The Fund returned -9.3% during the fourth quarter of 2024, 1.3% behind the return of the benchmark MSCI Emerging Markets (Net) Total Return Index. As a result, the Fund was 2.5% behind the benchmark for the year. Over two years, the Fund has returned 7.1% p.a., 1.6% behind the benchmark’s 8.7% p.a. return. Over 10 years, the Fund has returned 0.8% p.a., which is 2.9% behind the benchmark return. Since inception in mid-2008, the Fund has returned 2.9% p.a., which is marginally ahead of the benchmark.

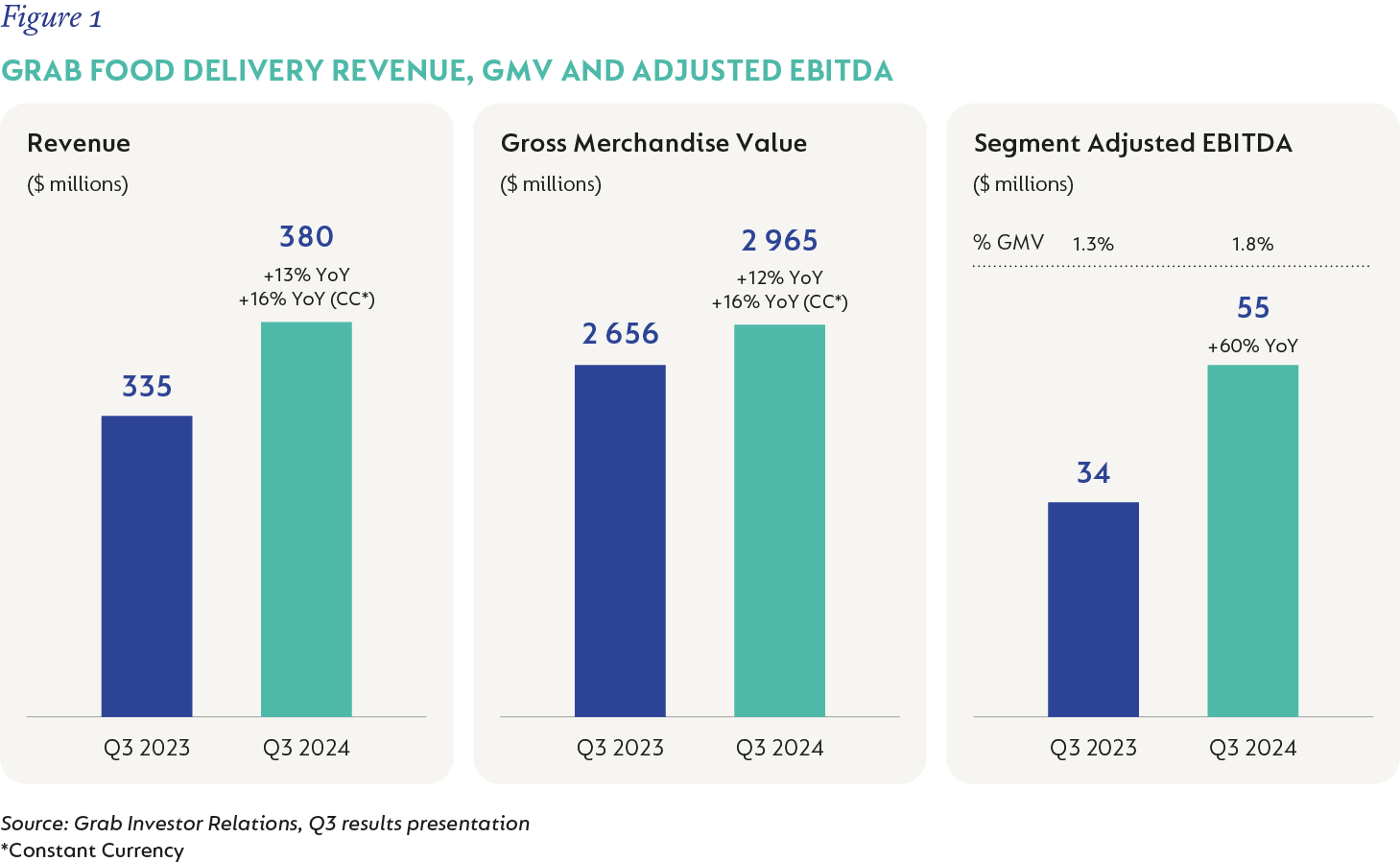

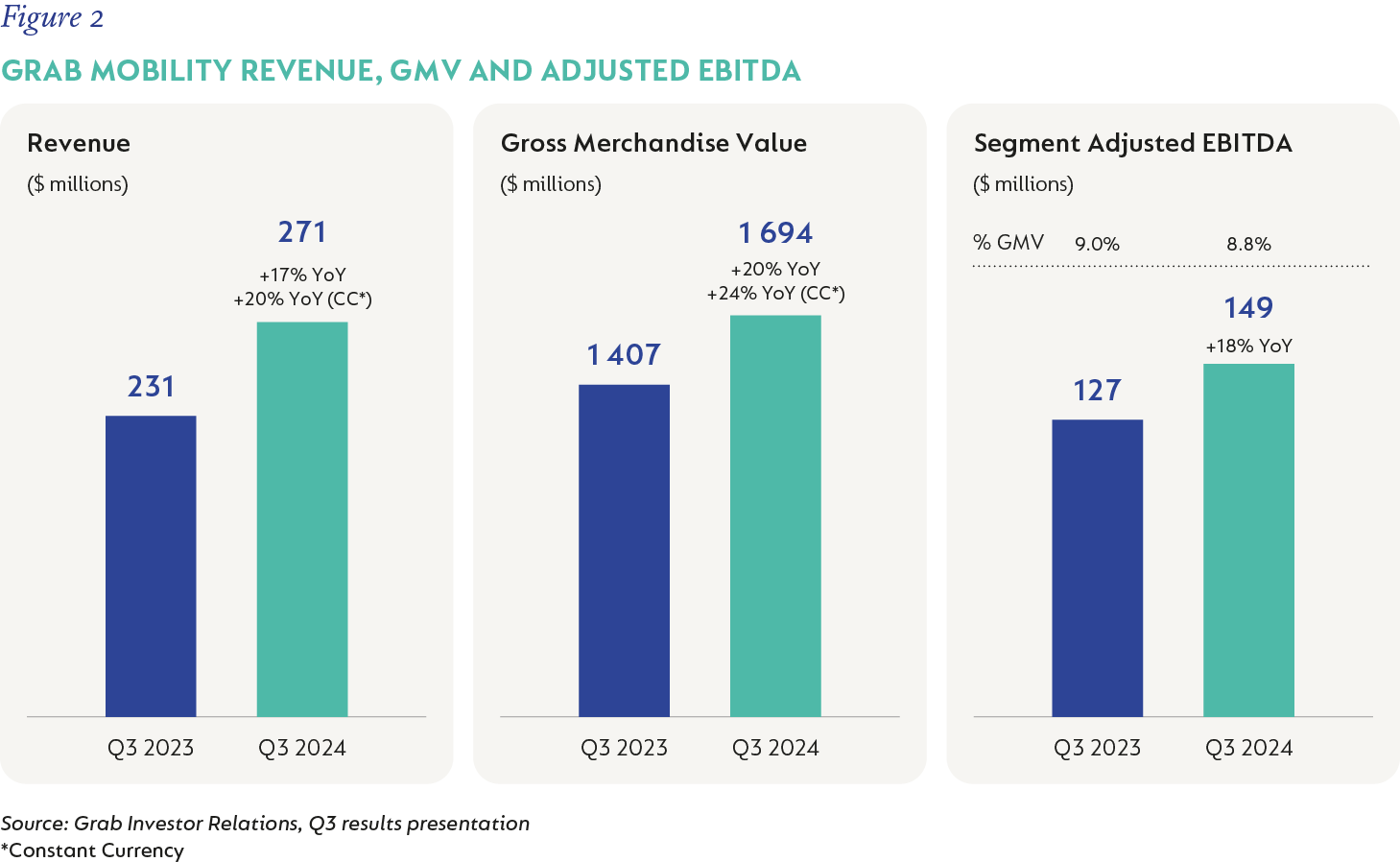

The biggest positive contributor for the quarter was Grab Holdings. Until now, this Southeast Asian ride-hailing, food delivery, and financial services platform operator had been a somewhat frustrating investment as the share price had declined since our initial investment in 2023 despite its operating performance improving materially. Almost uniquely among peers, Grab sits with substantial net cash on its balance sheet, and we had been advocating that the company buy back shares when the share price was trading below $3.50. In this last quarter, Grab appreciated 23% and contributed positive relative performance (alpha) of 1%. The share price had already been increasing off its lows, but after Q3 results were released in mid-November, it appreciated rapidly to over $5.00 on the back of a significant improvement in revenue and (especially) profitability in both food delivery (Figure 1) and mobility/ride-hailing (Figure 2).

