Markets remained extremely volatile throughout this quarter as global markets digested the real possibility of higher interest rates for longer to deal with stickier inflation. Concerns about sovereign debt levels, both at home and abroad, also added pressure to longer-term interest rates. Ultimately, these rates impact all asset classes as they represent the benchmark risk-free rate used in the pricing of assets. Some of the substantial gains achieved in the first half of the year reversed over the quarter.

In the latest quarter, the MSCI World Index retreated -3.5%, the MSCI Emerging Markets Index -2.9% and the FTSE World Government Bond Index -4.3% (all in USD). Strong global equity market gains in the first half of the year, combined with rand weakness, have resulted in solid positive real returns year to date for South African investors of 23.5% (MSCI World, Developed Market equities), 13.2% (MSCI EM, Emerging Market equities) and 8.2% (WGBI, Global Bonds) respectively.

In contrast, domestic asset returns have been dismal. Year to date, the FTSE/JSE Capped Shareholder Weighted Index is essentially flat, listed property is down -4.5%, the FTSE/JSE All Bond Index has delivered a meagre 1.5%, and the rand has weakened 10% against the US dollar. These returns are, in part, a reflection of the attractive yields on offer in developed markets. But equally, they are all a reflection of increasingly evident inhibitors to growth in the domestic economy, the weakening commodity cycle and the fiscal pressure that results. National Treasury has communicated the need for budgetary restraint, but they appear increasingly isolated. The likelihood of any meaningful belt-tightening coming to pass seems low – particularly in an election year when policies such as the introduction of National Health Insurance and an extension of the Social Relief of Distress grant are likely to be central to an ANC campaign.

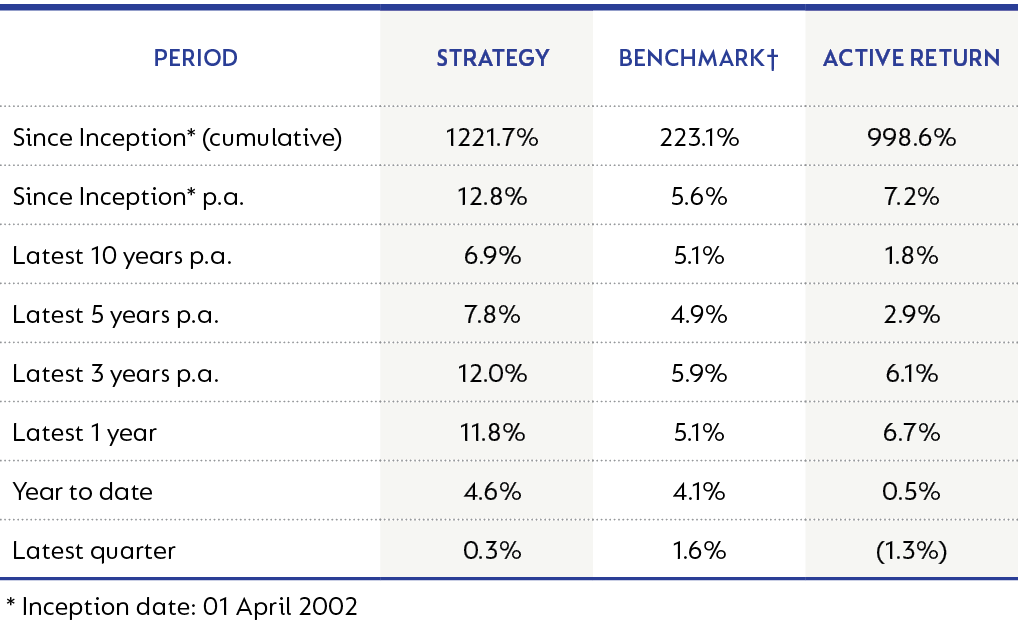

Against this backdrop, the Strategy has delivered very pleasing performance over all meaningful periods. The Strategy’s performance as at 30 September 2023 is shown below:

