Economic views

Is economic optimism warranted by political change?

“It always seems impossible until it’s done.” – former President of South Africa, Mr Nelson Rolihlahla Mandela

The Quick Take

- The success of SA’s coalition government hinges on aligning around a common purpose and implementing much-needed policy reforms

- Structural headwinds persist, weighing on SA’s ability to bring life back into an anaemic economy

- The failed state of SOEs, rising government debt and an unsustainable wage bill have placed the fiscus under severe pressure, making private sector participation essential

- There are encouraging signs, with business confidence improving, bolstered by declining inflation and policy rates that should provide a cyclical lift to growth

The African National Congress (ANC) was expected to lose support in South Africa (SA)’s elections on 29 May. But a decline from 57% to 40% marked a turning point in the country’s democracy. Against the odds, given historic differences and a very narrow timeframe, the two largest parties – the ANC and the Democratic Alliance (DA) – along with eight other parties, signed a foundational Statement of Intent (SoI) and formed the country’s second Government of National Unity (GNU).

Sentiment towards this new political arrangement has been positive (given the economic and political implications of the alternatives). Asset prices have rallied: 10-year bond yields at the time of writing are down 90bps (8.8%), the ALSI is up 10.9% and the currency is 4.6% stronger. There are two questions worth exploring: 1) can the GNU hold, given historic, ideological and factional differences; and 2) can this new political configuration contribute meaningfully to better economic outcomes?

HISTORIC DIFFERENCES, A COMMON AGENDA, FACTIONAL HURDLES

There are encouraging signs that, at a practical level, the members of the GNU can work together on a shared agenda. President Ramaphosa’s ministerial appointments have created opportunities for new Ministers to potentially deliver more effectively on their mandates than the previous administration; and, GNU appointments, including Home Affairs and Cooperative Governance and Traditional Affairs (COGTA), have already demonstrated promising performance gains in the early stages of the new government.

Feedback from both the large parties following working Lekgotlas has highlighted a common commitment to the foremost priority of the SoI, which is to deliver: “Rapid, inclusive and sustainable economic growth, the promotion of fixed capital investment and industrialisation, job creation, transformation, livelihood support, land reform, infrastructure development, structural reforms and transformational change, fiscal sustainability, and the sustainable use of our national resources and endowments.”

That said, there have been wobbles, especially since the commitment of the GNU has, to date, failed to create replica arrangements at the local government level. The volatile political associations in local government – most significantly in the country’s economic heartland, Gauteng – will continue to pose a threat to national unity, especially if a more formal arrangement cannot be agreed upon (Tshwane here is a critical pinch point). Different views on policy are also a potential area for conflict or compromise, with reforms passed by the previous administration but challenged by the then-opposition DA likely most at risk.

The signing of the Basic Education Laws Amendment Bill as well as the pre-election enactment of the National Health Insurance Bill, which are both ‘red lines’ for the DA, have raised concerns about how the GNU partners will navigate issues to which each is fundamentally opposed. In response, President Ramaphosa has initiated a ‘clearing room’ in which parties can debate contentious issues – the initial framework perhaps for a conflict resolution mechanism. The early days of the GNU have seen regress and progress relative to the principles of the SoI, but also the emergence of a common agenda, considerable support from the private sector, and a newly-motivated body politic after a bruising election.

Our expectation for now is that the GNU will hold nationally through 2025. Also, that it has improved momentum to deliver reform in key ministries, and an initial willingness to work together on issues of common cause. Here, we see Energy and Transport as critical, as are interventions by the Department of Water and Sanitation in the provision of bulk water investment, streamlining authorisation requirements and water service provision. Overarching support and reach by National Treasury, Operation Vulindlela in the Presidency, Home Affairs and Public Works are also critical for maintaining positive momentum and focus on reducing red tape to create an enabling environment for growth.

