Our approach to stewardship

Our approach to stewardship derives from our purpose of delivering superior long-term investment outcomes for our clients as responsible stewards of their capital. We recognise that companies that are managed on a sustainable basis are more likely to create value over the long term. Our analysis of the ability of each investment to create, sustain and protect value is, therefore, an integral part of our long-term valuation-driven investment philosophy.

This includes understanding the key ESG risks and opportunities facing each investment, how an entity is responding to these challenges, and driving meaningful change where required. Driving change is only possible through rigorous, company-specific research, which provides a thorough understanding of the issues and trade-offs. Our research informs our engagements and, as active managers, these engagements are key to our process.

Effective active management

We believe that active engagement on material ESG issues is the most effective way to encourage companies to improve their practices and drive positive change. This approach aims to achieve a win-win outcome, where more responsible corporate behaviour leads to improved sustainability and, ultimately, higher long-term returns for our clients.

Conversely, we are not in favour of automatic divestment, which we believe is a short-term solution that removes our ability to significantly influence corporate behaviour, and potentially transfers ownership to less accountable parties. In a South African context, eliminating entire categories of potential investments would also exclude a large part of the investable market, including many businesses that contribute significantly to employment in the country.

Notwithstanding our view that active ownership has a greater positive impact on a company’s practices than divestment, we have always excluded companies that appear on the OFAC and EU sanctions lists. In addition, we also apply a set of product- and conduct-based exclusions to a number of our global strategies to meet the needs of our clients.

The four pillars of our approach

Our stewardship activities are underpinned by four pillars: integration, engagement, collaboration and public policy advocacy. These activities allow us to gain a holistic understanding of the underlying issues facing each company, how companies are responding to these issues, and advocating for change in a proactive and responsible manner.

- Integration: We integrate material ESG-related risks and opportunities into our investment decision-making process in order to account for these factors in assessing the long-term value of each of the companies in which we invest.

- Engagement: We engage with investee companies through informed dialogue about the environmental and social impact of its everyday operations and appropriate governance to drive long-term business success.

- Collaboration: We collaborate with like-minded organisations where we believe that a combined effort will be more effective than individual engagements.

- Public policy advocacy: We collaborate with industry partners and regulators to promote an investment industry that safeguards the long-term interests of asset owners and benefits the societies in which we operate.

Determining our engagement agenda

Our engagement agenda is determined through a few key processes. Firstly, we adopt a stock level, bottom-up approach where our analysts evaluate a company’s ESG standing and identify key areas of concern. Our objective is to drive meaningful change that we believe will benefit shareholders over the long term. Secondly, we actively engage with clients, both through direct interactions and surveys, in order to remain well-informed about key themes and priorities our underlying clients emphasise. Lastly, our membership of many working groups on ESG-related matters allows us access to the most recent developments and thinking in this regard. Based on a comprehensive understanding of the key issues affecting each company, as well as the industry and jurisdiction in which it operates, we then develop tailored engagement strategies.

Stewardship responsibilities

We believe it is imperative that ESG analysis remains within the remit of the investment team, as our analysts and portfolio managers are best placed to understand the nuances and implications of company-specific ESG factors and how they affect each individual company. By choosing not to establish a separate sustainability-focussed team, we ensure that sustainability considerations are fully integrated and aligned to our fundamental, research-driven investment process. Coronation has a large and well-resourced investment team which executes on our stewardship activities. Senior staff members and executives are responsible for directing our sustainability work:

CIO and senior portfolio managers: Our CIO and senior portfolio managers are responsible for setting our sustainability agenda and for guiding and overseeing all ESG activities. They are directly involved in all the thematic projects that we undertake, as well as the overall sustainability-related research agenda. They also oversee all proxy voting decisions especially ones that may be considered contentious.

- Analysts: All Coronation analysts are responsible for identifying and integrating ESG factors into their investment analysis and assessments of a company’s long-term fair value. They are further responsible, alongside senior team members, for driving engagement with companies on material issues and for making their recommendations on proxy votes. All initiation reports include key ESG considerations, and analysts update their valuations as new information becomes available.

- ESG analyst: Our dedicated ESG analyst supports the investment team’s integration, engagement and collaboration efforts by assisting with in-depth research where additional assistance is required. The analyst conducts research on the latest ESG topics and ensures that our investment team is aligned with the latest developments. Furthermore, our analyst participates in industry activities and brings industry initiatives to the attention of senior decision-makers.

