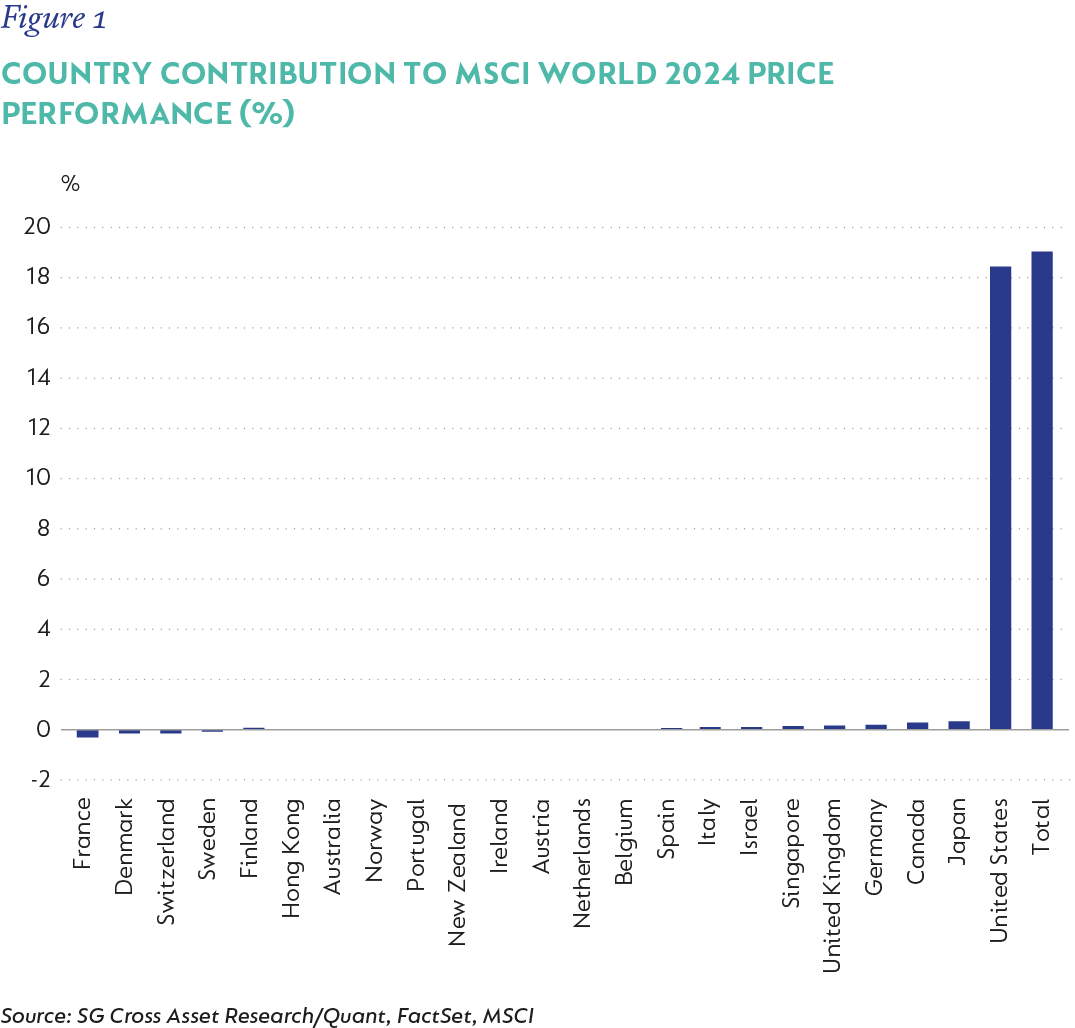

The final quarter of 2024 (Q4) finished on a weaker note, with equity and fixed income markets declining. The -1% decline for the MSCI All Country World Index (ACWI) is perhaps surprising considering the ebullience after the US election. Once again, this can be explained by a meaningful divergence in regional performance, with the S&P 500 Index increasing 2% in Q4, compared to the MSCI World ex-US declining 7% and MSCI Emerging Markets declining 8%. The bond market (as measured by the Bloomberg Barclays Global Aggregate Bond Index [BBGAB]) fared worse, declining 5% for the quarter. Against the benchmark return of -2.6%, the Fund fared well, gaining 3%. For the full year, the Fund posted a solid 16% return compared to the benchmark return of 9.6%.

Much has already been written about the narrowness of equity market returns in 2024. In our Q1-24 commentary we wrote: “On the equity side, we think the opportunity to add value from differentiated stock picking remains elevated. The market’s appreciation and inflated trading multiple (relative to history) obscures opportunities at the single stock level, which our analysts believe to be compelling.”

Yet equity returns for the year continued to be dominated by the US, and, specifically, by a narrow cohort of large technology stocks within the US. In the final quarter, four of the Fund’s largest detractors were stocks we did not own: Tesla, Apple, Nvidia and Broadcom which collectively account for c. 12% of the ACWI and are four of the eight largest companies in the world with an average market capitalisation of $2.3 trillion. With contributions this skewed, consensus is now firmly that the US is the only game in town.

