Personal finance

Post-retirement income options amid potentially higher inflation

Selecting a strategy that is flexible and can perform well in various inflationary scenarios is key.

The Quick Take

- It is crucial that your retirement income keeps pace with inflation, but knowing what inflation outcome to plan for can be a tough call to make upfront

- The vast majority of investors who choose a life annuity as their retirement income option do not purchase true inflation protection

- Selecting a retirement income strategy that is flexible and can perform well in various inflationary scenarios is key

- Our analysis shows that investors who choose to withdraw their retirement incomes from a living annuity with sufficient growth asset exposure through a fund such as Coronation Capital Plus are more likely to enjoy inflation protection in both benign and higher inflationary scenarios

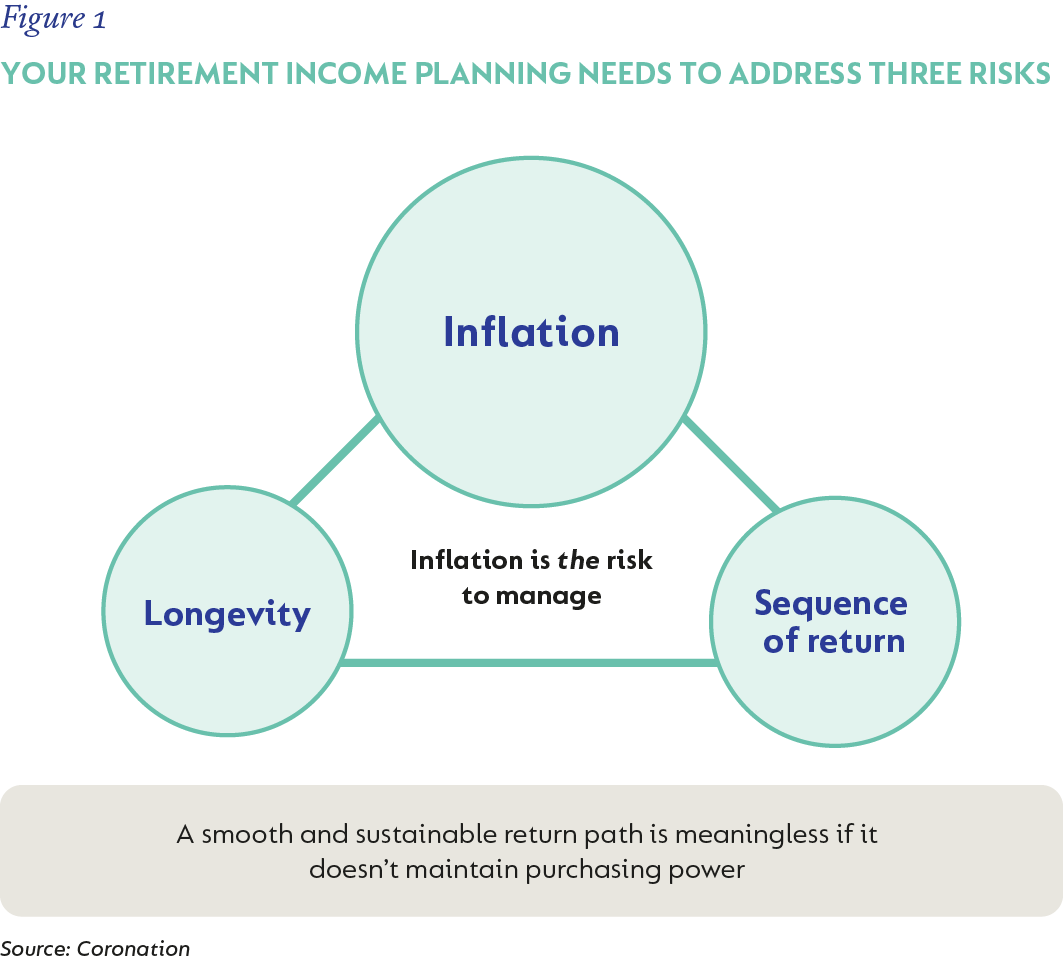

Inflation is the risk that investors will face in retirement. Being able to maintain your purchasing power for the duration of your retirement years is key. That is because a retirement income that lasts or is delivered by way of a smooth return path is meaningless if it doesn’t produce the necessary returns to keep pace with (or ideally beat) inflation.

Unfortunately, knowing what inflation figure you need to use, or stress test for, as part of your retirement income planning is a tough call to make. The potential outcomes are broad and the forecast risk therefore high. This article seeks to explain the importance of choosing the right retirement income option within the context of potentially higher inflationary scenarios and how one of these options helps you avoid making such an important call about future inflation, regardless of the outcome.