Negatively, many political uncertainties remain, and the road ahead is far from set at the wheels of the GNU. Internal policy disagreement aside, factionalism within the ANC in particular poses a destabilising threat to national unity and local governance. The party’s succession, as will be decided at its National Conference at the end of 2027, could have a material impact on the alliances of local parties thereafter. The local elections in 2026 will see GNU partners campaign against each other in local councils – keeping agendas and competition separate is not unusual in coalitions globally but is untested in South Africa. While political accountability should improve materially with non-ANC parties better represented in portfolio committees, the Umkhonto we Sizwe party as the official opposition could frustrate formal sittings of Parliament and, possibly, the legislative process.

Lastly, it is important to acknowledge that the formation of the GNU, within the framework agreement of the SoI, is an achievement accomplished in a constrained environment within a very short time. On balance, we see the current political arrangement as more able to deliver an enabling environment for stronger growth than before.

IT’S THE ECONOMY, STUPID

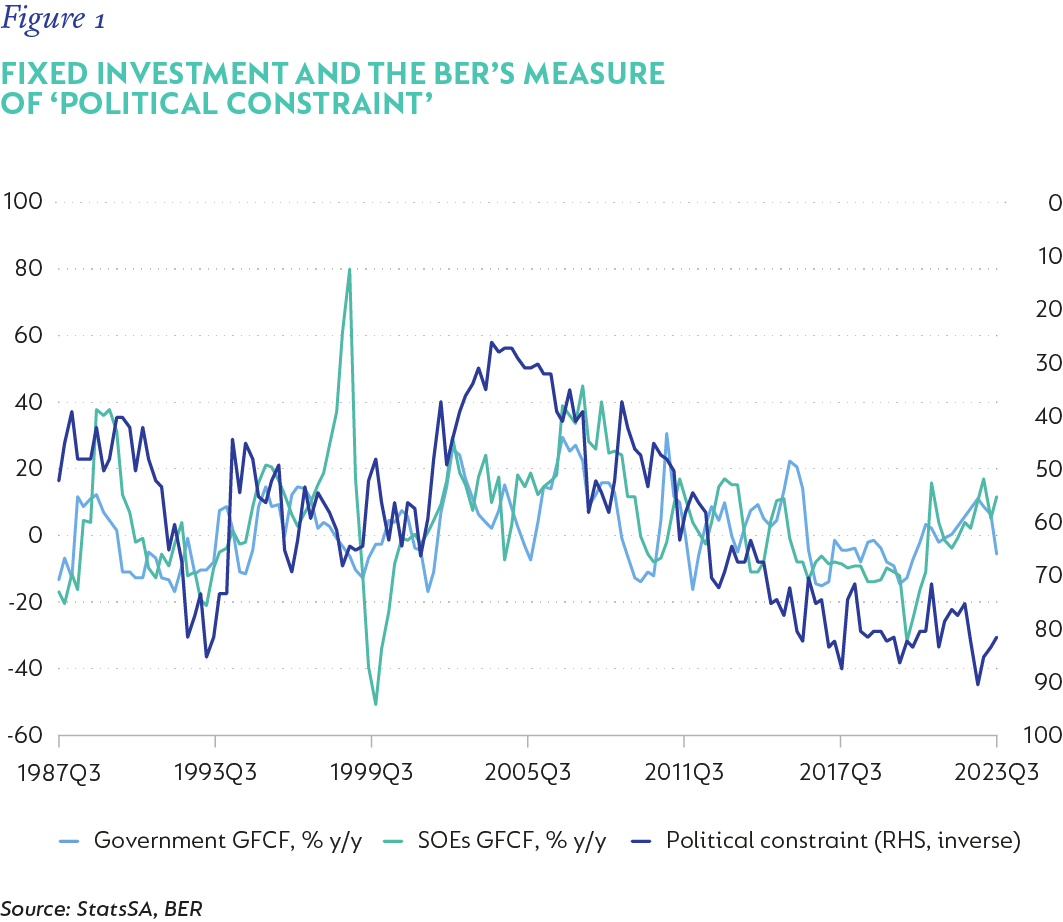

SA’s economic stagnation really set in in the period after the 2008/2009 Global Financial Crisis. In steady stages, average economic growth slowed from 4.1% through 2008 to 2.1% in 2015, including the support from the spending associated with the World Cup Soccer in 2010, offset by the onset of loadshedding. Since 2016, average real GDP has been just 0.6% below the rate of population growth, implying that South Africans have gotten poorer. The primary reason for the slowing was a steady collapse in investment, which undermined productivity and contributed to weak, low-quality employment and low economic-value consumption. Confidence was systemically undermined by the degradation of institutions, largely public but also private, in a reinforcing loop. State Capture exacerbated this process. Figure 1 illustrates data from the Bureau of Economic Research (BER) and Statistics South Africa that highlight a deeply negative trend aligned with shifting politics since 2012. The data shows the proportion of manufacturers surveyed who viewed the political climate at the time as a constraint on investment. This peaked at 91% of respondents in early 2023 as the power crisis deepened. Weaker infrastructure also eroded the capacity of the exporting sectors, hampering the economy’s ability to capitalise fully on global tailwinds.

