Personal finance

Income investing

Understanding the risk and return objectives of your chosen income fund

Overview

Income funds have an essential role to play within your overall investment portfolio. Their purpose is to provide conservative investors (who may need to preserve capital in the short term) with a consistent income stream from a portfolio of investments.

While the classic income fund approach is to achieve a return of 1%-2% over a pure money market fund and to deploy duration (interest rate risk) of no more than two years, not all income funds are of equal risk and thus return. The investment universe with which to achieve a consistent income stream is much more complex than that of equities.

As a result, it is imperative for conservative investors to understand the risk and return objectives of their chosen income fund and to invest in funds with a proven track record of delivering through the various interest rate and market cycles.

This edition demonstrates how we use our broad and deep skill set to deliver on the risk and return objectives of conservative investors through our classic income fund solutions – Coronation Strategic Income and its global equivalent, Coronation Global Strategic USD Income.

Our classic income fund solutions

CORONATION STRATEGIC INCOME

Launched in 2001, Coronation Strategic Income is an actively-managed multi-asset fixed income fund that follows the traditional income fund approach (as described above).

With the aim of achieving a higher return than a traditional money market or pure income fund, Coronation Strategic Income has the following key objectives:

In order to meet this clear set of objectives, the fund combines conservative portfolio construction and a limit on more volatile asset classes.

These guardrails include:

- a risk budget that is capped at 25%; of which

- no more than 10% can be invested in listed property; and

- no more than 15% in a combination of hybrid fixed-income instruments and offshore bonds/cash.

Not all income funds are of equal risk

The ASISA South African – Multi Asset – Income category houses the income funds most commonly used by South African investors. However, it is important to note that the category allows for a high level of flexibility with no specific limits on risks that are appropriate to income investing.

The category allows as much as 45% offshore exposure, 10% equity exposure and 25% property exposure. Increasing demand in this space has resulted in a wider variety of funds (with increasingly varying investor outcomes) as fund managers have responded with new fund launches. As a result, the category now comprises a significantly less homogenous set of options compared to a decade ago with differing risk and return profiles.

CORONATION GLOBAL STRATEGIC USD INCOME

Born out of the same principles that we use to manage and construct the Coronation Strategic Income Fund, we launched Coronation Global Strategic USD Income more than a decade ago in 2011.

The fund is suitable for investors seeking to utilise their offshore allowance conservatively through a flexible mandate.

In order to achieve its objectives (that are in line with that of Coronation Strategic Income), Coronation Global Strategic USD Income has the following guardrails in place in terms of its risk budget:

- no more than 10% invested in listed property;

- no more than 30% in BBB-rated corporate bonds;

- no more than 10% in sub-investment grade bonds

- a maximum of 25% in non-hedged USD exposure

Later on we will demonstrate how the benefits of active management in local and global fixed-income markets have paid off for investors in these two funds.

What to expect from our classic income fund solutions

We apply the following fundamental principles to deliver on our domestic and global classic income funds’ objectives.

TO OUTPERFORM THE RISK-FREE RATE, THE FUNDS WILL PLACE CAPITAL AT RISK

We need to take risk to outperform cash over the long term. However, we never do this at the expense of our capital preservation commitment or if it risks underperformance of cash.

So we set out to do this by:

