Business & Industry views

Coronation enters the ETF market

Seven funds have now debuted on the JSE, with more to follow.

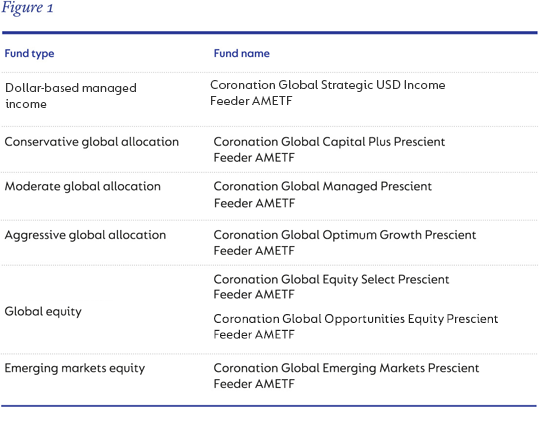

We are pleased to announce our entry into the exchange-traded fund (ETF) market, with the listing of a suite of actively managed ETFs (AMETFs). Following the launch of the JSE’s first dollar-based managed income AMETF, Global Strategic USD Income, on 14 August, Coronation expanded its offering with six more strategies from its well-established offshore range of investment opportunities covering risk-profiled allocation funds as well as global and emerging market equity funds. As a result, Coronation’s entire range of international strategies is now available as AMETFs.

The latest listing on 11 October is that of the Coronation Global Opportunities Equity Feeder AMETF.

BROADENING OUR REACH AND ACCESSIBILITY

Coronation is a market leader in the South African domestic and offshore fund industry, but as an active manager, listing rules have historically prevented our participation in the ETF market. Recent amendments to the JSE Listings Requirements have removed this barrier. We are therefore excited to make our well-established and proven investment strategies available to investors who prefer to implement their investment views via the JSE.

Our initial Feeder AMETF launch focused on our existing international strategies that cover the full range of investor needs as set out below.

Our AMETF range will be feeder funds into Coronation’s UCITS funds, which are managed by our experienced and fully integrated global investment team. The feeder model enables the new AMETFs to immediately benefit from the scale economies and efficiencies of the more than $4bn asset base already invested in their respective underlying master funds.

For similar reasons of scale and efficiency, coupled with their proven track record in the fund-hosting and ETF markets, we have partnered with Prescient Management Company [RF] (Pty) Ltd to bring our first AMETFs to market. Over time, we expect to expand the range of Coronation-managed strategies available as AMETFs, including replicating some of our successful domestic unit trust funds.

INVESTING IN OUR AMETFs

The table below explains how our new funds can be accessed directly through stockbrokers and online share trading platforms. In time, our AMETFs will also be available to Coronation’s clients via our secure investor portal, where they will enjoy a consolidated portfolio view and benefit from our client service capability.

| Coronation AMETF | Listing Date | JSE Code | Fund Description | Master Fund | Master Fund Fact Sheet |

|---|---|---|---|---|---|

| Coronation Global Strategic USD Income Prescient Feeder AMETF | 14 August 2024 | COUSDI | A managed USD income fund | Coronation Global Strategic USD Income Fund | Click here |

| Coronation Global Capital Plus Prescient Feeder Actively Managed ETF | 21 August 2024 | COGCAP | A conservative global allocation fund | Coronation Global Capital Plus Fund | Click here |

| Coronation Global Managed Prescient Feeder Actively Managed ETF | 21 August 2024 | COGMAN | A moderate global allocation fund | Coronation Global Managed Fund | Click here |

| Coronation Global Equity Select Prescient Feeder Actively Managed ETF | 21 August 2024 | COGES | A global equity fund | Coronation Global Equity Select | Click here |

| Coronation Global Optimum Growth Feeder Actively Managed ETF | 27 August 2024 | COOPTI | An aggressive global allocation fund | Coronation Global Optimum Growth | Click here |

| Coronation Global Opportunities Equity Feeder Actively Managed ETF | 11 October 2024 | COGOE | A global equity fund of funds | Coronation Global Opportunities Equity | Click here |

| Coronation Global Emerging Markets Feeder Actively Managed ETF | 27 August 2024 | COGEM | An emerging markets equity fund | Coronation Global Emerging Markets | Click here |

The individual AMETF fact sheets are available on Prescient's website.

Investors who currently hold the relevant rand-and foreign-currency denominated offshore unit trust funds will not be affected by these listings, nor will there be any changes with respect to how their portfolios are managed.

If you have any questions, please contact us on 0800 22 11 77 or clientservice@coronation.com

Comprehensive fund factsheets:

South Africa - Personal

South Africa - Personal