PERFORMANCE

The Fund returned 1.4% in the second quarter of 2024, lagging the 5.0% return of the benchmark MSCI Emerging Markets (Net) Total Return Index by 3.6%. The Fund has had a good two-year period since bottoming in the aftermath of Russia’s invasion of Ukraine, having outperformed the benchmark by 4.7% p.a. However, over five years, the Fund has underperformed by 4.4% p.a. due to the tough performance cycle experienced from end March 2021 through to end June 2022. Since its inception in July 2008, the Fund has outperformed by 0.2% p.a.

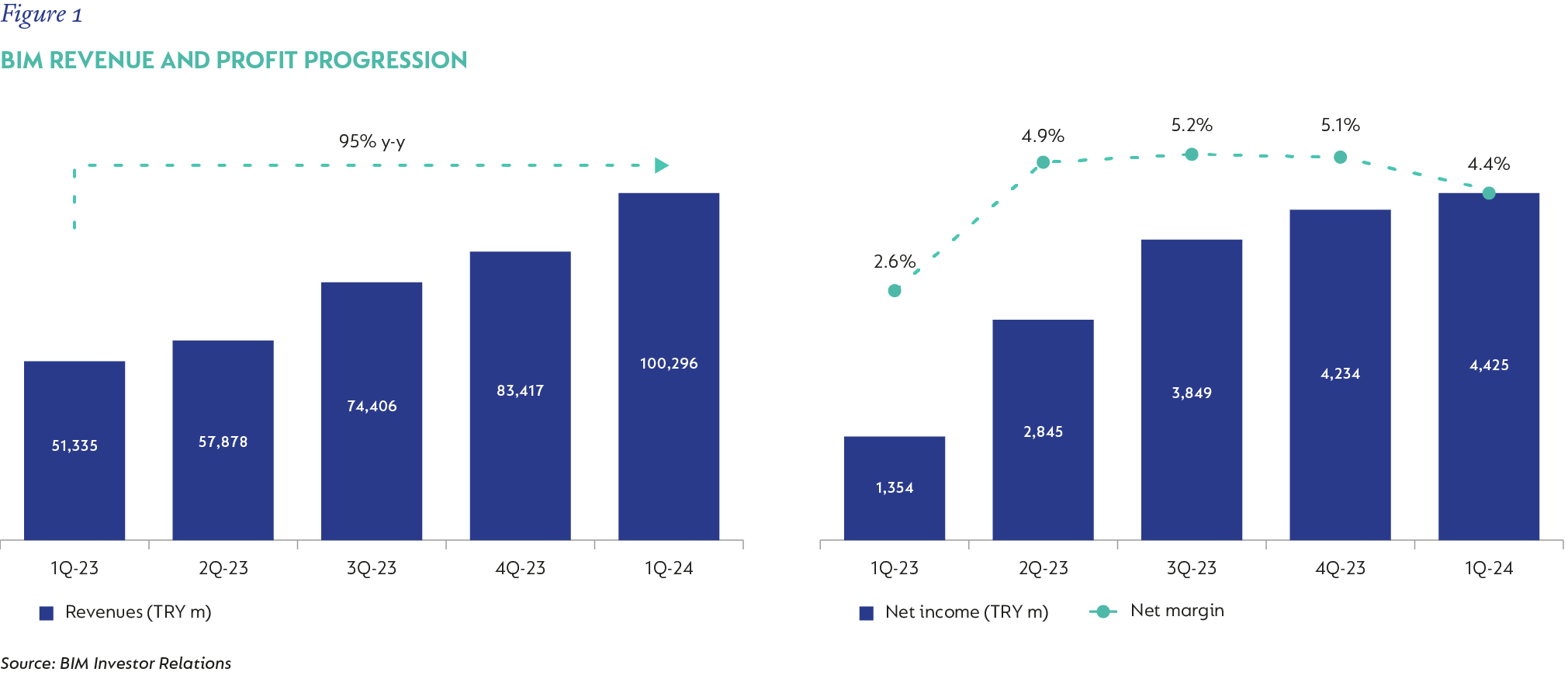

The biggest positive contributor to relative performance in the quarter was Turkish hard discount food retailer BIM, which returned 53% (in US dollars) and contributed 0.5%. We sold BIM in 2021 when Turkey, driven by President Erdogan, started to adopt a very unconventional monetary policy by reducing interest rates to try to bring down inflation. Our view at the time was that the risk of significant currency depreciation outweighed the fundamental attractiveness of BIM. Late last year, however, it started to become clear that after securing re-election to the presidency, the Turkish president was reverting to more market-friendly economic policies, in particular, allowing the Central Bank of Turkey to abandon the policy of running low interest rates in a high inflation environment. This had the positive effect of bringing inflation down, and in doing so, the Turkish currency’s depreciation slowed significantly. As a result of this shift, we bought BIM in the Fund in Q3 of 2023. Since then, the company has almost doubled quarterly revenues on a year-on-year basis and tripled profits. As a result, the share price has doubled (in dollars) from the levels at which we bought it back into the Fund last year.

Despite the strong absolute share price performance, BIM still trades at 10 times next year’s earnings and offers a 3% dividend yield.