A QUICK REMINDER ABOUT YOUR RETIREMENT INCOME OPTIONS

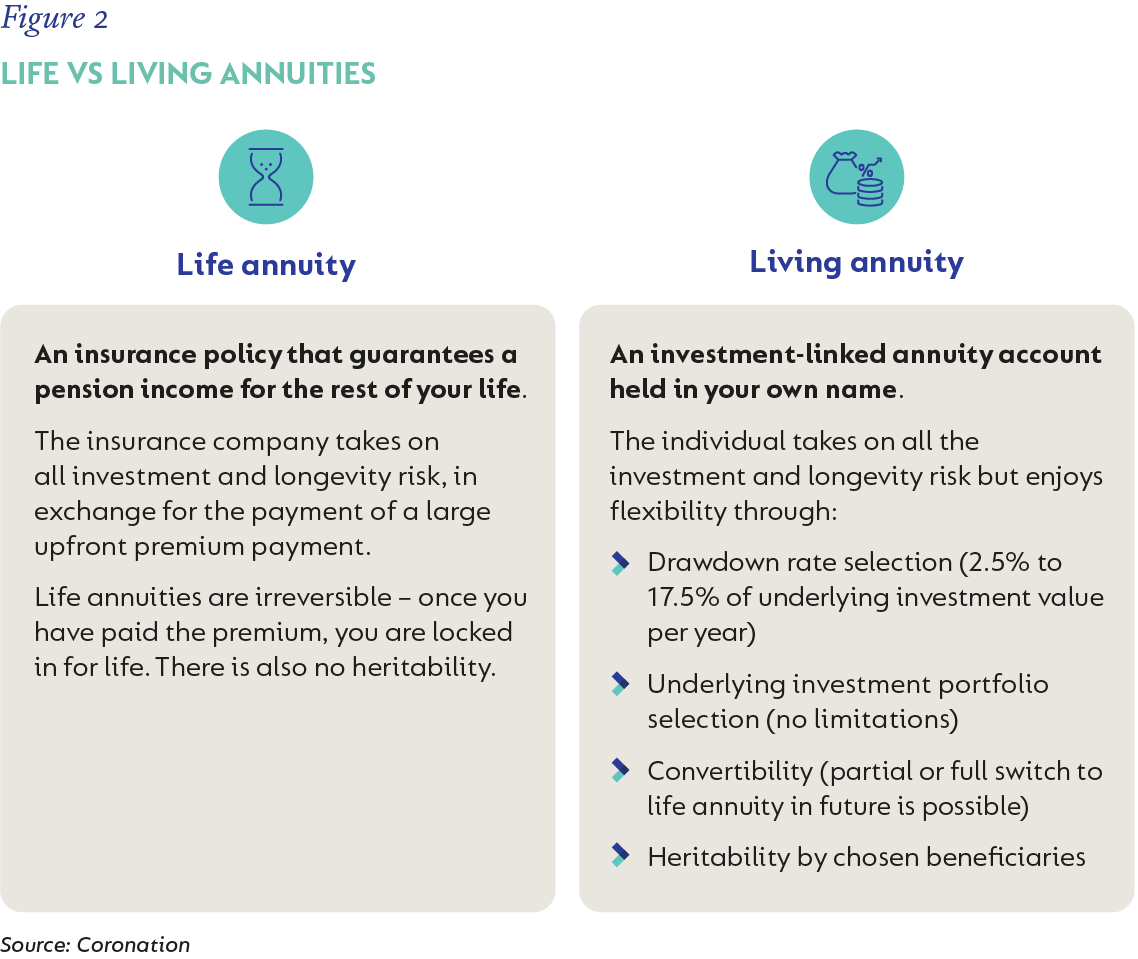

Upon retirement, investors have two options from which to draw their retirement incomes:

- a life annuity, which is an insurance policy that guarantees a pension income for the rest of your life, and

- a living annuity, which is an investment-linked account held in your name, as detailed in the table below.

There are three types of life annuities, each offering a different guaranteed income drawdown rate for life (which we discuss in more detail below). In the case of a living annuity, your income drawdown rate remains flexible (within certain legislated limits), allowing you to adjust it in response to the underlying performance of your chosen investment portfolio.

WHY LIFE ANNUITIES HAVE BECOME MORE POPULAR RECENTLY

For much of the last two decades, living annuities have been the most popular retirement income option (comprising ~90% of annuity purchases at retirement). However, life annuities have become more popular recently, taking the split closer to 60% in favour of living annuity purchases and 40% in favour of life annuities.

This growth in popularity is thanks to the higher starting retirement income rates for life annuities driven by elevated yields on long bonds. This is because the life insurers (who issue life annuities) typically buy government and other high-quality bonds to back the guaranteed future obligations (retirement incomes for life) that they have to pay to their annuitants. Long bond yields are currently high due to several country-specific factors, which we have written about on several occasions.

In turn, the value proposition offered by living annuities did not meet expectations over the past decade, following a period of disappointing returns from SA assets in general and risky assets specifically. This has since resulted in a shift in asset allocation in favour of fixed income assets supporting the portfolios that typically back this type of annuity.