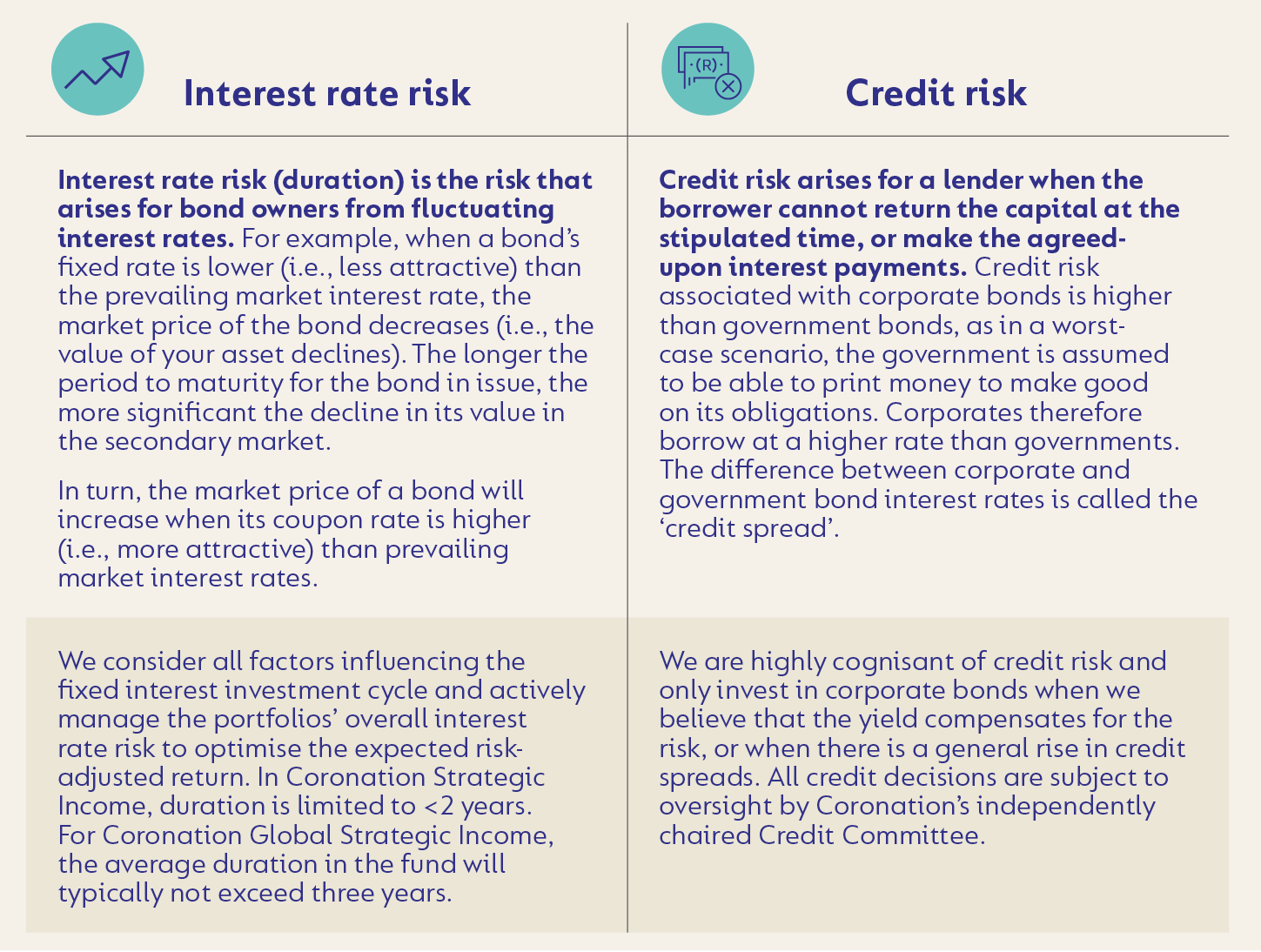

- taking considered interest (duration) and credit risk where appropriate; and

- increasing exposure to alternative sources of return when the likelihood of outperformance is high.

The following visual explains how we take considered interest rate and credit risk, where appropriate, across our income portfolios.