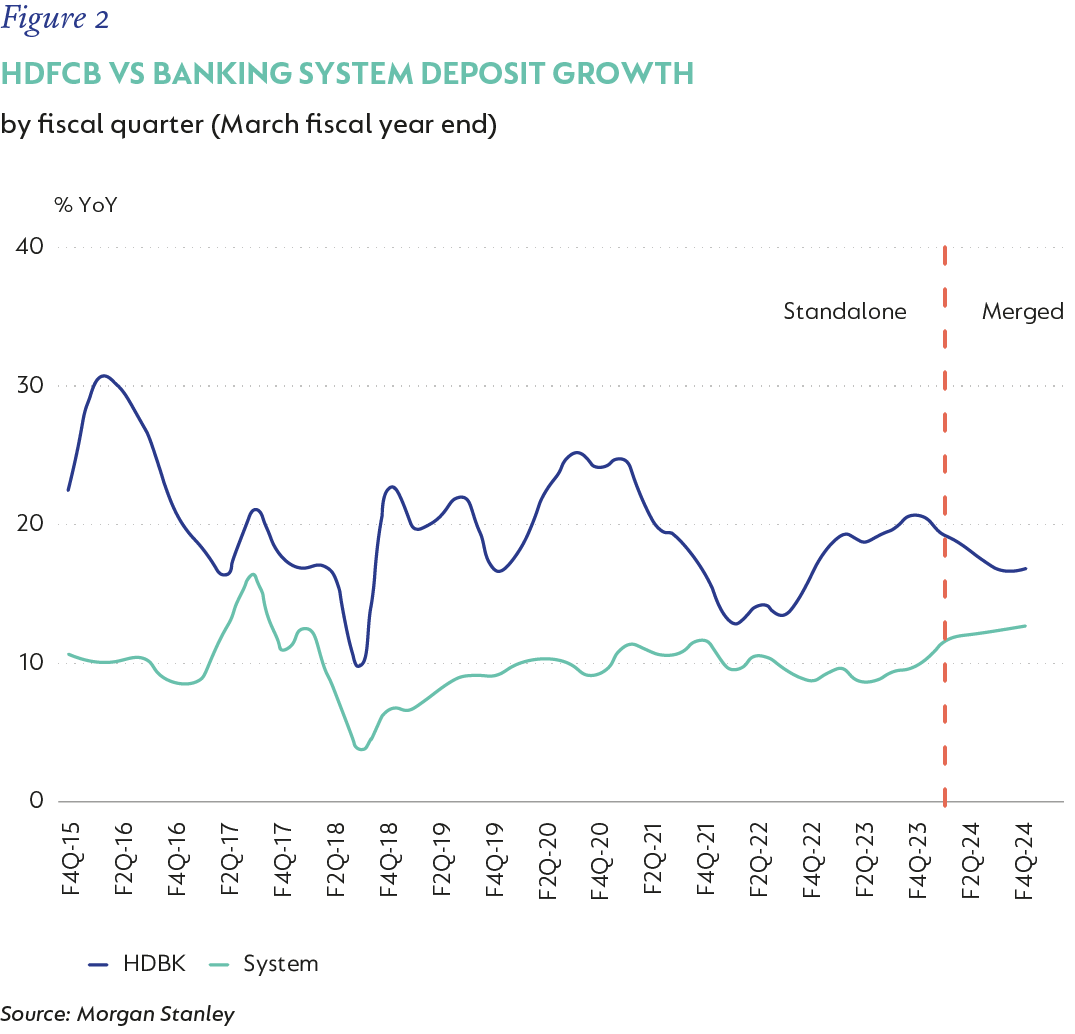

The second largest relative contributor was HDFC Bank, which largely recovered from the selloff in Q1. HDFC Bank returned 17% and contributed 0.4% to relative performance in the period. A key worry earlier in the year for investors (which largely resulted in the share price decline) was the high Loan-to-Deposit Ratio, which constrains the ability of the bank to grow loans at a high level unless it can pick up deposits at a higher rate. The bank continues to grow deposits higher than the banking system as a whole, and crucially, HDFC Bank is doing so without paying up for deposits (through higher interest rates), as evidenced by the Net Interest Margin remaining largely unchanged. Although there was some disappointment with the Indian election results initially – the market and initial exit polls seemed to be pricing in a thumping majority for the ruling (market-friendly) BJP – these concerns largely dissipated when it became clear that the BJP would remain in charge, albeit in a coalition.

Other meaningful contributors were SEA (33% return) and Tencent Music Entertainment (27% return), each providing around 0.4% of relative performance.

Unfortunately, there were a few significant detractors in the quarter that fully offset the positive contributors. The biggest detractor was Assai (also known as Sendas), the cash and carry retailer in Brazil. Assai returned -37% in the quarter (of which 12% was driven by the depreciation in the Brazilian real) and this had a -1.2% impact on relative performance. Most of the selloff occurred after the release of its Q1 results, which were somewhat underwhelming. Interest rates in Brazil remain high, and Assai has a reasonably high net debt level, which would have also played a role in the share price decline. Cash and carry (in which Assai is the leader) continues to take market share from other formats in Brazil, and there is still a significant opportunity for Assai to roll out more stores in Brazil. In addition, profitability is depressed by newly opened stores that have not fully ramped up to profitability. Assai is focusing on debt reduction, has reined in capex, and has slowed down new store expansion. As a result, in our view Assai will start to generate significant free cash flow in the short to medium term. Assai now trades on 10 times next year’s earnings, and we believe it is very attractive with 75% upside to our fair value.