THE DOWNSIDE OF FIXED PERCENTAGE ESCALATING ANNUITIES

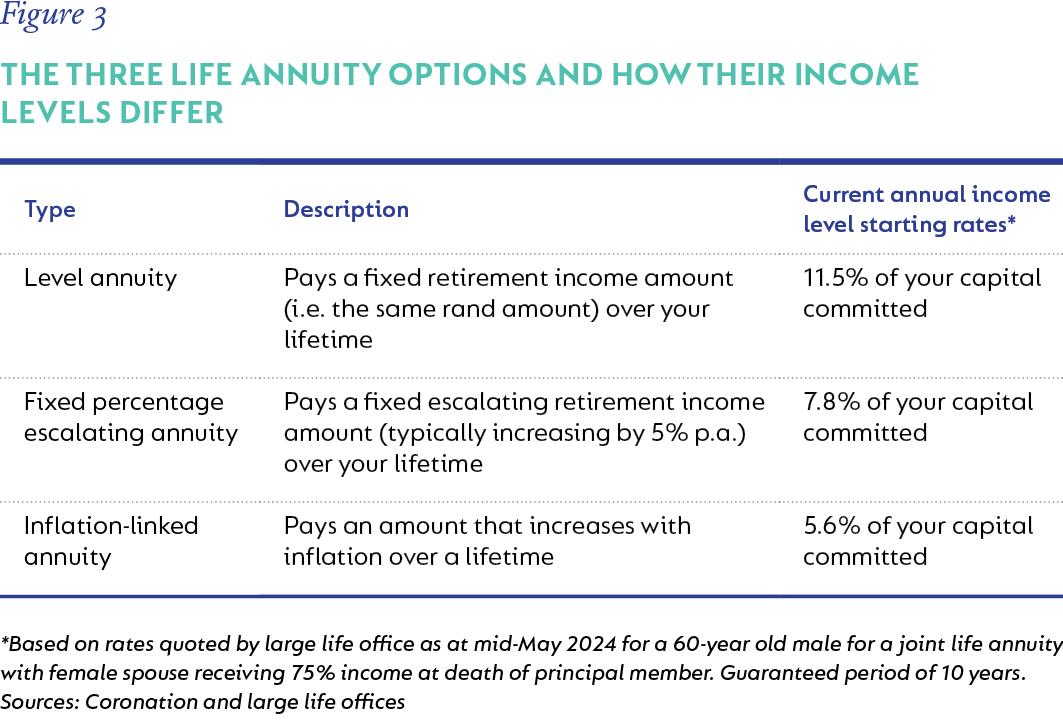

If you prefer a guaranteed retirement income, you can choose between a level, fixed percentage escalating or an inflation-linked income as explained below. In 2023, nearly all life annuity purchases were fixed escalating annuities, while very few retirees chose full inflation protection of their income stream. This preference is understandable, given the materially higher initial income level achievable as shown in Figure 3.

While the 5% escalation rate has been a good proxy for inflation in South Africa in recent years, coupled with the rhetoric from the South African Reserve Bank (SARB) around anchoring local inflation expectations lower to be more in line with global competitors, the implicit assumption that buyers of fixed escalating annuities make is that inflation will remain around 5% p.a. for the next 20-25 years. We think this is a mistake and akin to insuring your car against a fender bender (mild inflationary outcome), but not a total write-off scenario (double-digit inflation).

