Investment views

PSG – the makings of a long-term winner

“Playing the opening like a book, the middlegame like a magician, and the endgame like a machine” - Rudolf Spielmann, chess master

The Quick Take

- PSG Financial Services is a great business that has long looked expensive but has delivered for patient investors

- Outperformance has been driven by strong execution and consistent investment in key underlying businesses that have delivered good earnings growth

- Key group businesses – PSG Wealth and Western National – remain well positioned to continue delivering and building on the successes we have seen to date

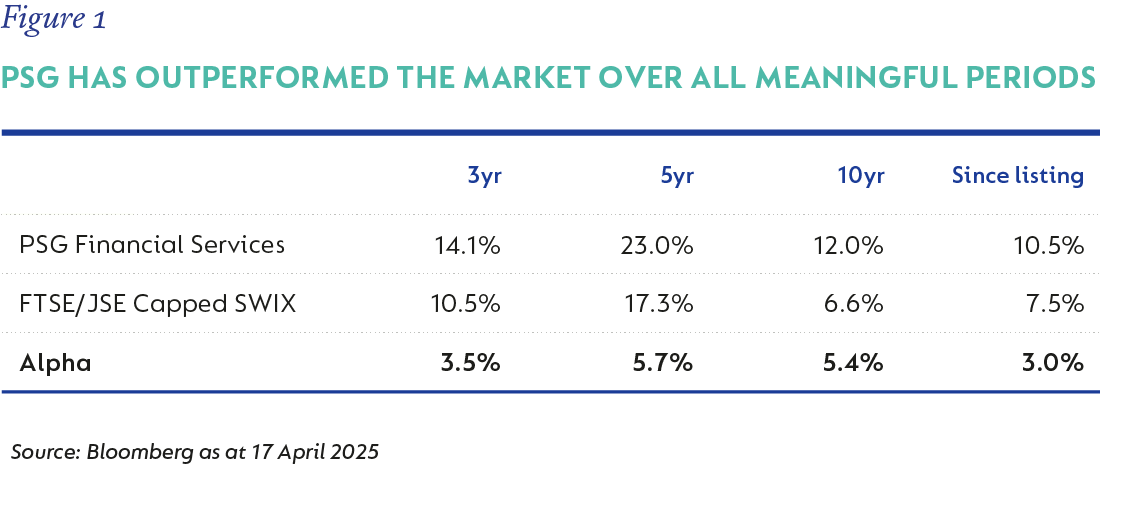

PSG Financial Services (PSG) is a great example of a long-term winner whose valuation has looked full[1] at almost any time over the last decade but has nonetheless done well for the patient investor (Figure 1) as it delivered growth underpinned by strong fundamentals.

