Business & Industry views

Inspire Inclusion

Practical steps to cultivate inclusivity in financial services

The International Women’s Day’s theme for 2024, Inspire Inclusion, encourages the recognition of the unique perspectives and contributions of women. But what needs to happen in practice for the inclusion of women to become a greater reality on the ground? At Coronation’s 2024 Women’s Month breakfast, Azola Lowan, Fund Manager at Coronation, discussed this question with panel members Melissa Breda, Head of Multi Management at the Public Investment Corporation, and Nilza Mngomezulu, Head of Finance at Hollard International. The following is an edited summary of the discussion.

Azola Lowan: This morning, we want to look at how we move beyond powerful and impactful words to making a real-world difference. Ladies, could you please start by sharing a little bit about yourself, and then tell us why you believe that it's important for women to play a pivotal role in financial services, and whether there is any benefit to increasing diversity in the workplace?

Melissa Breda: I completed my honours degree in actuarial and mathematical statistics and got the opportunity to join a graduate program at Momentum. I moved from the Eastern Cape to Gauteng and thought, ‘This insurance company is where I'm going to become an actuary’, but this was not to be. The graduate program included an investment course, and I thoroughly enjoyed it. I was hooked! The permutations and probabilities that I could calculate in investments just appealed to me. I also found myself in a nurturing and supportive environment, where I was able to hone my technical skills in portfolio construction. The leaders in the organisation at the time were all women. I think the most critical contribution that they could have made to my career was instilling in me the confidence to be myself. They convinced me, as young as I was, that my authenticity was my superpower, and that they wanted my unique perspective. They robustly debated my recommendations, really considered them, and valued them. Now, I manage a team of 13 professionals, and I enjoy working with young graduates. I know what a difference I can make in their story, as those women had done for me.

To me, diversity means that we have better, broader perspectives and that we're able to meet our clients' needs better. If we are diverse, we can see diversity in our customers. Diversity is not an ethical matter or a social responsibility. It's a technical contribution to us achieving better returns for our clients.

Nilza Mngomezulu: I grew up in Carltonville, Gauteng, and later moved to Soweto to live with relatives after the passing of my parents. This experience forced me to mature quickly and take on more responsibility, which helped me develop leadership skills at a young age. A few years later, I was among the top 10 matriculants in my class, and I received a bursary from Deloitte to further my studies.

After completing my articles, I began my career in the insurance industry. During my job interview, when asked what I knew about insurance, I was honest and said that aside from knowing my car was insured, I knew very little. Despite this, the interviewers, two women, took a chance on me. I took on a technical role in financial reporting, statements, and consolidation, and was promoted to Manager for Reporting within eight months.

Through my journey, I've learned that women have the ability to hold key roles in organisations. It's important not to shy away from learning new skills or taking on new challenges because you never know where your true passion may lie.

