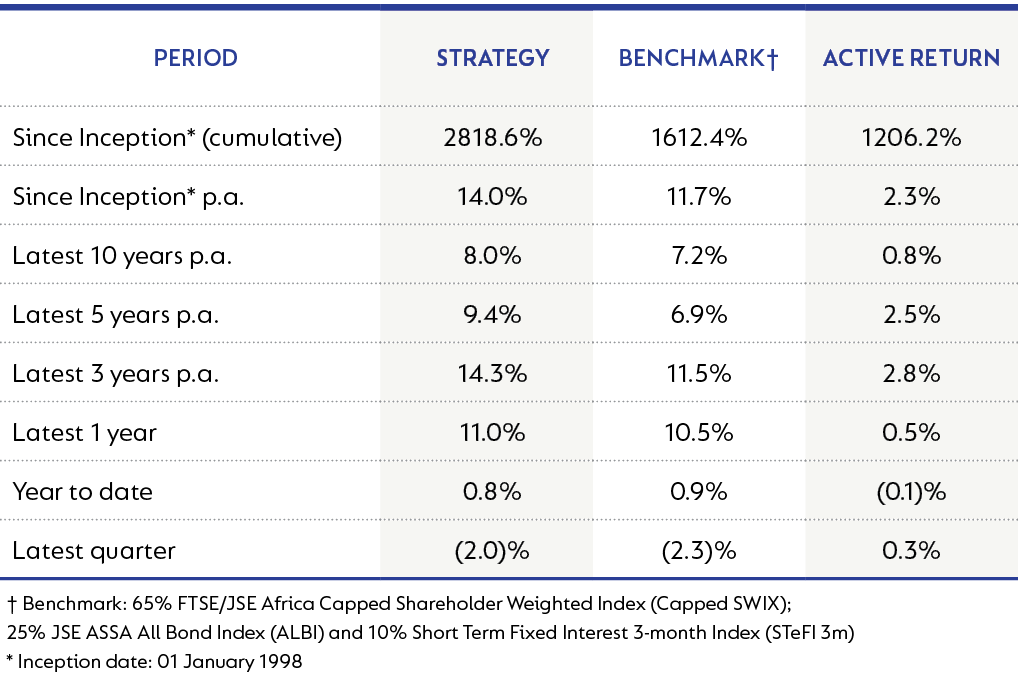

The Strategy returned -2.0% for the quarter (Q3-23), resulting in a return of 11.0% over the last year. The Strategy has performed well against its peer group over all meaningful time periods.

After a strong start to the year, global markets retreated in Q3-23, with the MSCI All Country World Index down -3% (+10% year-to-date [YTD]). The S&P 500 Index similarly declined -3% for the quarter (+13% YTD). US demand remains resilient, supported by robust employment and household savings buoyed by Covid stimulus. This has cushioned the pressures of higher inflation and interest rates, enabling the economy to shrug off recessionary threats thus far.

The Strategy’s performance as at 30 September 2023 is shown below:

Despite the committed efforts of central banks, inflation looks set to remain higher for longer. The oil price rose 27% during Q3-23, supported by demand resilience, Saudi Arabian production cuts and Russian oil export bans. The higher price will exacerbate inflation as it filters into transport and food costs. The renewed Israel-Hamas conflict could further affect oil supply and pricing. Expectations of interest rate cuts are being pushed into 2024. The Bloomberg Barclays Global Aggregate Bond Index declined -4% for the quarter (-2% YTD).

Geopolitical tensions remain high. The Russia-Ukraine crisis drags on with no resolution in sight. Following the quarter's end, what appeared to be easing Middle East tension was dealt a blow by Hamas’ significant attack on Israel. It is early days, and the longer-term consequences of this renewed conflict are as yet unknown.

In SA, the economic outlook remains poor, constrained by failing infrastructure, a thinning talent pool and rising costs of production. Lower levels of loadshedding are forecast for the coming months. This should bring some relief for businesses but is insufficient to materially change the muted growth prospects for the domestic economy. The FTSE/JSE All Bond Index delivered a return of -0.3% for the quarter (+1% YTD). We remain concerned about the sustainability of SA’s high sovereign debt level, given the poor fiscal outlook. Economic growth is weak while spending pressures remain elevated (rising debt service costs, wage increases, ongoing bailout of failing municipalities and state-owned enterprises, grants, etc.). Despite high government bond yields, the Strategy has an underweight position in SA government bonds. Part of the Strategy’s bond holding sits in inflation-linked bonds that offer protection against sticky domestic inflation. The weaker currency and higher oil price will worsen inflation further. In the face of the many domestic challenges, the currency weakened by -0.4% against the USD for the quarter (-10% YTD).

