The Fund was up 10.3% in USD in the third quarter of 2024 (Q3-24). Global markets continued to exhibit strength in the quarter, with the MSCI World Index up 6% in USD, but interestingly, the MSCI Emerging Markets Index was up 9% in USD, a notable change from the past. A large driver of this was a sudden and rapid rally in Chinese assets driven by government stimulus announcements, which resulted in the Hang Seng increasing 22% in USD in the quarter and taking its year-to-date return to 30% compared to the MSCI World Index, delivering a 19% USD over the same period. This is obviously a short time frame, and the key question is whether the rally can be sustained. However, considering the very low starting valuations in China and a Chinese government that appears concerned about the weakness in the economy, there is a probability that this rally has some legs but, most likely, not without volatility along the way. It was also encouraging to see returns from a much broader array of assets this quarter which, again, is quite different to the more recent past.

After a tough performance period for the Fund in 2022, it has been encouraging to see a strong performance come through, with the Fund delivering an annualised return of 21% in USD over the past two years. This has started to filter into some of the longer-term numbers, but we still remain unsatisfied with the medium-term performance of the Fund. In this regard, we remain excited about the Fund’s future prospects - the weighted average equity upside of the Fund is currently 53%, which remains compelling. Beyond this, the weighted equity five-year expected IRR (internal rate of return) is 19% and weighted equity FCF (free cash flow) yield for stocks owned is ~5%. Using the rand-denominated Fund’s long-term track record (expressed in USD) as proxy*, over the past five years, the Fund has generated a positive return of 7.0% per annum (p.a.), over 10 years a return of 8.7% p.a. and, since inception more than 24 years ago, 12.8% p.a.

During the quarter the largest positive contributors were South African government bonds (+18%, 1.5% positive impact), Delivery Hero (+71%, 1.5% positive impact), JD.com (+63%, 1.1% positive impact) and Naspers/Prosus (+23%, 0.7% positive impact). The largest negative contributors were Sendas (-26%, 0.4% negative impact), Brava Energia (-34%, 0.3% negative impact) and SK Hynix (-26%, 0.3% negative impact).

While it was pleasing to see a rally in Chinese assets, including those owned by the Fund, the underlying valuations of many Chinese assets remain attractive – to illustrate the point, below are the five biggest Chinese positions, which represent just under 90% of our total Chinese asset exposure (in total now 14% of Fund) – as can be seen the prospective IRRs (five-year earnings growth + annual dividend yield, adjusted for a rerating/derating) remain high notwithstanding the rally.