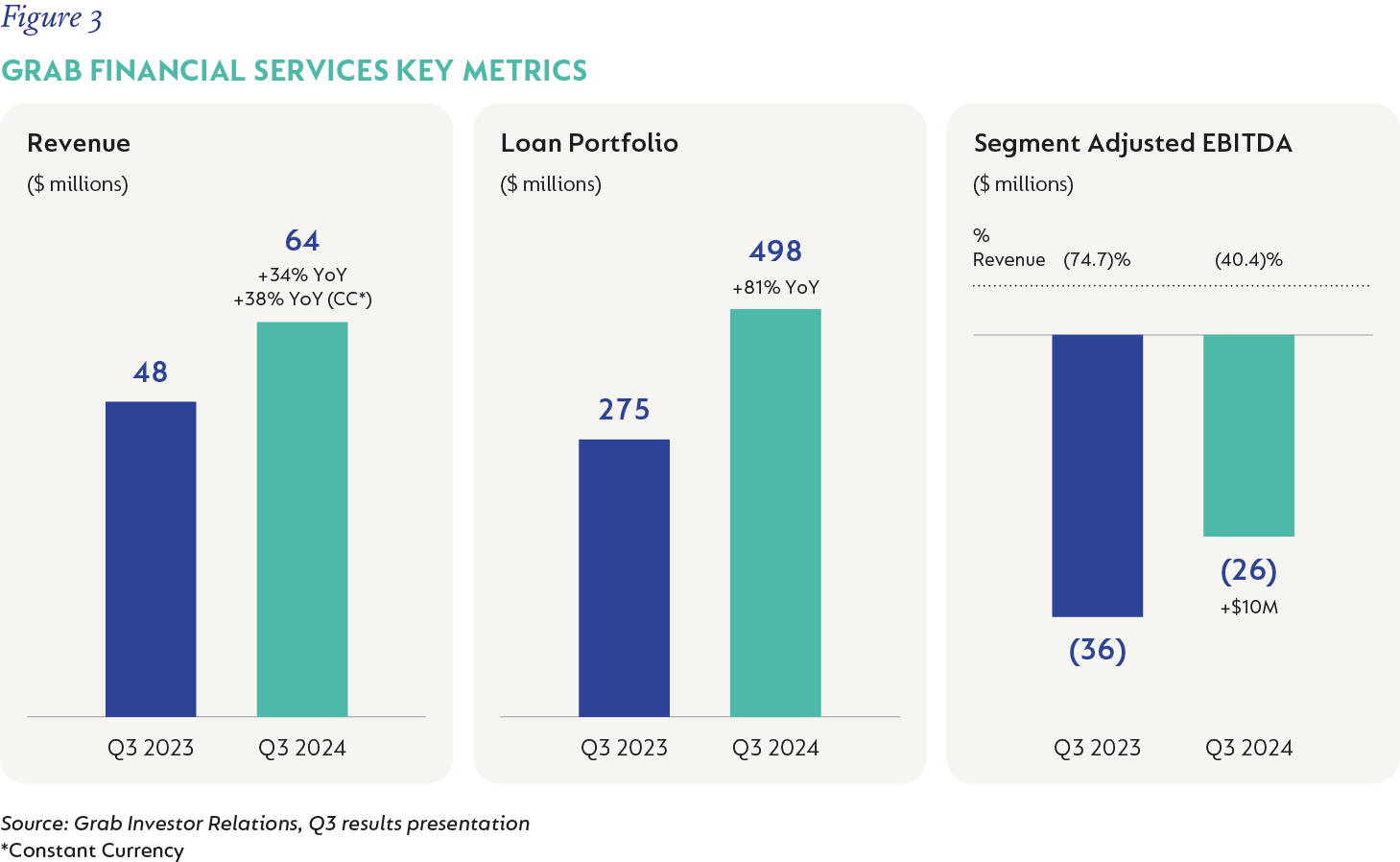

Most pleasingly, the financial services arm reached a milestone of $1bn in deposits and saw losses narrow despite the division still being very much in ramp-up phase (Figure 3).

The second largest contributor to relative performance also came from Southeast Asia, namely SEA Limited (SEA), which offers gaming, ecommerce and financial services throughout the region and in other geographies, the most material of which is Brazil. SEA returned 13% in the quarter, but by virtue of being a 2.9% position in the Fund at the start of the period, the alpha contribution was 0.7%. Like Grab, Q3 results were strong, with group revenue up 31% (despite currency headwinds) and operating profit swinging from a $128m loss to a $202m profit. Over the years, the business has invested heavily in developing an in-house logistics provider (as opposed to outsourcing delivery to third-party couriers); it is now generating returns from these investments. This means SEA now delivers 70% of its orders in Brazil and 50% of its orders in Asia through its in-house logistics provider. The result is an improvement in the customer experience with a reduction in wait times, crucially, self-fulfilment brings down the costs per package as scale benefits on the fixed historical investment costs kick in with growing volumes.

Other material contributors in the quarter were Airbus (+9% return, 0.5% alpha), BIM in Turkey (+4% return, 0.4% alpha) and Brava Energia (Brava) in Brazil (+18% return, 0.3% alpha). Brava was a material detractor in the previous quarter, but announced positive developments at two of their fields that will see oil production increase significantly in 2025. Not owning Alibaba in the Fund (it was down 21%) contributed +0.5% alpha as the late September rally in Chinese stocks, which was quite positive for the Fund in the prior quarter, somewhat fizzled out.

