Personal finance

5 Tips for investing in 2025

Whether you're just starting out or looking to save more, these insights can help you take the next step toward your investment goals.

With the constant flow of news and market noise, it can be difficult to know where to focus as an investor. In early 2020, we shared our top investment tactics for the new decade. Five years on, the world looks different in ways few could have fully anticipated. Yet, through it all, some investment principles still hold true. We revisited our original article and selected five tips that remain just as relevant today.

1. JUST GET STARTED

If you remember nothing else, remember this. One of the secrets to achieving your goals is simply to take the first step, and it’s no different when it comes to investing. You can start small, from as little as R250 a month, and build up from there. Once you’re comfortable that you are invested in the right fund for your needs, you can ramp up your investment. But get started. Today. Because every day is an opportunity to grow your wealth.

2. THE KEY TO SUCCESSFUL INVESTING CAN BE SUMMED UP IN JUST TWO WORDS: ASSET ALLOCATION

The essence of asset allocation is “not putting all your eggs in one basket”. It involves identifying how your portfolio should be distributed across asset classes like equities, bonds and cash to maximise returns and minimise risk, based on your goals, risk tolerance and time horizon.

History shows that different asset classes perform better or worse depending on economic conditions, market forces, technological change and political developments. The goal of an asset allocation strategy is to ensure that you own a robust portfolio that can withstand many different outcomes. It makes sense for many investors to outsource these decisions by investing in an appropriately mandated multi-asset fund with the ability to hold a wide variety of assets.