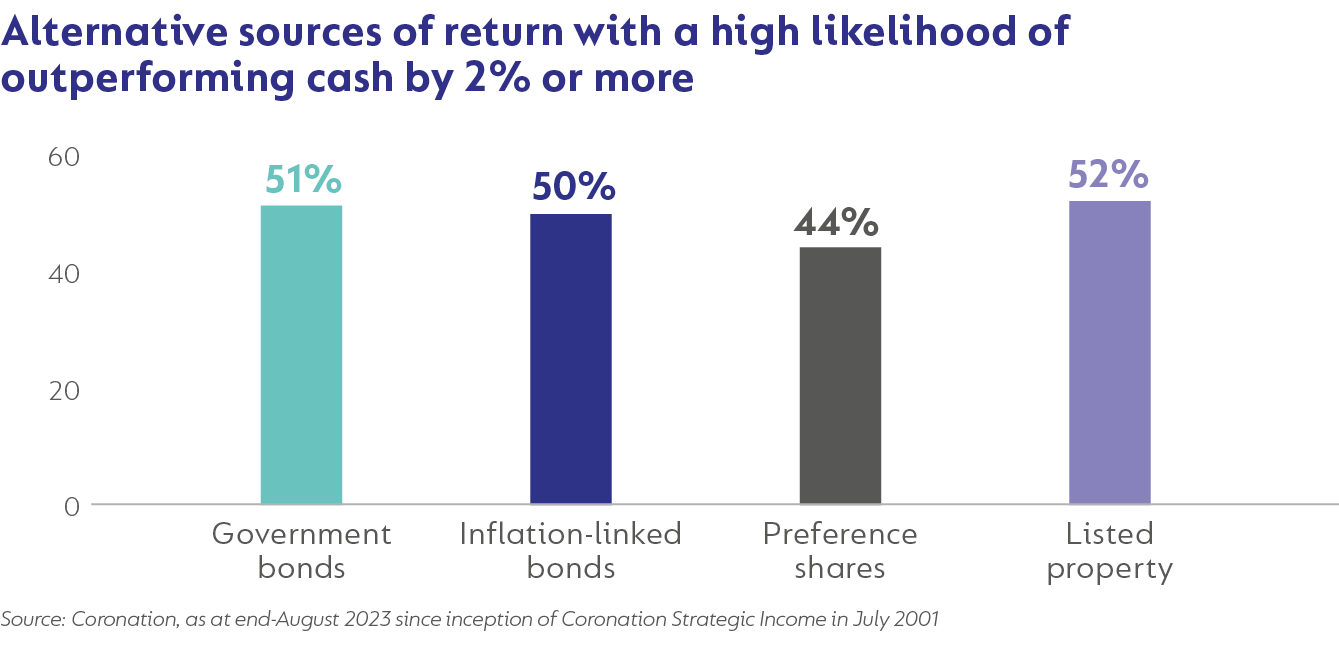

To achieve our internal performance target of cash plus 2% over the long term, one could argue that it is as simple as constructing a portfolio comprising only of instruments that offer a cash yield plus 2% or more. The following graph demonstrates the percentage of months these asset classes have outperformed cash plus 2% since the inception of Coronation Strategic Income.

However, allocating to alternative sources of return that offer protection and diversifying qualities requires careful analysis of the prevailing market environment and then to dynamically adjust exposure when the likelihood of outperformance changes.

ROBUST PORTFOLIO CONSTRUCTION

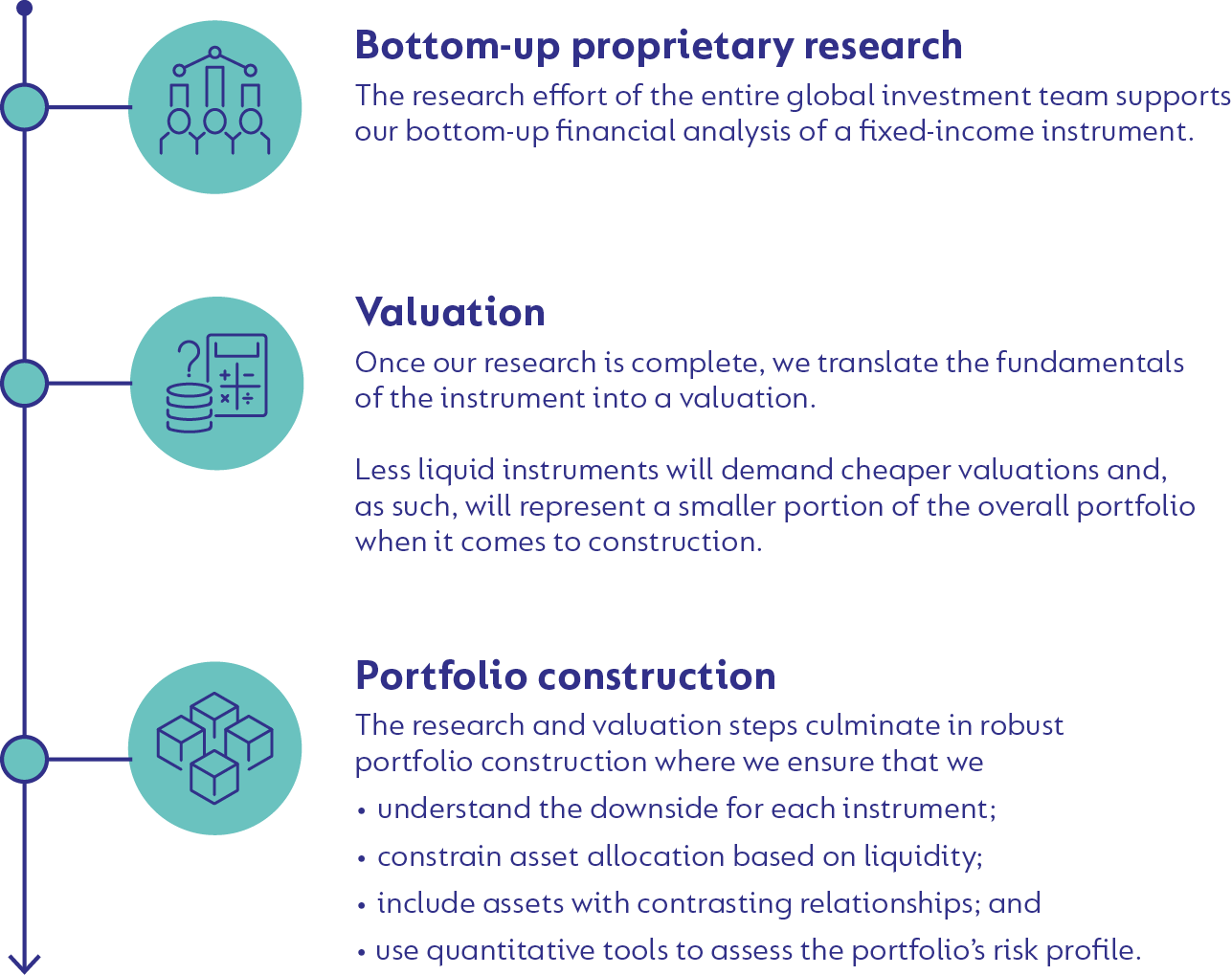

As with equities, we believe we can add value to conservative investors in our classic income funds through bottom-up security selection when assets are mispriced.