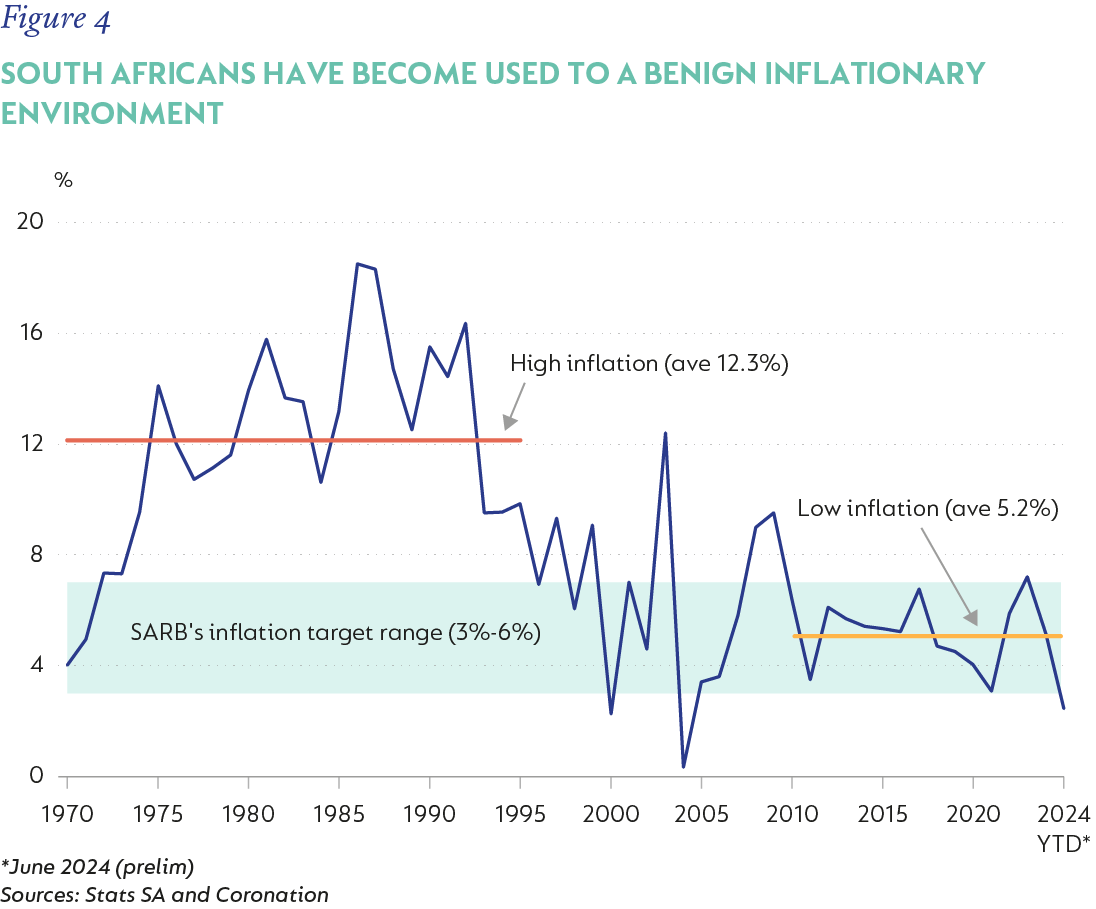

We have become used to a benign inflationary environment in South Africa, with annual price increases typically within the SARB’s target range of 3%-6%. The period of high inflation experienced in the 1970s and 1980s seems far in the distant past.

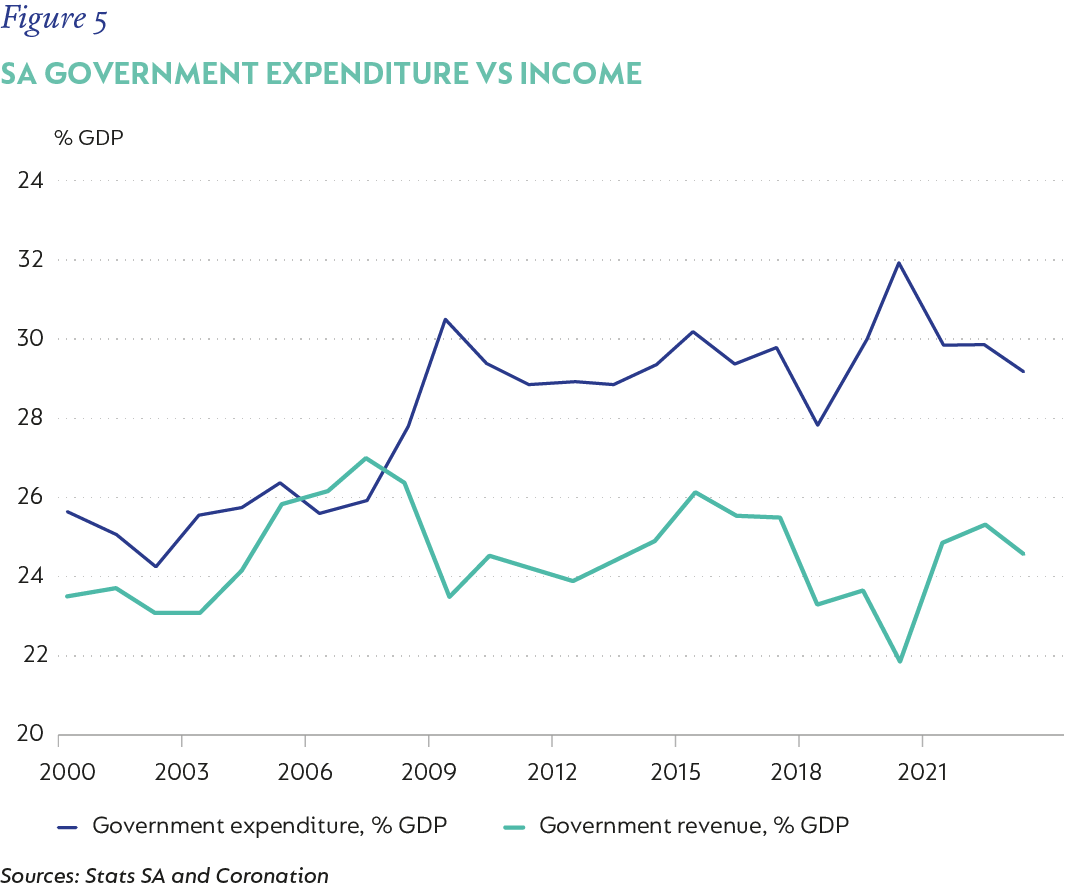

While our base case is that monetary policy will remain sound and that inflation should stay close to the target, the tail risk of a period of much higher inflation over the next two decades has increased. This is because of the additional funding required as a result of deteriorating government finances, as demonstrated by the increasing disconnect between government expenditure (blue line) and revenue (mint line) shown in Figure 5.