This obsession with a small number of large technology stocks within a single country continues to create compelling opportunities for stock pickers like us. And in contrast to the index, the Fund’s outperformance was driven by a number of businesses that operate across a diverse range of sectors in many different geographies. The median market capitalisation of our top 15 contributors for Q4 was $25bn, with the biggest stock having an index weighting of only 0.2%. While we admire the business models of many of the largest stocks, follow them closely, and own a select few, we continue to see more value outside of the megacaps. A few examples follow:

- Spotify performed strongly throughout the year, exhibiting a rare combination of accelerating revenue growth alongside rapidly expanding margins. Revenue grew at around 20% in 2024 thanks to market share gains and price increases off a very low base. This monetisation momentum is set to continue into 2025 with the launch of higher-priced VIP tiers alongside other initiatives. Against this strong operating backdrop, Spotify’s cost base actually declined on a year-on-year basis, exhibiting exceptional cost control. As a result, the business moved from being loss-making in 2023 to earning EBIT margins of 11% in the third quarter of 2024. We feel that the company has now firmly proven that it can be both a great product and a great business that is sustainably profitable.

- Airbus shares appreciated strongly in Q4 as management reiterated full-year guidance against an industry-wide backdrop of supply chain bottlenecks and delays. We don’t believe this to be a defining milestone for the long-term investment thesis but are encouraged by the steady progress being made in addressing the supply chain bottlenecks affecting Airbus’s production ramp-up and we remain confident that Airbus will generate materially improved free cash flows (FCF) in the second half of the decade.

- Auto1 delivered an exceptional set of Q3 results, marking the third consecutive quarter of above-expectations results. Unit volume and revenue growth accelerated in both the merchant and retail businesses. Gross profit per unit, a key metric that we follow, was sustained at a high level in the merchant business and it continued to improve towards management’s €3 000 target in the retail business. The retail business is quickly approaching breakeven unit economics, at which point management is intent on accelerating the growth in that business.

- Accor, the European-centric asset-light hotel franchisor, continues to trade at a significant discount to US-focused peers despite a growing track record of consistent execution of management’s strategic plan. Hotel demand globally, specifically within Accor’s European heartland, remained resilient through the end of the year, and net unit growth should continue to accelerate in 2025 as post-Covid portfolio churn moderates. The restructuring of AccorInvest’s balance sheet is progressing, and Accor management continues to reiterate its intention to dispose of the business’ residual stake in AccorInvest and return the proceeds to shareholders within the next 18 to 24 months.

- Tapestry, the owner of brands operating in the affordable luxury category, was a strong performer in Q4. The company is well-run and its largest brand, Coach, continues to grow at a healthy rate whilst maintaining operating margins in excess of 30%. But the likely key driver of outperformance in the final quarter of the year was the joint announcement that the proposed acquisition of Capri Holdings was being terminated, with Tapestry also announcing a significant $2bn share repurchase programme. The fundamentals of the two companies have diverged significantly since the deal was originally announced in 2023, and the market rightly celebrated Tapestry’s renewed focus on its own high-performing brands alongside material shareholder returns.

- Booking Holdings is executing at a very high level, cementing its reputation as a consistent long-term outperformer in the online travel market. Booking.com continues to show good progress with two of its key strategic priorities: alternative accommodations and their connected trip strategy. Booking.com has been taking market share in the alternative accommodation market and growing faster than Airbnb over the last few years. Whilst still nascent, Booking.com is increasingly using its flights business to cross-sell more lucrative hotel accommodation. The company continues to return all its FCF to shareholders via buybacks and a recently instituted dividend.

More broadly, financial markets had to contend with a surging US dollar in Q4. The currency’s rally began following Donald Trump’s victory in the US presidential election and his threats of high tariffs on imported goods. Then, in December, although the Federal Reserve Board cut interest rates by another 25 basis points, the accompanying statement dampened expectations for further rate cuts. Chairman Jerome Powell indicated that in light of the resilient US economy, the pace of interest rate reductions could be slower and the trough in rates could be higher than the markets had anticipated.

From a macroeconomic perspective, most economists expected US growth to slow during 2024. The pessimists warned of a “hard” landing, the optimists predicted a “soft” landing, but the real outcome is more akin to a “no” landing, with growth remaining quite strong. In Europe, the economic slowdown has been more pronounced, which may prompt the European Central Bank to pursue deeper interest rate cuts than the US. The interest rate differential is expected to be in favour of the US and, therefore, contributing to a stronger US dollar.

The most concerning aspect of the global economy is the high levels of government debt in many of the developed world economies (and this affects the rest of the world too). After the Global Financial Crisis of 2008/2009 and the Covid pandemic, most governments experienced soaring debt levels as they implemented expansionary fiscal policies to mitigate the shocks of these events. Debt servicing costs have become a burden to many governments, and tackling it by raising taxes and spending less is obviously an unpopular choice. Bond investors are rightly demanding higher yields.

The US 10-year bond yield, currently hovering around the 4.5% level, is a far cry from the lows of around 1.5% seen in the lockdown period. Although somewhat more attractive, it reflects the state of debt markets, and we do not find it sufficiently compelling to warrant building meaningful positions in sovereign bonds. The unsustainable sovereign debt levels are a long-term concern that will, at some point, have to be addressed by politicians. We continue to maintain our conservative positioning in the fixed income markets. The Fund’s duration is approximately three years shorter than the BBGAB index, with a yield to maturity of 4.9%.

At quarter-end, the portfolio was positioned as follows:

- 67% effective equity

- 6% in real assets (listed infrastructure and property)

- 4% in high yield fixed income

- 9% in inflation-linked assets

- 13% in investment-grade fixed income instruments

The remaining 1% was invested in various other assets.

After two consecutive years of strong returns, there is little doubt that the S&P 500 Index is highly valued. We therefore caution against extrapolating the strong returns of the past two years into the future. Although we still find good value in select stocks, we do not anticipate another year of returns in excess of 20% from global equities.

Thank you for your support and interest in the Fund.

South Africa - Personal

South Africa - Personal