Our approach to asset allocation within the local and global fixed-income universes mirrors that of the broader Coronation investment team, but the process needs to be overlaid with certain constraints given the needs of our income fund investors. These constraints include allocating to a blend of assets that:

- can deliver on our income funds’ respective performance objectives (cash plus 2% over the long term or cash-like returns during volatile times);

- while prioritising capital preservation over 12 months; and

- providing liquidity to investors with immediate income needs (such as those drawing a regular retirement income).

The following visual demonstrates the process in a bit more detail:

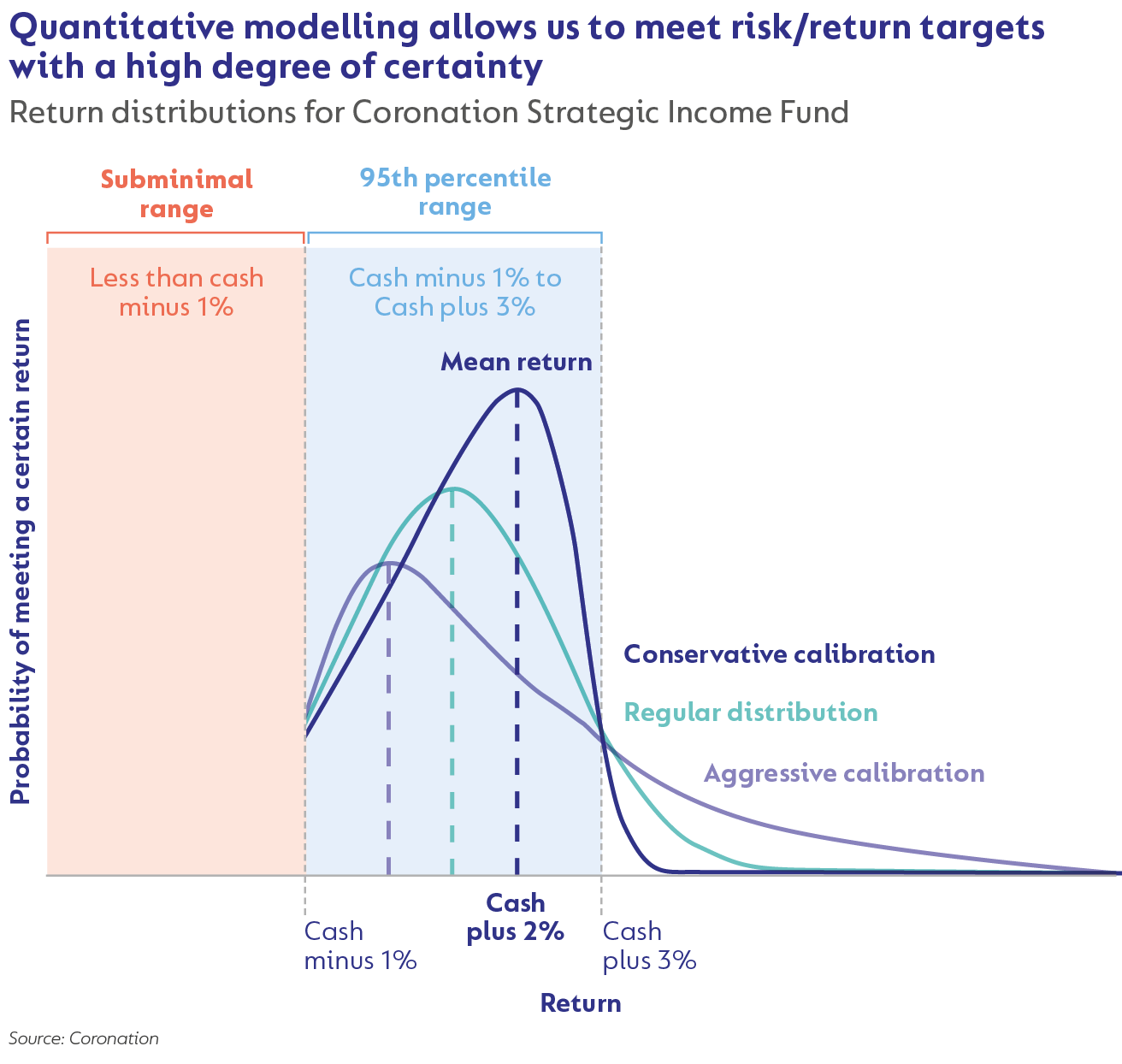

AVOIDING EXCESSIVE RISK FOR CERTAINTY OF RETURN

As part of our disciplined portfolio construction process, we never aim to increase our income funds’ risk profile or performance by increasing the possibility of investor downside.

