Investment views

Opportunities in US wealth management

How Interactive Brokers, LPL Financial and Charles Schwab are capitalising on emerging trends

The Quick Take

- The US wealth management industry has grown assets by 8% p.a. over the past decade, driven by new flows and asset appreciation

- The self-directed segment is growing fastest, benefiting from technological and demographic shifts

- Within advisor-intermediated channels, advisors and assets are shifting from wirehouses [1] to independent platforms

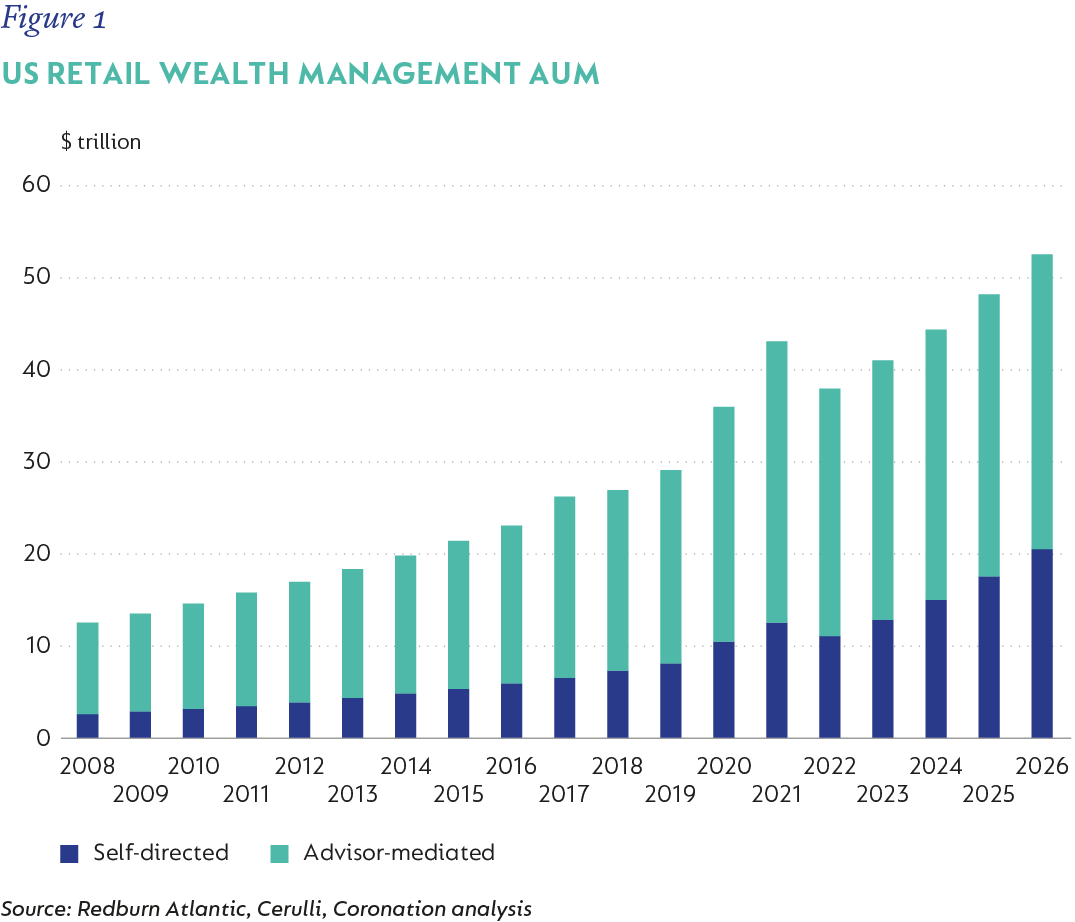

American households with investable assets – and the wealth management industry supporting them – have been notable beneficiaries of the growth in the broader economy and appreciation of financial assets over the past decade. Retail assets held with brokerages and advisory platforms (which exclude institutional pools such as retirement funds) have grown at 8% p.a. since the 2008 financial crisis, reaching in excess of US$44 trillion (Figure 1).