The FTSE/JSE Capped Shareholder Weighted Index declined -4% for the quarter (-0.3% YTD). Amongst the domestic asset classes, the Strategy favours SA equities that offer attractive return prospects and diversification away from a tough domestic economy (through a combination of non-SA exposure and strong domestic franchises). Strategy holdings include global stocks listed on the JSE and selected resources and domestic stocks. Domestic stocks offer good stock-picking opportunities but avoiding value traps is critical. Over the past six months, a slew of weak domestic results has illustrated the pain that comes when costs grow faster than the top line. We favour companies with strong business models that can grow faster than the underlying economy and can pass cost pressures on to customers.

The financial sector returned 2% for the quarter (+9% YTD). The Strategy has a sizeable holding in the banks with their low ratings and attractive high single-digit dividend yields. Recent bank results showed pleasing revenue growth from higher interest rates. Some of this benefit was offset by increased credit losses as pressure on consumers’ disposable income began to bite. We expect credit losses to stabilise as inflation subsides over the next 12 months. We continue to believe that banks with their low ratings and ability to grow their revenues in the mid-to-high single digits offer an attractive medium-term investment.

The resource sector was down -4% for the quarter (-14% YTD). Slower global growth and weaker-than-expected Chinese demand have fed into lower prices across most of the commodities basket. The Strategy cut its resources exposure meaningfully over the last two years as we exited PGMs and gold shares and took profits on the diversified miners. The long-term PGM outlook has deteriorated as electric vehicle adoption accelerates and local producers battle rising production costs. The underweight position in PGMs has benefited the Strategy, which continues to have no exposure to pure-play PGM producers. We don’t believe the ratings of the SA gold shares offer a sufficient margin of safety for the short-life, high-cost nature of their assets and have no exposure to gold miners as a result. This benefited the Strategy over the quarter but remains a detractor YTD. We remain constructive on energy markets where we expect tightness in the medium term as demand remains robust during the transition to lower carbon energy sources, and the lack of investment in new capacity over the last few years constrains supply. We have diversified our energy holdings across a global basket of names to reduce company-specific risk. Additional resource holdings include Mondi, Glencore and Anglo American. Mondi is a market leader in the paper and packaging sector with low cost, well-invested plants. The sector is benefiting from structural tailwinds, including ecommerce growth and an increased focus on sustainable packaging. Mondi is investing significantly into new capacity to take advantage of these factors and should grow strongly over the medium term. We added to the Mondi position during the quarter.

The diversified miners offer attractive free cash flow streams, even at more normal commodity prices, and we have maintained a holding.

The Industrials Index declined -6% for the quarter (+10% YTD). The Strategy’s core holdings include many of the global stocks listed in SA: Richemont, Aspen, Bidcorp, British American Tobacco and Anheuser-Busch InBev. Global luxury stocks sold off during the quarter amidst concerns about global growth and a slower Chinese economy. The Strategy used the weakness to add to its position in Richemont. Richemont has an enviable portfolio of luxury brands desired by consumers across the globe. Richemont’s branded jewellery offering is expected to continue gaining market share in high-end markets. The stock trades on an attractive mid-teen multiple with strong long-term prospects.

The Strategy has limited property exposure, preferring to use its risk budget in equities. The medium-term outlook for the sector remains constrained, given a weak economy, nodal decay, and cost pressures.

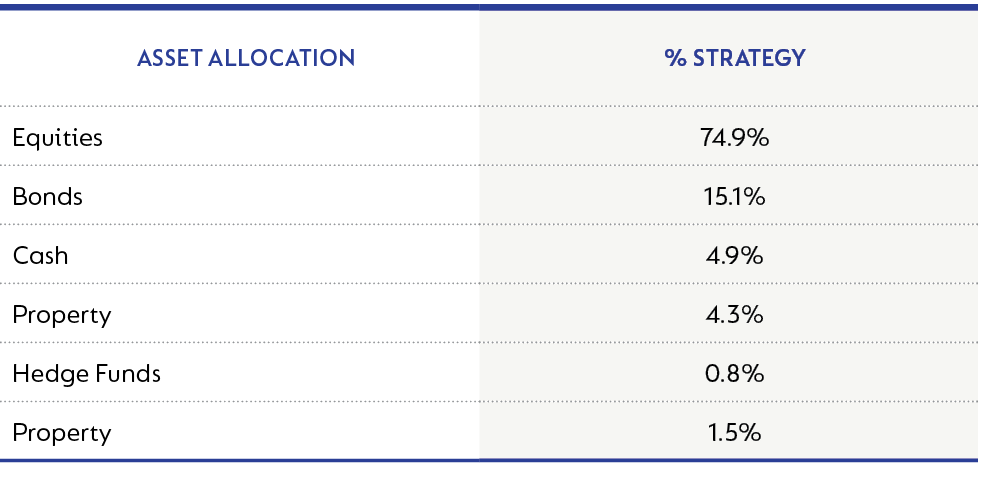

Our asset allocation as at 30 September 2023 is shown below:

