PERFORMANCE

The Fund was down 0.3% in USD in the quarter (Q2-24). Global markets continued to exhibit strength over the period, but after seeing some broadening of the breadth of returns in Q1-23, the markets were once again driven by very few companies, notably Nvidia, Microsoft, and Apple, in the three months to end June.

FUND POSITIONING

Of the three stocks mentioned above, the Fund only owns Microsoft. Whilst Nvidia’s fundamental performance has been exceptional, the big question is how sustainable this is considering the business now generates ~$100bn in revenue on a rolling 12-month basis – up more than 3 times versus a year ago. More impressively, operating margins have gone from a historic mid-30% range to just under 70% today – the business’ pricing power has been immense thanks to their current monopolised competitive position driven by a frenzy of deep-pocketed customers trying to get their hands on GPUs. These same deep-pocketed customers, the likes of Microsoft, Amazon, Google and Meta, are all, however, heavily financially incentivised to reduce their reliance on Nvidia chips, with all having various strategies to pursue this goal. It remains to be seen if the super level of profits at Nvidia will be sustainable. With the company now trading at 35 times 2025 earnings (which we deem unsustainably high), the margin of safety embedded into its valuation appears low.

Whilst the Fund has not owned Nvidia due to these valuation concerns, we have owned three other stocks that have benefited from this structural trend and have been positive attributors to the Fund’s returns: TSMC, ASML and SK Hynix. These three businesses have different places in the ecosystem with positive market structures due to high barriers to entry, with more palatable valuations and earning levels which appear more sustainable. Beyond these three stocks, the Fund continues to own what we deem to be a highly attractive diversified collection of assets that excite us about the Fund's prospective returns.

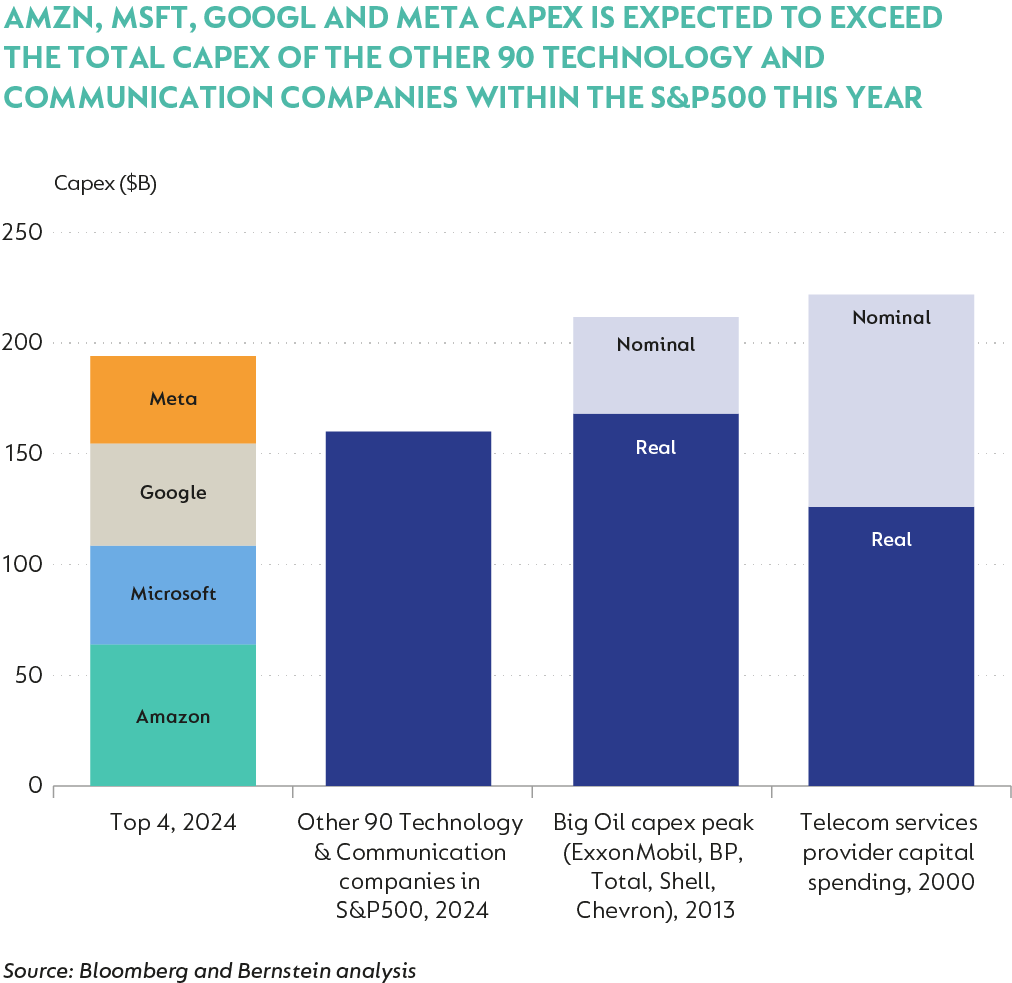

The impact of AI is, most likely, still in its early innings, notwithstanding the rapid capital spending currently taking place to build the “factories of the future”. As it stands, this capital spending is dominated by the large hyper scalers, with the level of capital spending today rivalling that of other similar periods globally, as illustrated by this graphic:

