Investment views

An attractive company in a resilient sector

The case for Dis-Chem

The Quick Take

- Despite the share price doubling in the nine years since listing, we believe Dis-Chem offers compelling upside for our client portfolios

- The healthcare sector remains resilient through economic cycles, driven by its status as a priority spend and an increasing focus on wellness among South Africans

- Large retailers are rapidly gaining market share from independent pharmacies due to their ability to leverage scale for cost efficiency and enhanced convenience

- Key growth opportunities in digital innovation, cost management and financial product offerings further strengthen the investment case

Dis-Chem is a leader in the South African pharmacy retail sector, operating out of 274 stores nationwide. The business was founded by Ivan and Lynette Salzman in 1978 and listed on the JSE in 2016, with an initial placement of 27.5% of the company. The remainder was retained by the family trust, senior management, and a private investor. Coronation participated in the IPO placement at an average price of R18.50. We built up our position in subsequent placements and currently own c.30% of the company. The share has doubled since listing and outperformed the FTSE/JSE Capped Shareholder Weighted All Share Index. Despite this handsome showing, we believe the investment case for Dis-Chem remains attractive, based on the key drivers outlined below.

MARKET LEADERSHIP IN A DEFENSIVE INDUSTRY

Dis-Chem is one of South Africa (SA)’s largest pharmacy retailers and holds the largest dispensary market share (around 25%). This is a sector that benefits from robust long-term demand drivers. SA’s growing middle class, rising health awareness, and increasing expenditure on personal care and wellness products underpin a favourable demand outlook. Additionally, the country’s ageing population and prevalence of chronic diseases create sustained demand for prescription medications and healthcare services. The historic 10-year Compound Annual Growth Rate for pharmaceutical and medical spend in South Africa is 7.4%. Furthermore, the pharmacy retail sector is relatively resilient to economic cycles. While discretionary spending may fluctuate during downturns, healthcare and essential goods remain priority expenditures for consumers, ensuring a stable revenue base for companies like Dis-Chem.