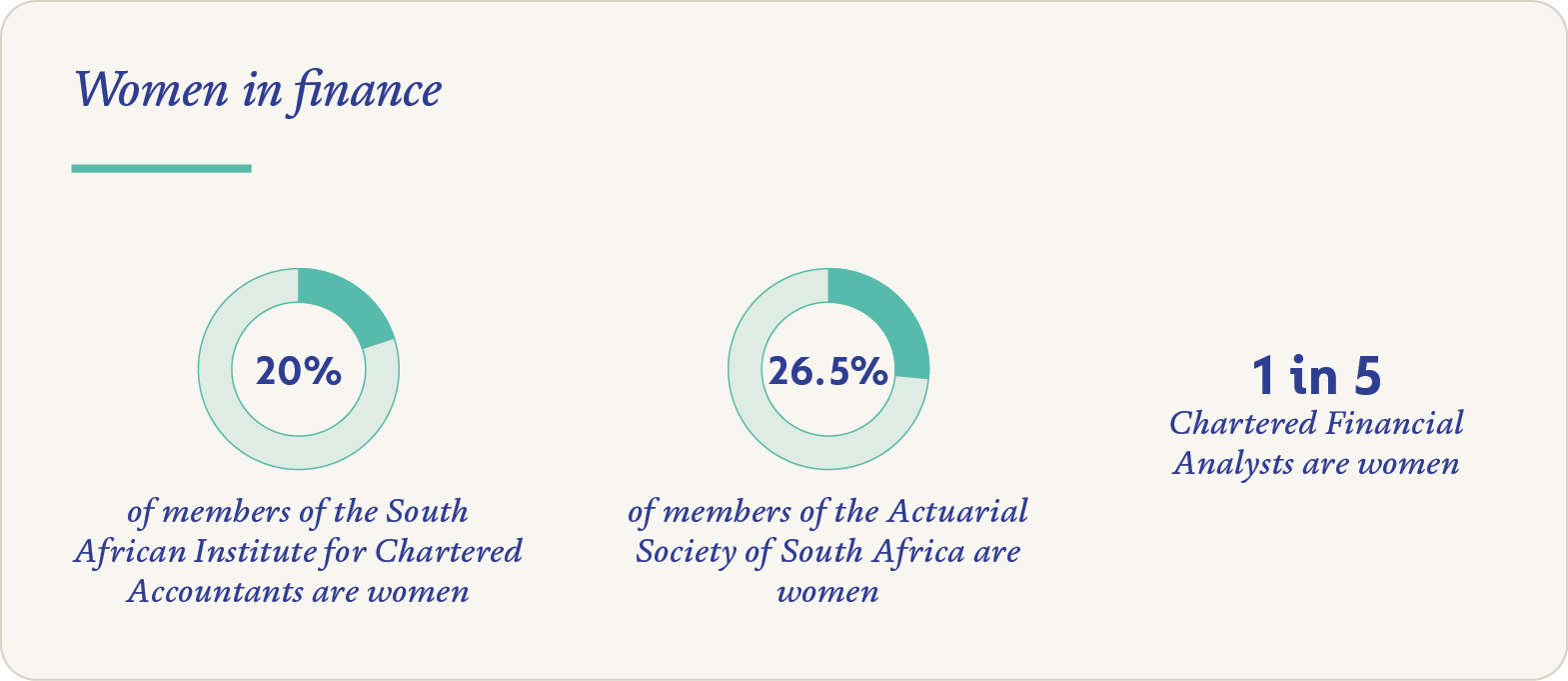

Azola: The South African Institute for Chartered Accountants have about 60,000 members and associates. However, women of colour make up just under 20% of their membership. Nilza, from your perspective, what do you believe are the reasons why women of colour are so underrepresented? And what can we do to improve the throughput of black CAs? When you were growing up, was this the career that you had envisioned for yourself?

Nilza: I wasn’t aware of the Chartered Accountant (CA) qualification until a guest speaker visited our school assembly and talked about it. That’s when I began researching, though I still had doubts. Growing up, the careers we were familiar with were those we saw around us, like nurses, doctors, and police officers. In fact, I once wanted to become a Metro cop! But when I scored 100% in accounting in Grade 12, I took it as a clear sign of the path I should pursue.

There are many reasons why so few women of colour qualify as CAs, but I’ll focus on two key challenges. First is the quality of education in public schools, particularly in rural areas and townships. Many students with potential are not receiving the education needed to access this qualification. Second, even if they meet the academic requirements, many cannot afford to pursue their studies.

As women in positions of influence, we can give back to our communities through mentorship and by raising awareness of career opportunities. That’s why I founded the Phenomenal Women Foundation. I’ve adopted the school I attended in Soweto and invite women from various fields to share their stories and career paths. This helps students realise the opportunities available to them and understand that they, too, can reach those heights.

Azola: Another important professional body is the CFA [Chartered Financial Analyst] Institute. Women represent only about one in five CFA charterholders. When you look at the Actuarial Society of South Africa, women only make up 26.5% of its 2 000 members. Melissa, in your view, why do we see such a few female CFAs and actuaries? As the PIC, what role are you playing to improve gender diversity in our industry?

Melissa: What Nilza described is a grassroots issue. We have to delve into the reasons why women are not choosing this career path. When we look at other industries, we find high representations of women in the medical field, for instance, and in other fields that are perceived to be more impactful. I think women do not understand how they can actually make a difference or impact in the finance field. I think what you're doing today with having the high school students here is critically important because we've got to start at that level to address the concern.

The CFA is such an incredibly difficult designation to achieve, and the CFA Institute lists a couple of reasons for the low participation from women. They noted that women often drop out at level three, when they experience difficulty in attaining the charter, are slightly older and starting to reconsider their life priorities. That's the critical point where women need to be convinced to persevere.

The other issue is the perception that investment decision-making roles are reserved for men. We need to make sure that we dispel those perceptions. While senior women in business management roles, such as CEOs and CFOs, are needed in our industry, when we do find women who want to be in investment decision-making roles, we have to support them and ensure that they have support structures to succeed.

There are many recent bespoke publications and some annual surveys that highlight the underrepresentation of women in the industry. As the PIC, we allocate capital to 23 domestic firms, and we monitor and engage the trajectory for each of those firms with regard to their gender statistics. How are they improving on a year-on-year basis? When they are hiring, are they purposefully attracting women? The PIC also runs a career fair where we target high schools in rural areas and underrepresented provinces. We have a bursary committee that currently has 50 students fully funded by the PIC . They're doing very well, and they're predominantly women from previously disadvantaged regions and institutions. The PIC also runs a graduate program that tries to bring young women into various roles in financial services.