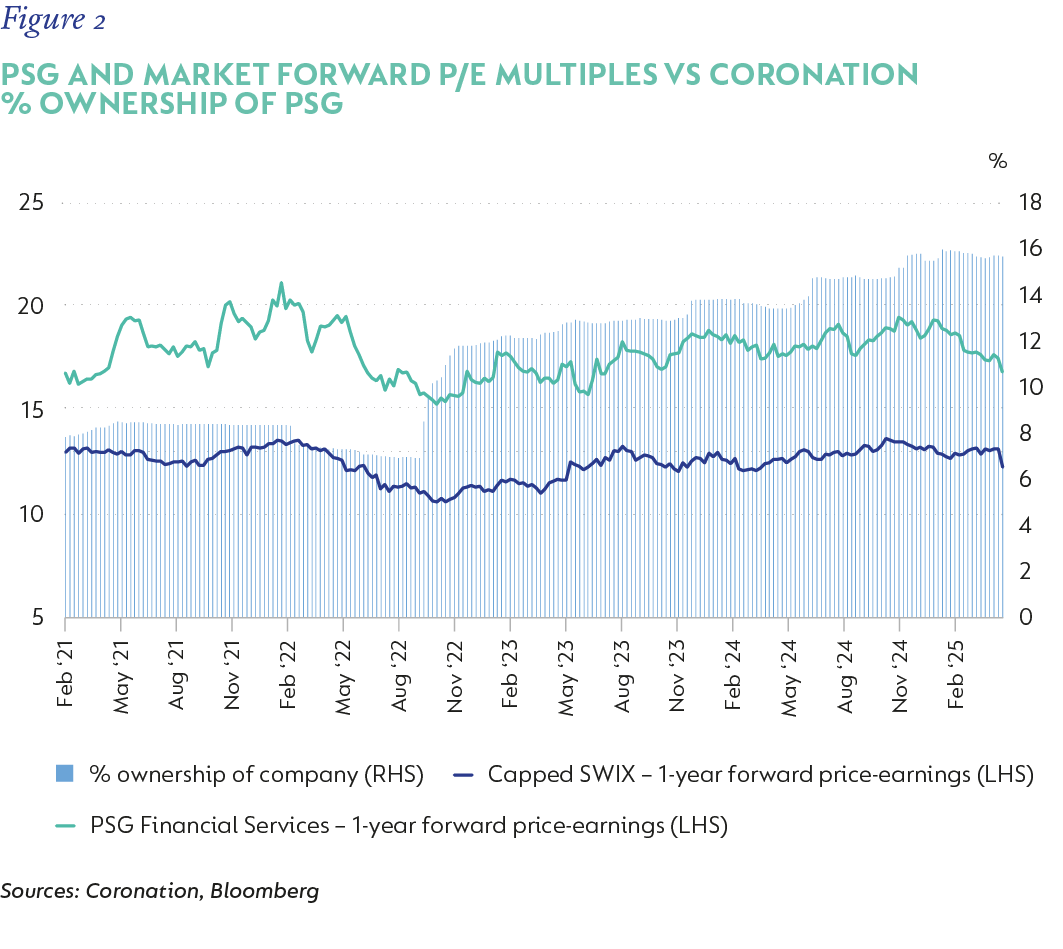

Even in recent years, forward price-earnings multiples looked expensive, trading at a notable premium to the market (Figure 2). Despite this, we have long liked and owned the company, meaningfully increasing our stake over the years. This is due to our conviction that the market has never fully appreciated the size and quality of the business PSG is set to become over time. Even on what looks like a full rating today, we believe it remains attractive and consider the c.16 times forward price-earnings multiple undemanding, given the size and durability of its long-term growth prospects.

THE NUTS AND BOLTS

PSG is an advice-led financial services group with operations in wealth management, insurance and asset management. Founded almost 30 years ago, it has grown a strong wealth management franchise in PSG Wealth; built well-regarded insurance operations (distribution and underwriting) in PSG Insure; and nurtured a respectable asset manager in PSG Asset Management.

Particularly noteworthy is its transformation and growth over the last decade. The current group CEO and CFO took the helm in 2013. They then embarked on a disciplined journey of cleaning up, institutionalising, investing in, resourcing, and strengthening the Group’s businesses. This process built strong franchises with favourable positions from which they can compete for long-term market share and win. A strong feature of the Group is outstanding senior leadership with the ability to think long-term. This is probably underappreciated but has been vital in ensuring exemplary execution over time. Shareholders have been richly rewarded in the process, and with management also benefitting through their long-term incentives and notable stakes in the business, they are closely aligned with shareholder interests.

Today, PSG is a high-performing company and its largest business – PSG Wealth – is extremely well positioned for superior long-term growth, arguably beyond our investment horizon. Complimenting this is a small but fast-growing underwriter in Western National – part of PSG Insure – whose growth and progress over the years have been impressive. Execution in both businesses has been strong, and we think their futures are bright.

THE JEWEL IN THE CROWN

PSG is all about PSG Wealth. At c.60% of current earnings, this is a business with an outsized share of the Group’s current and future fortunes. It enjoys an extraordinary set of circumstances that have supported its growth to date and should see it thrive further in years to come.

PSG Wealth is a respected wealth manager with the largest non-life/non-bank-tied wealth advisory force in South Africa (SA) and operates in a large and fragmented financial advisory market. It runs a time-tested revenue-sharing business model with its advisors. This respects their autonomy and allows them to build independently run advisory practices within the PSG stable. In addition, they benefit from the support of a strong centre that takes away the administrative burden of running advisory practices. This frees advisors up to do what they do best – serve clients well and grow their practices.