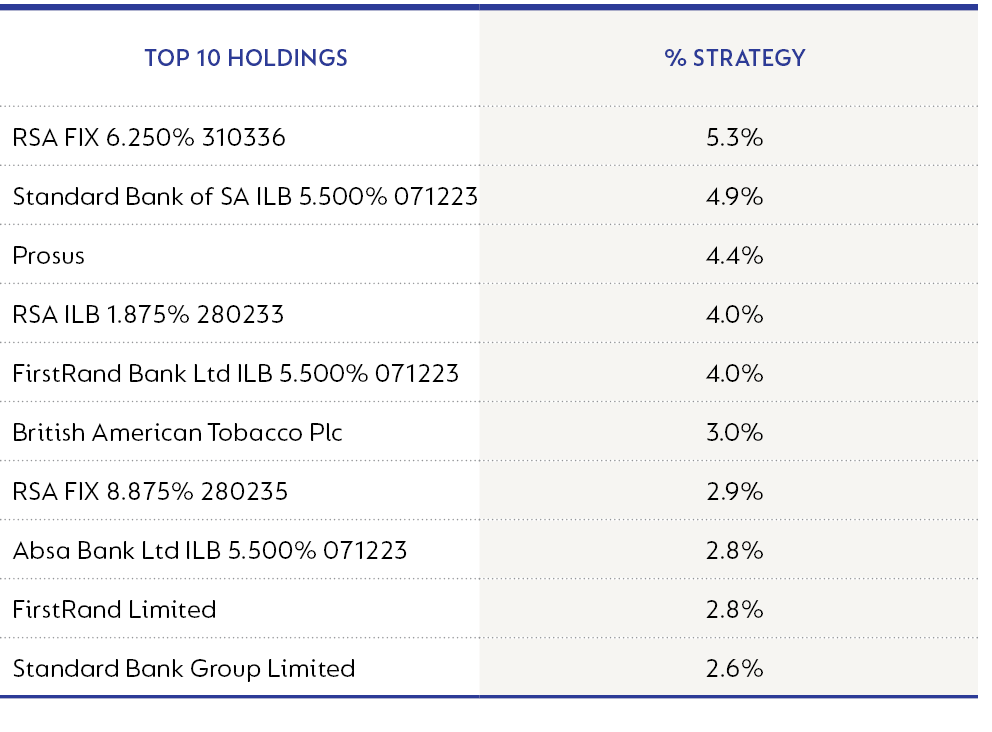

Domestic assets contributed positively to Strategy returns. Equities made a larger contribution, but both equities and bonds delivered positive returns, and good selection resulted in the outperformance of their respective benchmark indices. While real yields on SA government bonds appear attractive, we are alive to the increasingly challenged fiscal position in which SA finds itself and the implications for longer-term debt sustainability. For this reason, we continue to limit the duration of the bond carve-out and balance the holding of government nominal bonds with meaningful exposure to both inflation linkers and corporate paper. Within domestic equities, Standard Bank, OUTsurance and Prosus were the most significant contributors to returns year to date; Anglo American, Impala Platinum and British American Tobacco were the largest detractors.

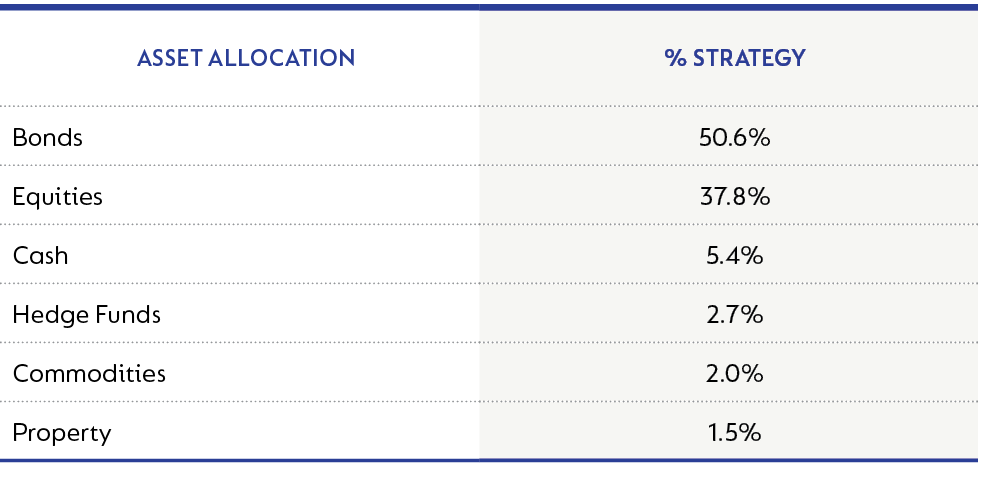

During the quarter, we reduced exposure to risk assets slightly in the Strategy, principally through a reduction in SA equities (commodity stocks in particular), and we retain sufficient cash to take advantage of opportunities should they present themselves. This action is supported by cash now offering an acceptable yield.

Our asset allocation and top 10 holdings as at 30 September 2023 are shown below:

A weaker commodity cycle and increasingly evident infrastructural constraints (power, rail, roads, water) will place more significant pressure on economic growth and social stability. We are of the view that it is only the higher quality domestic businesses that will be able to navigate a low- or no-growth economy successfully, and it is these companies that feature in the domestic equity carve-out of the portfolio. We are still cognisant of valuation, and the market has taken down the value of many SA businesses to very low levels. Some of these will be ‘value traps’ where the business will continue to struggle with no top-line growth and the ongoing pressure from costs, while others will manage to defend their top line by taking market share and managing their costs. The latter will offer investors great returns as the market starts to differentiate between the winners and losers. In addition, the Strategy has a significant holding in SA-listed global-facing businesses.

Our bottom-up assessment of expected returns by asset class gives us confidence in being able to deliver targeted returns for clients over the medium term.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

South Africa - Personal

South Africa - Personal