Personal finance

Approaching a decade of tax-free growth

Invest your money and let compounding do the rest

The Quick Take

- South African investors have been able to take advantage of tax-free growth for close to a decade

- We believe it matters how you approach tax-free investing

- Our research shows that maximising your tax-free contributions in a growth-oriented multi-asset fund over the long term can deliver the best results

Financial wisdom doesn’t always require complex strategies. For the past decade, tax-free investments (TFIs) have offered South Africans the most straightforward path to building wealth: invest your money, see your returns grow tax free, and let compounding do the rest.

As we mark the 10th anniversary of tax-free investing in South Africa on 28 February 2025, let’s revisit why this is such a game-changing opportunity and how you can make the most of it by choosing your underlying investment wisely.

WHAT IS TAX-FREE INVESTING?

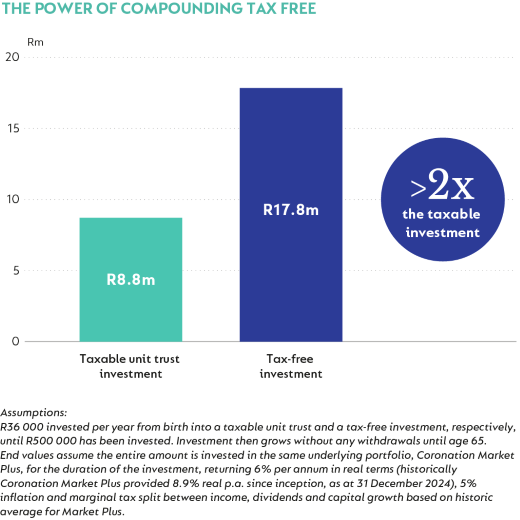

Tax-Free Savings Accounts - as they were originally called - were launched on 1 March 2015 by the National Treasury as an initiative to encourage households to increase their savings. This allows individuals to invest or save in approved financial products without incurring taxes on their returns (that is, interest income, dividends and capital gains), both while they remain invested and when they withdraw. The initial annual contribution limit was set at R30 000, with a lifetime limit of R500 000. Over the years, the annual limits were increased and today, you can invest R36 000 per tax year, enabling you to reach your lifetime limit (still capped at R500 000) earlier and thus enjoy the benefit of compounding for longer.

IT MATTERS HOW YOU APPROACH A TFI

Since the introduction of this initiative, and the launch of our own Coronation Tax-Free Investment Account in October of 2015, we’ve consistently made the following three arguments that we believe enable investors to get the most out of their TFIs:

1. The smart approach is to invest (not save) for the long term

You want your money to work as hard as it can for as long as possible and be exposed to the best growth potential over time. Investing over multiple decades and leaving your money untouched enables it to comfortably withstand the effects of the inevitable periods of financial market volatility. Over the long term, the bumps smooth out, and the overall trend is for your money to grow more over time than if it were just earning interest in a bank account.

Our research shows that long-term investing in a TFI account can more than double a similar amount invested in a taxed investment.

2. It’s easier to stay committed if you choose a multi-asset fund

One of the benefits of a tax-free investment is that there are no regulatory asset class constraints applicable to your underlying investment fund. This flexibility means that you can give your money the best opportunity to grow over time by considering a multi-asset fund with an equity bias (or in other words, a growth-oriented fund). Multi-asset funds make it easier to remain invested as they offer a less volatile experience than investing solely in equities. Multi-asset funds also simplify investing as you leave the asset allocation decision-making to the investment professionals.

Our growth-oriented multi-asset fund Coronation Market Plus is very well suited to investors who want to take advantage of tax-free growth over the long term. The Fund can invest in a wide range of assets such as shares, bonds, listed property and cash, both in South Africa and internationally (limited to 45%). It will typically have a bias towards shares, which offer the highest expected long-term returns. But unlike an equity fund, it is more broadly diversified across different asset classes.

Investors who prefer to diversify their investment portfolios into a predominantly international market portfolio while still achieving some boost from tax-free growth can consider Coronation Global Optimum Growth. The Fund has a flexible mandate and can invest in any combination of developed economies (including the US, Europe and Japan) and emerging market assets based on where the most attractive valuations are available.

3. You can access your money but it’s a pot of savings best left invested

When you invest tax-free, you can withdraw your cash whenever you like. But you can’t ‘replace’ the money you withdraw with a new investment. So be mindful that all amounts you invest count towards your annual (R36 000) and lifetime (R500 000) tax-free contribution limits, regardless of any withdrawals you make.

INVEST EARLY, TAX FREE. YOU’LL BE SO HAPPY YOU DID.

A TFI is money you ideally want to leave invested for as long as possible, as its one of the best ways for South Africans who have extra money to save outside of their retirement fund to build up a nest egg for the future.

If you haven’t yet opened a TFI with us, you can still do so before the end of the current tax year on 28 February 2025. And the good news is that you can start from as little as R250 via debit order. Or, if you haven’t maximized this year’s allowance, ensure you top-up in time. Simply log on to our secure online portal Coronation Online Service (COS) and follow the steps to completion.

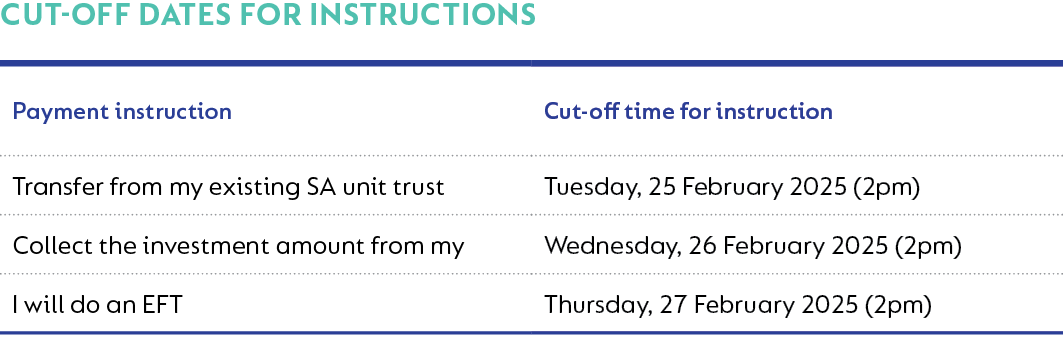

The cut-off dates for instructions are as follows:

South Africa - Institutional

South Africa - Institutional