The biggest detractor in the quarter was Delivery Hero (DHER), which declined 31% in the period and contributed -1.0% to the Fund’s relative return. From a share price low in the middle of July to its peak in late October, DHER returned 120%, largely as the balance sheet concerns dissipated due to management action to unlock value from some of the company’s operating countries. Two main events drove the share price surge. Firstly, in May 2024 DHER announced the sale of its Taiwanese operation to Uber for $950m (€900m), subject to local competition authority approval. Secondly, as discussed in our previous commentary, the company announced the IPO of Talabat, its pan-Middle Eastern operation, which went ahead in December at a €9.5bn valuation, in line with the mid-point of the range of estimates touted for this business. The IPO brought €2bn in cash into DHER to deal with its debt burden of €4.5bn. The Taiwanese divestment would have further bolstered the cash inflows from these value-unlock developments. Unfortunately, in late December, the Taiwanese Fair Trade Commission, which has regulatory oversight for competition matters, blocked the sale from going ahead on concerns that with a combined 90% share of the food delivery market in the country, competition would be frozen out. Further negative news emerged in Spain, where DHER’s local operation, Globo, has been in dispute with labour authorities on the treatment of riders as employees. To prevent further contingencies from accruing, Globo reclassified riders as employees, with the associated increased costs of doing so, while the historic treatment (and associated fines) are being contested.