While National Treasury has done well in containing spending in the fiscal year 2023/2024, as detailed in economist Marie Antelme’s economic outlook article, looking ahead, however, decisions about large allocations (such as the long-term future of the Social Relief of Distress grant, funding of national health insurance and additional investment in critical infrastructure), have yet to be made.

WHY THIS MATTERS SO MUCH TO INVESTORS CHOOSING THEIR RETIREMENT INCOME OPTIONS

Let’s consider a simplified model to illustrate the importance of selecting the right retirement income strategy within the context of potentially higher future inflation.

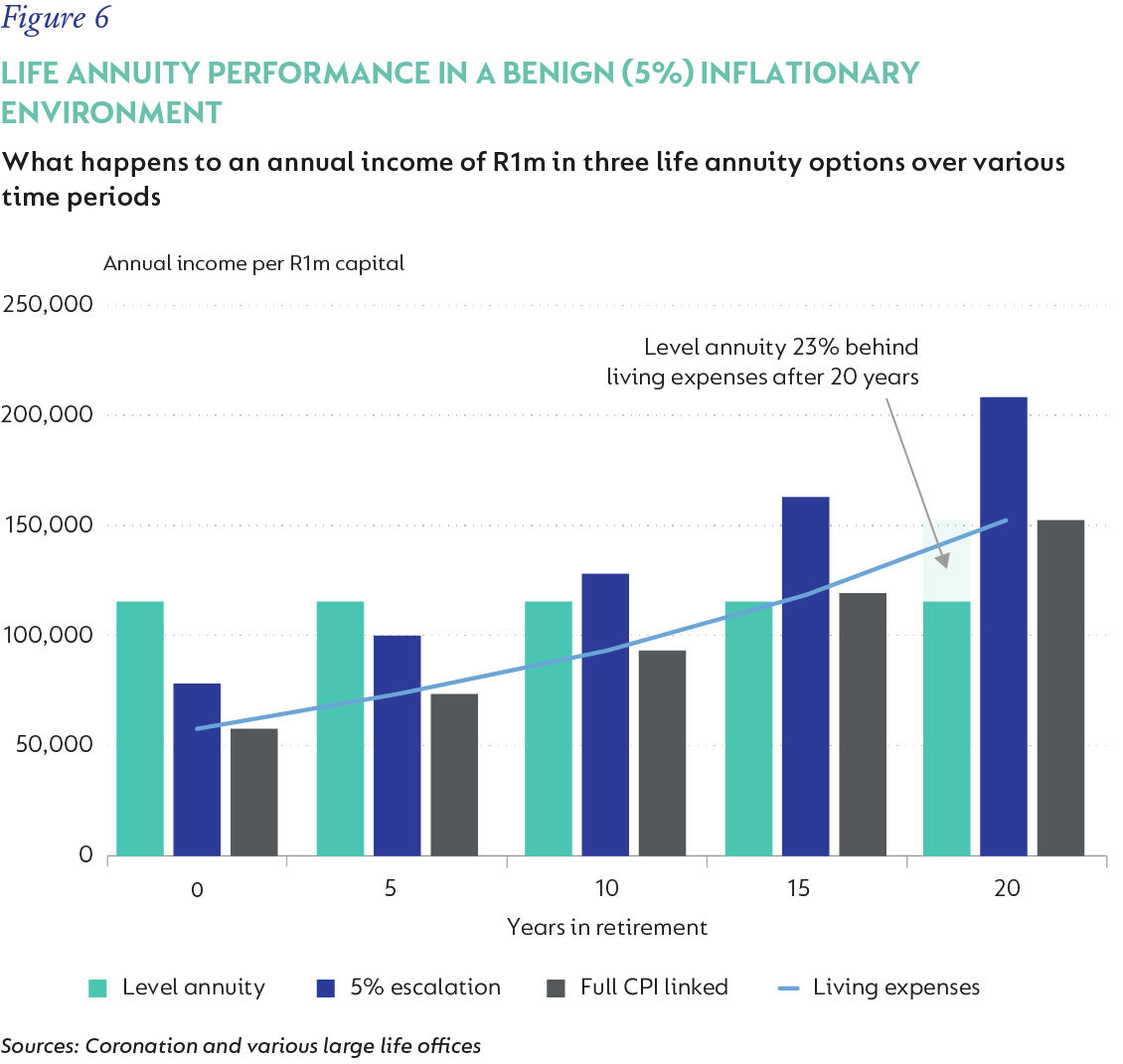

The graph below represents the retirement income level for an investment of R1 million given certain assumptions (Figure 6). The starting income for the level life annuity is defined by the mint bar, for the escalating annuity in blue, and the inflation-linked annuity in grey. Suppose we assume the lowest starting income amount to be equal to your current living expenses (as represented by the blue line) coupled with a benign inflationary environment (5% inflation over 20 years). In that case, only the level annuity’s income falls behind in purchasing power after 15 years. And after 20 years, selecting this annuity option would leave you 23% behind in living expenses.

