Investment views

Finding value in more than just the Magnificent Seven

The Quick Take

- The robust performance of global stock markets continues to be dominated by US-listed large cap tech shares

- While we find many of these stocks attractive, we believe the market’s fixation with them obscures other compelling investment opportunities

- As active investors with a long time horizon, we are finding attractive opportunities in lesser-known companies with the ability to sustain above-average revenue growth while compounding returns on capital at a high rate

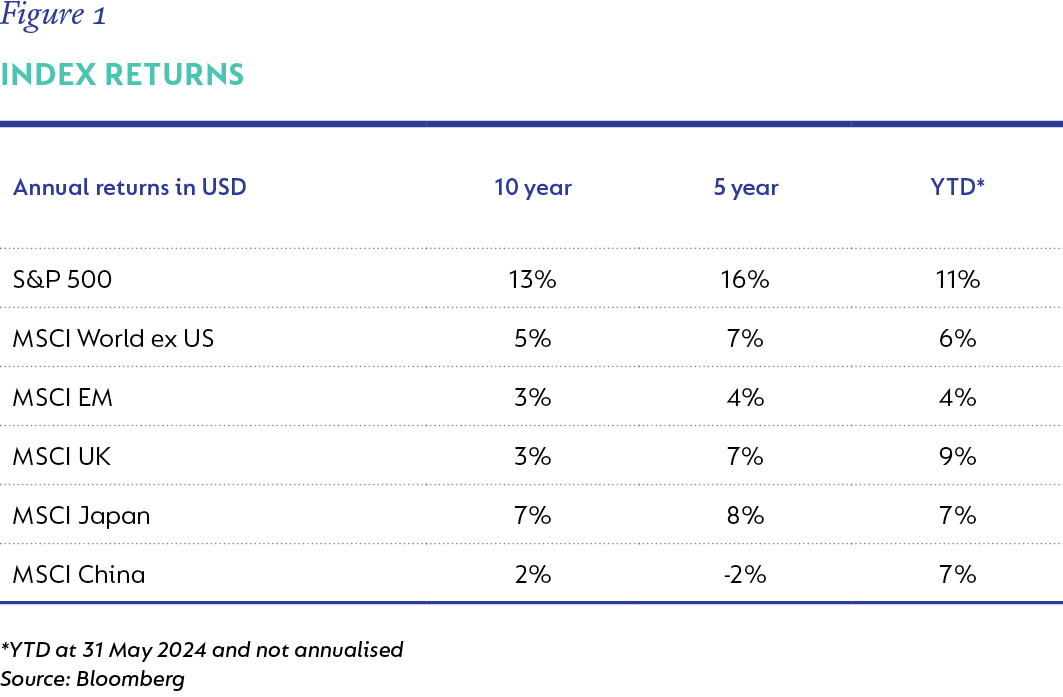

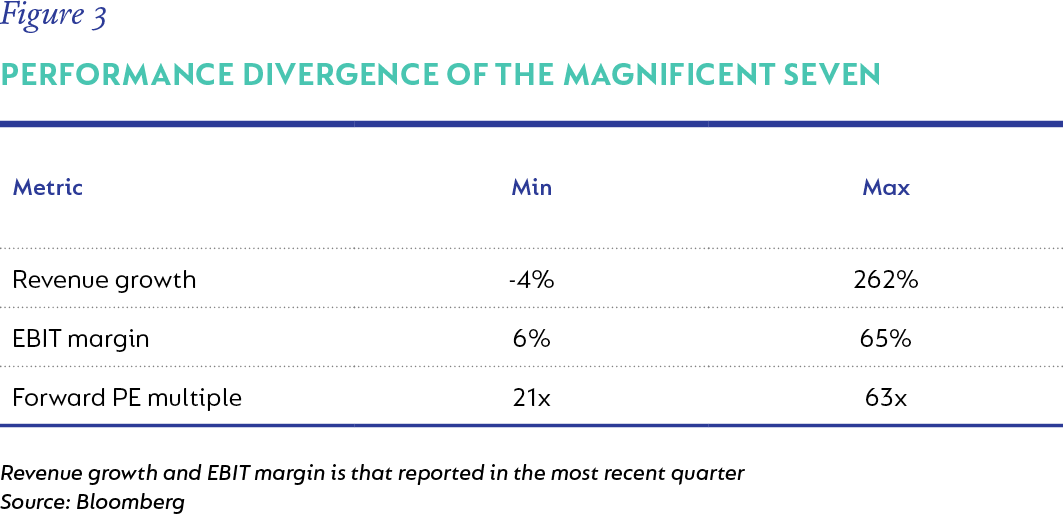

Many stock markets have delivered strong returns thus far in 2024, but the US continues to dominate, compounding more than a decade of outperformance. Indeed, much has been written about the narrowness of stock market returns, with the US beating all regions, technology beating all sectors, and the Magnificent Seven of Amazon, Alphabet, Apple, Microsoft, Meta, Nvidia and Tesla trouncing, well, almost everything. In fact, an