- Sustainability Committee (SusCom): The SusCom comprises of the Chief Investment Officer, Global Head of Institutional Business, Global Head of Risk and Compliance, Company General Counsel and a number of senior portfolio managers. The SusCom is responsible for formal governance and oversight of the design, implementation, monitoring and reporting of Coronation’s approach to the integration of ESG factors into its investment process, as well as associated alignment with codes, standards, disclosure obligations and regulatory requirements.

- Global Head of Institutional Business: Our Global Head of Institutional Business ensures that the business stays informed and responsive to the ever-evolving sustainable investment landscape. This is accomplished through active engagement with clients to understand their changing needs and adapt our processes accordingly. Additionally, we are active participants in global sustainability initiatives that we believe are meaningful and aligned to our overall sustainability approach. Furthermore, we emphasise clear and effective communication with clients to ensure they understand our sustainability approach and related activities.

- Product development actuary: Coronation’s product development actuary is responsible for ensuring that our product offering meets the needs of our clients on an ongoing basis. This includes ensuring that product design and mandate limits are aligned to Coronation’s sustainability approach and applicable regulations.

- Global Head of Risk and Compliance: Our Global Head of Risk and Compliance is responsible for monitoring regulatory developments and ensuring that we adopt and comply with all relevant legislation.

- Global Head of Operations: Our Global Head of Operations is responsible for supporting the investment and client-facing teams by ensuring that we have the operational capability to execute on our sustainability strategy.

How we engage

- Who: We engage with management, board members and industry experts of the companies in which we invest, as well as those we do not invest in where we believe that appropriate action will improve the attractiveness of the company as an investment.

- How: We engage during in-person or virtual meetings, emails, formal letters and telephone calls. As a general principle, we find that constructive, behind-the-scenes engagement is far more productive than debating issues at a public AGM or through the press.

- Topics: Our engagements focus on the most material business strategy and ESG practices that need to be addressed. We often address a number of issues per engagement.

- Nature of discussion: We engage through informed dialogue. Our role is not to get involved in the day-to-day management of the business.

- Frequency: We are not driven by the need to demonstrate activity on every issue. Instead, frequency is determined by the nature and importance of the issue.

- Measure of success: The extent to which our activities drive meaningful change. Depending on the situation and context, an effective company response could be providing us with more information or clarification on an issue, accepting the validity of our concerns, agreeing to make modifications to its business or policies, or making other commitments to address the issue.

- Timeframe: In general, engagements on specific issues are multi-year endeavours.

Proxy voting

Voting is an important way in which we exercise our ownership rights. Coronation’s Proxy Voting Policy outlines the principles that determine how we will vote on company resolutions. We consider and vote on all proxies for all companies in which we hold shares on behalf of our clients, regardless of the size of these holdings.

As a result of our engagement approach, we often engage extensively with boards and management teams well ahead of any votes, as we want to ensure that our concerns are dealt with before the vote. We believe that exercising a proxy without prior engagement or forewarning to the company is contrary to the company’s and, therefore, our investors’ best interests. Only when a company fails to consider or acknowledge our suggestions, do we vote against resolutions. When we vote against or abstain from voting on a particular resolution, the vote is followed up by a letter or telephone call to management explaining our reasons.

Unusual or contentious issues, such as hostile takeovers or proposals not considered to be in the interests of shareholders, must be discussed with the CIO and other senior investment managers. In addition to the proprietary research by our analysts, we also access the research and voting recommendations provided by a large third-party proxy voting advisor. Our analysts review this data to gain additional information on complex votes so that we are aware when we are taking views that are not in line with the broader market and are comfortable with the rationale for doing so.

Securities lending

When stocks are on loan, the voting rights for those shares are also transferred as part of the lending arrangement. Securities lending thus limits our ability to exercise proper long-term stewardship of these investments. We do not engage in securities lending on the portfolios that we manage, but we do permit segregated clients to engage in securities lending on their own behalf subject to reasonable restrictions such as setting a threshold on how many shares can be on loan at a given time. This allows us to exercise their shareholder voting rights in relation to that portion of the shares that may not be lent out. In certain circumstances, clients reserve the right to recall securities on loan prior to AGMs, enabling us to include the recalled shares in our voting.

Client-specific voting policies

We apply bespoke voting policies for segregated clients who prefer this. These clients either provide us with their own proxy voting guidelines to which we adhere, or they outsource their voting to a specialist company. However, given our active management approach, we prefer to retain the voting rights of shares held on behalf of clients, as it allows us to apply the full weight of our ownership to our voting powers, with the goal of enhancing long-term value for our clients.

Shareholder proposals for a company to table a resolution

There are instances where an individual shareholder or groups of shareholders propose that a company table a resolution for approval by its shareholders. We consider such shareholder proposals and generally support those that are likely to materially enhance long-term company value, reduce financial and/or ESG risks or improve disclosure practices. However, active engagement and the growing propensity of corporate directors to seek input from large shareholders have reduced the need for such proposals to be put forward.