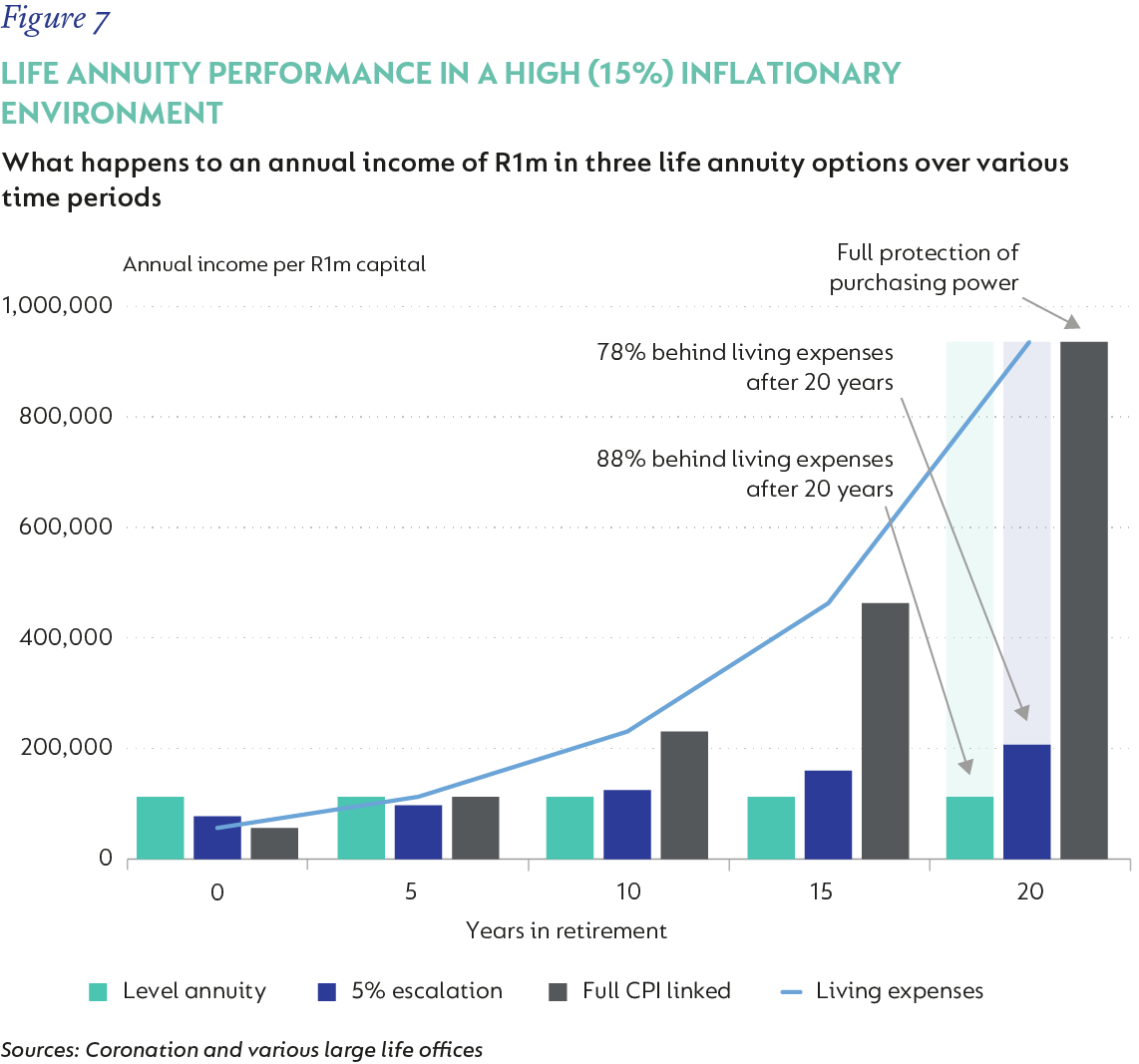

Suppose we consider a blow-out scenario, with high inflation of 15% p.a. over 20 years. In that case, the retirement incomes paid out by a level and escalating annuity will fall behind one’s living expenses by around Year 5. In contrast, the income from an inflation-linked annuity continues to offer protection for the 20 years.