equal-weighted index of these seven shares has returned an annualised 47% over the last five years, roughly triple the S&P 500’s very healthy 16% (Figure 1). To put this into perspective, $1m invested in the Magnificent Seven five years ago would now be worth $6.8m, compared to $2.1m if invested in the S&P 500 and $1.3m if split equally across the five other indices shown in Figure 1. More recently, returns in this group have been amplified by excitement around artificial intelligence and its potential applications, with the market handsomely rewarding early winners in this large capitalisation group, as shown in Figure 2.

TWO KEY OBSERVATIONS FOR BOTTOM-UP INVESTORS

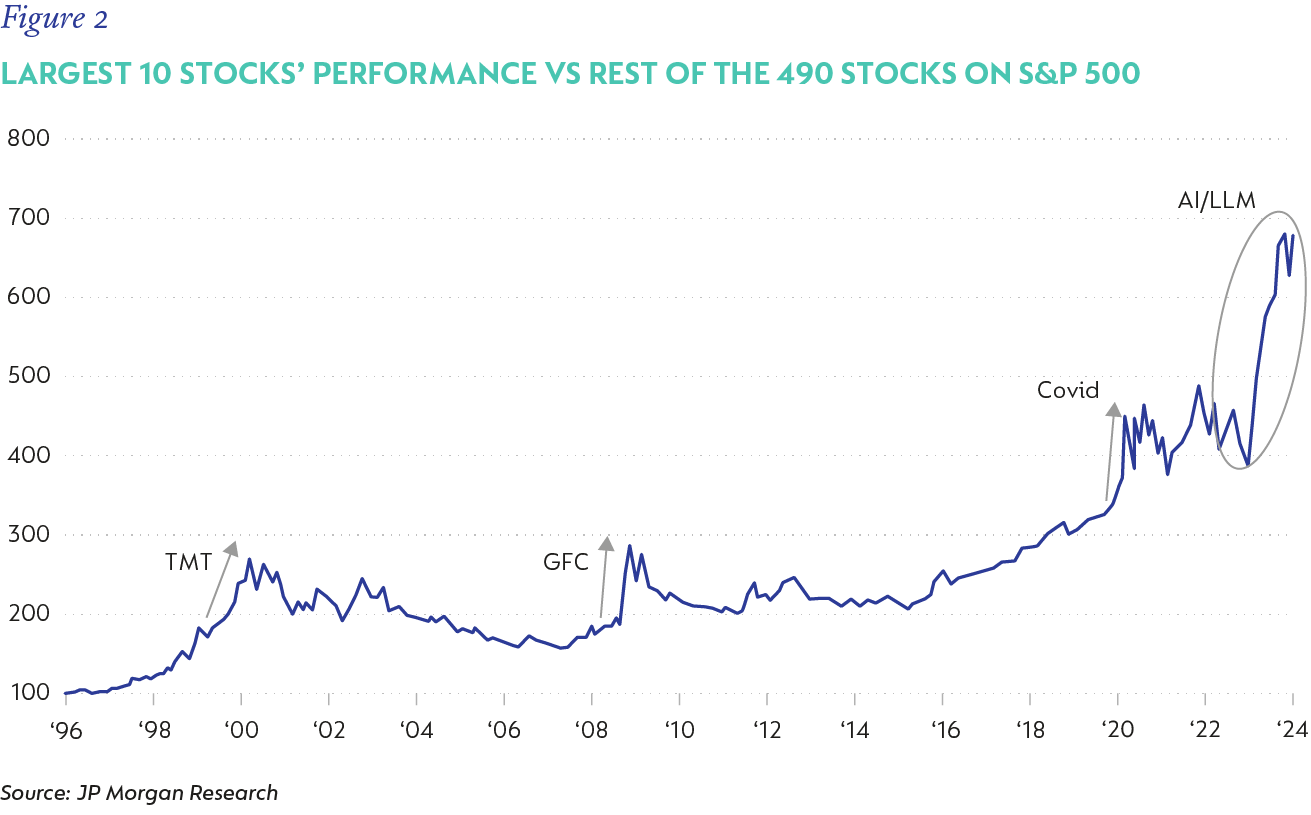

As bottom-up stock pickers, we would make two key observations. First, there is massive dispersion within this cohort of seven stocks. This is clear if we examine the fundamental performance of these businesses, with the table below (Figure 3) highlighting a stark divergence in revenue growth, margin profile and earnings multiple within this group of companies.