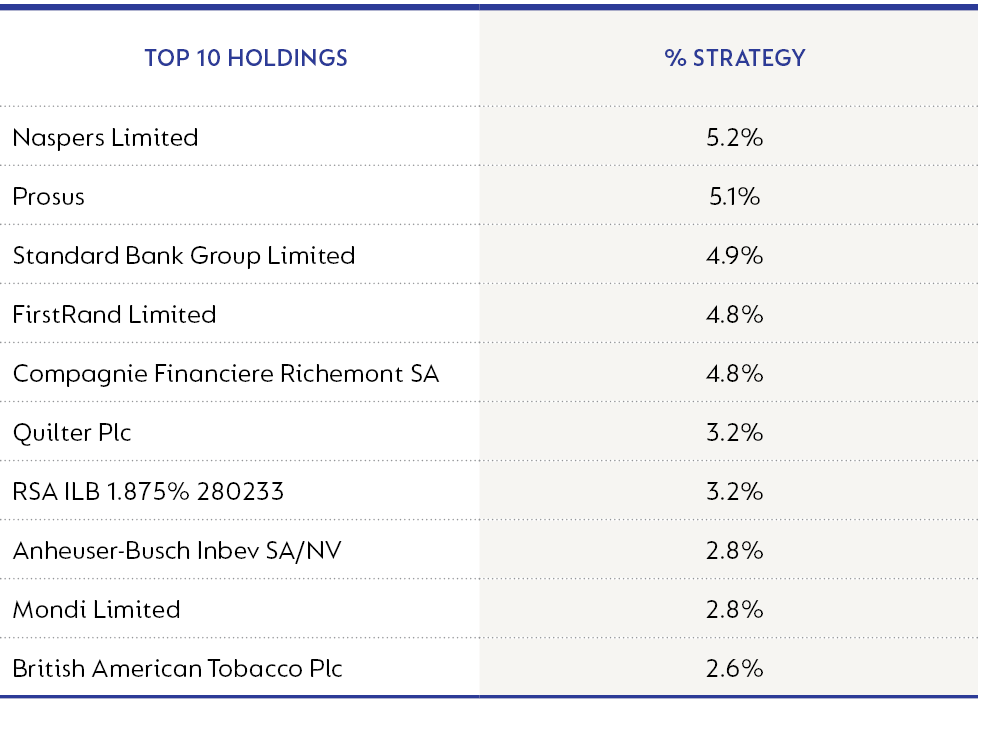

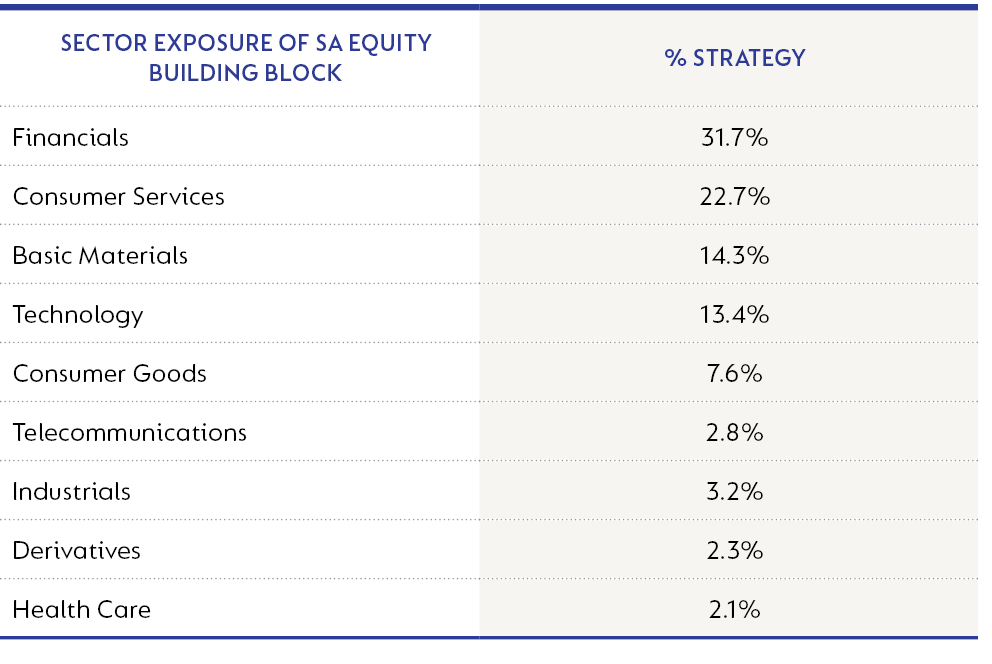

Our top 10 holdings and sector exposure as at 30 September 2023 is shown below:

While headwinds exist in global and domestic markets, we believe growth assets (enhanced by good stock picking) offer the best medium-term returns.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

United States - Institutional

United States - Institutional