As network industry failures intensified after the Covid crisis, notably in energy and logistics, but also in water, unemployment has continued to rise. With the additional challenge of a sharp increase in the cost of living, the focus on necessary intervention has intensified. In 2020, the Presidency championed National Treasury’s programme to cut red tape and enable growth, embodied in Operation Vulindlela, while the private sector mobilised in support of partnerships and programmes to improve the operating environment.

Over time and with much effort, these workstreams and partnerships are starting to slowly bear fruit. The most visible is the improvement in the security of energy supply, which is largely the result of decreased demand for Eskom-generated power owing to private self-generation initiatives, as well as better fleet and maintenance performance. Challenges related to municipal funding and energy transmission are well understood, but, nonetheless, far from resolved. Progress in improving the functioning of logistics has been slow, with a full return to normal port and rail activity unlikely, even in the medium term. Transnet is expected to miss its 2024 port and rail targets, although the separation of its transport and infrastructure entities is encouragingly underway. While both sectors – crucial to driving economic activity – are showing signs of improvement, progress remains slow and fraught with challenges.

Looking ahead, we expect both Eskom and the private sector to sustain investment in machinery and equipment. However, all else being equal, we expect transmission capacity to remain constrained, capped at just below 2%. We expect the Renewable Energy Independent Power Producer Procurement Programme spending to evolve as planned, helping boost supply over time. Early negotiations between Transnet and the private sector users of the two export lines at Saldanha and Richards Bay should see an increase in investment in rail infrastructure and port turnover. Again, we believe this will be relatively slow and see these activities picking up in late 2025 and into 2026/2027.