Notably, while the 15% inflation scenario is purely hypothetical, it is not entirely inconceivable, as shown in Figure 4 (1970s to early 1990s). Think of this as a stress test of the robustness of your chosen retirement income strategy.

HARNESSING THE FLEXIBILITY OF A LIVING ANNUITY

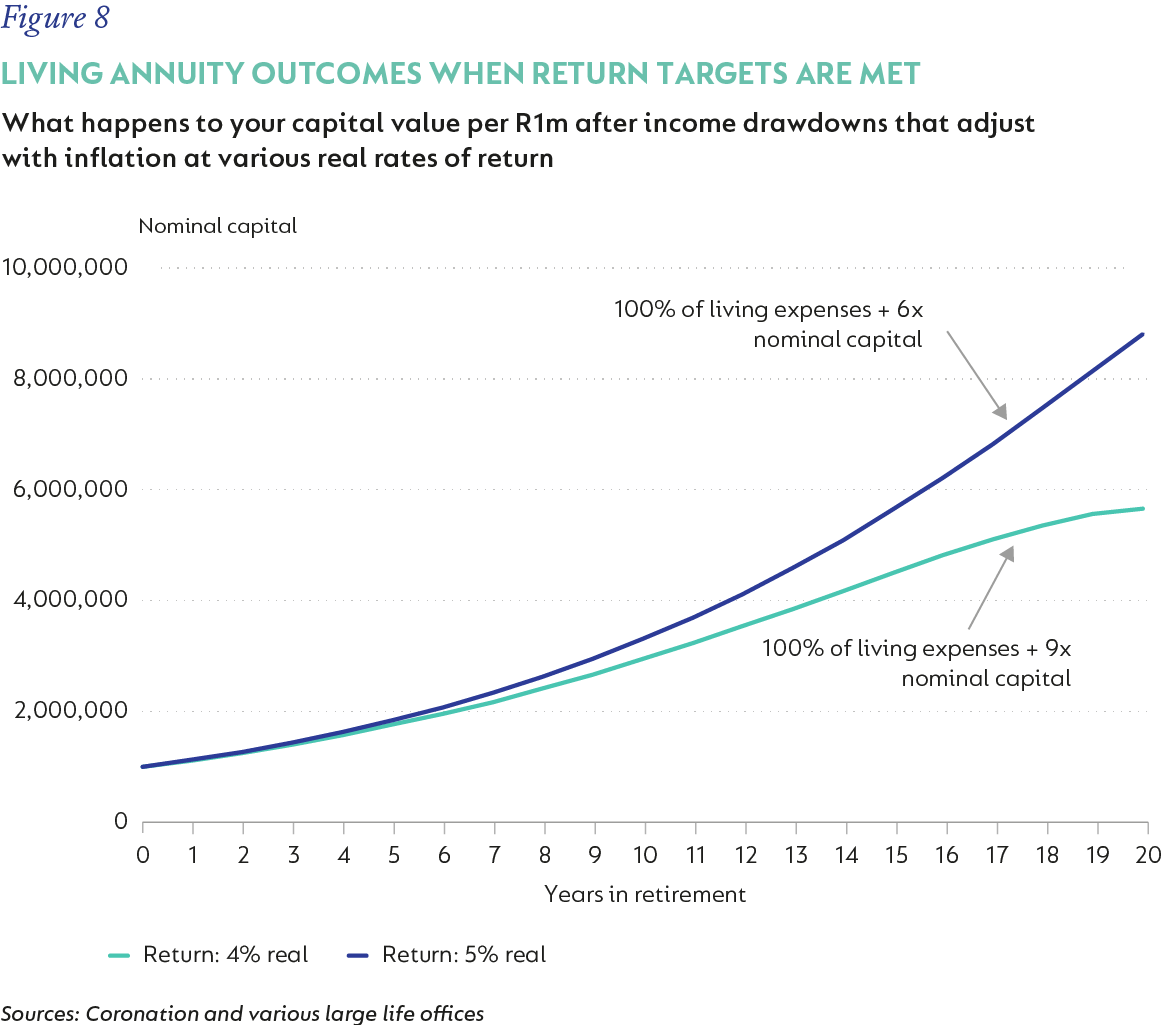

Let’s compare this to a living annuity where the underlying investment portfolio consists of an actively managed multi-asset portfolio with enough growth assets (60% to 70%) to achieve meaningful real returns over time such as the Coronation Capital Plus Fund . (This Fund aims to achieve a return of 4% above inflation while minimising volatility and has historically achieved 5%-6% above inflation.) Importantly, the inclusion of growth assets in the portfolio funding your retirement income means that you have a decent probability of protecting purchasing power in both the benign and blow-out inflationary scenarios.

