Personal finance

Overview

As a South African investor, one of the best investment strategies is to ensure that your asset base is appropriately diversified.

By not putting all your “eggs” into a single (and notably small) basket, you spread your investment risk and return opportunities across geographies and, importantly, jurisdictions.

This edition of Corolab demonstrates:

- the benefits of strategic diversification into international markets;

- why it makes sense to consider doing so with a manager who has proven and established global capabilities across both developed and emerging markets; and

- how best to take action.

The benefits of an appropriately diversified asset base

Strategic diversification into international markets holds the following benefits for your portfolio:

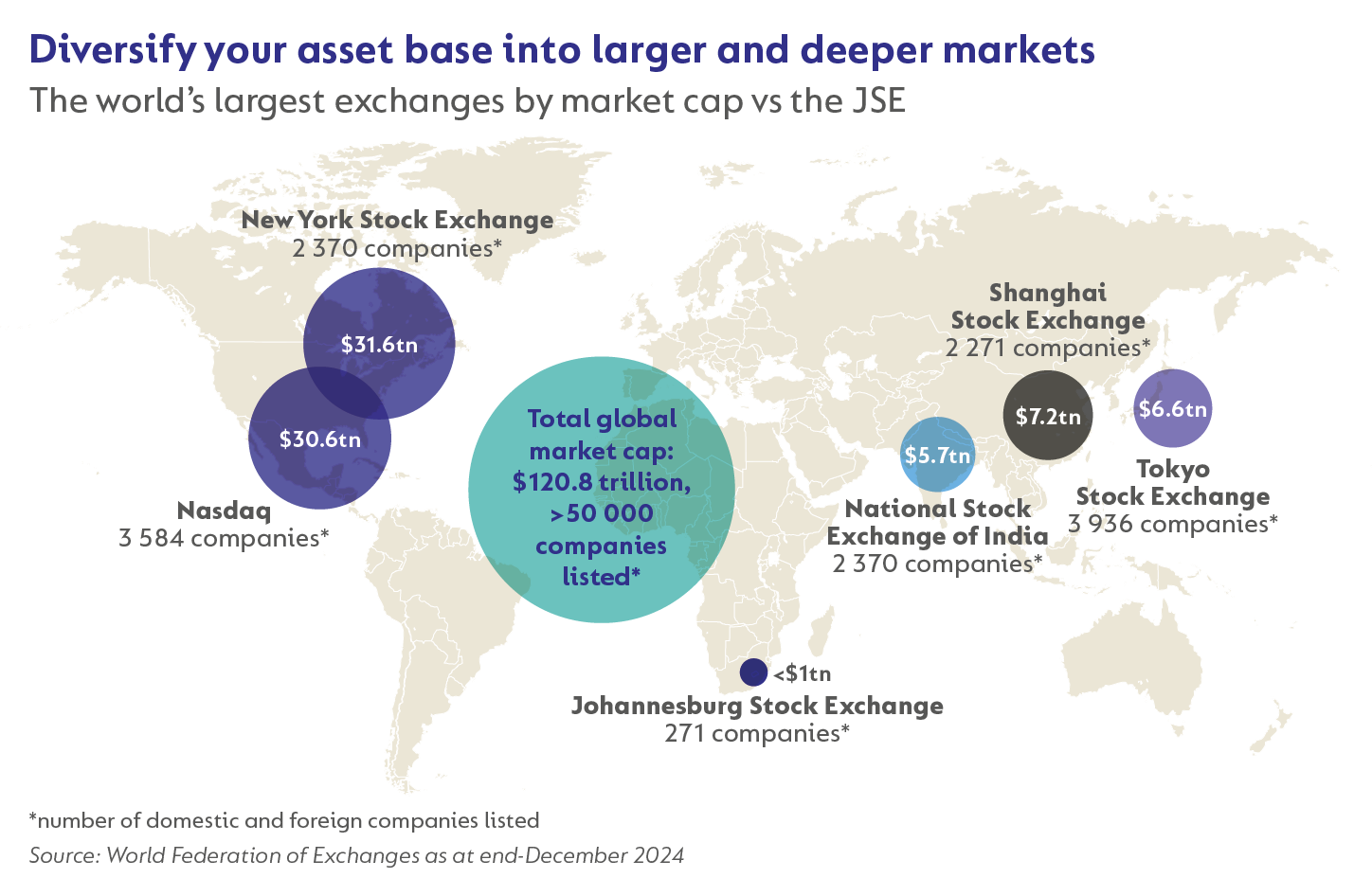

1. Enhanced returns through larger, more diverse and deeper markets

The sheer magnitude of investment opportunities outside our home market is evident in the combined market capitalisation of the world’s top five exchanges*, which exceeded $80 trillion (and comprised more than 14 500 listed companies) compared to the JSE’s ~$1 trillion (and universe of 271 listed companies) as at end-December 2024.

When you widen your investment universe, you gain exposure to engines of innovation and growth, and access industries that are not as deep in our home market, likely improving your overall investment outcomes.

What do you get when you combine a greater opportunity set with more diversification?

The following graph demonstrates that South African investors who diversify their asset base with meaningful international exposure can expect better risk-adjusted outcomes from their long-term investment portfolios. At 0% international exposure, investors are compensated with 1 unit of return for every unit of risk taken. But by having international exposure of 45%—the optimal point—investors’ return increases, and their risk decreases, meaning that they can achieve 1.32 units of return for every unit of risk taken.

2. Reduced overall risk through uncorrelated returns