While the wealth management industry generates revenue through a combination of commissions, advisory fees, and interest income, the most important underlying driver of value is growth in AUM. Within the industry, a structural shift in the market is enabling some firms to grow AUM at a faster pace than others.

Firstly, the self-directed segment is growing fastest, as more individual investors take responsibility for their investment decisions. There are many reasons cited for this trend, such as:

- Technology, as modern applications make it easier for retail investors to manage their own portfolios.

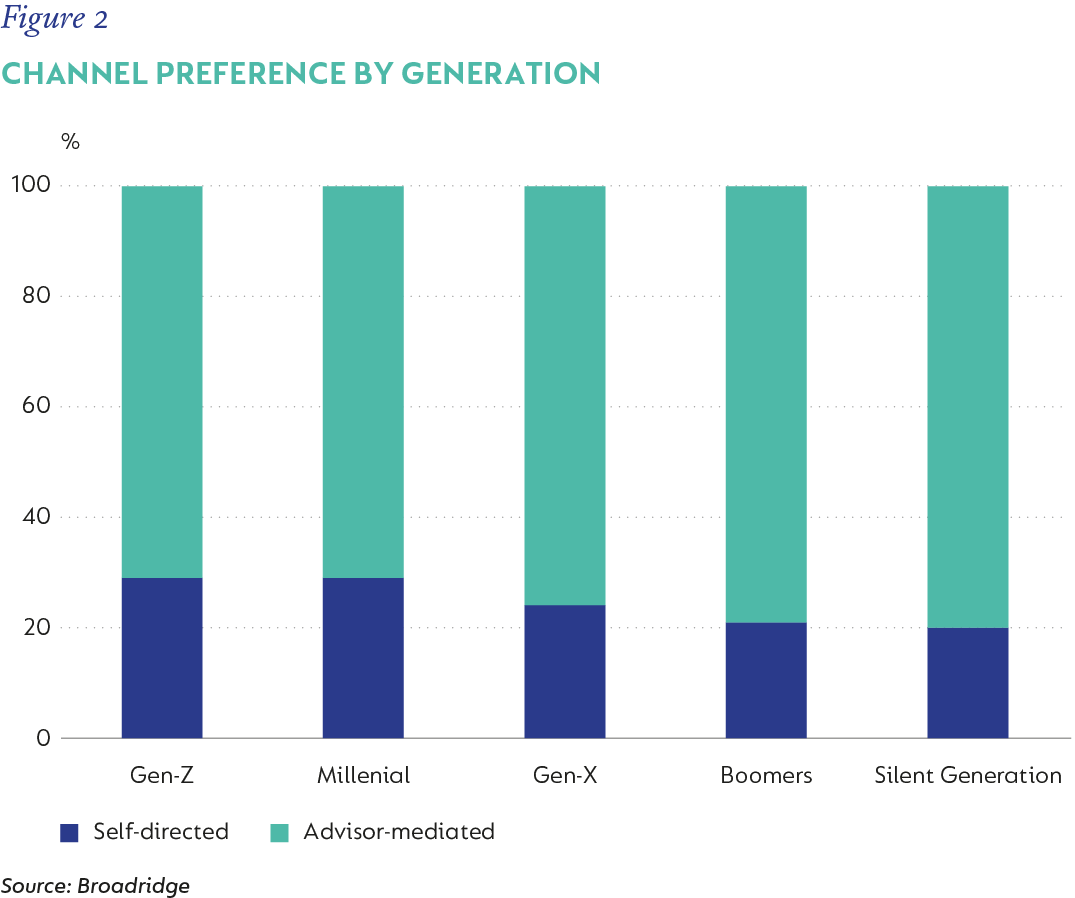

- Demographics, as younger generations that are more likely to use self-service channels are growing in the investor mix (Figure 2).

- Product availability, for instance, the proliferation of low-cost exchange traded funds.

