The Fund returned 8.5% in the third quarter of 2024, slightly behind that of the benchmark return of 8.7% (as measured by the MSCI Global Emerging Markets (Net) Total Return Index). Short-term performance has improved materially since the bottom of the performance cycle around June 2022, with the Fund 2.2% p.a. ahead of the benchmark over the last two years. Over longer-term periods, however, the impact of the very tough 15-month period (March 2021 to June 2022), means the Fund is 4.4% p.a. behind the benchmark over five years. Since inception, the Fund has outperformed marginally.

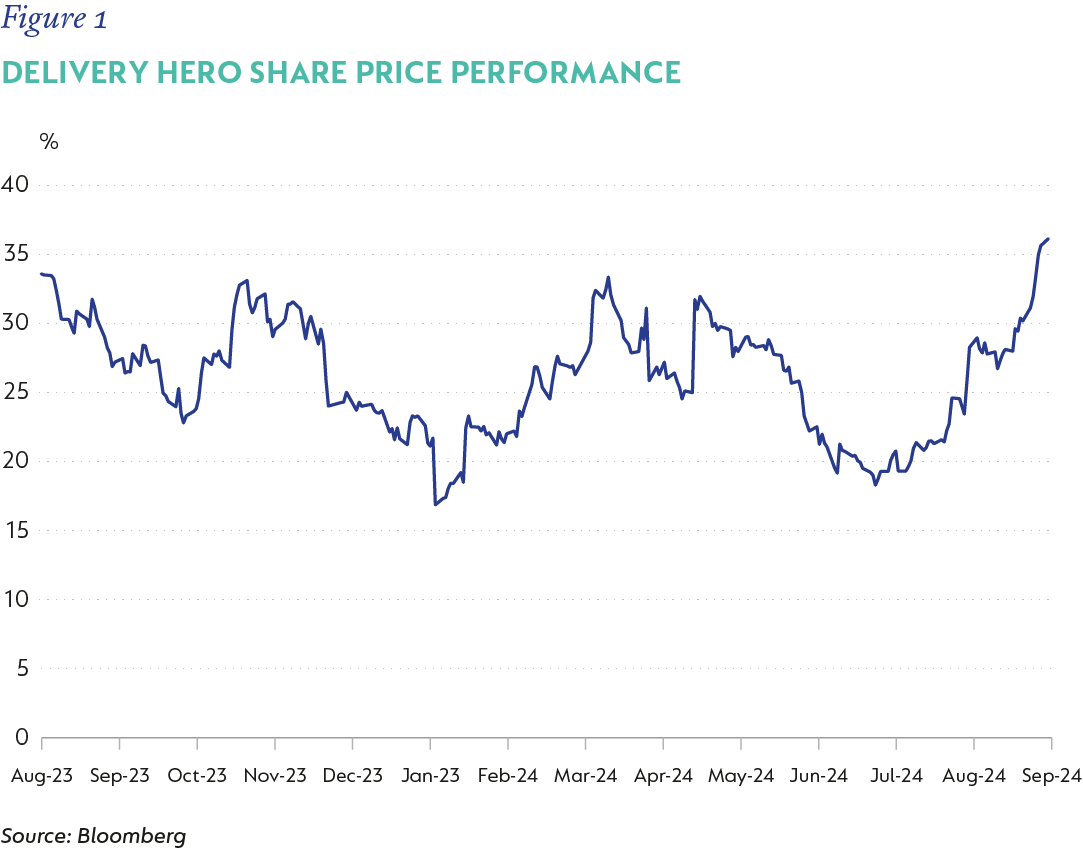

The biggest contributor in the quarter was Delivery Hero (DHER), which returned 70% and contributed +1.6% to relative performance (alpha). DHER’s share price has been exceptionally volatile over the last year, reflecting significant changes in the market’s view of its long-term outlook. DHER has a number one or two position in online food delivery in several attractive countries within Asia, the Middle East, the Americas, and Western Europe. Although it is listed in Germany, around 90% of DHER’s business comes from emerging markets. Generally, strong network effects result in most food delivery markets consolidating into two to three players per country. These players tend to dominate volumes and generate most of the profits for the industry, with smaller players unable to survive and certainly not making any meaningful money.

