Personal finance

Are you taking the risk you ought to take in retirement?

And why it is not too late to remedy?

The Quick Take

- The great derisking trend in the SA living annuity book has slowed down thanks, in part, to better returns from growth assets in recent years

- But many retired investors remain under-allocated to the level of growth assets we believe they ought to own

- If left unchecked, this can have a profound impact on long-term outcomes

- The good news is that it is not too late to rerisk into an appropriately balanced portfolio of income and growth assets

The most counterintuitive aspect of investing after your retirement date is that you need to take meaningful market risk (through exposure to growth assets such as equities) to manage certain other risks (such as inflation or outliving your accumulated capital). At the same time, you need to avoid introducing too much risk exposure into your portfolio to avoid unwanted levels of volatility, so an appropriate balance between income and growth asset exposure needs to be struck.

However, a significant portion of the South African living annuity book remains under-allocated to the level of growth assets that we believe these investors ought to have. We explain why this is problematic, but not too late to remedy, and offer a solution with which living annuitants can avoid having to make the derisking/rerisking decision themselves in future.

HOW DID WE GET HERE?

In the mid-2010s (post Nenegate), South African investors were faced with three conflicting experiences:

- Local equities were underperforming, meaning that taking risk was not directly resulting in higher returns over the short term;

- Cash rates were relatively high, meaning that one could achieve inflation-beating returns without taking risk (through exposure to growth assets); and

- The yield curve of the South African bond market was flat, resulting in a significant yield pick-up without having to take much risk.

As a result, over a number of years, income funds (that invest in cash and/or bonds) performed better than the lower risk multi-asset class portfolios (often referred to as income and growth funds) that we believe are more appropriate for most investors who draw their post-retirement incomes from a living annuity product.

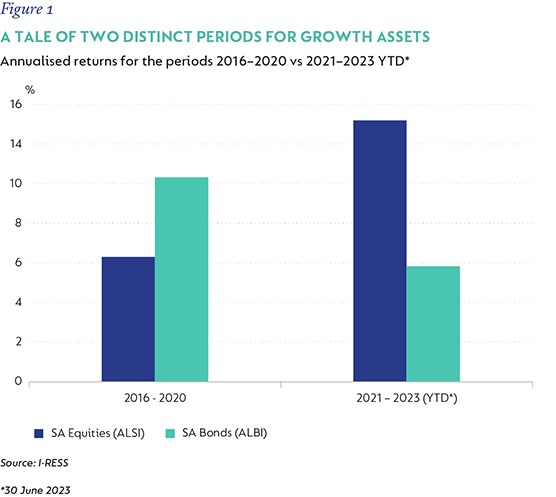

When investors became disillusioned with the poor performance from the growth assets in their retirement portfolios (as demonstrated by the annualised asset class returns for equities between 2016 and 2020 in Figure 1 below), they embarked on a mega derisking trend from the mid-2010s up until the early 2020s whereby they switched out of conservative multi-asset class funds aimed at retirees (such as Coronation Capital Plus and Coronation Balanced Defensive) and into fixed income funds (such as Coronation Strategic Income).

Around the height of the Covid-induced market sell-off early in 2020, we argued that “the derisking trend favoured by many South African investors can have a profound impact on long-term investment outcomes if left unchecked. By moving their portfolios out of multi-asset funds and into low-risk cash-heavy alternatives, investors have effectively assumed the asset allocation responsibility themselves. This means that they need to make the second leg of the timing decision – when to rerisk – themselves.” (Source: Beyond 2020: Investing through unsettled times, a special edition of our Corolab Investment Guide, published in July 2020.)

Fast-forward to 2023 and the lower-risk multi-asset funds have now meaningfully outperformed investors’ forward-looking return expectations thanks to the improved returns from growth assets in recent years. In turn, the actual returns from income funds meaningfully underperformed investors’ expectations (see Figure 2 below).

And, while the recent better returns from growth assets have staunched the outflows from moderate risk portfolios, by our calculations there remains approximately R200 billion of living annuity capital that is under-allocated to risk, which includes being significantly under-allocated to offshore exposure.

WHY IS THIS PROBLEMATIC?