Azola: Let’s take a broader look at financial inclusion. In South Africa, a statistic that is often quoted is that more than 70% of South Africans are underinsured. Nilza, what are the reasons for this, and what can we do to tackle this issue?

Nilza: One of the major challenges in today’s economic landscape is affordability. Many people see insurance as a luxury rather than a necessity, making it one of the first expenses they cut from their budgets. This perception stems from financial constraints and a lack of awareness about the long-term benefits of insurance. As a result, insurance often doesn't become a priority unless it’s mandatory, such as for health or vehicle policies. To address this, insurance companies need to innovate and develop products tailored to the financial realities of broader segments of the population.

Azola: Let’s turn the focus to retirement outcomes and the impact of the new two-pot system. Currently, less than 10% of South Africans can retire comfortably. If you can tap into your savings pot annually, does that not undermine long-term saving?

Melissa: I think the devil is in the detail. We've got to take a step back and think about what we are trying to address with this pension reform. If you think about the experience of South Africans over the last couple of years, particularly since Covid, households are under significant pressure. The behaviour that has manifested from this is that people are predominantly cashing out their pension funds when they're changing jobs. We have even seen people intentionally putting their employment at risk to access savings. I think the government has heeded calls from retirement fund members to access some cash to meet their basic needs and to deal with financial emergencies. So this reform aims to balance the promotion of preservation as well as creating some flexibility that members have been asking for.

Azola: We have an audience question about work-life balance for Melissa. You are managing a team of 13 individuals; you operate in a complex environment and you travel internationally. How do you maintain a stable and successful personal life given all the demands from your career?

Melissa: It's important as leaders that we realise that work-life balance for every woman means a different thing. I am a mother, but not everybody in my team is a mother. We've got to consider that the flexibility that we allow mothers is extended to everyone with regard to the personal priorities that they have in their life so that they can also have work-life balance.

For me, I think I wouldn't be able to do what I do without a very good support system. I've had to learn to ask for help, and now I ask for help from everybody able to assist me to do what I need to do! I also believe that we can have it all - but we can't have it all at once. I definitely have weeks that are intensely work-oriented, particularly when I’m travelling. So I do have days when I have one ball in the air and feeling like I’m dropping another. I manage that by ensuring that I keep juggling and not prioritising one aspect of my life over another for too long. While our work provides us with huge measures of satisfaction and purpose, family is always first!

Azola: Nilza, we have a question from the audience for you. As one of the youngest CFO in the ABSA group, how did you navigate sitting in various committees or various boards, being the youngest person in the room?

Nilza: That's a very powerful question. It can be challenging to be the youngest or the only woman in the room, and it can feel intimidating. However, I’ve learned to manage this by being well-prepared. Before presenting to any committee, I thoroughly review my presentation, ask myself critical questions, and seek input from my boss, mentors and/or support network. I often ask, "Does this make sense?" or "Is there something I’m missing?" My mentors have been instrumental in my growth, and I owe a lot to the remarkable women and men who have guided me along the way. I believe that age and gender shouldn’t define your value in a room – it’s about what you bring to the table and the substance of what you’re saying. The key is to embrace the challenge, not be intimidated by the room, and ensure you’re ready by doing your homework and knowing your material.

Azola: Thank you very much to the panellists this morning. I hope that you've been inspired to take up the challenge to inspire another young person, open a door or share some knowledge with them.

Speaker biographies:

Melissa Breda is the Head of Multi Management for public markets at the Public Investment Corporation. Previously, Melissa worked at Momentum Outcome-based Solutions as head of Portfolio Management. She completed her BSc (Hons) degree in Mathematical Statistics and has over 20 years of industry experience.

Nilza Nonhlanhla Mngomezulu is the Head of Finance at Hollard International. Nilza previously worked at Absa as Head of Finance and at Global Alliance, a wholly owned subsidiary of the Absa Group, as Chief Financial Officer. She is a qualified Chartered Accountant and holds a Master of Business Leadership degree. She is also the Chairperson and co-founder of the Phenomenal Women Foundation.

Azola Lowan is a Fund Manager at Coronation. She joined the company in January 2019, bringing a wealth of experience across multiple roles in financial services. She has 21 years of industry experience. Azola holds a Master of Business Science degree (Economics) from the University of Cape Town and is a CFA charterholder.

South Africa - Personal

South Africa - Personal