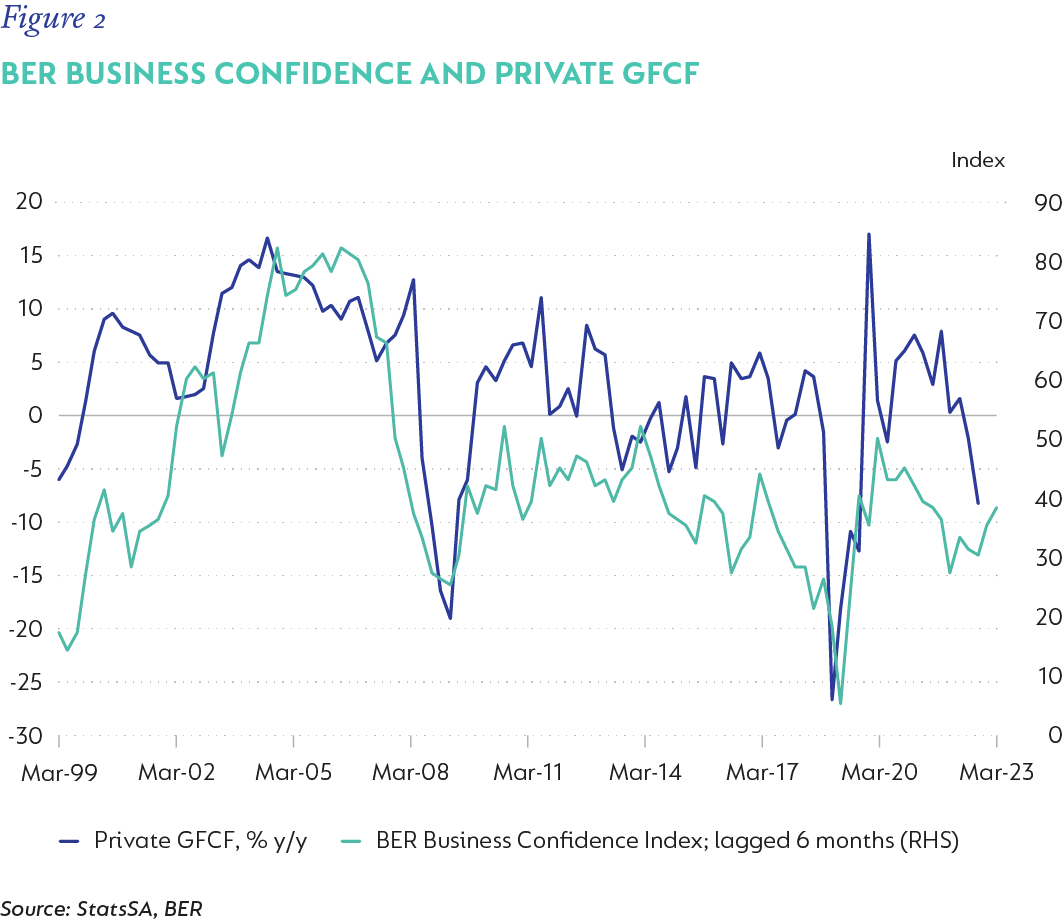

Private participation is key to sustainably stronger fixed investment. However, it is still too early to see sufficient evidence of meaningful momentum in forming effective partnerships. We are encouraged, though, by the pickup in business confidence, which, if sustained is a useful leading indicator of private investment. More practically, a combination of low maintenance capital expenditure (included in gross fixed capital formation [GFCF] in Figure 2), system failures (with water potentially becoming the next electricity crisis), and gradual capacity reductions over time all support, at the margin, some improvement in private investment – if improved sentiment and a less challenging operating environment are sustained. However, these structural supports for growth are likely to be slow moving and non-linear.