When considering which asset classes to include in your overall investment portfolio, it is vital to consider correlation. Correlation measures how closely the price movements of two asset classes are related. You can combine asset classes with negative or no correlation to reduce your investment portfolio's overall risk. This means that if one asset class in your portfolio declines during a market downturn, other asset classes will either rise or remain unaffected, resulting in a better overall outcome and reduced overall risk.

In a severe risk-off event, the inclusion of developed market assets (specifically bonds), gold and cash can offer much-needed diversification at a time when equities (global and SA) typically sell off and emerging market bonds depreciate.

The following table demonstrates the value of introducing global assets to your South African portfolio.

South African equities and bonds have low to negative correlation with their global equivalent asset classes, and there is an even lower correlation when looking at the relationship between asset classes (i.e. SA equity to global bonds and SA bonds to global equity).

The key takeaway from this exercise is that by allocating money internationally, you add another asset class or set of asset classes to your overall investment portfolio, that behave differently to those in your local asset class mix, especially when factoring in the impact of the local currency.

3. A further perk – hedging your future shopping basket

Many items in the South African consumer’s shopping basket (from fuel to food to healthcare) are largely priced in foreign currencies as the inputs are either commodities (with prices struck in global markets) or heavily reliant on imported content.

Having adequate international exposure within your overall investment portfolio is a hedge against the long-term change in the price of this part of your future shopping basket.

Episodes of currency weakness will more than likely remain a strong driver of price increases into the future. Having more than the minimum offshore exposure recommended for retirement savers may also be warranted for those planning for future liabilities in hard currency. This would include expenses such as overseas travel (for leisure purposes or visiting family members living abroad), business opportunities, investing for the next generation’s education, or emigration.

A deeply established global offering investing according to a tried-and-tested approach