This means that we won’t attempt to deliver more than cash plus 2% if we believe it will put our capital preservation commitment at risk or result in us underperforming cash (see chart below). To achieve this, we use quantitative modelling to arrive at a blend of assets that allows us to meet our risk/return target with a high degree of certainty.

CASH-TYPE RETURNS IN A VOLATILE ENVIRONMENT

As explained before, the need to put capital at risk through the portfolio positioning decisions means that our income funds will not have a linear return series like that of a money market fund.

Over short measurement periods, capital at risk can fluctuate. We will, however, never position our income fund portfolios towards a single outcome. Instead, we create portfolios that comprise a diversified set of assets and always take a conservative approach to risk (e.g., through option protection strategies).

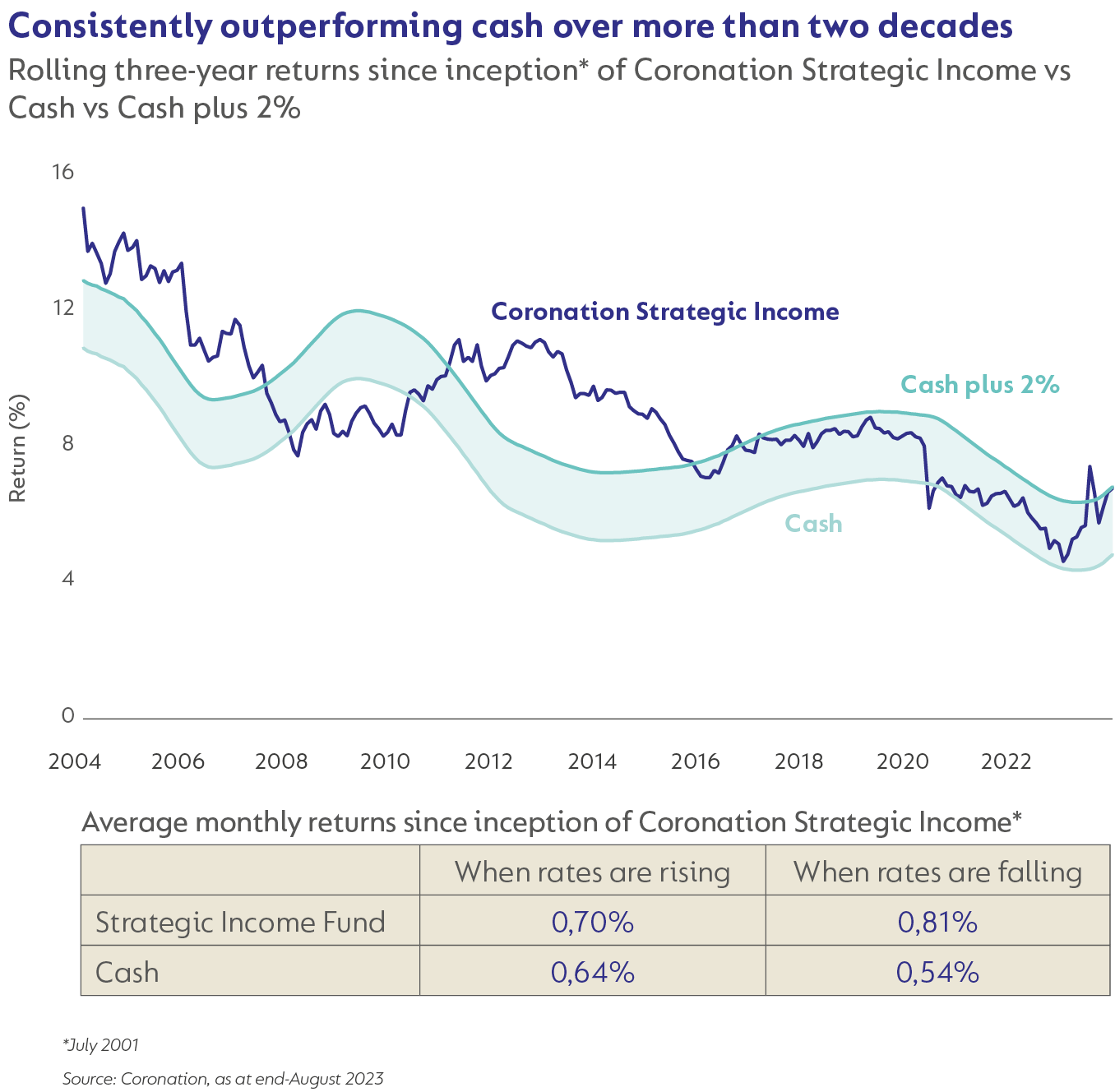