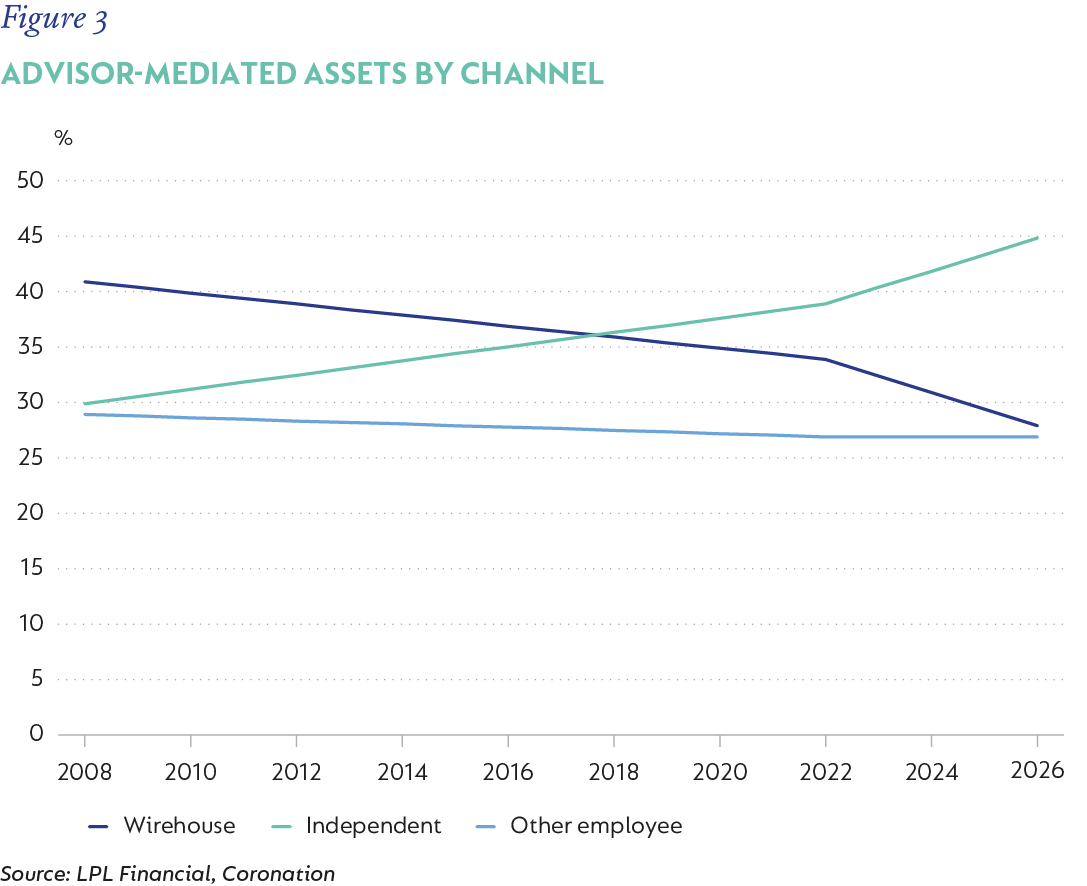

Secondly, Figure 3 shows that, within the advisor-mediated market, advisors (and assets) are steadily migrating away from large banks (the wirehouses) and broker-dealers to independent platforms. Again, the reasons are multitude, and include the following:

- Financial: Unlike advisors employed by big banks, independent advisors are typically able to retain a greater share of the fee revenue they generate. For instance, while a bank-tied advisor on average retains 36 cents of every dollar in fee or commission revenue generated, an independent advisor is likely to retain 80% to 100%.

- Ownership: Independent advisors have the autonomy and freedom to choose how they want to operate and serve their clients. Importantly, they own their client relationships, allowing them to sell their business, for example, when they retire.

- Product and technology: Whereas in the past the wirehouses had the advantage of being able to offer unique access to products such as investment research and initial public offerings (IPOs), these points of differentiation have been eroded. Independent advisors typically have access to best-in-class technology and a broad suite of product offerings at their disposal.