DHER built up its portfolio through acquisitions over time and funded much of this with debt. Once the post-pandemic surge in food delivery dissipated, the high level of debt, coupled with a slower level of top-line growth than in previous years, saw the share price fall precipitously, reaching its nadir in early February 2024 when the market capitalisation was below the value of the debt outstanding. Much of this outstanding debt was convertible debt that was deeply out of the money (the weighted average conversion price is over €100 per share so most of this debt is likely going to have to be repaid). Since then, the share price has pretty much doubled, halved and doubled again in the space of seven months. We are not believers in trying to time the market and don’t think that the value of the business has materially changed in this intervening seven-month period, but we do believe that it is significantly undervalued and have generally added when it was extremely oversold and have somewhat lightened our exposure as it has recovered quickly.

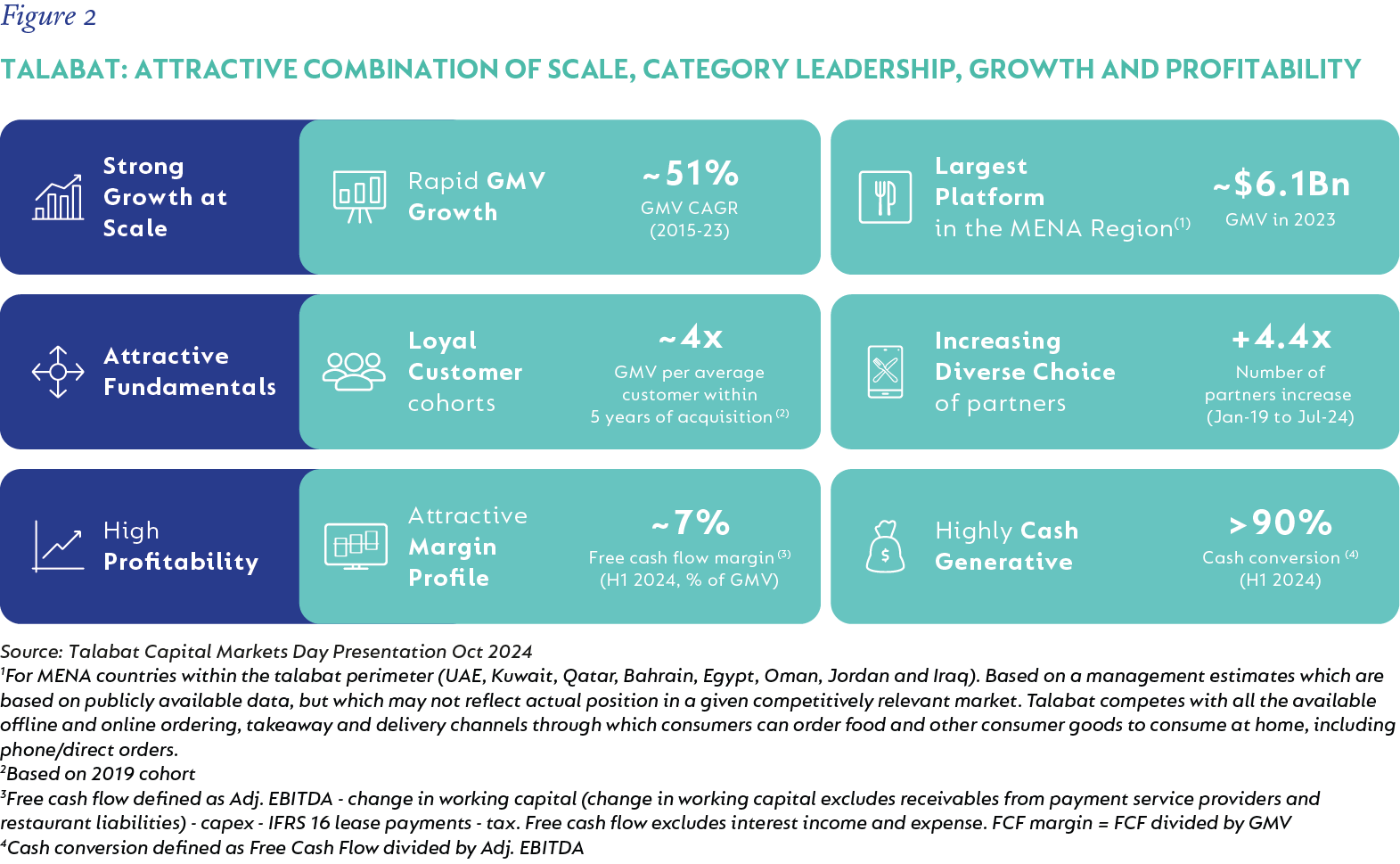

The key driver for the strong recovery in the share price since July was the announcement that DHER would IPO its Talabat business in the Middle East. Talabat is the leader in eight MENA countries and is expected to command a valuation above $10bn. DHER today own 100% of Talabat but will sell some of this stake in the IPO to pay down debt. DHER also owns 100% of Hunger Station in Saudi Arabia (which is not part of Talabat) and is the leader there too. The total market capitalisation of DHER today is $12bn (compared to the value for just Talabat of around $10bn), yet Talabat contributes only 14% of group GMV (Gross Merchandise Value). DHER has reiterated its €750m guidance for EBITDA for this year compared to its Enterprise Value (market capitalisation plus net debt) of just over €14bn, and profitability is well below normal across most of its markets. We forecast EBITDA to grow at over 35% p.a. for the next five years to in excess of €3.5bn in 2029. Over this same period, we forecast annual free cash flow to grow to over €2.5bn (compared with a current market capitalisation of $12bn, so a 20% normalised free cash flow yield to equity). Further positive news for DHER was a stabilisation of competitive intensity in Korea and where a new CEO for the local business was announced. In addition, DHER is in the process of selling its Taiwanese business (only 3% of GMW) to Uber at a price just shy of $1bn, so another 8% of DHER’s market capitalisation. Despite the recent strong share price recovery, in our view there is still conservatively 60%+ upside (more optimistically, 100%+ upside) to DHER, and it remains a top 10 holding in the Fund.