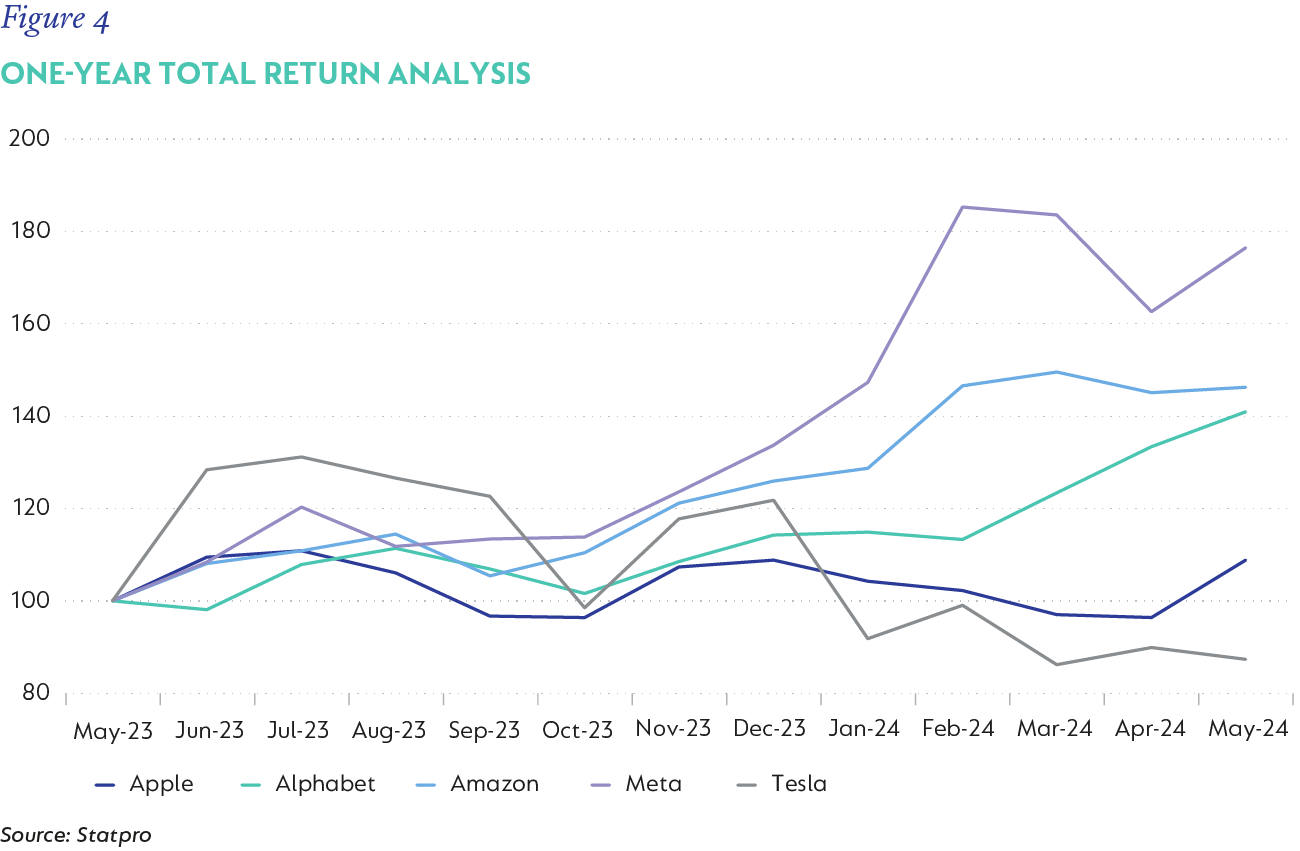

The share price performance is also surprisingly anything but uniform. Figure 4 shows the total return of Meta, Alphabet and Amazon, three of the names in the group that we continue to hold in our portfolios, versus Apple and Tesla, which we have avoided, over the last 12 months. Even within this much-publicised group, there have been clear winners and losers over various time periods, which highlights the importance of stock picking. We continue to hold sizeable positions in the above three stocks as we believe the market is still under-valuing the growth potential of these AI beneficiaries.

Our second observation is that a focus on factors, styles or groups can obscure investment opportunities. Active investors who are willing to do the fundamental research work on individual names will find a myriad of opportunities below the surface. The market’s fixation on the Magnificent Seven, while ignoring dispersion within the group, diverts attention from a rich opportunity set of companies that share some important attributes with the abovementioned group, including the ability to sustain above-average revenue growth while compounding returns on capital at a high level. Three such examples are highlighted below.