Sometimes, in the short term, these funds cannot deliver on their cash plus 2% targets. Rising interest rate environments make it more challenging to provide cash plus 2% (as has been the case since November 2021). When rates are falling, it becomes easier to achieve this goal. However, we are confident that we can consistently deliver cash plus 2% through the cycle.

OUR INCOME FUNDS ARE NOT BOND FUNDS

Coronation Strategic Income and Coronation Global Strategic USD Income are not bond funds. Both funds are actively managed multi-asset funds that can invest in a wide range of fixed-income instruments that may include bonds.

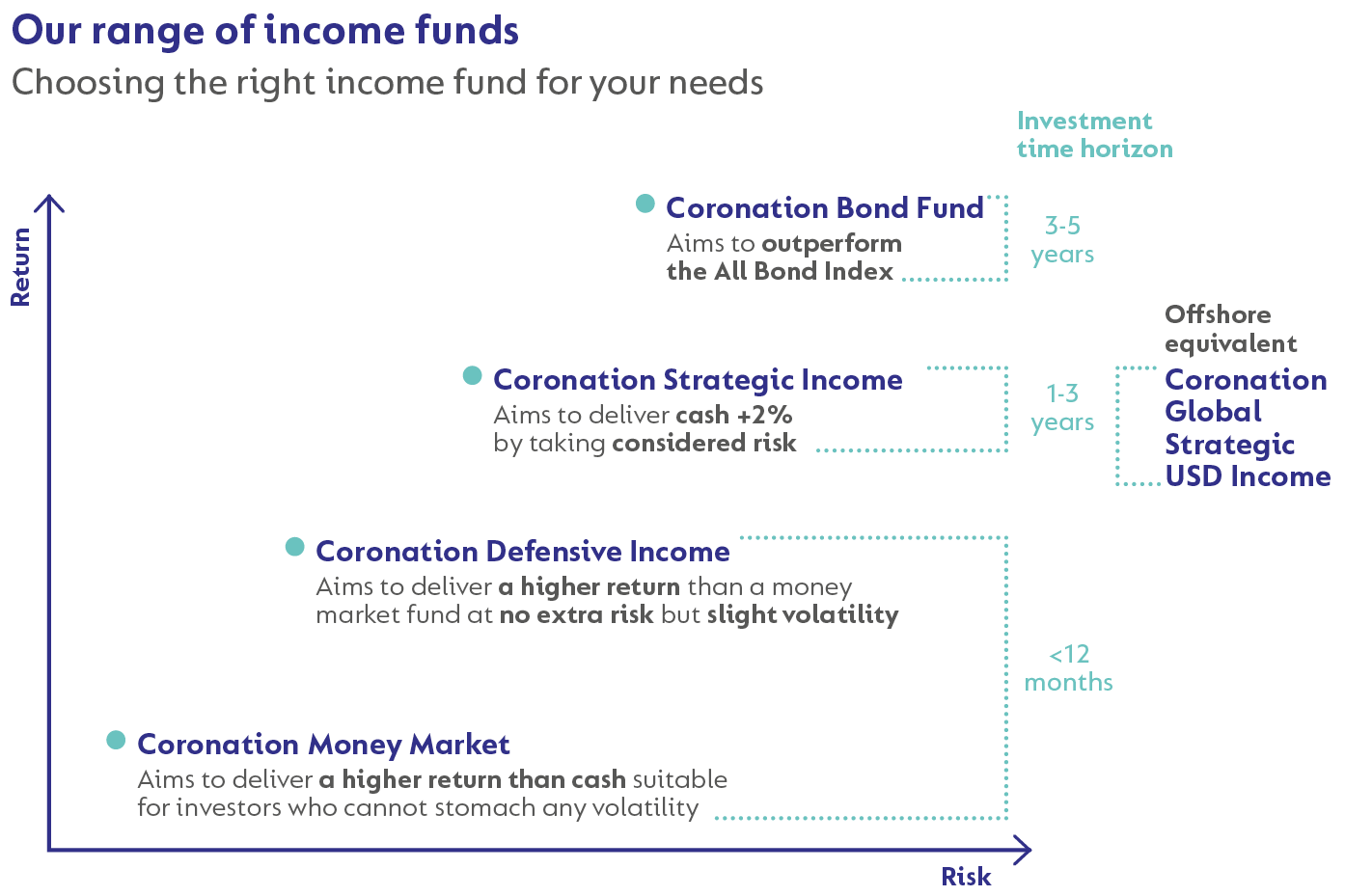

These funds are appropriate for investors who want to beat cash over the medium term (1-3 years) and can stomach more volatility than a cash-plus fund. To ensure the funds remain appropriate for medium-term investors, we manage them with significantly less interest rate sensitivity than a bond fund. We are typically more conservative in our credit risk management than many other funds in the domestic category.