Despite these two setbacks, we believe that DHER is significantly undervalued. Their 80% stake in Talabat alone is larger than the group’s market capitalisation and makes up almost 70% of DHER’s Enterprise Value (market capitalisation plus net debt). We added to the position as the share price declined, and at year-end, DHER was a 4.1% position in the Fund.

Although TSMC is the largest individual position in the Fund at 5.3%, at quarter end, the stock’s continued outperformance (it returned +9% in Q4 compared to the -8% for the benchmark) meant that the underweight (it is almost 11% in the benchmark now) cost the Fund 0.6% in alpha. We reiterate that we are very positive on the long-term prospects and valuation for TSMC; however, given our clean-slate approach to portfolio construction, the roughly 5% position is more appropriate in our view, given the business’s relative valuation and competition for space within the Fund.

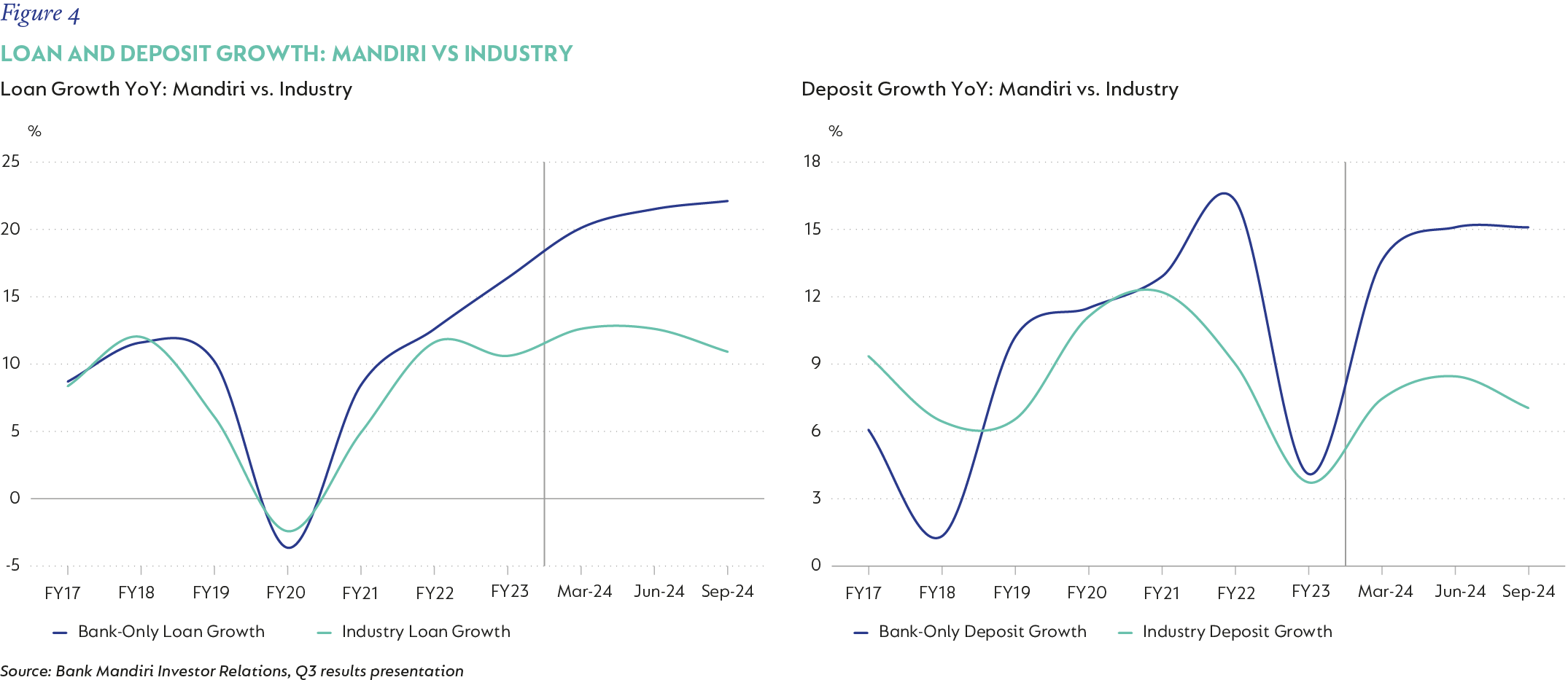

Bank Mandiri in Indonesia returned -23%, costing the Fund 0.5% in relative performance. Mandiri’s operational performance was mixed. On the positive side, loan growth and deposit growth are double the respective industry levels, and non-performing loans are at half the industry levels (Figure 4). Loan yields have declined marginally, and the cost of funding has increased to leave Net Interest Margins down by 40-50 basis points compared to last year. As a result, overall Net Interest Income was only up by 4% in the nine months to the end of September compared to the same period in 2023. We do expect the funding cost pressure to abate going forward, and with an easier base, profits are likely to return to the double-digit growth level that we believe Mandiri can deliver long-term, which makes it very attractive at less than 9x forward earnings and paying a 6.5% dividend yield.