The key debate today regarding this capital spending is what sort of return it will generate, and then if these levels of spending will prove to be sustainable. We are only at the early stages of recent AI advances being embedded into enterprise workflows and consumer applications, and thus, it remains uncertain as to how much utility this technology will provide and if the current exponential technology progress seen over the last two years will continue. There are industry insiders who have quite divergent opinions on the outlook, which illustrate the inherent uncertainty of how this will play out. Nonetheless, the impact cannot be ignored, and beyond the directly exposed companies, all businesses should see an impact from the technology, whether positively via revenue or cost optimisation or negatively due to disruption. Something to keep in mind is if all this economic surplus will accrue to the companies and, in effect, their shareholders because capitalism has a long history of driving competition and reducing the benefit captured by enterprises unless those enterprises have a significant moat. Therefore, our attention remains on discovering businesses which we feel have strong moats and can earn sustainable above average economic returns. Through this process, we believe the Fund holds a collection of assets which exhibit this characteristic but, importantly, can be purchased at attractive valuations, another key element to both return maximisation and risk mitigation.

In the quarter, there were numerous elections worldwide with largely peaceful outcomes, even if somewhat unexpected – this is a good outcome for democracy. Still, the US election remains a key event in November this year. We don’t spend too much time predicting election outcomes, but we do consider the associated risks. Election risks are just one aspect of a broad spectrum of geopolitical risks present today, including the ongoing wars in both the Middle East and Ukraine and strained relationships between the US and China. The way we protect against these risks is not by trying to predict their outcome but rather by owning a collection of well-diversified assets with distinct drivers which should allow the Fund to generate good returns notwithstanding any of these risks coming to fruition. The price you pay for an asset is often an essential risk mitigation tool, so considering this, the weighted average equity upside of the Fund is currently 54%, which remains compelling. Beyond this, the weighted equity five-year expected IRR is 18%, and the weighted equity FCF yield for stocks owned is ~5%. Using the rand-denominated Fund’s long-term track record (expressed in USD) as proxy*, over the past five years, the Fund has generated a positive return of 1.8% per annum (p.a.), over 10 years, a return of 2.7% p.a. and, since inception more than 24 years ago, 8.0% p.a.

During the quarter, the largest positive contributors were TSMC (+24%, 0.56% positive impact), Naspers/Prosus (+13%, 0.42% positive impact), Alphabet (+20%, 0.33% positive impact) and HDFC Bank (+17%, 0.32% positive impact). The most significant negative contributors were Airbus (-24%, 0.80% negative impact), Sendas (-37%, 0.65% negative impact) and Alight (-23%, 0.41% negative impact).

The Fund ended the quarter with 79% net equity exposure, slightly higher than the prior quarter. The Fund also has put option protection, equating to 3% of effective equity exposure spread across various indexes (US, Europe, EM).

Bond markets continue to trail equity market performance as the pace and extent of interest rate cuts across the developed world continue to be uncertain, with the tempering of rate-cutting expectations negatively impacting bond markets. The Fund has continued to add to its bond exposure, which now sits at just under 13% at the time of writing, split between sovereign and corporate bonds. The notable addition in the quarter was the purchase of South African 10-year government bonds, which (at the time of writing) represent ~6.5% of the Fund. South African government bonds have rallied somewhat after what appears to be a positive electoral outcome, but the 10-year bond still yields just over 11%. Our view on the domestic fiscal situation has evolved and become more positive, notwithstanding SA’s deep-rooted problems. What is encouraging, though, is a continued commitment to structural reforms post the election, along with some key cabinet appointments being occupied by the business-friendly DA, which should further help impose both fiscal austerity and growth-oriented reforms. The fiscal position of South Africa is by no means solved. Still, the direction of travel appears to be more positive today. Thus, notwithstanding the continued fiscal risks, we believe the current yield of the bonds purchased more than compensate you for these risks. Outside of the South African sovereign bonds held, we continue to hold a collection of foreign corporate credit which, in aggregate, is providing us with a weighted yield in hard currencies of just under 8%, which remains very attractive. We have limited exposure to real estate, with the balance of the Fund invested in cash, largely offshore.

Notable increases in position sizes (or new buys) during the quarter were Adyen (payments) and Sketchers (footwear and apparel).

Adyen is a stock we have owned in the past – it is a payment processing business which solves for complexity and allows merchants to accept a broad range of payment methods, which drive higher overall acceptance rates, thereby providing merchants with a positive ROI. The stock has been volatile, and we recently increased exposure as the valuation became more attractive. Adyen should continue to grow earnings in the mid-twenties for many years, and thus, while the one-year forward multiple of 30 times screens as expensive, this unwinds to 13 times in five years due to rapid earnings growth.

Sketchers is a footwear and apparel business which operates in the shadow of peers such as Nike and Adidas but has delivered both superior top-line and bottom-line performance over the long term yet trades at a discount to these peers. The business has executed exceptionally well over many years and services a particular segment of the market (being the older generation). It should continue to grow earnings at a mid-teens rate while trading on ~14 times 2025 earnings which we deem attractive.

OUTLOOK

The first six months of 2024 have been an exuberant period for global markets off an already strong 2023 return base, but the concentration of returns remains a dominant theme. Whilst the fundamental performance of these large stocks has supported their share price performance, an increase in their valuation multiples has been another contributing factor which naturally reduces your margin of safety, especially for stocks that appear to have unsustainable earnings levels as discussed earlier. We, however, continue to find businesses that trade at attractive valuations with a good growth outlook and thus remain excited about the prospects of the Fund. We believe our philosophy of bottom-up stock picking should drive robust absolute returns going forward.

South Africa - Personal

South Africa - Personal