The business model is attractive to independent financial advisors (IFAs) and bank-tied wealth managers alike. IFAs are attracted because growing regulatory and compliance pressures on financial advisors are compelling them to find a home for their practices. Wealth managers are driven by the superior economics of being a wealth advisor within PSG compared to being bank-tied.

We think this is a superior model that should take a meaningful share of the advisor market and advised assets, building on the progress of the last decade. Many small advisory firms hold significant assets under advice and could find a home in PSG. There also remains a sizeable pool of bank-tied wealth managers who could credibly build their own wealth practices within PSG and be more prosperous.

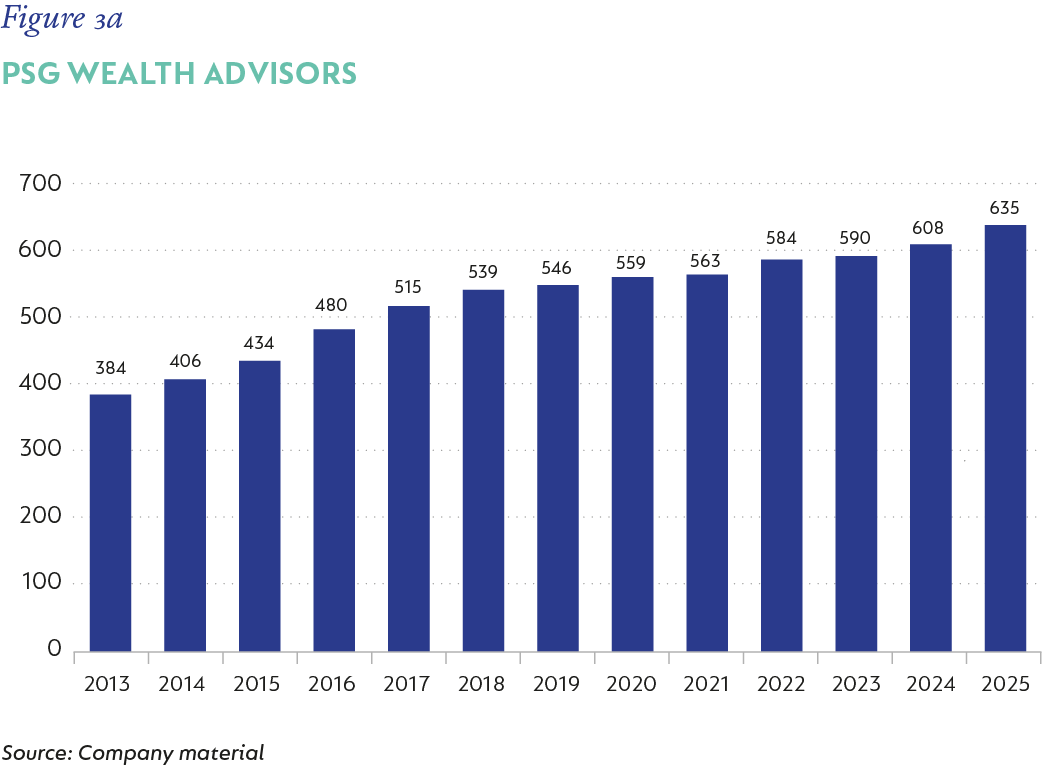

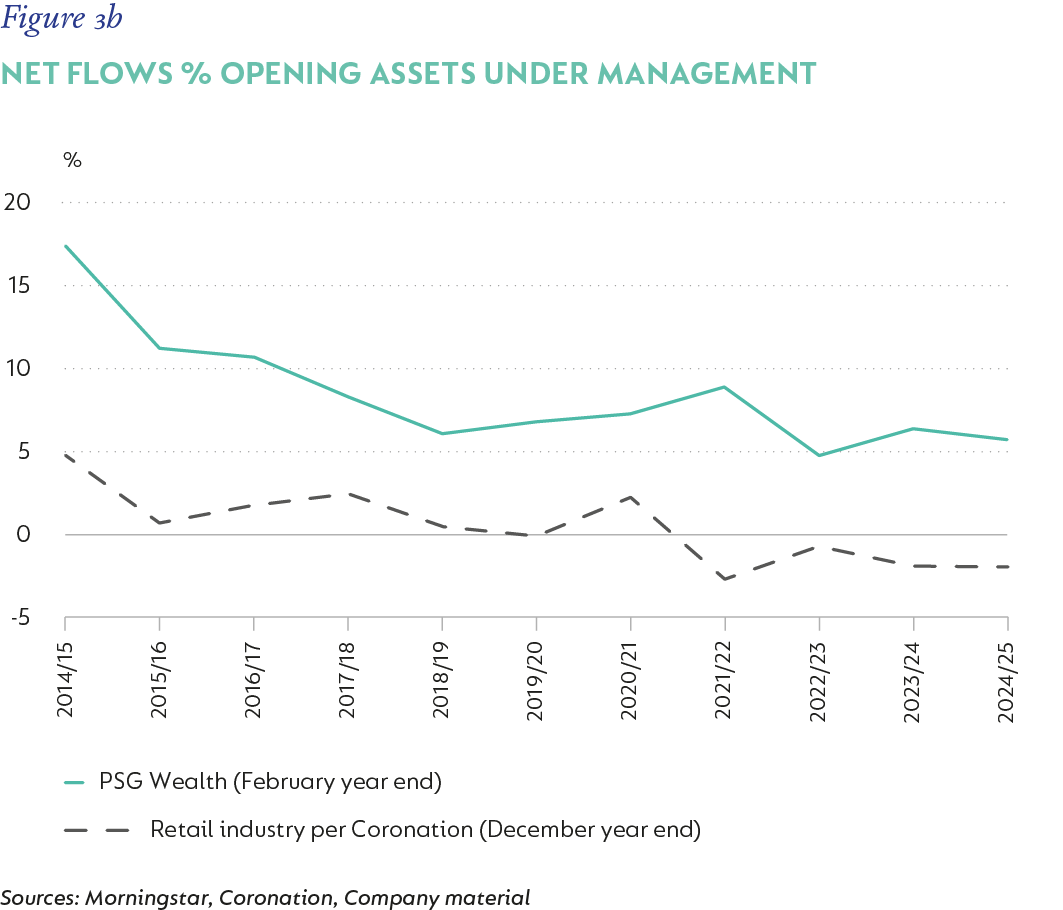

The power of this business model cannot be underestimated. It is optimised to serve advisors well (who are thus empowered to serve their clients well) and rewards them fairly for their efforts. In return, the Group receives its fair share of advisor revenues. As the business scales, it unlocks growing financial resources to accelerate investment in many areas, particularly in technology and infrastructure, driving the flywheel of growth, scale efficiencies, and reinvestment. This, in turn, enables advisors to continuously modernise and compete harder, entrenching PSG Wealth’s attraction to advisors and clients, which drives further market share gains (organic and inorganic). To date, this virtuous circle has translated into significant growth in the advisor base and, more importantly, superior flows generated by PSG Wealth compared to the overall retail industry. Figures 3a and 3b show that PSG Wealth has grown its advisor base steadily over time, and net flows as a percentage of assets have consistently been ahead of the market, supported by advisor acquisitions.