There are half a dozen Chinese stocks that feature within the top 15 contributions to alpha in the quarter and this largely is a result of a sea change in attitudes toward Chinese stocks in the last full week of September. The Chinese government, in an attempt to kickstart the local economy and improve sentiment, announced a wide range of measures to support the property market, local investors and state-owned banks. Further fiscal stimulus is expected to make this the largest intervention to support the economy in the country’s history. With most global funds owning very little in China and a large proportion of actively managed emerging market funds also having substantial underweights in China, the market reaction to such unprecedented levels of support was fierce and swift, with massive amounts of capital chasing Chinese stocks to close underweight and short positions. This resulted in the MSCI China and Nasdaq Golden Dragon China Index (an index of US-listed Chinese stocks) both up 22% in the last week of September, some of which has unwound in early October.

We have in recent years held the view that the Fund’s Chinese holdings were very attractively valued and the weighted average upside to fair value of these holdings peaked at 120% a month or two ago. In some cases, stocks like JD.com were trading at under 2x earnings adjusted for the cash on balance sheet and the stake it held in listed subsidiaries. Even though this stimulus was not part of our investment case, the Fund did very well from the resulting share price moves. For the quarter, the top Chinese contributor to alpha was JD.com, which returned 63% for +1.2% alpha. This was followed by AIA (+0.7% alpha), Naspers (+0.6%), Trip.com (+0.4%), Yum China (+0.3%), Li Ning and Wuliangye Yibin (+0.2% each). The only material detractor from the stocks owned in China was Tencent Music, which cost -0.3% relative performance. Not owning (or being underweight in) Alibaba, Tencent and Ping An, cost a combined -1.4% alpha but the overall impact of China for the quarter was still positive.