These trends are structural in nature, and as a result, are likely to persist.

We have identified three companies that are extremely well positioned to capitalise on these trends, attract assets, and are priced attractively relative to the market considering their quality: Interactive Brokers, LPL Financial and Charles Schwab.

INTERACTIVE BROKERS – LEVERAGING TECHNOLOGY TO LOWER TRADING COSTS

Interactive Brokers is a low-cost brokerage and trading platform serving both retail and professional investors globally. The business is singularly focused on delivering a highly automated platform that allows them to offer their customers the lowest trading costs, the lowest margin loan rates, the broadest array of markets, and excellence in execution. Clients have responded strongly to this proposition, increasing tenfold over the past decade. However, at only 3.2 million accounts (compared to 36 million at Charles Schwab) there is still plenty of room for growth over and above the general trend towards self-directed investing.

This competitive advantage is unlikely to be eroded soon given decades of investment in technology, the complexities of linking multiple highly regulated and disparate markets, and management’s singular focus on operating at the lowest cost. Shareholders reap the rewards – despite the superior offering to customers, Interactive boasts industry-leading margins of over 70% and generates healthy returns on capital.

Earnings are influenced by client trading activity and interest rates and can therefore be volatile, but their fortress balance sheet should allow them to weather most storms. We prefer to focus on the underlying earnings power of the business, which should continue increasing in double digits for a significant period.

The market price has begun to reflect some of these positives, but in our view not yet the full extent of the unique market position and longevity of growth.

LPL FINANCIAL – THE GO-TO FOR INDEPENDENT ADVISORS

LPL is the largest independent broker/dealer and advisory platform in the US. It offers financial advisors a variety of different affiliation models. These range from salaried employees to fully independent business owners, which are supported by a broad suite of functions, including technology, regulatory compliance, and customer relationship management. LPL essentially offers an advisor everything required to leave a wirehouse and become independent, and does so in a manner that is financially lucrative to the advisor (on average, LPL advisors retain 88% of fees, compared to 20%-50% at the wirehouses). As a result, LPL has grown AUM more than threefold over the past eight years.

This growth is likely to continue. The investments LPL has made in areas like technology are allowing them to affiliate with a greater variety of advisors of different sizes and expand their addressable market. For instance, it recently concluded a deal with Prudential to take on all its advisors in its first foray into the insurance-tied channel.

LPL has an enviable track record, with earnings per share (EPS) growing nearly sixfold between 2017 and 2024. While exposure to interest rates introduces some periodic variability, we believe LPL should continue to deliver mid-teens EPS growth for the foreseeable future.

CHARLES SCHWAB – WEALTH MANAGEMENT GIANT FACES TEMPORARY HEADWINDS

Schwab, the second-largest retail broker in the US, oversees more than 36 million active accounts and nearly US$10 trillion in client assets. Its scale and low-cost operating model allow it to offer comprehensive wealth management services at highly competitive fees. As a result, client assets, split between self-directed customers and advisors, are expected to grow in the mid- to high-single digits, driven by market appreciation and share gains from wirehouses.

Revenue growth is projected to outpace asset growth, bolstered by improvements in net interest income. Rising rates over the past two years prompted clients to shift cash deposits into higher yielding money market funds, raising the cost of funding to Schwab. Company-reported metrics suggest this shift is now subsiding. As a result, we anticipate that deposits will start growing again, reducing reliance on costly short-term funding. Schwab's net interest margin will benefit from meaningfully lower borrowing costs and the gradual repricing of its securities portfolio (which currently yields below-market rates).

With largely fixed operating costs, profits are expected to grow faster than revenue. Schwab plans to end 2025 with a strong capital position, which will enable share repurchases and drive high-teen EPS growth. Longer term opportunities include distributing higher-fee alternative assets such as private equity, which could significantly boost the company's fair value.

