Personal finance

Post-retirement income options revisited

While we believe the changing environment makes a stronger case for living annuities, retirees continue to prefer guaranteed annuities.

The Quick Take

- Navigating post-retirement income options is complex and requires careful consideration

- New annuity purchases continue to favour guaranteed (life) annuities, due to historically attractive starting income rates relative to the recommended sustainable drawdown rate for market-linked living annuities

- But starting income rates for guaranteed annuities have fallen over the past six months, shifting the value proposition in favour of a more flexible retirement income solution

- Living annuity investors can allocate their underlying portfolios to asset classes that have the best chance of delivering real (inflation-beating) returns over time

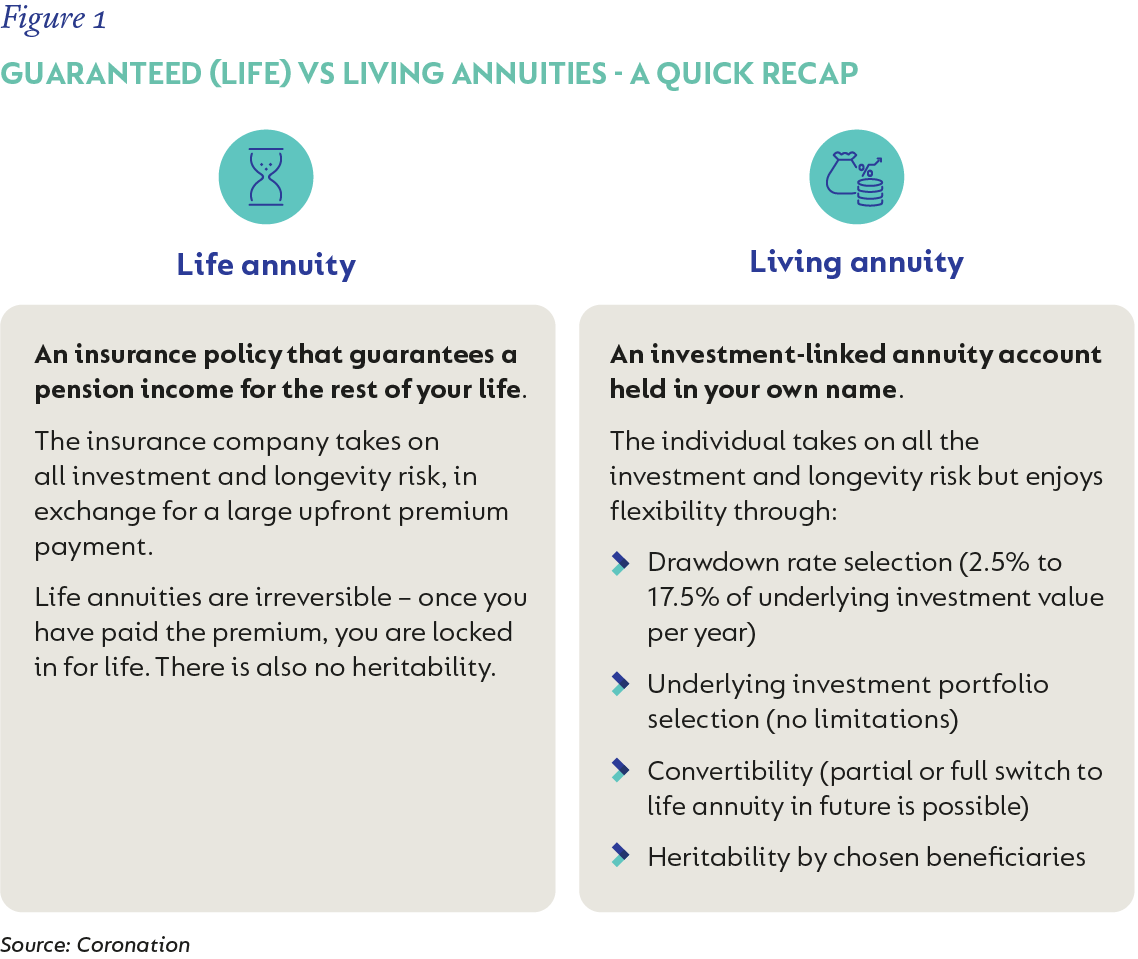

Six months ago, we wrote about a complex and potentially life-defining trade-off at retirement: the choice between a living annuity, a guaranteed annuity, or a combination thereof. In most cases, this significant decision will require the assistance of your financial adviser.