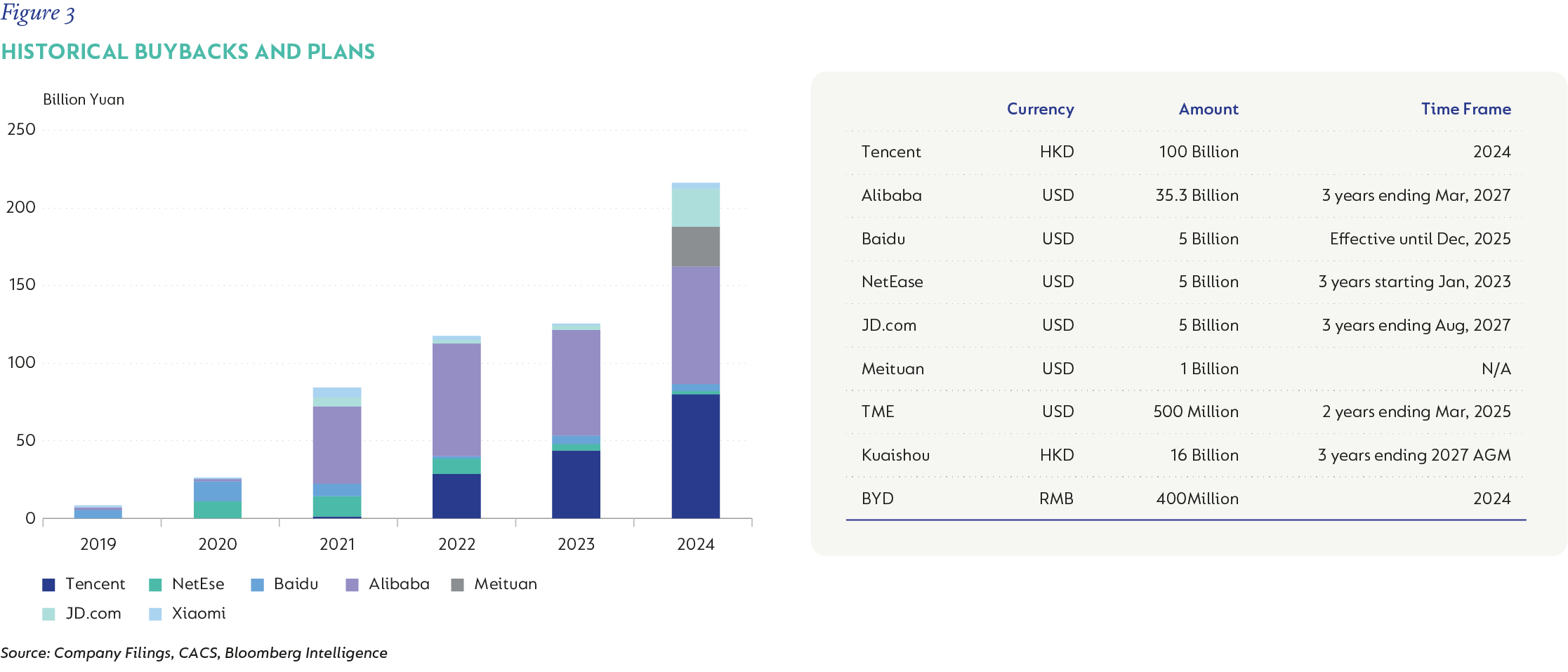

One of the most encouraging developments in recent years has been the increased willingness of Chinese companies to return cash to shareholders via dividends and buybacks. When earnings were growing very strongly every year, there was less pressure to return cash since the money was required for reinvestment but, more recently, with the businesses being more mature there has been less need to reinvest and many stocks built up large amounts of cash on their balance sheets. We have engaged frequently with management teams (and indeed boards) over the years on the need to return capital to shareholders and the value unlock that can be created through share buybacks. After a period of resistance by some companies, many of the most widely held stocks in China have started returning meaningful cash to shareholders.