VALUATIONS REMAIN ATTRACTIVE

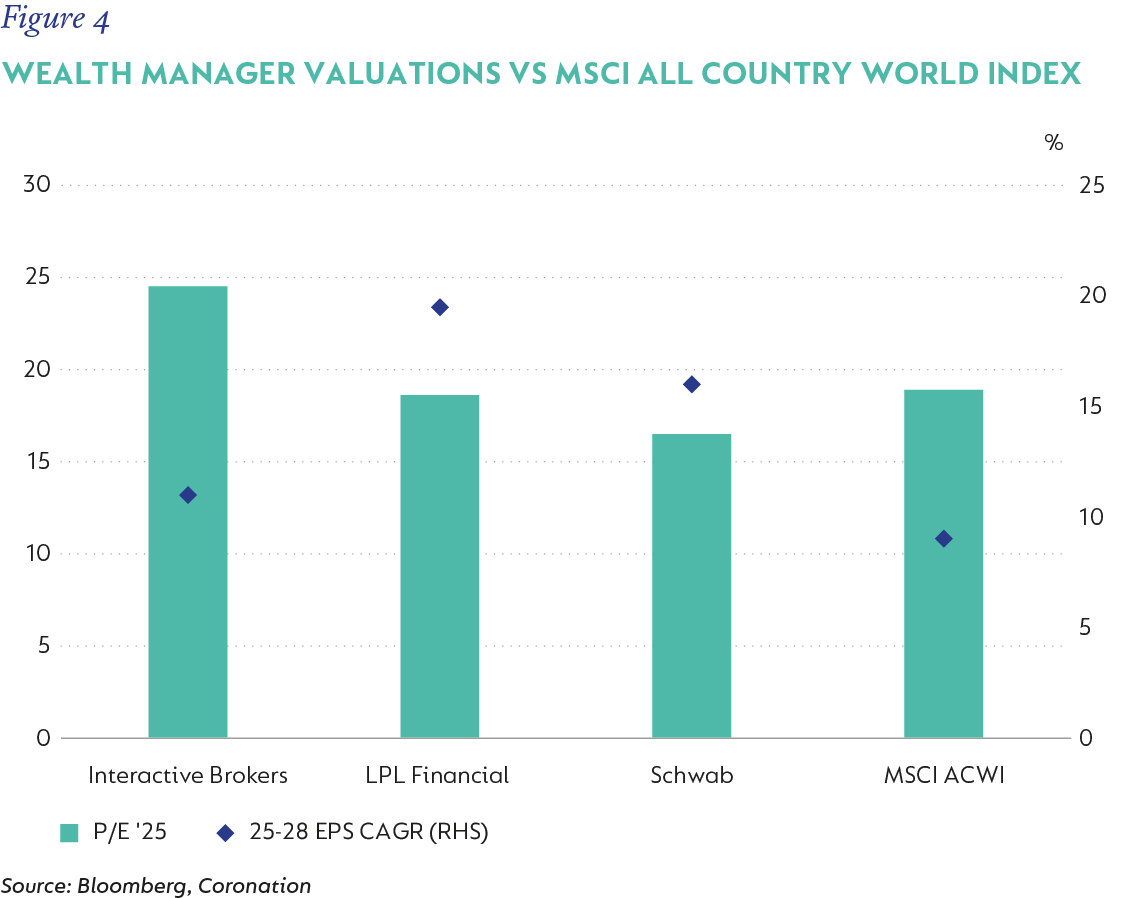

We believe all three companies remain attractively valued given their unique positions in the industry, business quality and durability of growth (Figure 4).

A key risk that we monitor for wealth managers is regulation. For instance, an enforcement action by the Securities Exchange Commission against a competing wirehouse last year raised questions about the sustainability of certain interest-related revenue streams. Our research suggests that Interactive, LPL, and Schwab are all relatively well positioned as low-cost and differentiated providers and, should the need arise, would likely have the ability to offset any potential lost interest revenue elsewhere in their businesses.

[1] Full-service financial services firms operating at scale such as banks, with tied advisors and own-brand products

South Africa - Personal

South Africa - Personal