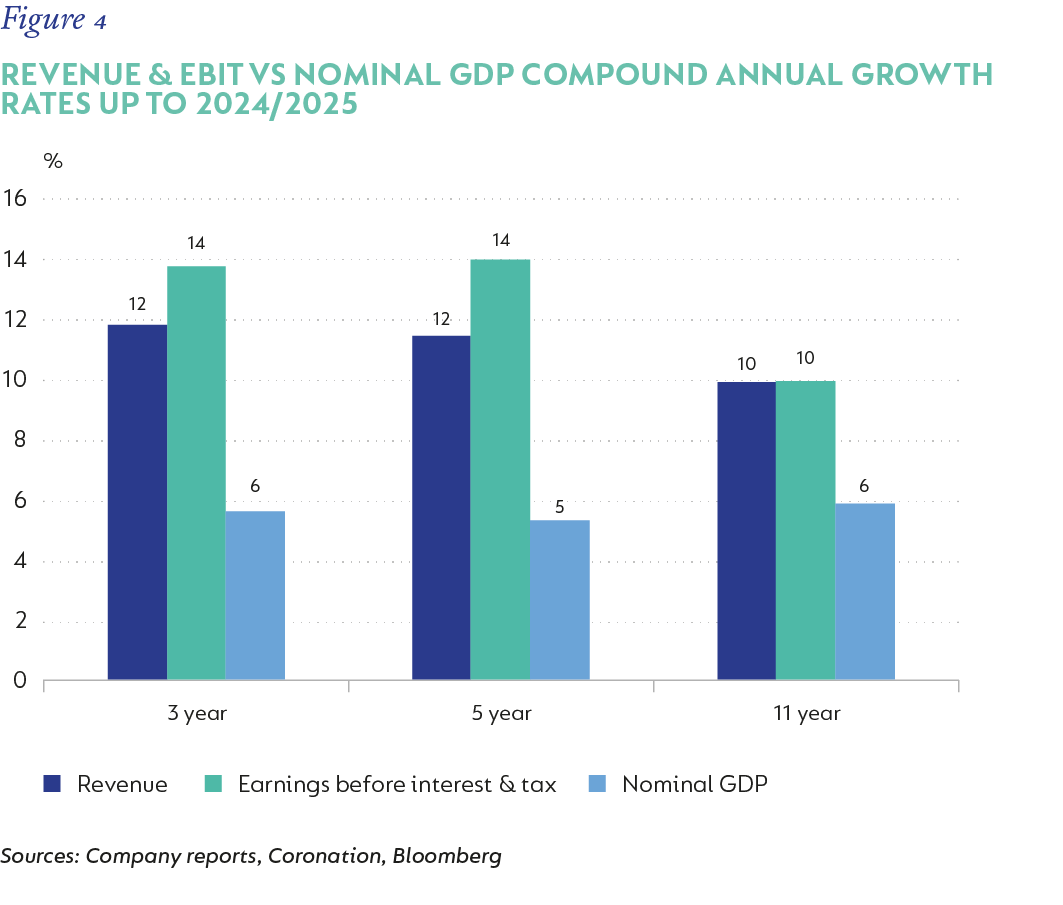

Given its low market share of no more than 13% of industry assets and an increasingly competitive business that is becoming more attractive to both advisors and clients, we think it is highly probable that this business will continue to take share, drive steady growth in advisor numbers, and deliver good flows. This would translate to good growth in its key drivers and continue to build on the growth in earnings we have seen over the years. Figure 4 illustrates how PSG Wealth has delivered strong growth in fundamentals over the long term.

Operating margins have started to expand in recent years. This is after heavy reinvestment of positive operating leverage gains back into the business to strengthen the Wealth franchise, drive revenue growth, and position it for the long-term prize: capturing an outsized share of a large and fragmented advisory market. Over the long term, we expect scale efficiencies to kick in on the back of a well-invested cost base and translate into operating margin growth, accelerating earnings growth ahead of revenues.