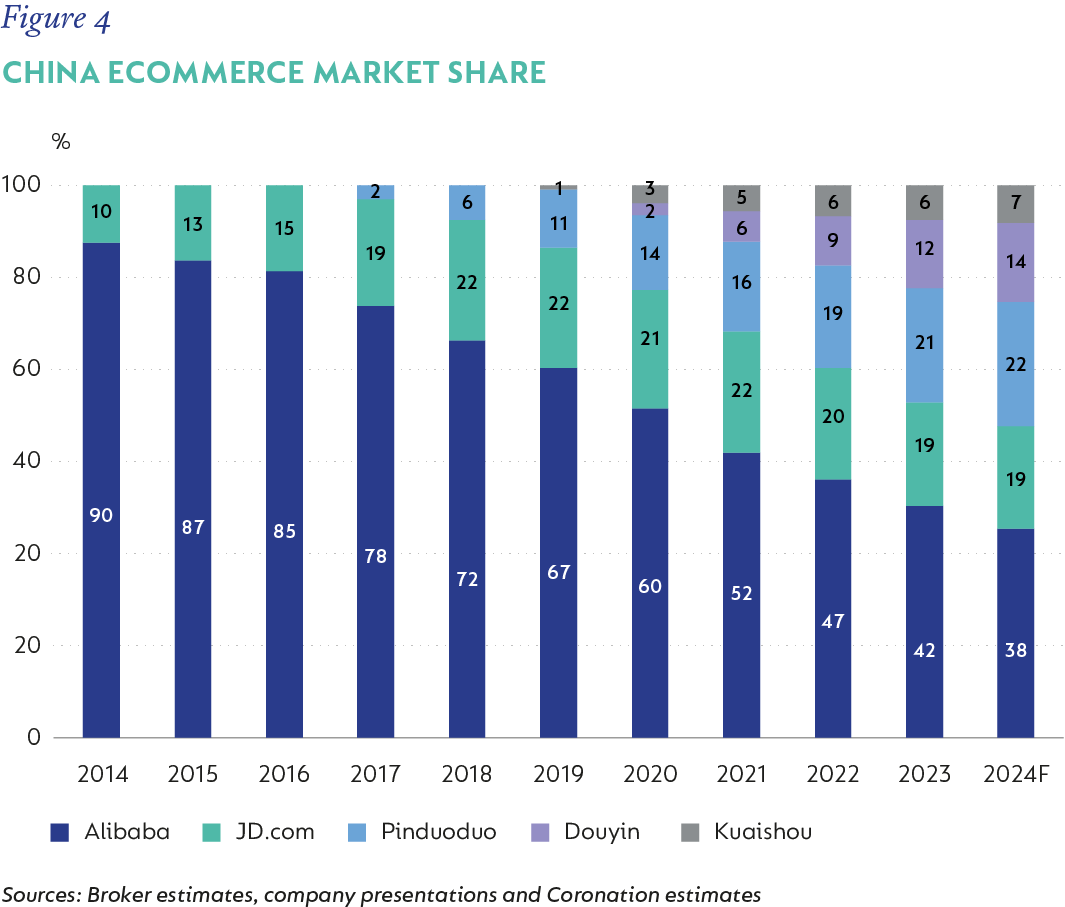

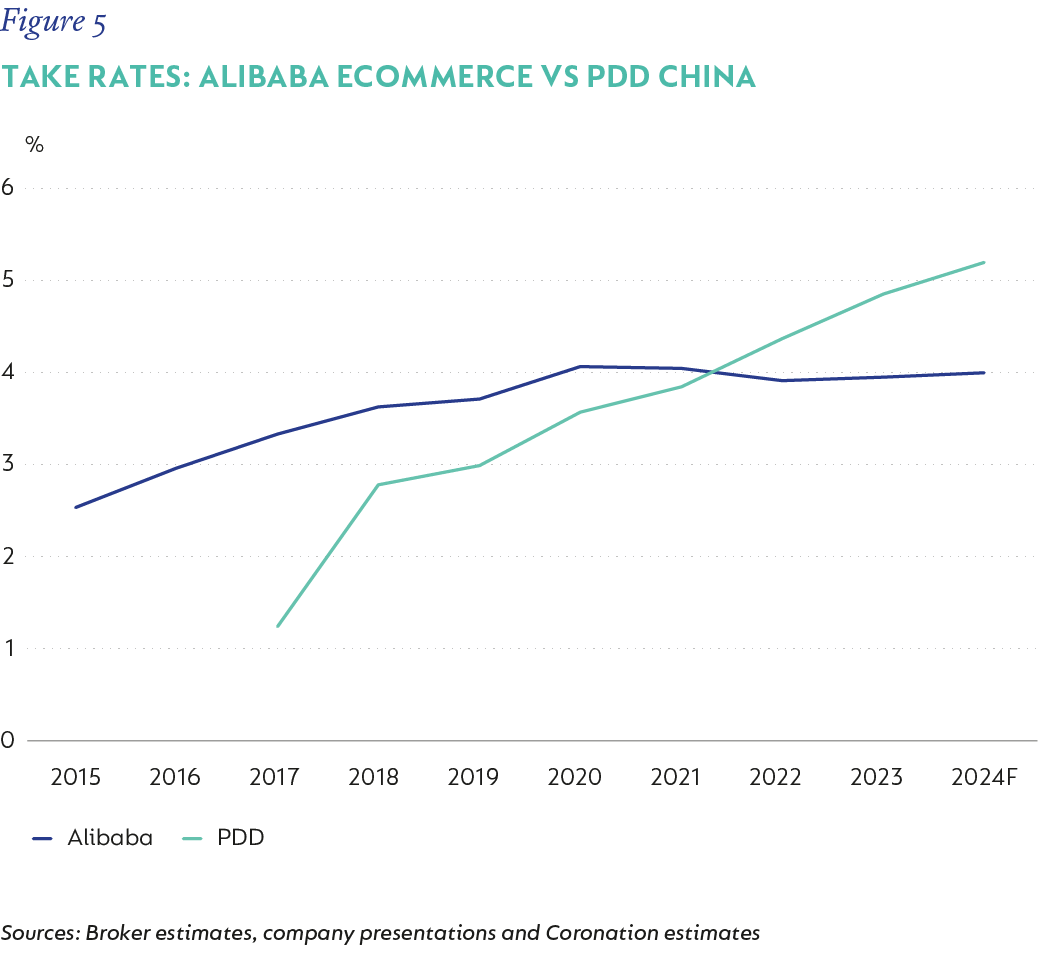

The one notable exception to this list has been Pinduoduo (PDD). During the quarter, PDD reported results that under normal circumstances would have been a cause for celebration. Revenue was up almost 90% year-on-year (yoy), with margin expansion leading to operating profit up 150% yoy. Free cash flow conversion also exceeded 100%. Yet negative comments by management about long-term profitability coming under pressure and the need to reduce take rates (commission on sales) to make the ecosystem more sustainable for merchants led to the share dropping by 40% in a short space of time, only to recoup most of the losses in the week before the end of the quarter to leave it only slightly down for Q3. A key criticism of PDD is that the business is somewhat opaque, with little interaction with investors and the sell-side, and limited disclosures outside of the required operating metrics we find in results releases. These are valid criticisms, but we have done a lot of work to understand PDD’s culture, management style, incentives and moat around its business model and believe that the reasoning has more to do with a desire not to assist competitors to counteract the threat PDD poses to them. This is why PDD has taken so much market share from Alibaba (in particular) over the years and why its take rates have been able to expand beyond that charged by Alibaba.

We have reduced the China exposure marginally in early October (a 1.5% net reduction in exposure at the overall Fund level) but continue to hold the view that the Chinese holdings in the Fund still offer very good value (the weighted average upside to fair value is now still >80%). Importantly, with one or two exceptions, the 15 Chinese holdings in the Fund were growing both top-line and earnings in the double-digits prior to any stimulus (in many cases by taking market share) and our investment cases were not based around or dependent on stimulus. We will obviously be assessing the impact of the stimulus actions on an ongoing basis, notably with regard to how it may impact the earnings streams (and hence fair values) of the companies owned.