The second largest detractor was Airbus, which returned -24% and cost the Fund -1.1% of relative performance. Airbus peaked in March at around €170 and sold off heavily in the quarter, particularly after a late June update to the market where it cut delivery guidance on aircraft due to supply chain issues, especially engines for the A320 aircraft (supplied by CFM and Pratt & Whitney), where Airbus’s market position is the strongest and its profitability the highest.

The aircraft delivery guidance was accompanied by a 20% cut in operating profit guidance and a 13% cut in free cash flow guidance. All of the above is very disappointing, but we do not believe it materially alters the long-term investment thesis where Airbus remains far ahead of its only real competitor, Boeing, in what is effectively an oligopoly in a structurally growing industry.

There were also a few other significant detractors that each took off 0.7% from relative performance. Bank Mandiri in Indonesia returned -18%, 3R Petroleum in Brazil returned -24%, Delivery Hero (global multinational) returned -17% and Li Ning in China -18%. This abnormally large number of significant detractors, combined with low exposure to the ongoing strong performance of India and Taiwan, ultimately drove the quarter's underperformance. Both India and Taiwan, particularly outside the handful of very large-cap stocks in both countries, are arguably now in bubble territory in our view. The Indian market has been driven by general enthusiasm for the country (which does indeed have attractive prospects: market valuation is what concerns us) and has also been a beneficiary of investors reducing/selling out of China. Retail investors in India have also increasingly embraced the stock market. Taiwan has largely been driven by AI, with retail investors here also being eager participants. In Taiwan, many stocks with even a hint of AI have appreciated significantly. In many cases, the AI contribution to these companies is very small or is commoditised. In other cases, profitability is way ahead of historical levels, which may be indicative of over-earning.