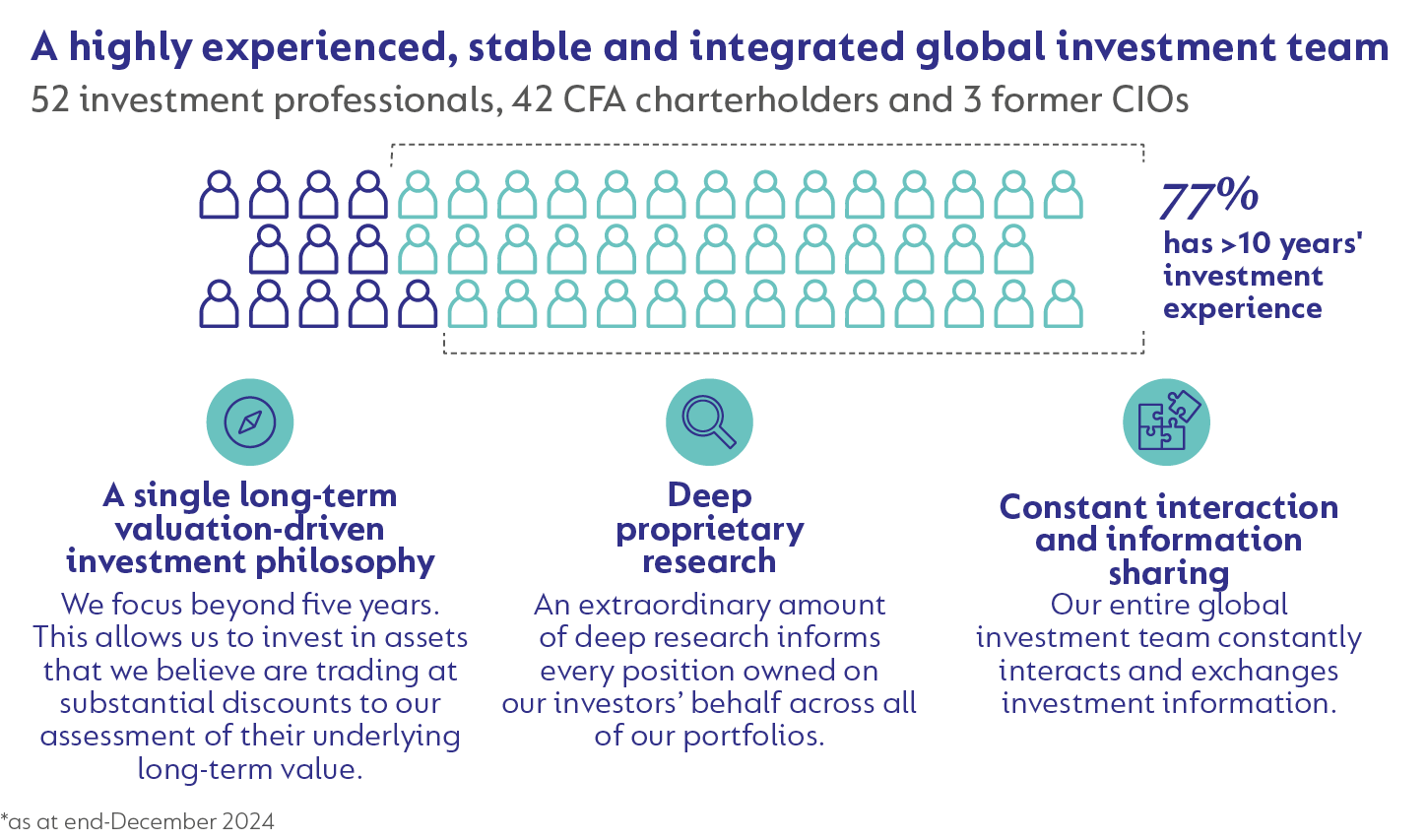

We’ve spent the last 25+ years using a deliberate and methodical approach to building a comprehensive global fund range to meet South Africa’s every offshore investment need. Today, this range has a demonstrable track record, and we are proud to be one of the few local investment firms with:

- critical mass to build world-class teams in both the domestic and global markets;

- a deeply established global offering, covering all major asset classes (building blocks) and multi-asset class strategies that clients may require;

- Many of our global funds have multi-decade track records; and

- More than $12bn of our total AUM* is managed by our global efforts, supported by a team of more than 20 professionals who solely focus on global markets (with no South African responsibilities), including 17 experts with >10 years of investment experience.

When investing offshore with us, you invest into a single, valuation-driven investment philosophy that has been tested through many market crises and applied by a global team of skilled investment professionals (see below) who consistently collaborate to identify the most attractive opportunities (regardless of asset class or geography) for inclusion in each of our global funds.