In turn, bond funds provide exposure to longer-dated debt instruments and, as such, are best viewed as an alternative to 5-year fixed deposits or as a building block allocation in a diversified portfolio strategy. Bond investors typically earn a much higher yield than income fund investors as they provide longer-term funding, but as a result, they are also exposed to much higher interest rate risk.

The following visual indicates where our different fixed-income fund solutions sit regarding return expectations, risk appetite, and time horizons. All funds are managed according to the same Coronation investment philosophy (disciplined, long-term focused, and valuation-based) we apply across our entire fund range. Over and above the following funds, we also offer a specialist listed property fund (Coronation Property Equity) for investors with different return objectives and time horizons.

Delivering on investors’ expectations over the long term

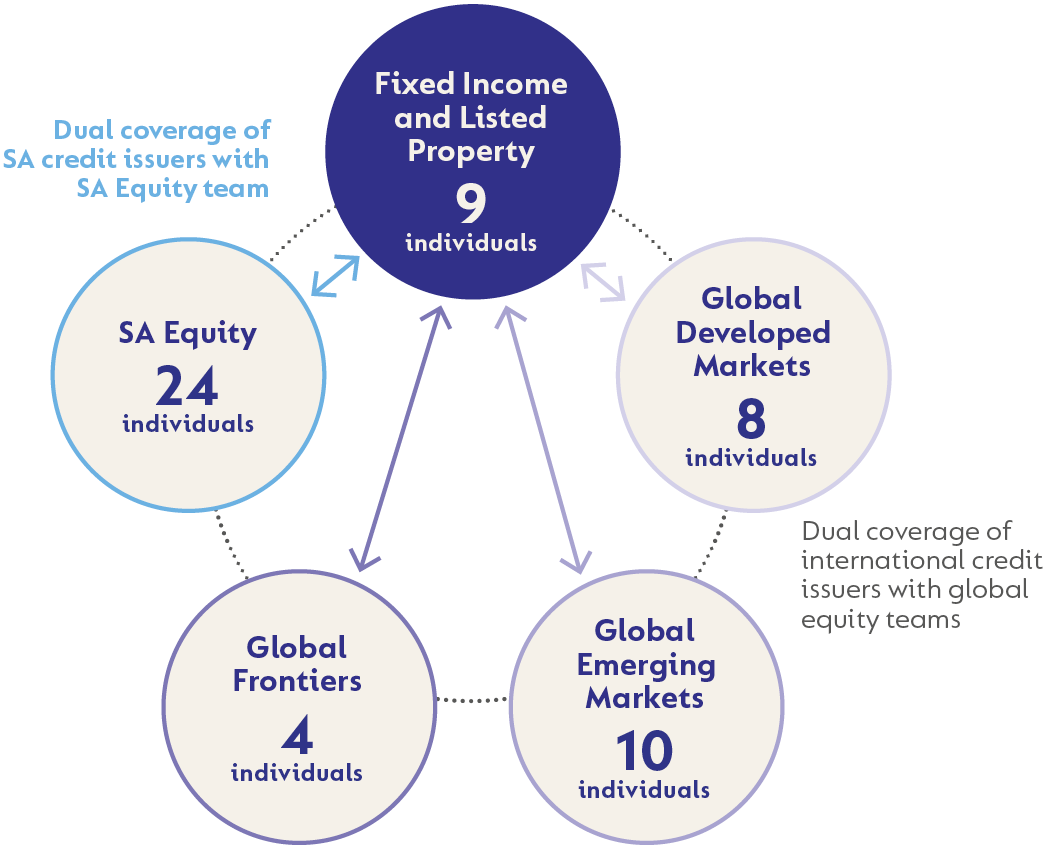

A COMPETENT TEAM

Our fixed-income team of 9 specialists is well-resourced and fully integrated into our global investment team of 55 professionals (see below). These specialists provide vital inputs to extract maximum value across the potential return enhancers in the fixed-income universe. The team covers instruments both locally and offshore. And to enhance the rigour of our investment process in this universe, we share dual coverage with our respective local and global equity teams of the local and international credit issuers held within our portfolios.

