all businesses to move in sync.

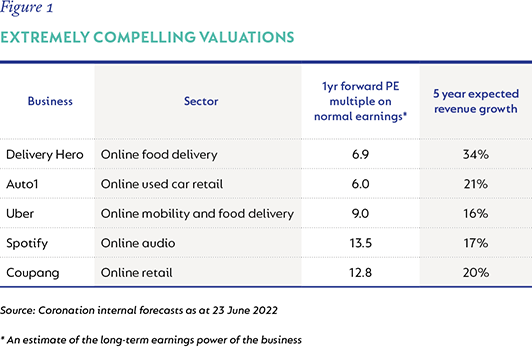

The Fund is positioned to take advantage of this environment with exposure to a broad array of what we deem very attractive assets, with us (more recently) buying lossmaking long duration stocks. As such, exposure to these assets moved from 4.6% of Fund in March 2022 to 10.1% of Fund at the end of the quarter, and 11.6% at the time of writing. Examples of businesses in this category (that are owned by the Fund) are trading at extremely compelling valuations in our view, as shown in Figure 1.

During the quarter, the largest positive contributors were Naspers (+23%, 1.09% positive impact), JD.com (+14%, 0.62% positive impact), and a collection of index put options (collectively +1.33% positive impact). The largest negative contributors were Amazon (-35%, 1.03% negative impact), AngloGold (-38%, 0.97% negative impact) and SA government bonds (-16%, 0.96% negative impact).

Amazon came under pressure as growth in the retail business slowed, but off what can be considered a high base, along with operational missteps by management overestimating their fulfilment capacity needs, leading to excess costs which has pressured retail margins. While operational mishaps are always disappointing, the Amazon management team has a long-term track record of exceptional execution, and after having acknowledged these mistakes, they are actively correcting for them. We therefore do not feel the long-term earnings power of the business has been impacted, yet the share price has meaningfully corrected, providing us with a buying opportunity. Amazon now trades on ~26x 2023 earnings if you normalise retail margins – this is compelling in our view as the cloud business remains in rapid growth mode, with only ~30% of IT workloads having migrated to the cloud. We believe little value is being ascribed to the core retail business after its operational missteps.

The Fund ended the quarter with 75% net equity exposure, slightly lower than the prior quarter end as our put option protection reduced equity exposure. The put option protection at time of writing was 11.9% of Fund (effective) which is at the high end of where it has been historically given the above-normal risks and a resultant wider range of potential outcomes in the world right now.

Our negative view on global bonds remained unchanged, but as rates have begun to rise, opportunities are emerging. We still do not feel that they look attractive yet, and do not compensate you for the risks undertaken, which are increasing due to inflation and rising interest rates. However, we continue to hold SA government bonds that now represent 6.3% of Fund. Our view on the SA fiscal situation has improved somewhat. Coupled with the fact that we are receiving a ~11% yield on these bonds, this is attractive in our view. Furthermore, considering that inflation within SA remains relatively lower vs that in the developed world, the real yields of SA government bonds are amongst the highest in the world.

The Fund continues to have a physical gold position of 3% and a 1.8% holding in AngloGold Ashanti, amounting to a total gold exposure of just under 5%. The gold price is up 3% in USD for the first half of the year, and we continue to hold the position for its diversifying properties in what we characterise as a low visibility world with increasingly visible inflation and geopolitical risks. AngloGold Ashanti has given back some of its strong gains from the first quarter and remains attractive due to the likelihood of operational improvements under the newly appointed CEO. This should lead to improved business performance, with the business trading on a 7x PE. The balance of the Fund is invested in cash, largely offshore.

Notable increases in position sizes (or new buys) during the quarter were Uber (online taxi/food delivery), Adyen (fintech payment) and Nvidia (semiconductor), thus largely focused in the areas of the market that have been hit the hardest and where we are now finding some of the best value.

Uber is a business that most consumers have interacted with due to its provision of high-frequency services such as ride hailing and food delivery. The business IPO’d in May 2019 and currently trades 45% below its IPO price. Revenue is up more than 2 times since then, but Uber has been notorious for its inability to generate sustainable profits and free cash flow. We feel this is changing, with the ride hailing business now consistently profitable, with further upside expected as they leverage the significant driver supply investments made in the past 12 months, along with the food delivery business heading towards profitability. We therefore expect both the profitability and free cash flow of Uber to inflect in the next 12-18 months, with management explicitly focusing on this as well. We also believe the business inherently has high incremental margins, due to its ability to grow without material further investments in its fixed cost base. As indicated above, if you consider the normalised earnings power of the business, its valuation is extremely compelling.

Adyen is a payment business that effectively solves the problem of merchants having to deal with multiple different payment options both online and offline. They provide a unified solution whereby the merchant can accept a vast array of different payment methods without any complexity or having to deal with multiple parties. This results in higher payment completion rates (and revenue for the merchant) which drives merchant loyalty, resulting in Adyen having an annuity-like revenue stream. The business was founded in 2006 and over the past 16 years has amassed significant scale processing over EUR600bn in annual payment volumes today. This scale has allowed them to generate very healthy EBIT margins of ~60%, which should move higher over time due to the high incremental margins the business generates, along with increasing scale benefits. Its share price is down ~45% from its peak, providing us with a compelling opportunity to buy into a business that we feel offers both an attractive valuation and significant long-term growth potential as the transition away from cash continues and merchants look for simple solutions to service the multitude of digital payment methods proliferating across the world.

Nvidia is a semiconductor design business that initially rose to prominence due to their gaming computer chips but has also become integral to the high-performance computing industry with their chips powering a large proportion of data centres running compute-intensive applications. Nvidia has also developed a software ecosystem which runs on their hardware, both improving the performance of their hardware solutions and enabling them to deliver a differentiated and hard-to-replicate product. The business is a critical enabler of the continued digitisation trend, which is structurally supported by mega trends such as the continued proliferation of AI within computing applications. We have followed the business for many years, but its valuation has always been the constraining factor in making an investment. However, Nvidia’s share price has halved from its peak, with its valuation now being more compelling at 25 times forward earnings for a business that should exhibit long duration growth, with a competitive position that is incredibly difficult to dislodge.

There remains an elevated number of unknowns today compared to the past due to a potential structural change in inflation rates across the globe, along with geopolitics bringing about another element of risk. We remain aware of these risks, and they are factored into our portfolio construction, but the primary focus remains bottom-up analysis of individuals businesses. Against this uncertain backdrop, we remain positive on the outlook for the Fund, which has been built bottom up, with a collection of attractively priced assets to provide diversification to achieve the best risk-adjusted returns going forward in a variety of future scenarios.

*Note that this is a new fund and as such does not yet have a track record for the relevant periods. As it is the dollar-denominated version of the same investment strategy deployed historically in the management of the rand-denominated Coronation Global Optimum Growth ZAR Feeder Fund, we show the track record of the latter portfolio, converted to US dollar, to indicate historical results achieved by the strategy.

Disclaimer

South Africa - Personal

South Africa - Personal