NU Holdings (Nubank) declined 24% in the quarter, costing 0.5% alpha. However, Nubank was still a positive contributor for the year as a whole. Sentiment has largely been driven by fears that Brazil’s fiscal issues will negatively affect the local economy, and with the central bank hiking rates (and expected to continue doing so), this increases their funding costs in the shorter term. The weakness in the Brazilian real was a further drag on the share, which is listed in US dollars. The company’s exposure to Mexico (albeit still small at this stage) also didn’t help, as Mexico is most exposed to the incoming Trump administration imposing heavy tariffs on its closest geographic trading partners (the other being Canada).

The only other material detractors (0.4% alpha or more) were Melco, AIA and JD.com, as the run-up in Chinese stocks following the stimulus measures announced in September partially reversed (as mentioned earlier). Although market sentiment remains weak towards China, the stocks are priced for a very dire outcome, and the weighted average upside in the Chinese stocks in the portfolio–our guideline for their intrinsic worth–is close to 100%.

With the sell-off in Brazil-exposed stocks reaching feverish levels in the quarter, the largest buying activity was centred on our two biggest holdings there. Mercado Libre (MELI, an ecommerce and fintech player across Latin America), whose share price reached levels over $2,100 in September, started the quarter as a 2% position, and a subsequent 30% decline allowed the Fund to buy back shares at under $1,800 to leave MELI as a 4% position in the Fund at the end of December. In a similar vein, Nubank reached a peak of close to $16 in November but then fell to a trough of just over $10 in December, and we bought close to 2% of Fund here to leave it as a 3.2% position at year-end. There were material trims of Trip.com (Chinese online travel agency), TSMC and BYD (Chinese electric vehicles) on very big positive share price moves.