Other positive contributors to relative performance were SEA (32% return, +0.6% alpha) and Mercado Libre (25% return, +0.5% alpha), which are both leading ecommerce operators with a little overlap in Brazil where they compete directly, albeit with very different business models. SEA in particular has recovered well off its lows, with a one-year return of 113% and +1.4% contribution to alpha.

The biggest detractor in the quarter was not owning Alibaba – although this was more than compensated for by the very high return in JD.com. Brazil exposure continues to have a negative impact on the Fund – with Brava Energia (“Brava” – the new name for oil company 3R Petroleum after its merger of equals with Enauta) costing -0.8% alpha, a bit more than Sendas cash & carry food retail, which cost -0.7%.

The largest new buy in the quarter was Chinese food delivery platform Meituan, which we last owned in 2023. We also bought back Chinese down jacket maker Bosideng (0.5% position) after its share price declined 20% due to the controlling shareholder reducing his stake. It now trades on 12x forward earnings (with a 6% dividend yield), having risen 35% from the levels at which we bought it back into the Fund.

There were several sales in the quarter, largely to fund the buys above and to increase position sizes in higher conviction names like ASML and Nubank. The three most meaningful sales were AngloGold (1.5% at end June) which reached and exceeded our fair value, Infosys (0.4% at end June) which similarly surpassed our fair value and was trading on 30x forward earnings at the time of sale, and Richemont (1.1% at end June).

The weighted average upside of the Fund of 60% has reduced slightly as a result of the strong moves in share prices in China in particular but remains comfortably above the long-term average of around 40%. For this reason, we are confident that the Fund represents an attractive investment opportunity for long-term investors into the asset class and can deliver market-beating returns in the years ahead.

South Africa - Personal

South Africa - Personal