55 Fully integrated investment professionals

Our fixed income team sits together with and works closely with our global and local equity investment colleagues to support us on local and offshore credit

EXPERTISE THAT CULMINATES IN DESIRED OUTCOMES FOR CONSERVATIVE INVESTORS, BOTH LOCALLY AND OFFSHORE

Our flagship domestic income fund, Coronation Strategic Income, consistently outperformed cash over its more than 20-year history, as shown in the graph below.

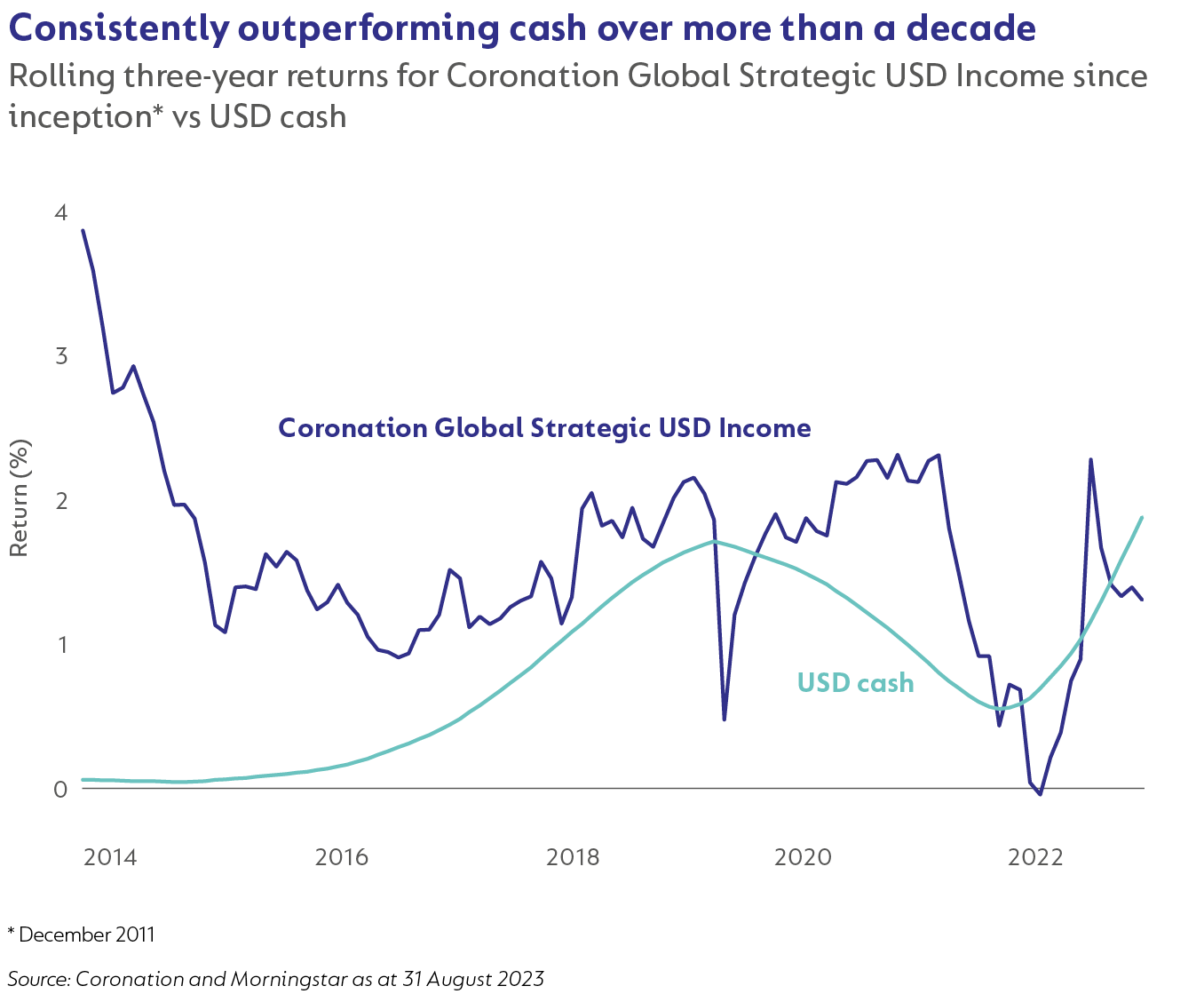

Equally, its global equivalent Coronation Global Strategic USD Income produced returns ahead of cash over its more than 10-year track record.

KEY TAKE-OUTS:

This outperformance of cash over rolling three-year periods (the two funds' recommended investment periods) demonstrates the value of considered risk-taking within the fixed income universe (both locally and internationally), coupled with active asset allocation and instrument selection, as well as diversification into alternative sources of return when the likelihood of outperformance is high.

Disclaimer

SA retail readers

South Africa - Institutional

South Africa - Institutional