A RICH OPPORTUNITY SET FOR ACTIVE INVESTORS

Interactive Brokers (IB) is a US-listed multinational online broker, offering its professional and non-professional clients a platform to trade various asset classes, including stocks, bonds and derivatives.

IB has a clear and simple competitive advantage. Its highly automated global structure ensures it can offer tremendous value to clients through lower prices while maintaining highly attractive operating margins of around 70% on a profit-before-tax basis. Furthermore, IB consistently achieves a return on investment of around 20%, even with a sizeable net cash balance.

IB also has a history of strong and profitable growth, with active clients growing north of 20% per annum over the last decade. With only 2.7 million active accounts today, its growth outlook remains extremely compelling, with investors globally continuing to shift towards self-directed investing. IB’s offering to clients cannot be matched by any of its peers and we believe this will allow the business to keep growing its underlying earnings power in the double digits for many years to come. This is an extremely attractive proposition considering its starting valuation of only 18x earnings, excellent management team and strong balance sheet. It remains a core holding in our developed market strategies, and we are happy to be invested alongside its highly-rated founder, Thomas Peterffy, who owns 75% of the company.

Accor is a French-listed global hotel franchisor. Its roots are in the European economy and mid-scale segments, but over the last decade, the company has successfully diversified into a truly global operator and is now the largest global hotel group outside of the United States and China. Accor operates in a structurally growing end market, with both leisure and business travel expected to outpace nominal GDP through an economic cycle. Against this backdrop, branded hotels have continued to take market share for reasons that we see as enduring. The five largest global hotel franchisors together still only account for 10% of global room supply, while Accor itself has a share of just below 2%, up from 1% in 2015.

Whilst cyclical, we expect Accor to grow its high-margin management and franchise revenues at a high single-digit rate, driven by a combination of growth in the number of hotels it manages (net unit growth) and the increase in revenue generated per available room in a hotel (RevPAR gains). In Accor’s key markets, which are outside of the United States, branded hotels have a multidecade growth runway as they continue to take share in a very fragmented and growing end market. Along with operating margin expansion post its restructuring to an asset-light model and ongoing share repurchases, earnings are forecast to grow at a very attractive mid-teen rate over our forecast period.

Considering the above, it is surprising to us that Accor trades at a material discount to other asset light franchise hotel groups. Post restructuring Accor still has some legacy exposure to low margin owned hotels via AccorInvest resulting in financial statements that are messy compared to peers. Exiting these hotels should allow the group to complete its transition to an almost fully asset light business, the core of which earns high margins (over 60% at the EBITDA level) and very high returns on invested capital. As the company builds on and establishes a track record of execution and disciplined capital allocation, we think the valuation gap to its peers will close over time. We believe the stock is very attractively priced, trading on only 17x forward earnings, excluding its stake in AccorInvest.

Elevance Health is the second largest US health insurer by membership, with over 46 million members. The company is well diversified across both government and commercial programmes, which results in a resilient business through both economic and underwriting cycles as the fortunes of the various business lines wax and wane. Elevance has an enviable track record of compounding earnings at a consistently strong rate, with the company having grown earnings per share at an 18% compound annual growth rate since the highly rated Gail Boudreaux took over as CEO in 2017. Scale is a critical competitive advantage in health insurance. As one of the leading commercial health insurance providers in 14 states, Elevance benefits from strong local market shares and is often multiples the size of its closest local competitors. This gives the company a key advantage in network coverage and pricing negotiations with providers.

The company is also following in the footsteps of its peer UnitedHealth and building out a faster-growing, capital-light healthcare services business in areas including primary care, specialty pharmacy services and behavioural health. This is a very natural adjacency for the company as it initially builds out capabilities to serve its own captive membership. Over time, Elevance can offer these services more broadly, with an opportunity to penetrate the other leading commercial health insurance provider plans that are not owned by Elevance. The stock currently trades on a multiple of only 14x forward earnings, which is a substantial discount to the market and highly attractive for a company that should continue to grow earnings per share in the low to mid-teens over our forecast horizon.

We continue to find attractive opportunities both within the large cap space (including the Magnificent Seven names of Alphabet, Amazon and Meta) as well as other high-quality stocks garnering less attention. These stocks share many similarities with the Magnificent Seven, with strong moats and sustainable competitive advantages leading to attractive rates of real earnings growth over the longer term. But they are not nearly as well-known and trade on very attractive earnings multiples as a result. As bottom-up investors, we tend not to focus too much on groups of stocks or broad themes. The same, however, cannot be said of Mr Market, and this provides a rich opportunity set for those with a longer-term horizon who are willing to do the work on individual names.

Disclaimer

SA retail listener

SA institutional listener

Global (ex-US) listener

US listerner

South Africa - Personal

South Africa - Personal