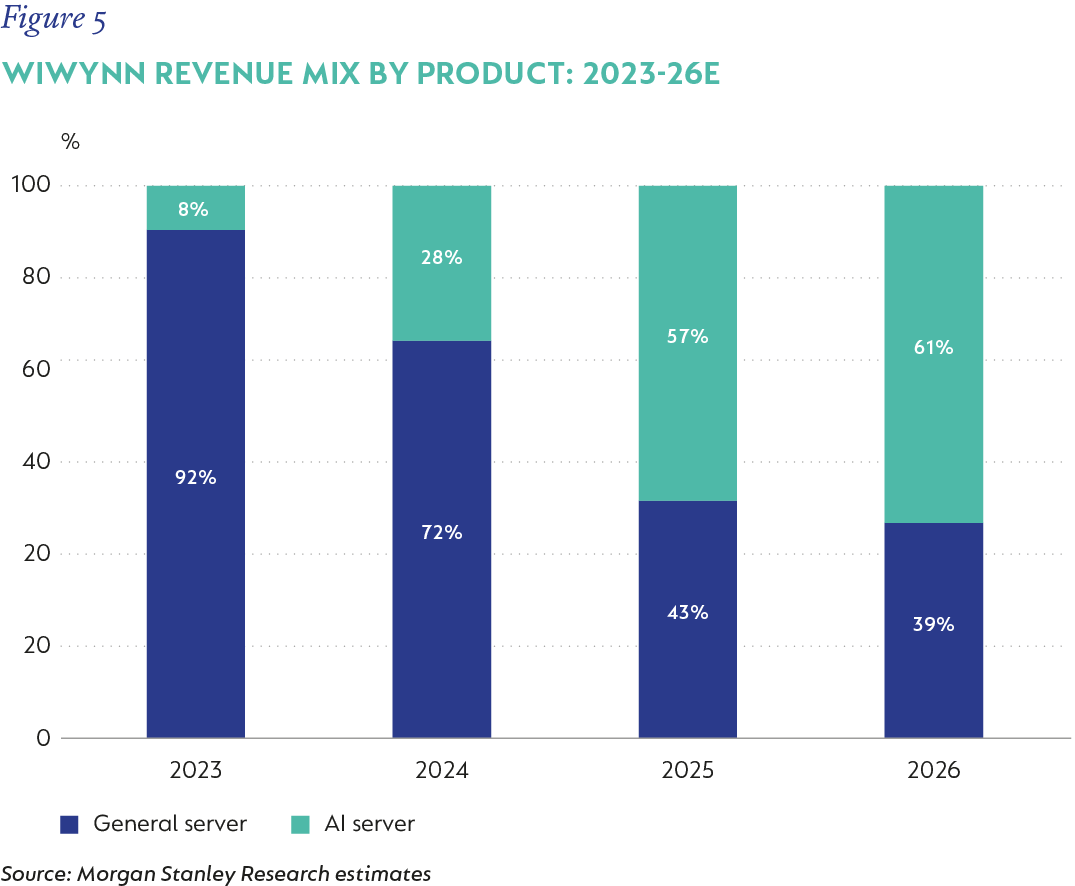

A few new stocks entered the Fund in the period, the largest of which was Wiwynn Corporation (Wiwynn) in Taiwan (1.1% position at year-end). Wiwynn is a manufacturer of traditional servers that is diversifying its business into servers for Artificial Intelligence (AI). In the last two years, AI servers have gone from immaterial to being a quarter of their business and these are expected to account for the majority of revenue within the next two years (Figure 5). Despite this significant growth potential, Wiwynn trades on a relatively modest 17x forward earnings multiple, has net cash on its balance sheet, and pays a 3% dividend yield.

Other new buys (all under 1%) were banking group BBVA, whose primary business is in Mexico, Gold Circuit Electronics of Taiwan (a specialist producer of printed circuit boards for servers, network infrastructure and consumer electronics) and Chinese battery producer CATL, the largest battery supplier for electric vehicles in the world.

The Fund sold out of its remaining position in Tata Consultancy Services (0.8% at end-September) as it reached our fair value, as well as out of KB Financial (0.9%) and Standard Bank (0.4%), which were identified as suitable funding sources for the buys covered already. The Fund also exited Tencent Holdings (0.6% position), which rallied strongly in October, leaving us preferring to retain our exposure via Prosus and Naspers only.

Despite the positive absolute performance of both the Fund and asset class, emerging markets underperformed global stocks and the US market in particular during 2024. The valuation discount at which emerging markets now trade has become even more attractive, and for the Fund in particular, the weighted average upside is now back at 75% with a 23% IRR. We remain confident that this represents a compelling opportunity for investors.

United States - Institutional

United States - Institutional