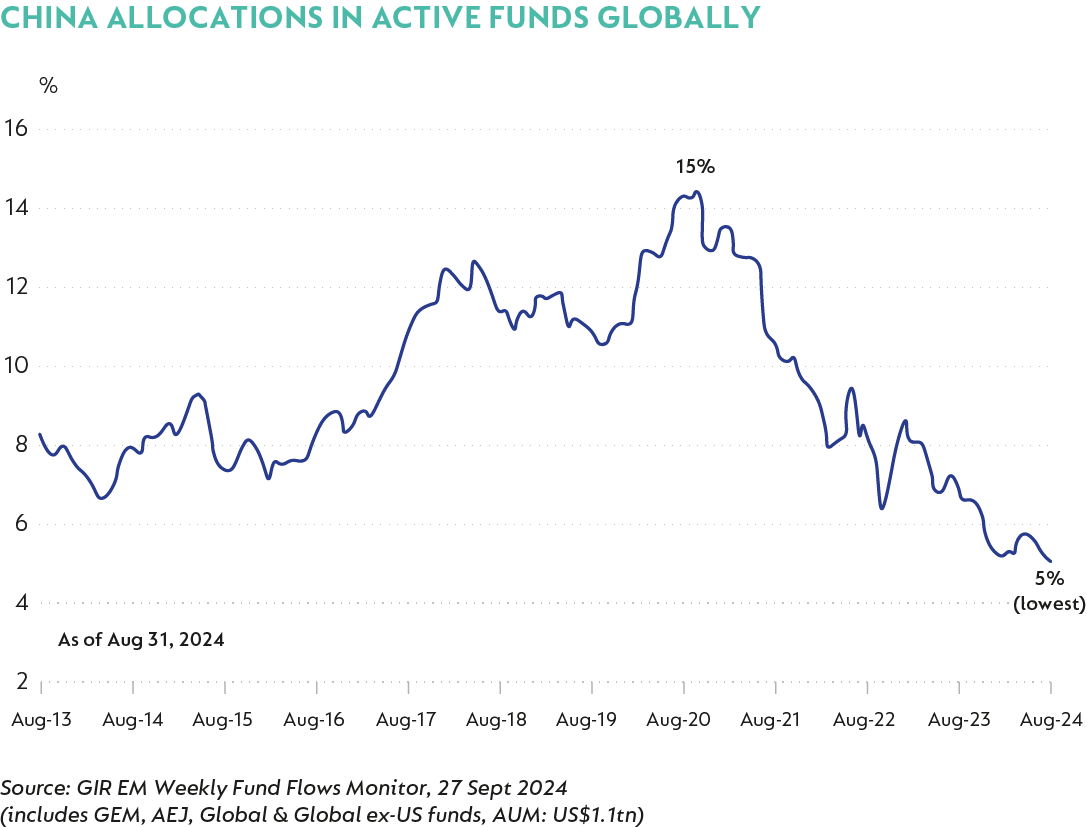

Global fund positioning to Chinese assets is also much lower than in the past and time will tell if this is the new normal or if appetite for these cheap assets garners more interest in future notwithstanding the risks that are still very much part of investing in China.

Whilst the Fund has ~14% exposure to Chinese assets, there remain many compelling opportunities outside of China – so while three of the Fund’s top 10 positions are Chinese assets, there are other several very attractive positions held, with exposure to a diverse set of industries and geographies which should deliver compelling future returns.

Considering the attractive and diverse equities on offer, the Fund ended the quarter with 79% net equity exposure, similar to the prior quarter. The Fund also has put option protection equating to 3% of Fund effective exposure spread across a range of indexes (US, Europe, and EM).

Bond markets performed better this past quarter, but as the pace and extent of interest rate cuts across the developed world continue to be uncertain, volatility in these markets should persist, with rate-cutting expectations being tempered due to recent robust jobs data coming out of the US. The Fund continues to hold a sizeable bond exposure which now sits at just under 13% at the time of writing, split between sovereign and corporate bonds. The South African 10-year government bonds purchased last quarter still represent ~8.4% of Fund at the time of writing. South African government bonds continued their rally, but the 10-year bond still yields just under 11%. Our view on the South African fiscal situation has evolved and became more positive, notwithstanding the deep-rooted problems the country still faces. What is encouraging, though, is a continued commitment to structural reforms post the election, and what seems like a fairly well-functioning coalition government. The fiscal position of South Africa is by no means solved, but the direction of travel appears to be more positive today and thus, notwithstanding the continued fiscal risks, we believe the current yield of the bonds purchased more than compensate you for these risks. Outside of the South African sovereign bonds held, we continue to hold a collection of foreign corporate credit, which, in aggregate, provides us with a weighted yield in hard currencies of just under 7%, which remains attractive. We have limited exposure to real estate, with the balance of the Fund invested in cash, largely offshore.

The most notable increase in position sizes during the quarter was Coupang. Coupang is an ecommerce retailer with a growing ecosystem beyond just ecommerce, based in South Korea. The business was founded by Bom Suk Kim, who remains the CEO and driving force behind it. Since its founding in 2010, the management team has executed superbly and now command just under 30% ecommerce market share. We expect their market share to continue to increase due to the excellent customer value proposition and they have also developed the second biggest food delivery business in South Korea, leveraging their ecosystem and loyal customers who are highly engaged. Beyond South Korea, Coupang is building a business in Taiwan that could be material over time, especially considering that Taiwanese ecommerce penetration is significantly lower than in South Korea, which provides natural market growth tailwinds for a strong executor to take advantage of. The business has begun an inflection towards profitability as the scale of the business becomes evident and they realise operational leverage from many years of foundational investment. Considering this, the business trades on a 22 times 2026 multiple which embeds an EBIT margin that is still well below normal. Earnings growth beyond 2026 should thus remain in the mid-30% range, leading to a rapid unwinding of this multiple.

OUTLOOK

The first nine months of 2024 has been a general exuberant period for global markets, but it is encouraging to see the contributors to these returns becoming broader based. We remain excited about the prospects of the Fund against this backdrop as we continue to uncover and own attractive stocks and bonds, and whilst at times asset prices and their underlying fundamentals detach, they generally align long term. Things can change quickly as evidenced by the Chinese market rally and thus our focus remains on uncovering attractively-priced assets versus trying to time markets - a core principle of Coronation and how the strategy has been run since its inception nearly 25 years ago.

South Africa - Personal

South Africa - Personal