PUTTING IT ALL TOGETHER

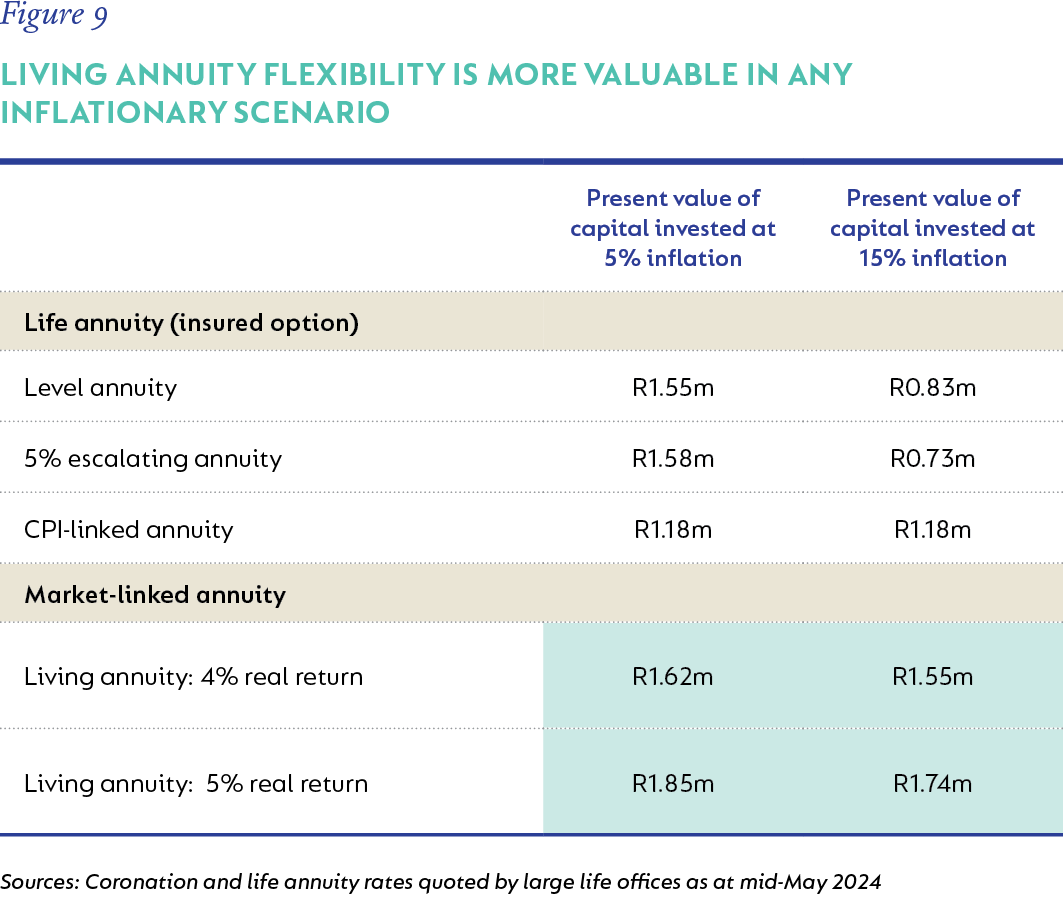

Calculating the present value of the cash flows of the respective life and living annuity options is a different way of examining these scenarios.

In the table below, and using the same assumptions as above, we show how well your chosen annuity option protects the purchasing power of R1 million over 20 years given the two inflationary scenarios (5% benign or 15% blow-out). Note that a present value of less than R1 million means that purchasing power hasn't been protected over this period.

Key observations

- Of the three life annuity options, selecting the 5% escalating annuity offers the best value in a benign (5%) inflationary scenario, whereas choosing the inflation-linked annuity delivers the best outcome in a high inflation (15%) scenario. This demonstrates that the preferred life annuity option depends on the inflation outcome (an unknown variable), effectively requiring investors who purchase life annuities to bet on the rate of inflation over the coming decades.

- In turn, the living annuity option (assuming the target rate of real returns are achieved from its underlying portfolio) managed to deliver good value in both benign and blow-out inflationary scenarios, potentially delivering much more valuable outcomes in a blow-out inflationary scenario.This is primarily thanks to the flexibility of a living annuity that allows investors to choose an underlying portfolio that can deliver inflation-beating returns through exposure to growth assets.

IN SUMMARY

While life annuities are often perceived to be lower risk than living annuities as they remove sequence-of-return and longevity risks, they force retirees into making a difficult trade-off between maximising either their initial income rate or their long-term inflation protection. The flexibility inherent in living annuities, primarily through enabling the inclusion of growth assets in your retirement portfolio, improves the probability of achieving good outcomes regardless of the actual inflation scenario that plays out. This removes the need to take a view on the future path of inflation at the point of retirement.

This analysis shows that navigating post-retirement income options is complex and requires careful consideration, which explains why most investors will benefit from the assistance of their financial adviser when making life-defining decisions at the point of retirement.

South Africa - Personal

South Africa - Personal