FUND POSITIONING

We have kept the positions in all four of the above-mentioned stocks. 3R Petroleum now trades on 3 times 2025 earnings, Li Ning (leading Chinese sportswear brand) on 9.5 times 2025 earnings with a 4.5% dividend yield (and almost 40% of its market cap in net cash), and while Delivery Hero (online food delivery in 75 countries, mainly emerging markets led by Korea) is currently not making money, it trades on 0.45 times price-to-sales (vs Zomato in India on 8 times sales, for example, and DoorDash in the US on 4 times sales). In addition to this, we believe that Delivery Hero will ultimately become very profitable in the years ahead and have a clear plan to achieve this. There is now more than 150% upside to our fair values for each of 3R, Delivery Hero and Li Ning. It is unusual for any stock we own to have more than 100% upside to fair value, let alone 150%+. We continue to spend a lot of time on these three stocks, continually reassessing our views and fair values for them. In Bank Mandiri’s case, the upside to fair value is a more moderate 35%, but the five-year IRR is 23% and the stock trades on 9.5 times 2025 earnings with a 6% dividend yield.

Five new buys were made in the period, the largest of which was NetEase (China gaming) at 1% of Fund. In India, the Fund bought 0.5% positions in car manufacturer/conglomerate Mahindra & Mahindra and financial services group Bajaj Finance. In Latin America, the Fund bought online travel agency Despegar (on 12.5 times 2025 earnings), and in South Africa, Standard Bank (on 7.5 times 2025 earnings with an 8% dividend yield) was added.

NetEase sold off heavily late last year on the threat of regulatory action against the gaming sector. These proposals were subsequently hastily withdrawn, and the responsible officials were censured for causing market panic. The share price recovered quickly, but then, along with most Chinese stocks, gave up most of the year-to-date gains. We met with the company in China in June and came away with a very positive view. The legacy PC gaming business is still growing and no longer heavily reliant on one particular game (their largest game is now only 10% of the overall business, as an example). It currently trades on a 10% free cash flow yield, has a very strong balance sheet (over 20% of market cap in net cash) and is returning two-thirds of free cash flow to shareholders.