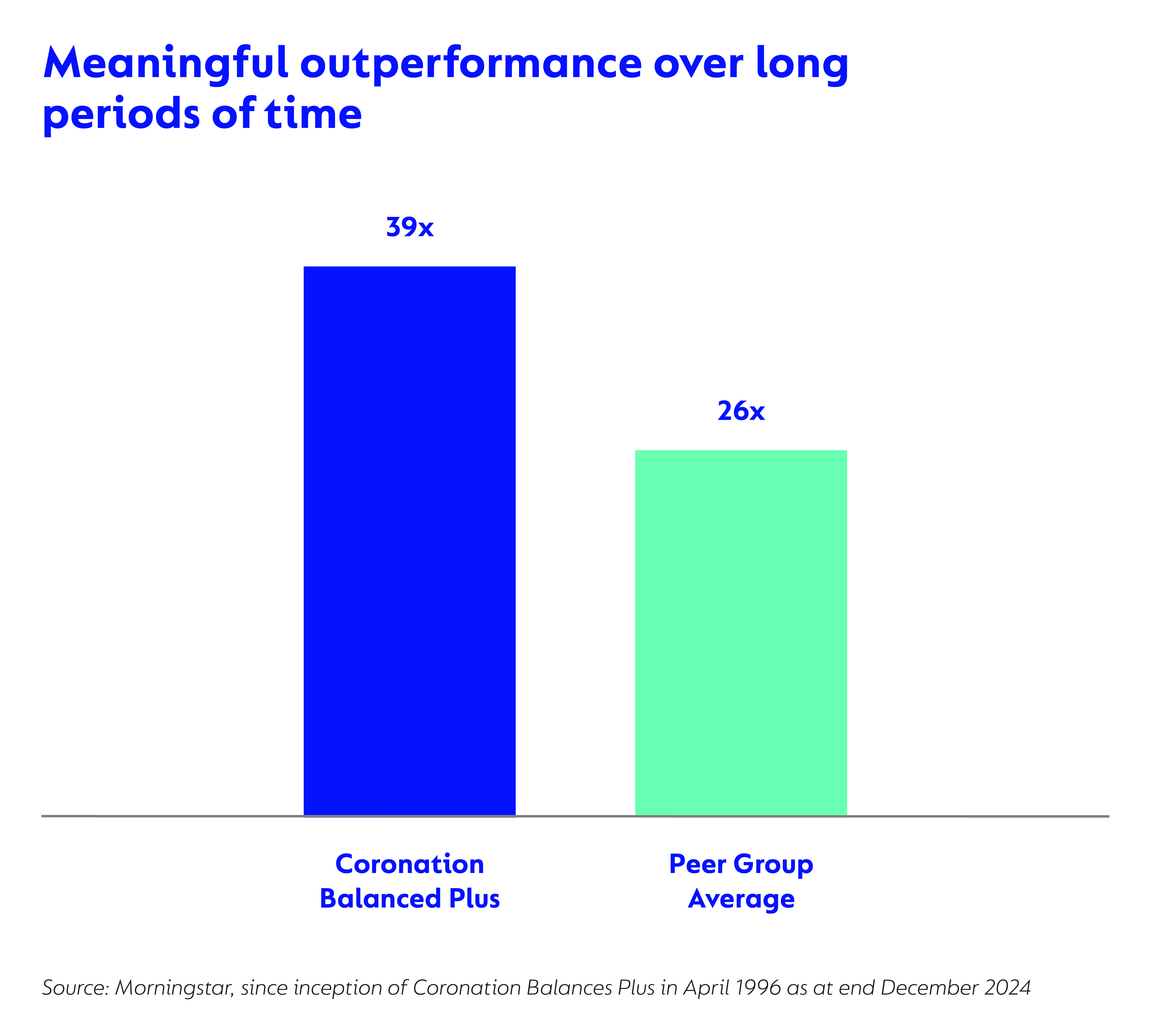

As a demonstration of the value that can be added as a result of good asset allocation, our multi-asset fund aimed at investors saving up for their retirements, Coronation Balanced Plus, has multiplied every rand invested by 42 times since its inception in 1996, compared to its peer group average of 28 times.

3. SET GOALS AND A TIMELINE TO STAY ON TRACK

Without clear objectives, choosing an investment strategy is like packing for a trip without knowing the destination. You might end up with flip-flops when you need hiking boots.

Your investment timeline also requires careful consideration. Starting in your 20s, for example, gives you 40+ years to build wealth before retirement, with the potential of decades of growth beyond that, especially if you plan to leave a legacy for the next generation. Yet many investors focus only on a timeline of five to 10 years, missing out on the advantages of long-term growth.