Escalation

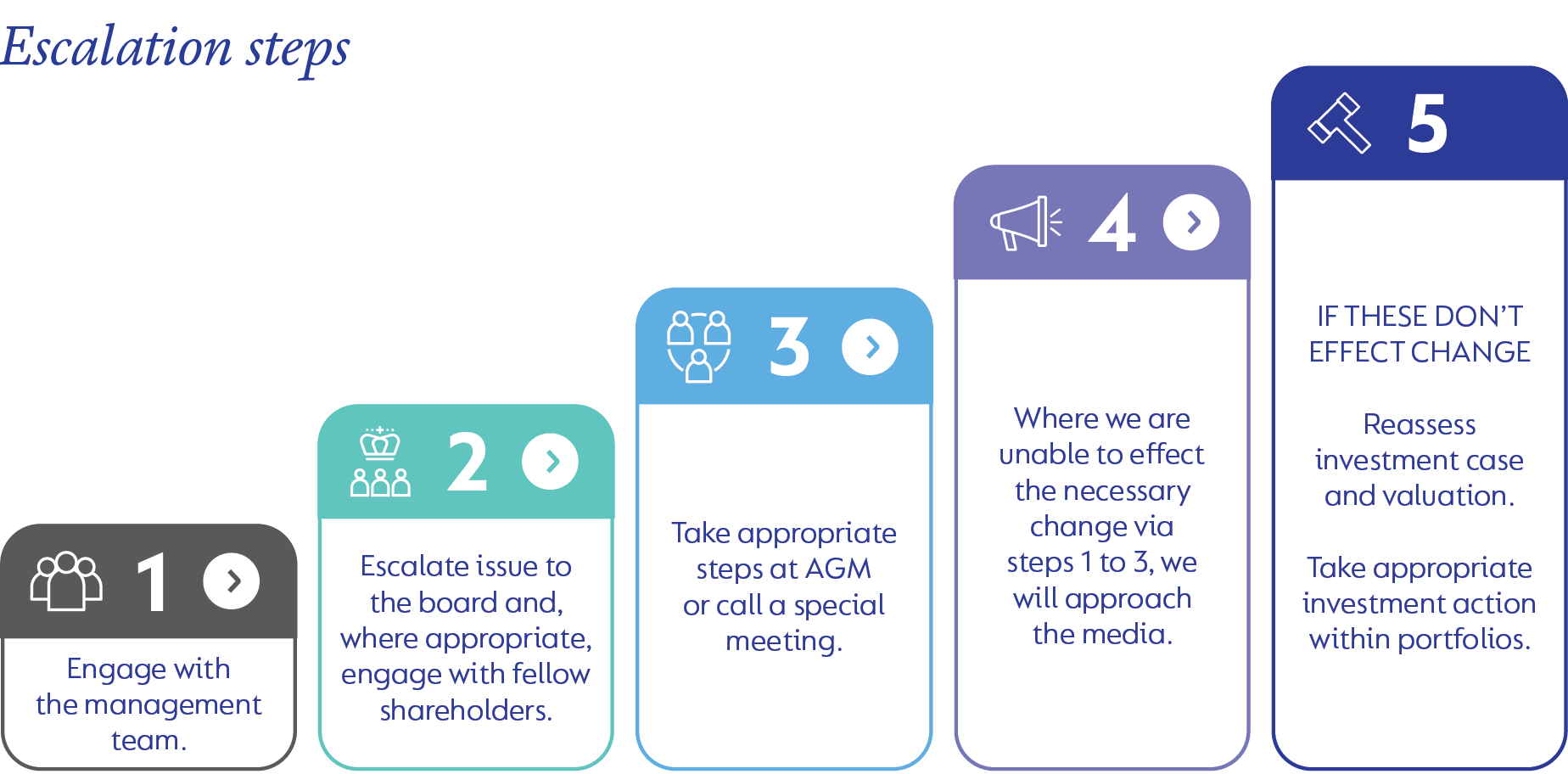

Our preference is to drive meaningful change through constructive dialogue informed by rigorous research. However, when we are not able to achieve the desired results on important issues, we recognise our responsibility to escalate our engagement efforts in order to achieve better alignment with shareholders and other stakeholders. Our approach to escalation may differ across markets as our access to management teams and boards differ across geographies. Depending on the context, we will use all means available to us, such as meeting with board members, collaborating with other shareholders, exercising our voting powers at AGMs, calling special meetings, and, if need be, escalating issues into the public arena via the media. If our best efforts are unsuccessful, we will reassess our investment case and take the appropriate investment action in our portfolios.

