PERFORMANCE AND FUND POSITIONING

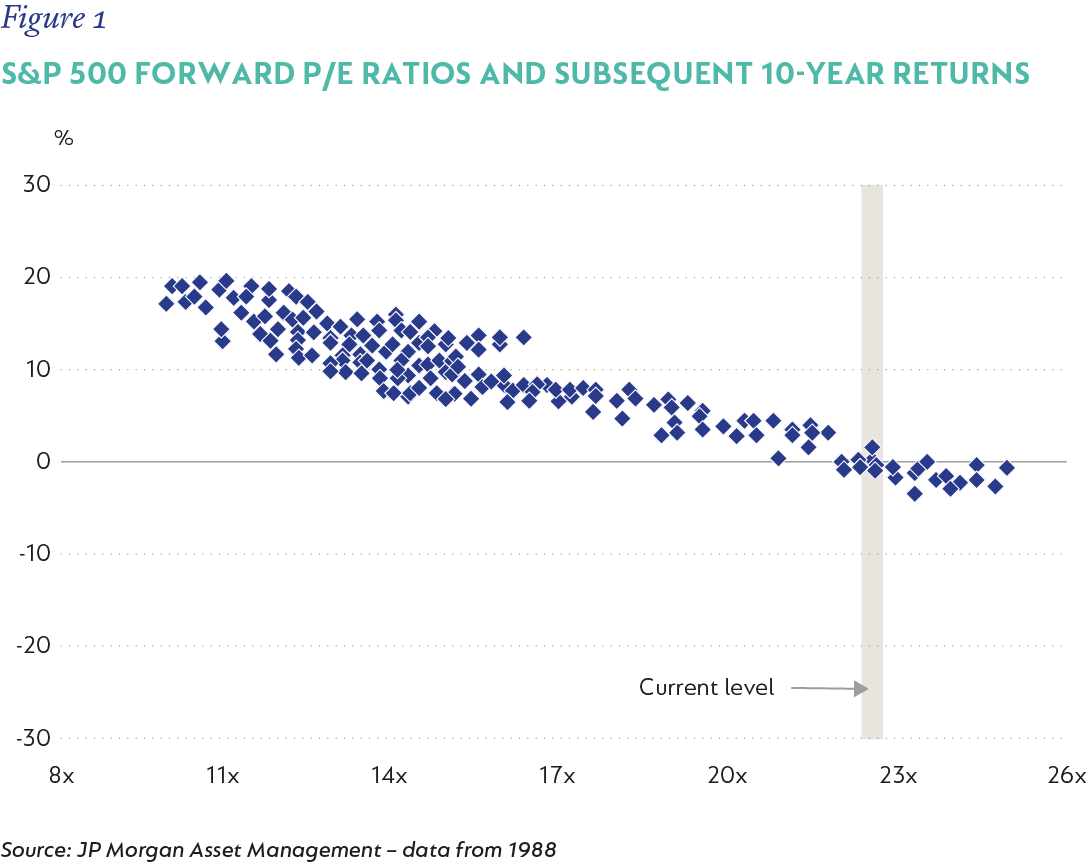

The Fund was down 3.65% (in USD) in the fourth quarter of 2024 (Q4-24). Global markets finished the year strong, in particular the S&P 500 Index, which gained 25% in 2024 after being up 26% in 2023 – this is only the fifth time in history that the S&P 500 has delivered two consecutive years of returns in excess of 20%. It does appear that animal spirits are back, with aggregate valuation levels being high compared to history and risk appetite being elevated – this will most likely have an impact on future returns from here, which is supported by long-term market data as illustrated by this graphic:

Against this strong market return backdrop, it is pleasing that the Fund delivered a 12.3% annualised return in USD over the past two years. This improved performance has started to filter into the longer-term numbers of the strategy*, but we remain unsatisfied with the medium-term performance. Whilst aggregate market levels appear expensive, we continue to uncover attractive individual investments resulting in the weighted average equity upside of the Fund being 64%, with the weighted equity five-year expected IRR being 20% supported by attractive valuations as the weighted equity free cash flow (FCF) yield for stocks owned is just over 6%. Using the rand-denominated fund’s long-term track record (expressed in USD) as proxy*, the Fund has generated a positive return of 1.5% per annum (p.a.) over five years, over 10 years a return of 3.8% p.a. and, since inception nearly 26 years ago, 8.1% p.a.

During the quarter, the largest positive contributors were LPL Financial (+40%, 0.82% positive impact), Tapestry (+40%, 0.73% positive impact) and Wise (+48%, 0.58% positive impact). The largest negative contributors were Delivery Hero (-31%, 0.83% negative impact), SA government bonds (-8%, 0.55% negative impact) and JD.com (-19%, 0.53% negative impact).