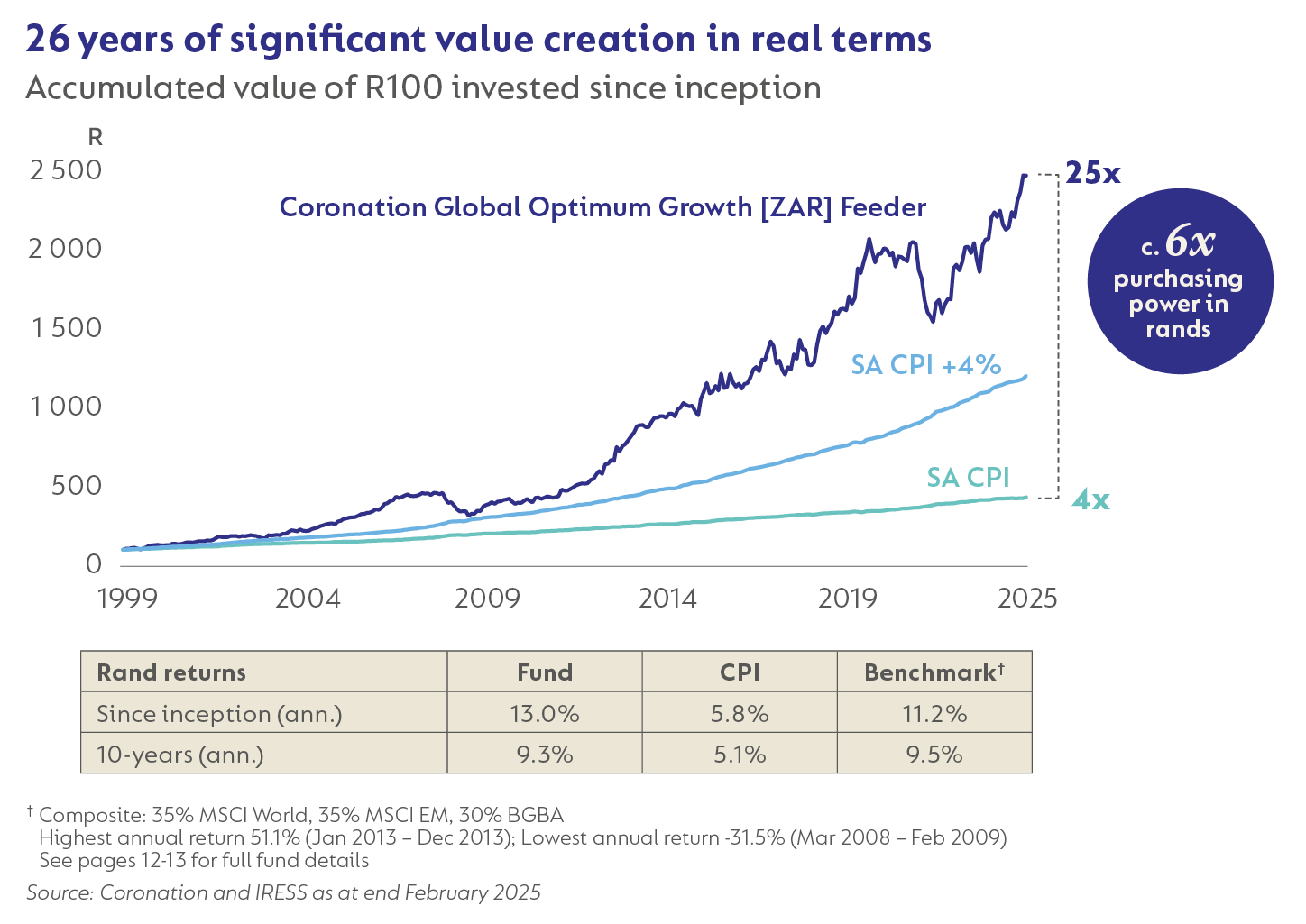

Creating significant value in global markets

Our proven capabilities to allocate across markets and asset classes have generated significant value for investors over the long term, as demonstrated by the 26-year track record of one of South Africa's longest-running global multi-asset class strategies, Coronation Global Optimum Growth. The Fund is an unconstrained global portfolio that allocates to our best ideas across asset classes in developed and emerging markets.

Key highlights for the rand-denominated feeder fund as of end February 2025 include:

- outperformed SA inflation by 7.2% p.a. since inception in March 1999; and

- ranked first in its ASISA category since launch.