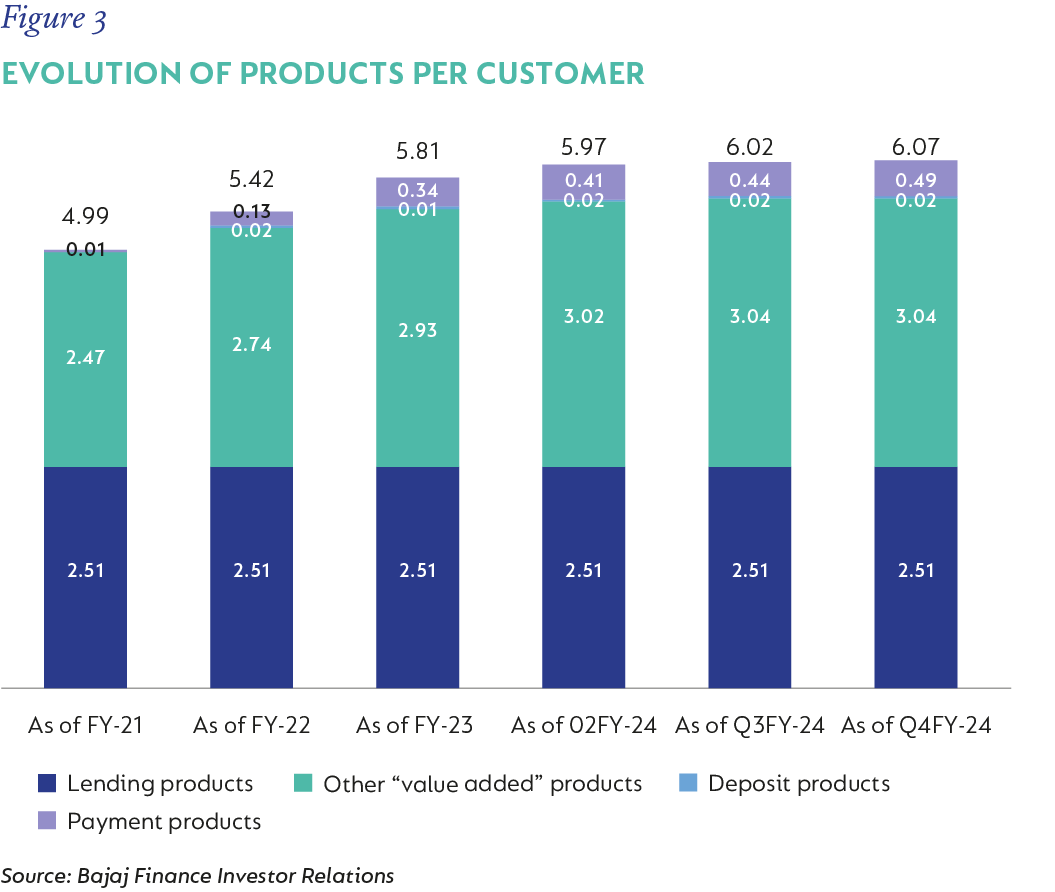

Bajaj Finance is a company we have been watching and meeting with for some time, but that always seemed too expensive to buy. With the share price now flat over the last three years, earnings growth has brought the valuation down to more palatable levels. One of the main concerns is that they cannot continue to operate as a non-bank finance company and will be forced to become a bank in the next few years. Doing so will increase costs and slow the business’s growth rate. While these concerns are real, we believe they are well reflected in the current share price. In addition, the conversion to a bank would also allow them to gather low-cost CASA (current and savings account) deposits, which they currently cannot raise. CASA funding will lower the reliance on expensive wholesale funding and be a net positive for Bajaj.

Bajaj pioneered a new product aimed at allowing customers to buy large ticket items over six months with equal instalments at zero interest. The company earned its profits on this product by securing the financed item at a discount to the advertised price, resulting in it earning the discount over the life of the loan i.e. a 20% discount on the goods means an effective 20% interest rate over six months or an annualised 44% p.a. Peers took a long time to replicate this product and Bajaj’s success means they now have over 80 million customers, with over 10 million more being added every year. In addition to growing the number of customers, Bajaj has been very successful at cross-selling additional products to its existing client base.

Bajaj has been led by the same impressive (in our view) CEO/MD since 2007, and he is only 54 years old, with a deep bench of talent below him when the time comes for him to step aside. Most lending is unsecured, so interest rates are higher, and they have compounded their loan book at 36% p.a. over the last 16 years, raising capital several times to fund this growth as it has exceeded the exceptional 20%-plus return on equity the book has consistently generated.

There were several sales in the quarter also, with the Fund selling completely out of Make My Trip (Indian online travel), Naver (search and ecommerce in Korea), Heineken (global brewer), Walmart de Mexico (retail in Mexico and Central America), Qualitas (Mexican insurance) and Total Energies (global oil major). In the case of Make My Trip and Qualitas, the sales were due to valuation. In the enthusiasm for fast growing Indian companies, Make My Trip, which we had owned for the past few years, is now up 240% over the past year, outperforming even Nvidia. In the case of Naver and Heineken, the sales were driven by concerns over the long-term moat around their businesses becoming progressively weaker. The small Walmex position (0.4% of Fund at time of sale) was effectively a switch into Femsa to take the latter to a 1% position. The sale of Total Energies (0.6% position at time of sale) effectively funded the Standard Bank purchase (0.5%).

Despite the negative relative performance in the quarter, we are positive on the prospects for the Fund. At current valuations, the Fund offers a weighted average upside of 70% and an IRR of 19%, which is well above the long-term average.

South Africa - Personal

South Africa - Personal