In order to manage risks such as inflation or outliving your capital in retirement, investors need to ensure that their future income streams can keep pace with the general increase in prices over an extended period of time. One of the best ways to do this, as we have argued on many occasions before, is to have adequate exposure to growth assets in your retirement funding portfolio.

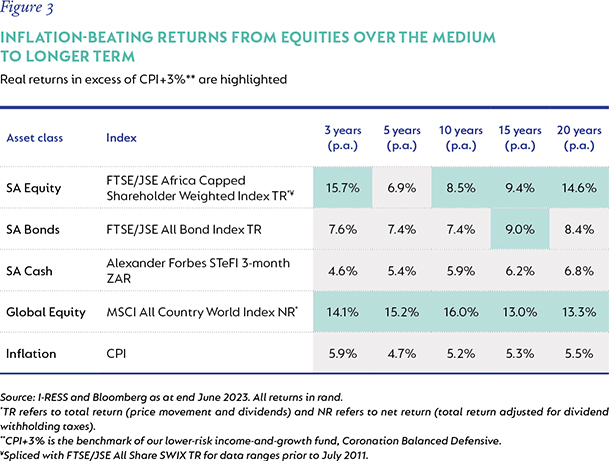

While it may sound (and feel) sensible to avoid all risk by investing very conservatively in cash or near-cash instruments, especially during times of heightened uncertainty, funds that only invest in these assets are not a suitable solution for investors requiring income over the medium to longer term as they do not provide appropriate inflation protection. This is evident from relative asset class performance over the more recent and longer-term periods (see Figure 3 below).

Over time, the most efficient asset class with which to achieve inflation-beating returns in your post-retirement portfolio remains equities. And in an environment where domestic inflation is moderating at a slower pace than that of our global peers, you want to have exposure to the equities of both international and domestic businesses with pricing power.

Furthermore, as our economist Marie Antelme argues in her latest economic outlook (South Africa’s inflation outlook remains challenging), we believe that the post-pandemic dynamics in our domestic economy pose a range of home-grown risks to the outlook for inflation.

And while it shouldn’t be your base case, one cannot fully ignore the possibility of a major inflation shock given South Africa’s idiosyncratic challenges. Taking a leaf from history, in the event of extreme increases in inflation, it is equity markets1 (not bonds or cash) that have proven to provide the best protection (as was the case in Germany’s Weimar Republic post-WW1).

For South African investors this means that you need meaningful exposure to growth assets (both select domestic and global equities) in your post-retirement portfolio that offers diversification and hedging qualities against sticky inflation in an almost no-growth environment.

SO HOW DO INVESTORS UNDER-ALLOCATED TO RISK ASSETS REMEDY THEIR SITUATION?

Over the long term, one of the most robust approaches to protecting your purchasing power throughout retirement remains investing in a well-diversified multi-asset portfolio with adequate exposure to growth assets while emphasising downside protection in times of market stress. The purpose of following this strategy is to remove the need for investors making the derisking/rerisking decision themselves.