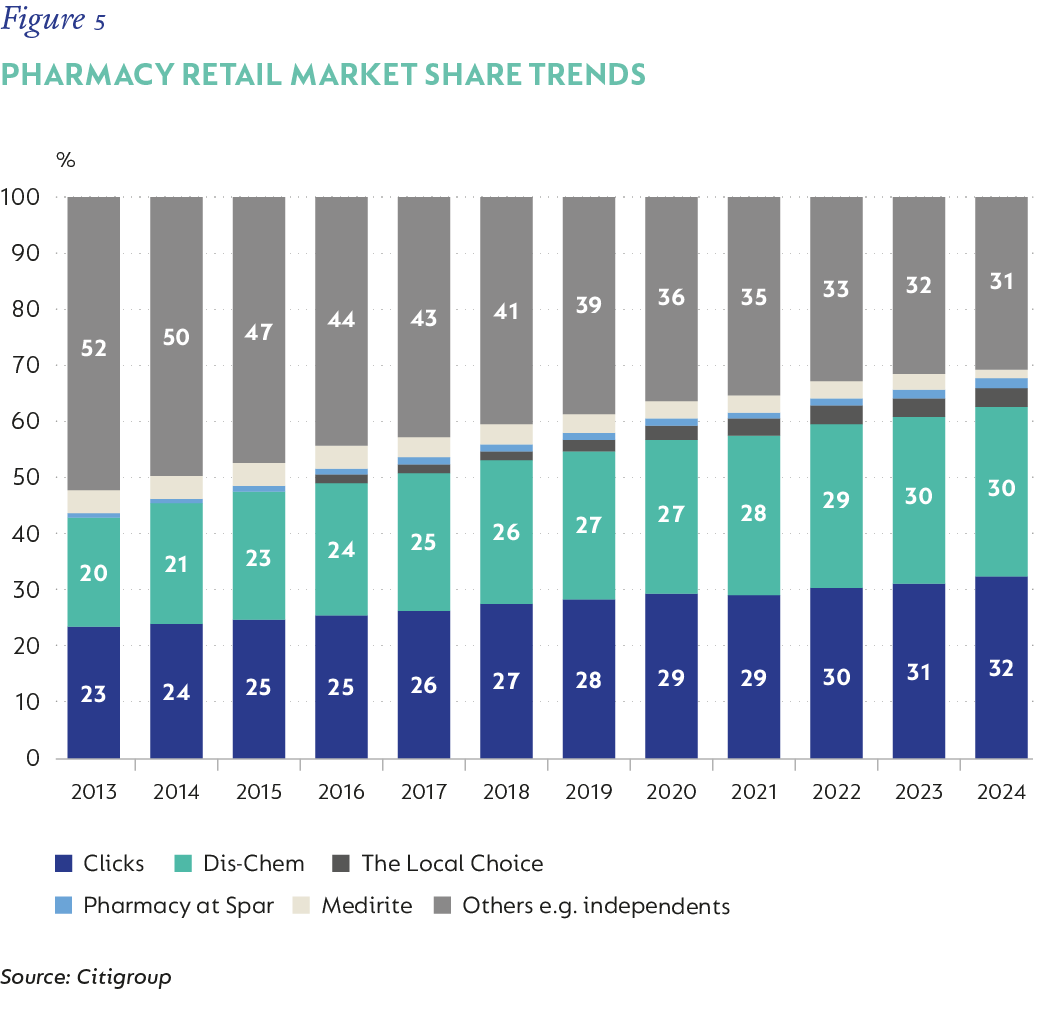

The million-dollar question is: how long can PSG Wealth sustain above-average growth? It is difficult to know exactly, but considering how small PSG Wealth is relative to the overall industry, there is considerable opportunity to grow its assets under management/advice as its superior model continues to win market share. Other industries, such as pharmacy retail, serve as a case study of how strong corporate players with winning business models can sustain market share gains for long periods at the expense of weaker players ceding share (Figure 5). It would therefore not be surprising to see PSG Wealth emerge as a major long-term winner in the financial advisory/wealth management industry.