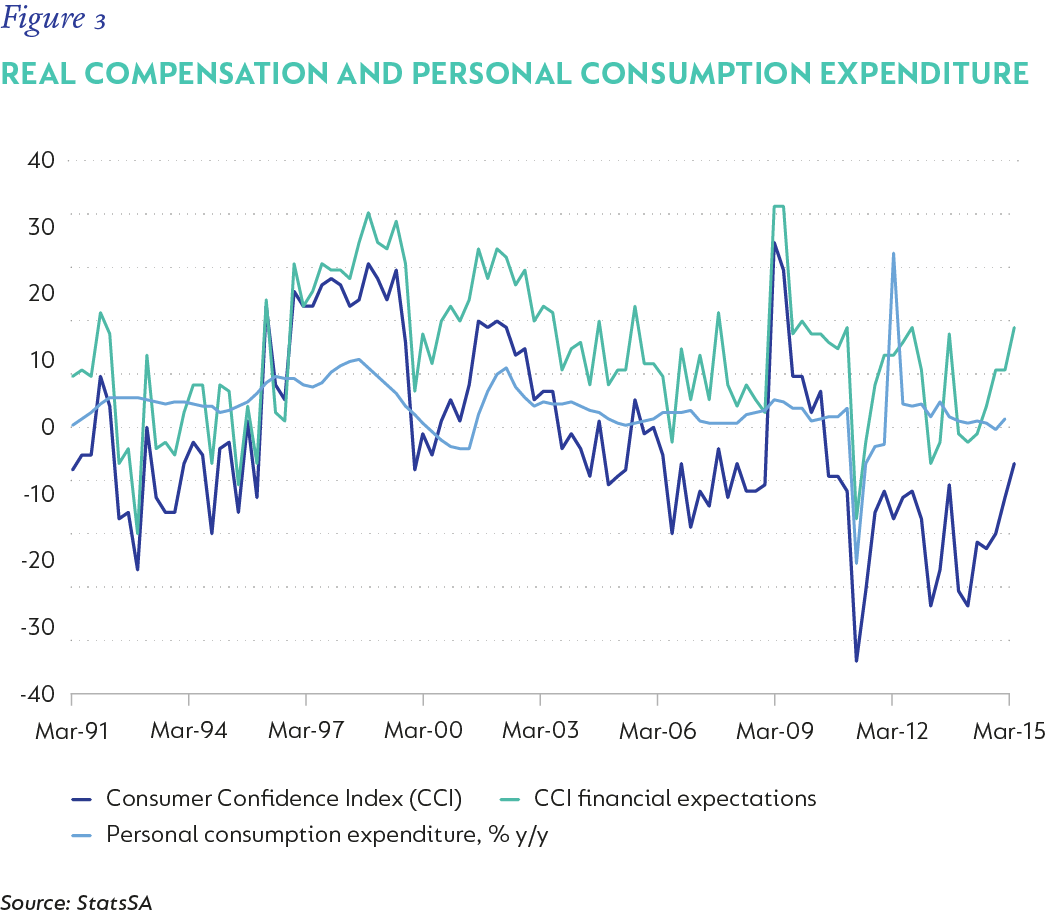

The cyclical outlook for consumer spending has also improved (Figure 3). Real compensation growth has averaged -0.9% since 2022, the result of low wage growth and high inflation, but this should turn positive in the third quarter of 2024 and continue to rise in real terms through 2025. Consumer sentiment has also improved, and lower interest rates should reduce the burden of debt service costs, with Two-Pot retirement withdrawals providing an additional boost to household liquidity. Household spending accounts for 64.7% of GDP (2023) and picked up smartly in the second quarter of this year to 1.4% quarter on quarter, contributing 0.9 percentage points (ppts) to an overall GDP growth of 0.4%. The above drivers suggest a strong finish to the year, and low inflation and further interest rate cuts should help sustain this through 2025. We consider this a cyclical uplift, which will need the structural drivers discussed above to be sustained.

A US ‘soft landing’ would support a moderation in global activity but with lower developed economy interest rates generally supportive of sentiment towards emerging markets. There remains considerable uncertainty about this outcome, but initial policy rate moves have been directionally positive. On balance, we expect South Africa’s GDP growth of 1.1% in 2024 to accelerate to 1.7% in 2025 and 2.0% in 2026.

We also see the opportunity for political change to catalyse regulatory changes that would further support growth, perhaps even in the near term. For example, a focus on opening tourism access (Trusted Tour Operator status) could see increased visitors from India and China; the proactive implementation of critical skills and remote work visas along with steps to digitise processes at Home Affairs would support employment creation; efforts to reduce the administrative burden of SMMEs; and ongoing red-tape cutting by Operation Vulindlela would all add impetus to growth, especially if solved concurrently.