CONTINUED MARKET SHARE GAINS AS THE PHARMACY INDUSTRY FORMALISES

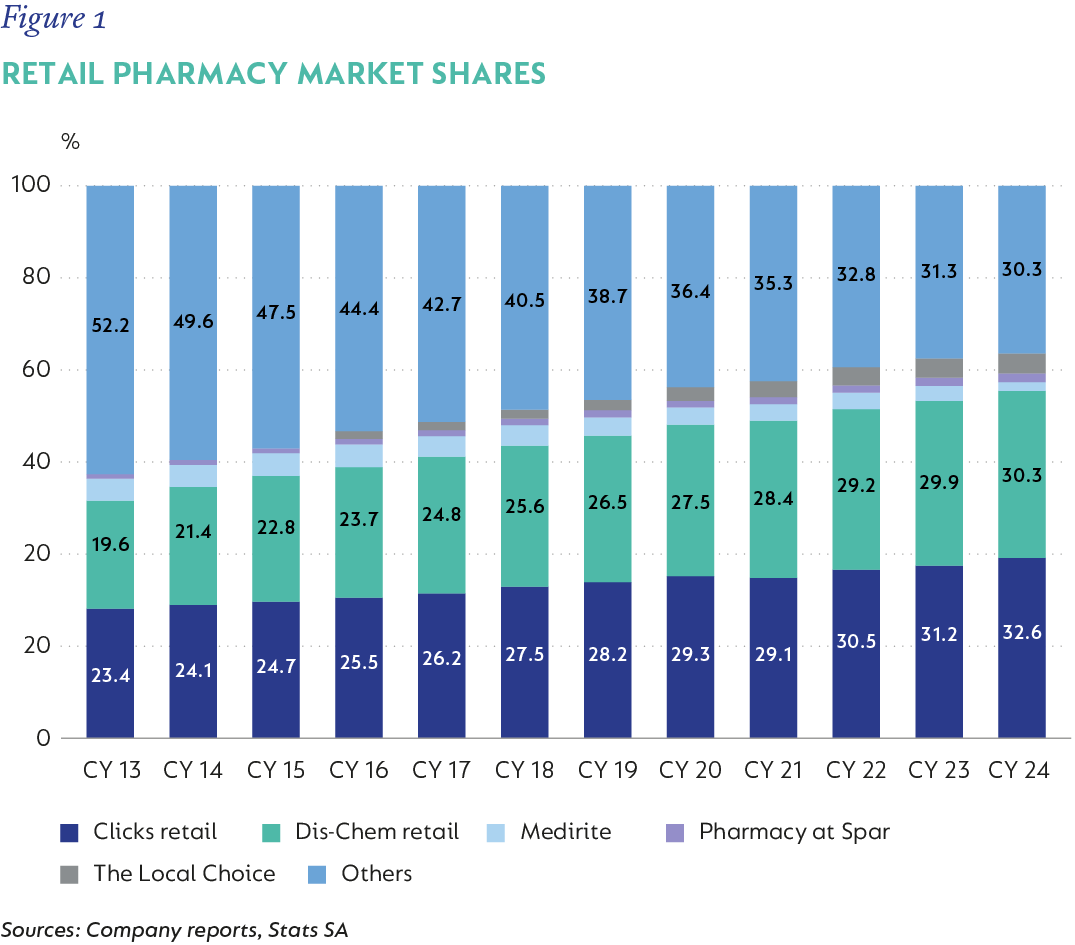

Dis-Chem and Clicks (its closest competitor) have led the formalisation of the pharmacy retail industry in South Africa over the last 15 years. Both players have gained market share from independent pharmacies across the dispensary, front shop health (over-the-counter medications and supplements), baby, beauty, and personal care categories. The combined market share of these two players has increased by 21% over the past decade (Figure 1). These gains have been driven by reduced dispensing fees, driving higher footfall in stores by offering a more extensive front-shop range, and building scale by integrating backwards into own wholesaler distribution networks1. We think these factors will continue to drive future market share gains from smaller, independent players and grocers. Dis-Chem is particularly well positioned to sustain further market share gains due to the faster pace of its space rollout versus its peers.

SUPPORTING REVENUE GROWTH THROUGH EXPANDING STORE NETWORK AND GEOGRAPHIC REACH

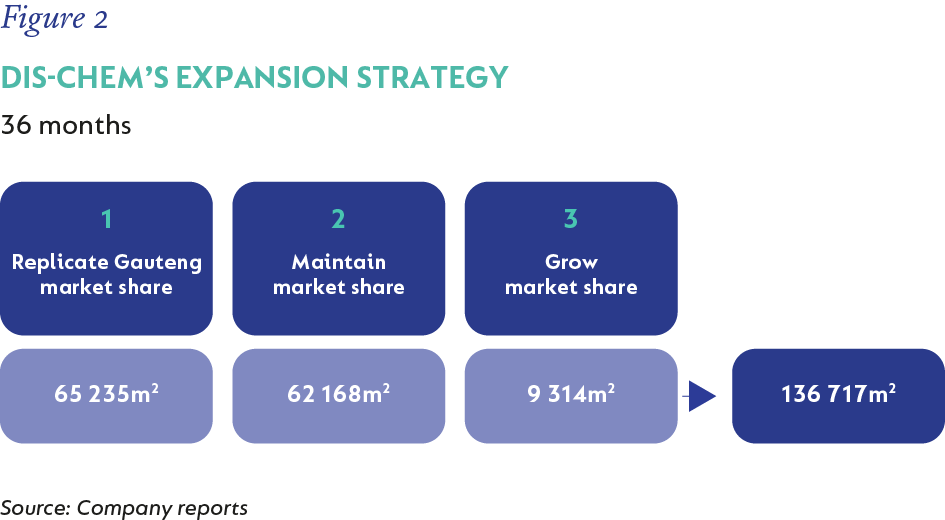

Dis-Chem’s store expansion strategy is the cornerstone of its higher revenue growth prospects. The company plans to increase its trading space by approximately 40% over the next three years. As illustrated by Figure 2, the company aims to replicate its 35% pharmacy market share in Gauteng on a national basis, as new stores are opened in Kwa Zulu-Natal, the Eastern Cape, and the Western Cape.

ENHANCING REVENUE GROWTH AND BUILDING OUT ADDITIONAL REVENUE STREAMS WITH AN EFFECTIVE DIGITAL STRATEGY

The company’s digital strategy has multiple facets. E-commerce is a growing but still nascent component of Dis-Chem’s business, with online sales currently contributing c. 5% of Dis-Chem’s revenues. The Covid-19 pandemic accelerated online shopping trends and the company has responded by enhancing its offering with the launch of its on-demand delivery service, online prescription service, and a refreshed app. This omni-channel approach enhances customer convenience and leverages the physical store footprint through digital channels.

The integration of technology into Dis-Chem’s operations extends beyond e-commerce. Data analytics and customer insights derived from its loyalty programme not only inform targeted marketing strategies but also allow the company to build out a wider health ecosystem. The business has branched out into offering its customers low-cost medical insurance policies and is looking to launch life policies soon. Initial indications show that a customer who has a Dis-Chem insurance policy has a higher shopping frequency, is a stickier dispensary customer, and contributes to increased in-store usage of clinical services and virtual doctor consultations.