As demonstrated in the graph below, for every R1 invested in Coronation Global Optimum Growth at inception in March 1999, you would have R25 today compared to R4 needed to keep up with inflation – resulting in a 5.8 times increase in purchasing power over that period (or a 4.2 times increase in purchasing power in USD terms over that same period).

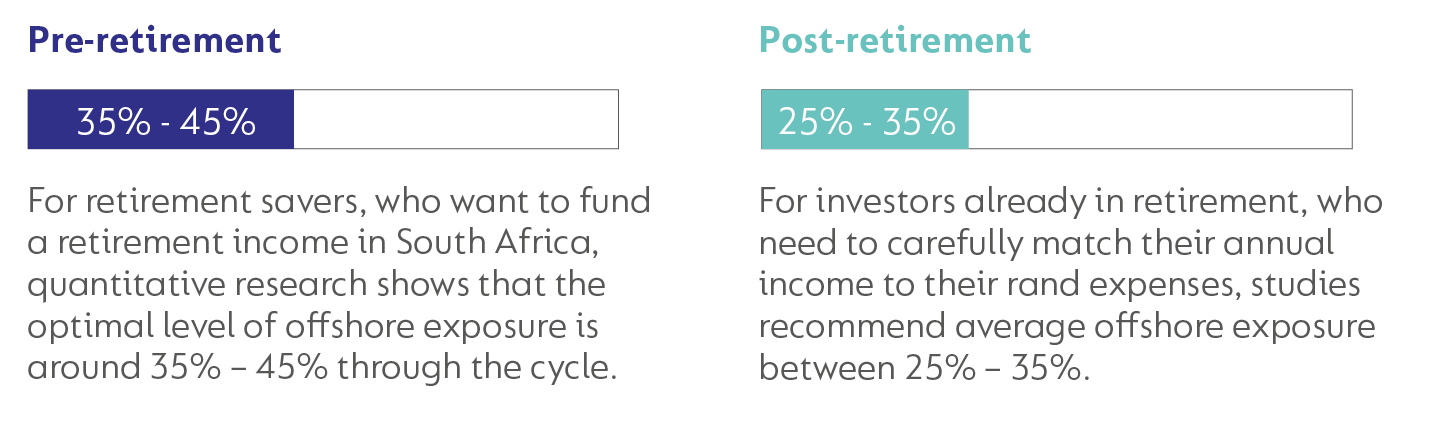

How much international exposure is appropriate?

The amount of international exposure that you should have as part of your long-term investment portfolio depends on how much you have to invest.

I only have the budget to save for retirement

If you only have the budget to save for retirement via compulsory/traditional retirement vehicles such as an RA or employer-sponsored retirement fund, the following guidelines apply:

Typically, these investors would consider investing in a Regulation 28-compliant (Reg 28) multi-asset fund in which the international allocation decision is made on their behalf.

Read more about our Reg 28-compliant multi-asset funds aimed at pre- and post-retirement savers in our respective Investing for long-term capital growth and Investing for income and growth Corolabs.

I have non-retirement savings that I want to invest offshore

Investors who can justify a larger international allocation include those who:

- spend regularly in foreign currency;

- are considered high net worth in a global context;

- need to consider offshore bequests because multiple generations live on different continents; and/or

- do not need to draw a significant domestic income from their savings.