Governance and oversight

In order to ensure that our stewardship approach is implemented effectively, we have adopted a set of internal policies that establish our approach, required processes and oversight responsibilities. Our ESG Policy sets the guiding principles behind our stewardship approach, and our Proxy Voting Policy outlines the principles that we apply when voting on company resolutions. Coronation’s Chief Investment Officer is responsible for implementation of these policies. Policies are reviewed periodically, and our Board of Directors is responsible for final review and approval.

Our proxy voting process include controls that provide reasonable assurance that corporate events and proxy voting are actioned, processed and recorded in an accurate and timely manner. These controls are subject to external assurance by our Service Auditor.

Our SusCom is responsible for formal governance and oversight. While ESG considerations are well-established and incorporated into the investment process, increasing ESG related regulations necessitated the establishment of a formal SusCom to consolidate and provide oversight over ESG processes and decisions. At the SusCom meeting in November 2022, the SusCom charter was adopted and additional topics discussed included the periodic review of Coronation’s ESG and Proxy Voting Policies, a review of the results of our ESG client survey as well as a regulatory review of matters affecting our global and local product range.

Fixed income stewardship

Our stewardship responsibilities extend to all the asset classes that we manage on behalf of our clients and as such, we follow the same approach of integration, engagement, collaboration and public policy advocacy within our fixed income investment process. While the risk/return profiles of these assets differ from more growth-oriented asset classes such as equities, the principles that underpin our stewardship approach are universally applicable across all asset classes.

Integration

Investment in fixed income instruments is anchored by our expectations of having our capital returned and interest payments made timeously. Hence, we focus our research efforts on understanding the primary factors that could result in permanent capital loss associated with these instruments. Our goal is to ensure that the credit spread adequately compensates us for the risks involved with the specific investment.

Similar to equities, our detailed proprietary research on the issuer and structure of fixed income instruments enables us to gain a complete understanding of the material ESG risks, which in turn helps us determine an appropriate risk-adjusted fair value for the instrument.

Our research entails rigorous interrogation and analysis of company, sector-specific and material ESG factors. Engagement with companies also helps to identify material risks or opportunities, and we assess the potential impact of these risks on an issuer’s cash flow and balance sheet. Additionally, we consider an issuer’s willingness to engage on various issues and to address material concerns where identified. This process allows us to determine a fair value for all instruments in our investment universe. We maintain ongoing analysis throughout the life of an instrument, allowing us to appropriately manage our portfolios at all times. Additional risk management is embedded into the construction of fixed income portfolios through diversification and by limiting exposures to individual issuers.

Corporate governance failures have historically contributed to the bulk of defaults in the South African market. Conversely, while environmental and social risks are lower-probability events, their effects can be severe, and single events can affect the creditworthiness of multiple issuers simultaneously.

It is also important to recognise that many ESG-related risks that are expected to be long-term risks could materialise during the shorter term of an investment. These risks need to be considered when assessing the predictability and certainty of an issuer’s ability to generate sufficient future cash flow to meet its debt obligations.

ESG-related risks can also impact the duration and yield curve considerations for fixed income portfolios. Systemic events can have significant macro-economic implications, including the need for government intervention. The monetary and fiscal response to these events affects the level of interest rates and hence the level of government bond pricing.

Engagement

Engagement has been a long-standing part of our fixed income investment process. We have large ownership stakes in many companies and, over the years, have developed relationships with company management and directors. We use these relationships to proactively address ESG issues that arise and that we feel may be relevant to the creditworthiness of an issuer. These engagements with issuers allow us to evaluate the strategic direction of the company and give us an understanding of how it will likely address future risks.

For any new issuance, we need to carefully evaluate the terms of potential transactions. In addition to our in-house legal expertise, we retain an external legal advisory firm for in-depth analysis where needed. This means that we can play a constructive role in helping shape some of the contractual agreements by, for example, ensuring that covenants include the metrics that we deem to be necessary, and setting disclosure obligations.

Given the asymmetric return profile of investing in fixed income assets, credit selection is primarily focused on mitigating downside risk, and our engagement efforts are aimed at reducing these risks and influencing positive impact where possible. As fixed income investors, our ability to effect material changes is limited by the lack of voting rights associated with fixed income instruments. Our options are thus to limit the horizon of our investment or exit the investment if we perceive the underlying risks to have materially increased.

In South Africa, owing to our size, we continue to engage with large issuers even if we do not hold exposure to their debt. One reason for this is that ESG factors can affect other investment returns indirectly.

United States - Institutional

United States - Institutional