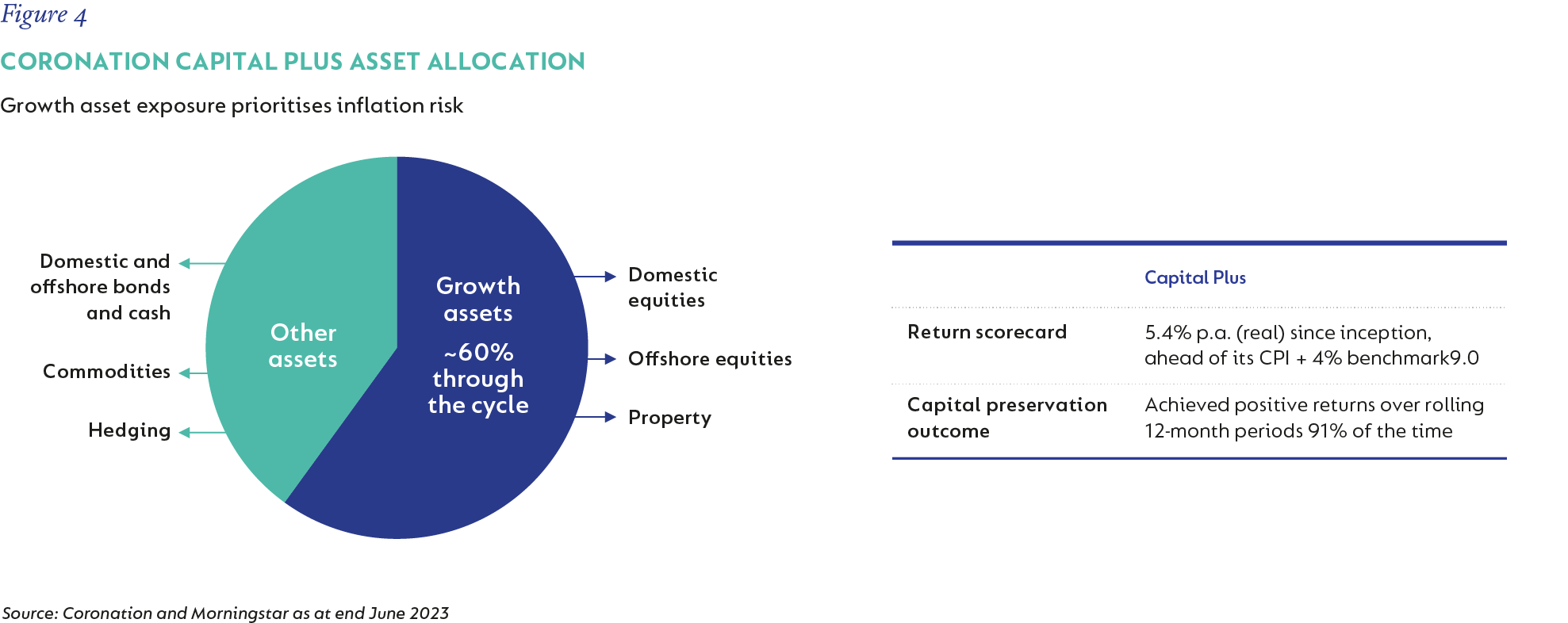

For the past 24 years, Coronation Capital Plus has generated meaningful long-term investment growth (5.4% real since inception as at end June 2023), through appropriate (yet mindful) exposure to growth assets while enabling its investors to withdraw a sustainable income drawdown.

As a demonstration of its dual focus in action, the Fund has reduced its risk asset exposure since the beginning of the year in favour of interesting opportunities in the global income space and near-dated domestic cash instruments that help to increase liquidity in the Fund and manage downside risk.

BUT IS IT TOO LATE TO RERISK TOWARDS MORE APPROPRIATE LEVELS OF RISK EXPOSURE?

We don’t believe it is too late for post-retirement investors to rerisk even after a period of good outcomes from growth assets. As we explained above, we effectively make the asset allocation decision on investors behalf in an actively-managed multi-asset class portfolio such as Coronation Capital Plus.

We make asset allocation and instrument selection decisions in the Fund based on relative valuation levels. For example, we continue to find very attractive opportunities in equity markets both in SA and abroad. Based on our assessment of fair value for the underlying shares in the portfolio, we expect double-digit returns in rand across a diversified basket of local and global equities over the next three to five years.

The Fund also maintains a healthy exposure to offshore assets (at 38.9%) as we continue to recognise select attractive investment opportunities in global equity and bond markets. This is despite global equity indices having performed very strongly at an overall level, thinning the air for further gains from this point. As such, we have increased the Fund’s put protection against global equities. In the global bond space, we continue to pick up our allocation to specific corporate bonds where yields are appealing. We have a well-diversified basket of holdings, limiting the risk of single-name exposure.

The Fund returned 17.7% over the past year and we remain confident that it is well positioned to deliver on its medium-term objective of beating inflation by at least 4% per year while taking less risk than the average balanced fund.

Read more about finding the right mandate for your post-retirement investment needs in our Corolab Investment Guide or watch this video about Coronation Capital Plus.

*Government bond holders were wiped out by hyperinflation in less than three years (by 1925, 2.5% of the value of bonds were reinstated). In turn, the German stock market increased significantly during hyperinflation, with equities increasing in value by approximately 3.5 times (measured in USD), according to JP Morgan estimates.

Disclaimer

SA retail readers

South Africa - Personal

South Africa - Personal