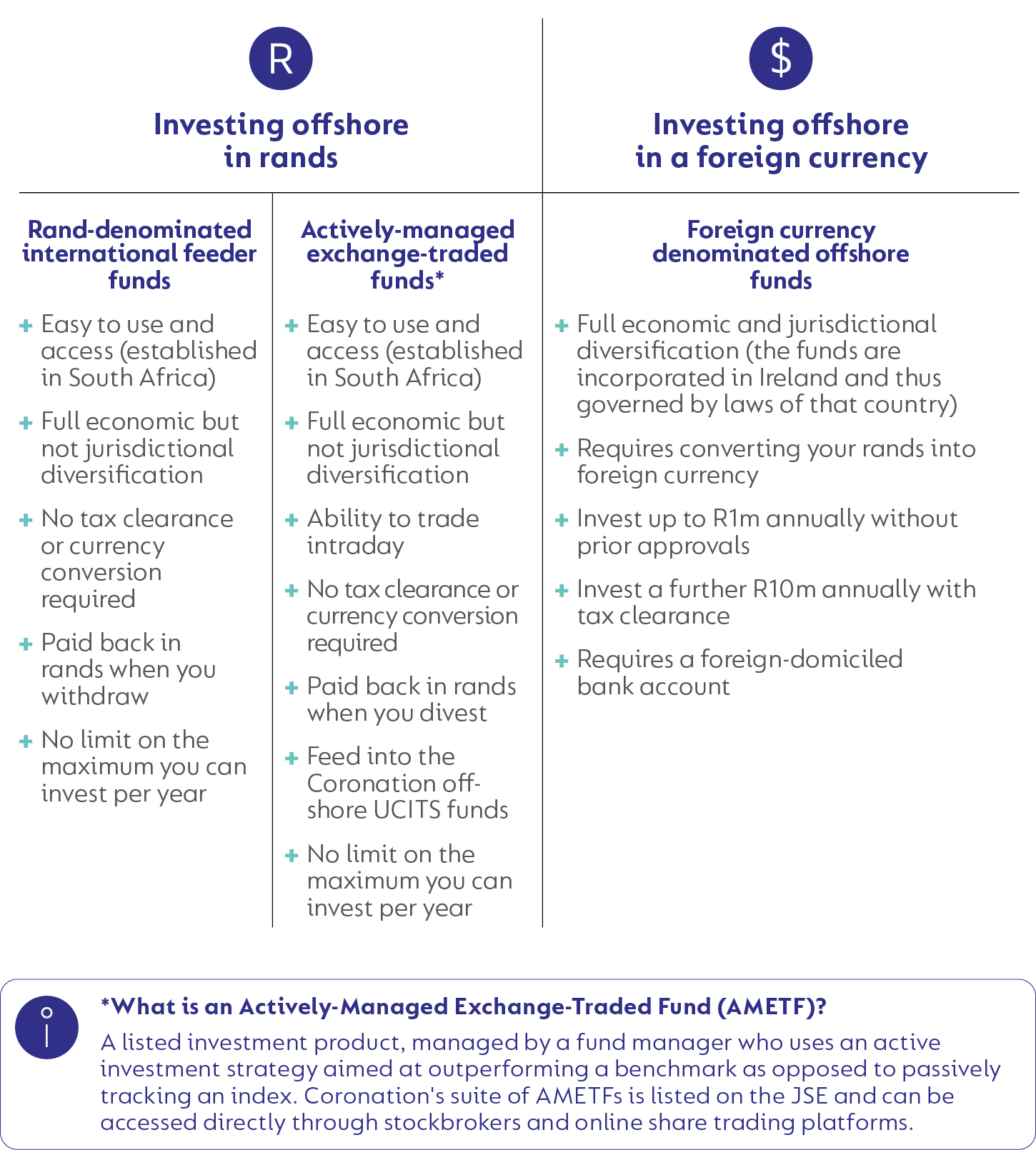

Investing offshore with Coronation

Investors who require more international exposure than achievable by way of their retirement savings (as discussed earlier) can consider using their discretionary (or non-retirement savings) to invest offshore with Coronation. We offer three access points to the same underlying portfolios as detailed in the table below.

An established international fund range

To give you access to the best global opportunities, we offer a range of multi-asset class and building block solutions (as per the table below), designed to meet specific investor needs.

Read more about the funds mentioned in this table

Conclusion

As we have shown in this edition of Corolab, it makes sense to diversify your asset base as a South African investor. By living, working and owning a house in our local market, you already have significant country-specific risk, arguing for additional international exposure.

At Coronation, we have spent more than a quarter of a decade building a global fund range that meets the needs of South African investors. All of our global funds are available in rands and US dollars and are managed by a global team of skilled investment professionals who are collaborating and applying our single, valuation-driven investment philosophy to identify the most attractive opportunities, regardless of asset class or geography.

Disclaimer

SA retail readers

South Africa - Personal

South Africa - Personal