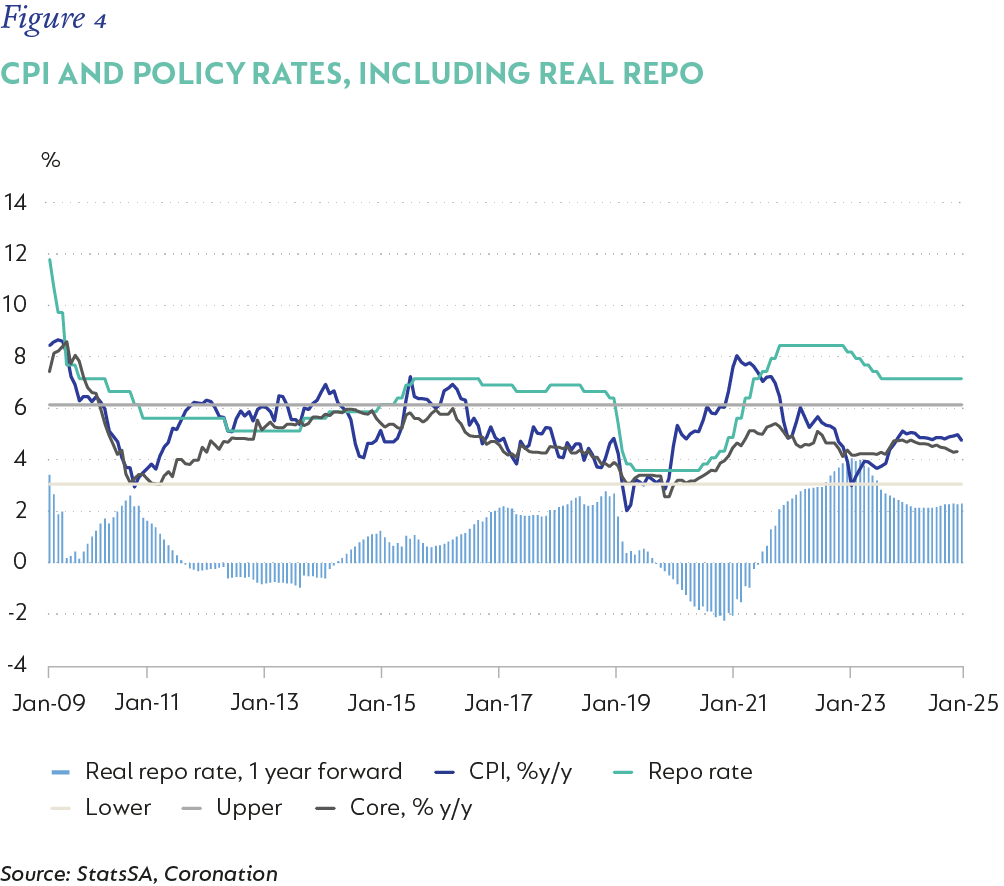

LOWER INFLATION AND STRONGER GROWTH: GOOD FOR THE FISCUS AND THE SARB

The currency rally, falling oil prices, and very weak domestic growth have all helped bring inflation down. We have made consecutive cuts to our forecasts and now see inflation generally below 4% through mid-2025, and averaging 4.5% in 2024, 4.2% in 2025 and 4.8% in 2026 (Figure 4). This should allow the South African Reserve Bank (SARB) to ease another 100bps into the second half of 2025. Better growth and fiscal gains may open the debate for a lower neutral rate and the door for further easing if realised.

The Minister of Finance will present the Medium-Term Budget Policy Statement at the end of October. Available fiscal data for the year to date shows that National Treasury has kept a firm hold on expenditure, but that revenue is likely to disappoint as corporate profits remain under pressure and VAT collection has been depressed by weak spending growth. Nonetheless, excluding the accounting impact of the Gold and Foreign Currency Exchange (GFECRA), cumulative expenditure is running at 4.3% year to date against a Budget target of 4.5%. The pragmatic use of GFECRA profits should help reduce the debt stock by about 1.4ppt of GDP in 2024/2025, and, at the margin, help lower the rate of accumulation in the next two fiscal years, and National Treasury has maintained a firm rein on expenditure. This was assisted by poor delivery of capital investment objectives, which allowed for the reallocation of funds to areas where expenditure exceeded expectations.