Calendar year 2025 is bound to be an eventful year with a new US administration touting seemingly positive business policies along with the appointment of numerous private sector individuals to key positions. A major risk factor, however, remains how far President Trump will push his tariff agenda which could have disruptive implications for numerous companies due to the globalised nature of the world today. It also seems likely that the aggressive US stance towards China will continue as these two superpowers struggle to find common ground, which is being exasperated by the race for AI dominance. Beyond the US, the war in Ukraine and the Middle East continues, and there remains political instability across both the EU and the UK. Geopolitical risks thus remain an important consideration when allocating capital. The flexibility of a multi-asset fund provides a useful toolkit to navigate these risks and helps to ensure that we maximise risk-adjusted return.

Against an expensive market, we continue to uncover attractive and diverse equities, and thus the Fund ended the quarter with 78% net equity exposure - only slightly lower compared to the prior quarter. The Fund also has put option protection, equating to 5% of Fund effective exposure spread across a range of indexes (US, Europe, and EM) which is a key feature of our flexible toolkit to manage risk.

Bond markets came under pressure in the quarter as US rate-cutting expectations receded due to the continued strength of the US economy. The Fund continues to hold a sizeable bond exposure which now sits at just under 12% at the time of writing, split between sovereign and corporate bonds. The latest bond purchase, which happened post quarter end, was Brazilian sovereign bonds that now represent 1.5% of Fund. Brazil’s fiscal situation is troubled, and this is compounded by a lack of real reform by President Lula’s government. Notwithstanding these risks, we believe that investors are being compensated as the bonds we purchased have a 16% yield to maturity in local currency, and whilst we are acutely aware of the foreign exchange risk associated to Brazilian assets, we purchased this bond after the currency had weakened more than 20% versus the US dollar, resulting in the Brazilian real being one of the worst performing emerging market currencies in 2024. Another major risk factor of owning bonds is inflation, which for now appears well controlled in Brazil and is sitting at just under 5%. The South African 10-year government bonds purchased in May 2024 now represent ~5% of Fund at the time of writing as we reduced exposure into the bond rally. South African 10-year government bonds still yield just under 11%. What is encouraging, though, is a continued commitment to structural reforms post the election, and what seems like a fairly well-functioning GNU government. Outside of the South African sovereign bonds held, we continue to hold a collection of foreign corporate credit, which, in aggregate, is providing us with a weighted yield in hard currencies of just under 6%, which remains attractive. We have limited exposure to real estate, with the balance of the Fund invested in cash, largely offshore.

The most notable increase in position sizes during the quarter was Warner Bros. Discovery.

Warner Bros. Discovery is a media business in the US with a strained balance sheet due to historic M&A and pressure on some of its legacy business segments, most notably linear TV. The business, however, is undergoing an active transition as they rapidly grow their streaming business whilst curtailing losses in this segment and working on a turnaround of their TV and movie production business. They have also recently announced the restructuring of their business, which should allow for value creation and the sale or spinoff of their legacy assets, which was further supported by a notable distribution deal with Comcast, supporting the linear TV business. We believe management is driving the business in the correct direction with an acute focus on managing the debt load, which is supported by robust FCF generation whilst positioning the business favourably in an evolving media landscape. We thus believe a lot of equity value is still to be created as debt is paid down and the enterprise value transitions from debt to equity. The business currently trades on ~5x 2025 FCF which we deem very compelling.

OUTLOOK

Calendar year 2024 was a general exuberant period for global markets, with certain pockets exhibiting bubble-like behaviour but in aggregate business performance has been robust and share prices have been supported by earnings growth. We do think caution is warranted, and that the returns experienced by US markets in the recent past should not be extrapolated. Against this backdrop, we remain excited about the prospects of the Fund as we continue to uncover and own attractive stocks and bonds, and whilst at times asset prices and their underlying fundamentals detach, they generally align long term. Things can change quickly and, thus, our focus remains on uncovering attractively priced assets versus trying to time markets - a core principle of Coronation and how this strategy has been run since its inception nearly 26 years ago.

*Note that this is a new fund and, as such, does not yet have a track record for the relevant periods. As it is the dollar-denominated version of the same investment strategy deployed historically in the management of the rand-denominated Coronation Global Optimum Growth [ZAR] Feeder Fund, we show the track record of the latter portfolio, converted to US dollars, to indicate historical results achieved by the Strategy.

South Africa - Personal

South Africa - Personal