PSG INSURE: WESTERN NATIONAL. A GEM

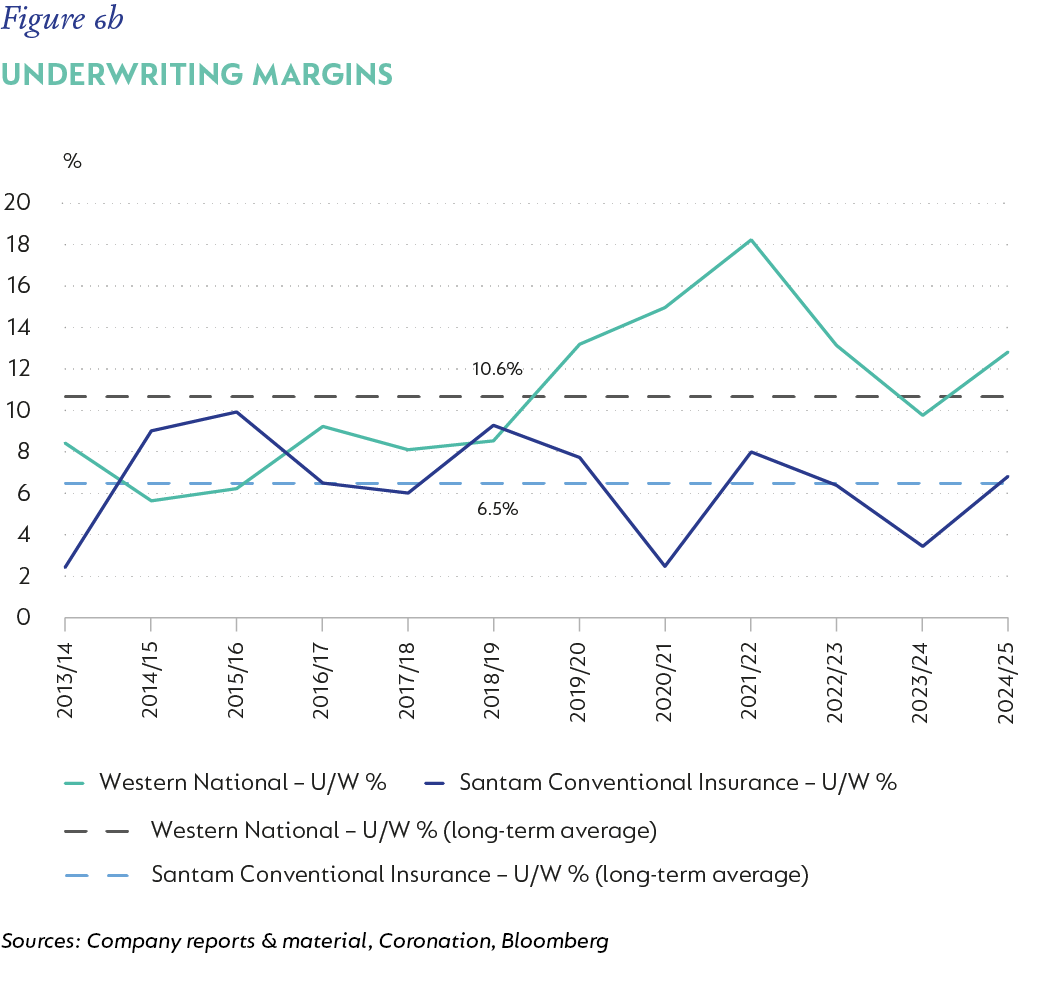

Western National is PSG’s underwriter focused on commercial risk lines. It is a small player in commercial insurance, with a differentiated service model that has earned commendable long-term gross written premium (GWP) growth off a low base. Execution over the years has been excellent, with significant reinvestment into the business to improve its quality and deliver sustainable growth. Reassuringly, growth has been accompanied by rising underwriting margins, which helps support our view that the quality of underwriting has been good and that market share gains are sustainable. Going forward, given its low industry share, we expect this business to continue to deliver above-average GWP growth as it continues to scale its winning service model. Figures 6a and 6b show how Western National is growing premiums faster than the market (using industry bellwether Santam as proxy) and at healthy, improved margins.

CONCLUSION

PSG has delivered handsomely for shareholders over the years, even though it has historically looked like a fully valued share. Today, it continues to trade at a mid-teens price-earnings multiple, which we think is reasonable given its calibre. It is a high-quality business with high recurring revenues, healthy margins, and strong returns, bolstered by an ungeared balance sheet and strong long-term growth prospects. Importantly, it is under the stewardship of a strong and experienced management team that is aligned with shareholders. For these reasons, we believe the stock should continue to deliver for the patient investor. PSG’s structural growth story is extremely valuable in these uncertain economic times, and we believe that backing the best and winning businesses, at fair valuations, is a strategy that should serve our clients well over the long term.

[1] A forward price-earnings multiple that is at a notable premium to the market and suggests weak prospects for future outperformance

Insights Disclaimer

United States - Institutional

United States - Institutional