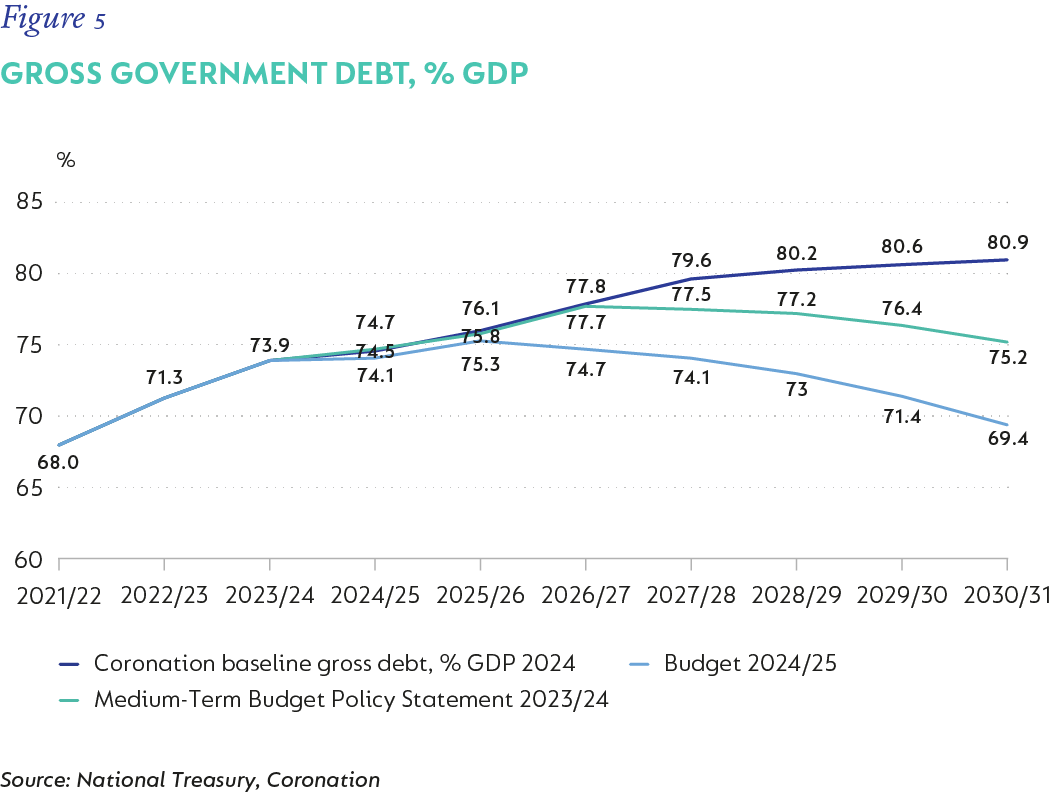

Despite this commendable consolidation, the laundry list remains long. Practically, public sector wages have not been agreed (Budget 2024/2025 assumes 4.5%, Coronation is slightly higher at 5.2%) for the period ahead; we believe financial support to assist Transnet’s precarious financial position will still be needed; the financial failures at other State-owned enterprises are unresolved; the streamlining of social support (including the Covid Social Relief of Distress Grant); and the likelihood that additional spending will be needed across departments and agencies to address service delivery and capital investment (including municipal debt), are all likely to increase. We think National Treasury will struggle to maintain the tight hold on expenditure given these demands and expect debt to continue to accumulate in the absence of considerably stronger growth (Figure 5).

IN CONCLUSION: COORDINATION, COMMITMENT, AND A MEASURABLE ALIGNMENT OF OBJECTIVES

We don’t need a ‘new’ plan – we need a renewed focus on the work that has not yet been done, but which is essential to achieve the well-known economic and social goals outlined in the many plans already developed. The medium-term strategic framework has always been the basis for its budgeting and implementation, but focus has become fragmented, and accountability lost. Now seems a good time to refocus and coordinate policy towards this common agenda by which measurable deliverables can judge the progress made, and policymakers can be held accountable. This is the only way to move beyond a cyclical lift in growth to a sustainably stronger growth trajectory. Failing this, we risk repeating past patterns – low growth, an unsustainable fiscal trajectory and persistent poverty and inequality – leading to political outcomes far less favourable than the present.

United States - Institutional

United States - Institutional