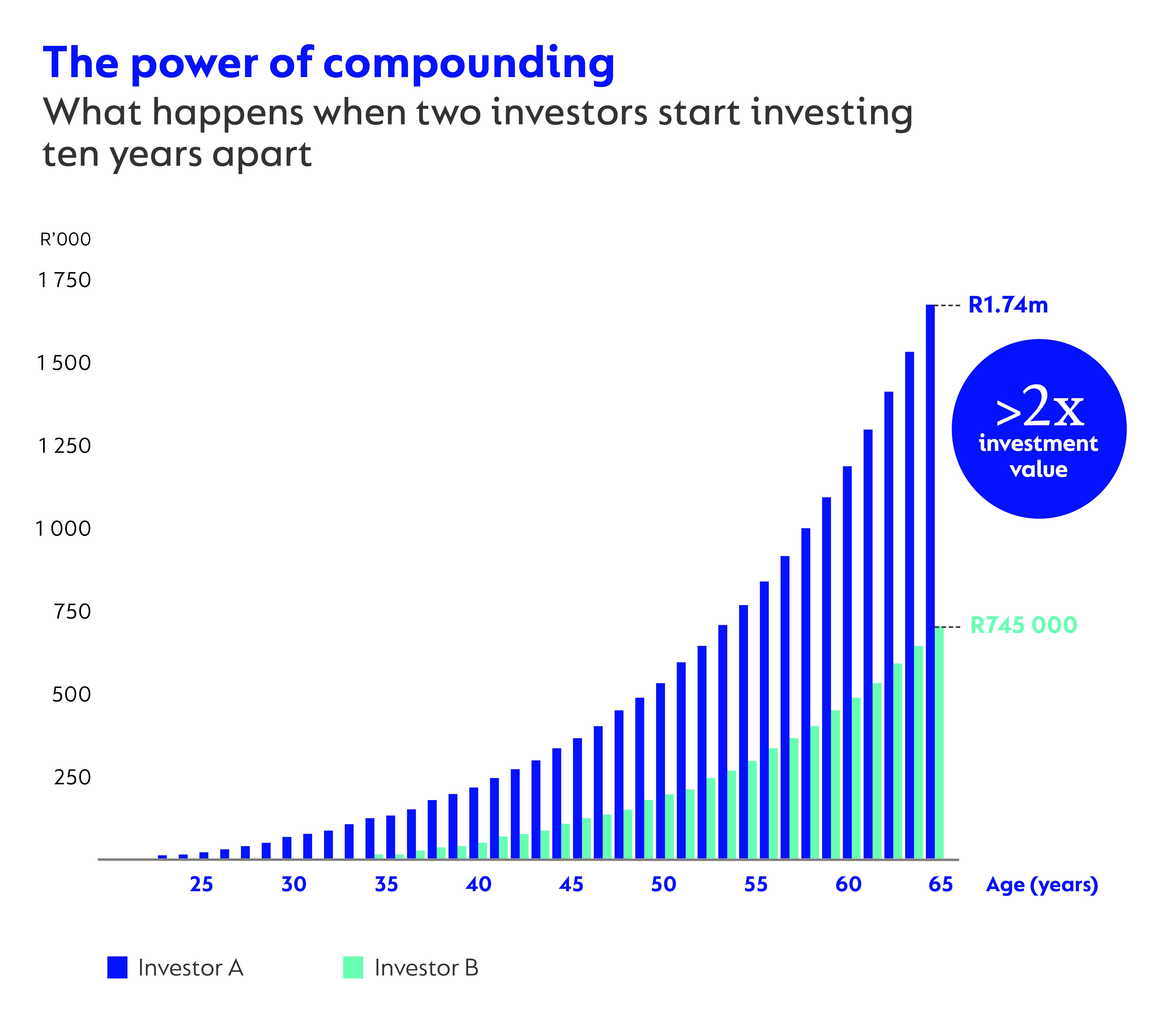

Consider the difference that ten years can make:

In the below example, Investor A started investing R500 a month at age 25, earning 8% per year. By retirement at 65, she had over R1.74 million. Investor B, who started 10 years later with the same contributions, ended up with R745,000 at the same age.

What made the big difference? Investor A’s early investments had a decade more to grow, generating returns that were reinvested and continued to earn more over time. The longer you stay invested, the more significant the impact of compounding.

Once you’ve considered your goals and timeline, choosing the right fund becomes easier, and you’ll be less tempted to chop and change. Staying invested is the key to benefitting from compounding. Frequent switching between funds can erode wealth, as you may end up selling lower-priced assets to buy higher-priced ones, disrupting long-term growth.

4. DON’T CHASE THE TREND

In times of stress and uncertainty, it’s human nature to seek reassurance from friends and family or to be drawn to the latest trends circulating in your social network. This leads to ‘herd behaviour’, where we make choices that align with other people’s decisions. While this instinct has helped humans survive many challenges, there are at least two reasons why this strategy isn’t recommended for investment decision-making.

- First, everyone’s circumstances differ and may have their own biases. To make informed choices, focus on your own goals, risk profile, and current assets and liabilities.

- Secondly, following the herd means you are likely to invest where the money already is. Wouldn’t you rather be focusing where the best opportunities are?

5. SET ASIDE AN EMERGENCY FUND

How prepared is your investment plan for financial emergencies? Many people struggle to reach their goals when unexpected expenses arise. You can protect yourself by building an emergency fund that is managed to focus on capital preservation.

How much to keep in your emergency fund will depend on your lifestyle and circumstances, but three to six months of your regular expense budget is a good starting point.

The principles of sound investing don’t change, even when the world does. What makes the difference is action. It’s often about beginning right where you are and making the most of what you have.

South Africa - Personal

South Africa - Personal