DELIVERING HIGHER RETURNS THROUGH IMPROVING OPERATIONAL EFFICIENCIES

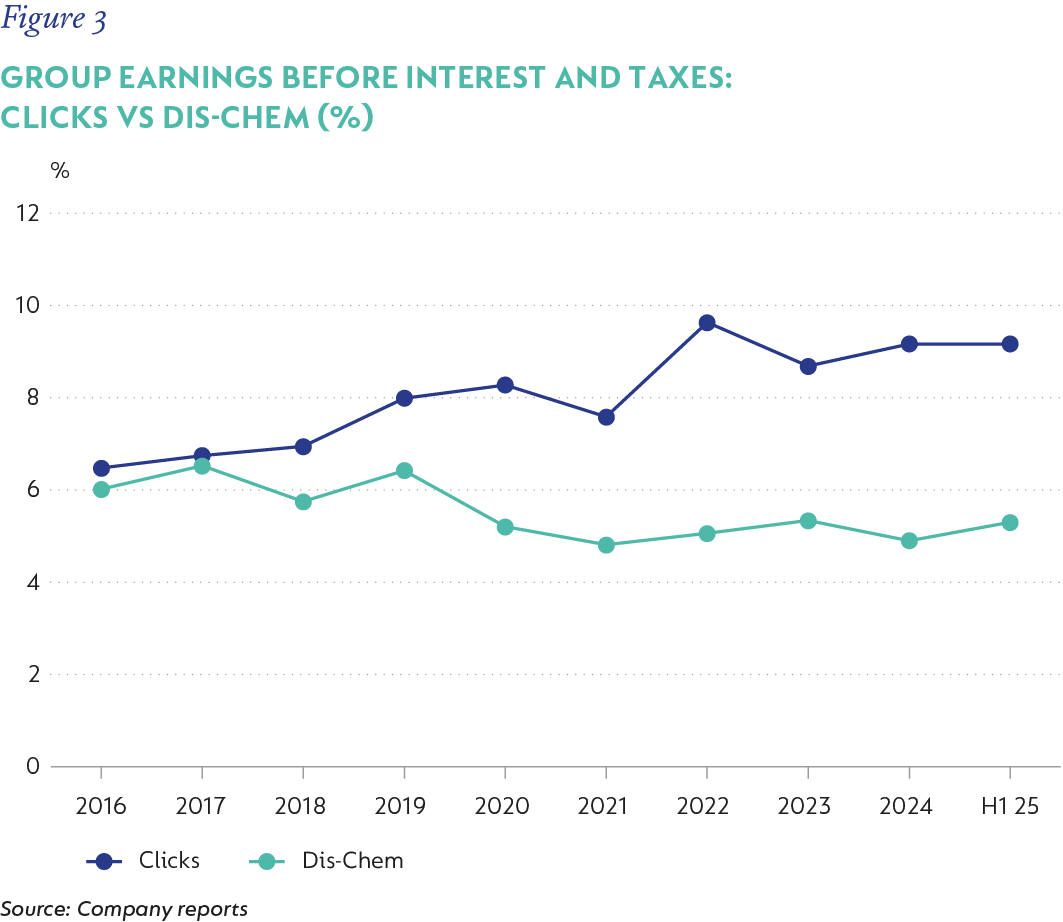

Since listing, Dis-Chem’s group operating margin has contracted from 6% to 5% (Figure 3). This fall is particularly stark when compared to that of Clicks, which has seen its group operating margin expand from 6% to 9% over the same period. Cost control thus remains a key focus. While Dis-Chem has managed to deliver a healthy total income margin expansion as they have extracted better supplier terms, operating cost structures in their retail stores have risen exorbitantly. In response, the company has recently launched a cost framework programme that is focused on optimising store personnel structures. We have observed early signs of operating margin expansion in recent results and think there is further opportunity to grow retail margins from here. Additionally, Dis-Chem has invested significantly in its distribution centre capacity. As these centres increase their utilisation through servicing their own expanded retail footprint and onboarding new independent pharmacy customers, the wholesale segment should also deliver growing margins. We think that Dis-Chem has the potential to close some of the margin gap with Clicks over the coming years, which will help drive strong earnings growth.

CONCLUSION

Dis-Chem presents a compelling future earnings growth outlook compared to other domestic-facing SA businesses. This is a high-returning business, delivering a quality earnings stream, backed by solid cash generation and deserves to be valued at a premium multiple. While the share has re-rated, there is still further potential for upside as the company exploits adjacent opportunities in financial services and healthcare delivery. The company has a secure balance sheet that can comfortably fund its growth initiatives and support a 65% ordinary dividend payout policy. There is further scope for the dividend payout to be increased as the balance sheet strengthens in the future. We anticipate this will provide an additional leg of returns to shareholders over and above the robust earnings trajectory.

Dis-Chem’s resilience, financial strength, and strategic growth initiatives position it well to continue to deliver value for shareholders.

[1] Supply chain management through operating the product distribution system. This reduces reliance on third parties, lowers costs, and improves efficiency and control over inventory and logistics.

South Africa - Personal

South Africa - Personal