We stress-tested the robustness of all three types of guaranteed annuities, each offering different guaranteed retirement incomes for life. We also evaluated a market-linked living annuity portfolio, where your income drawdown rate remains flexible within certain legal limits. These were all assessed under various inflationary scenarios.

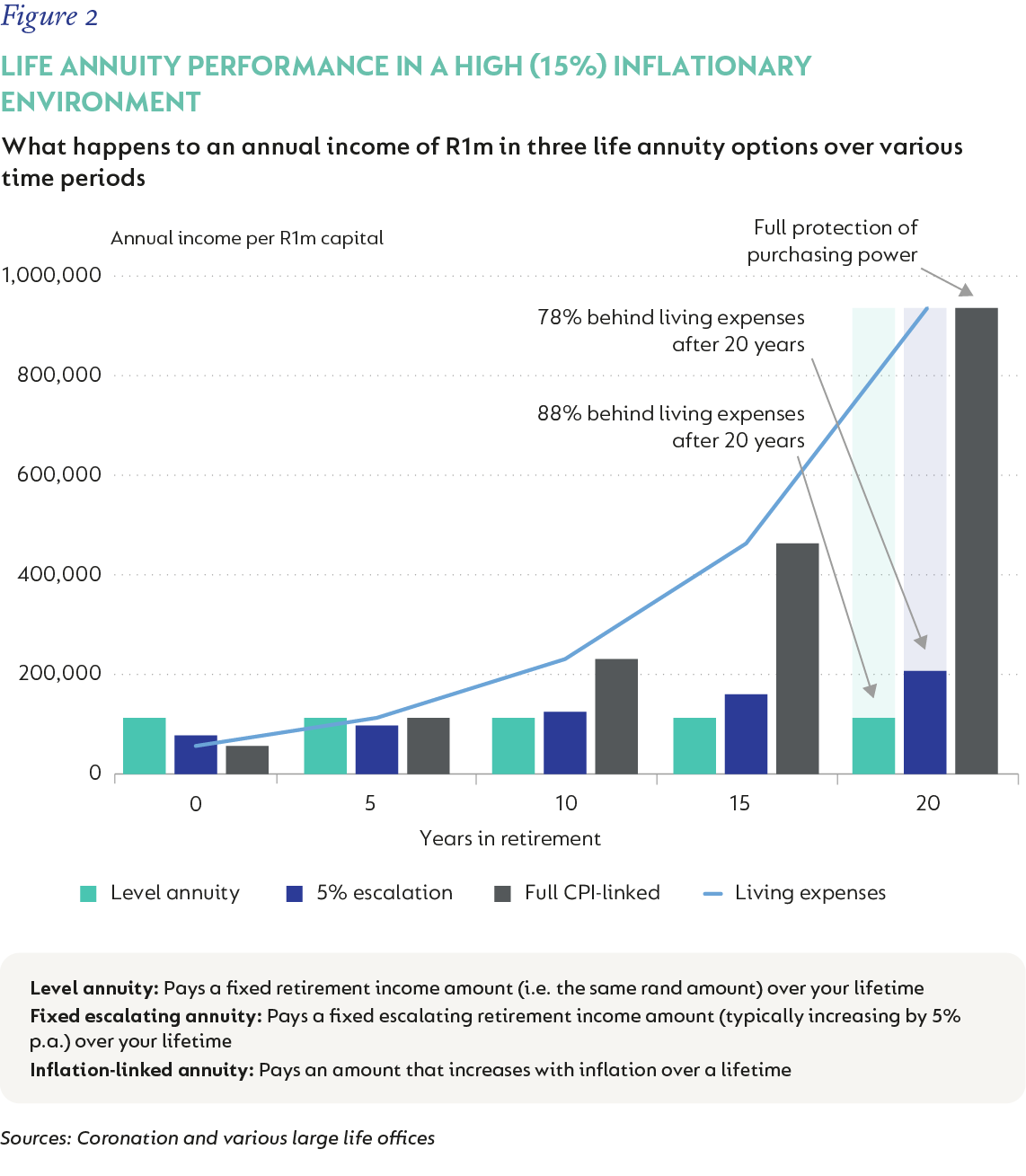

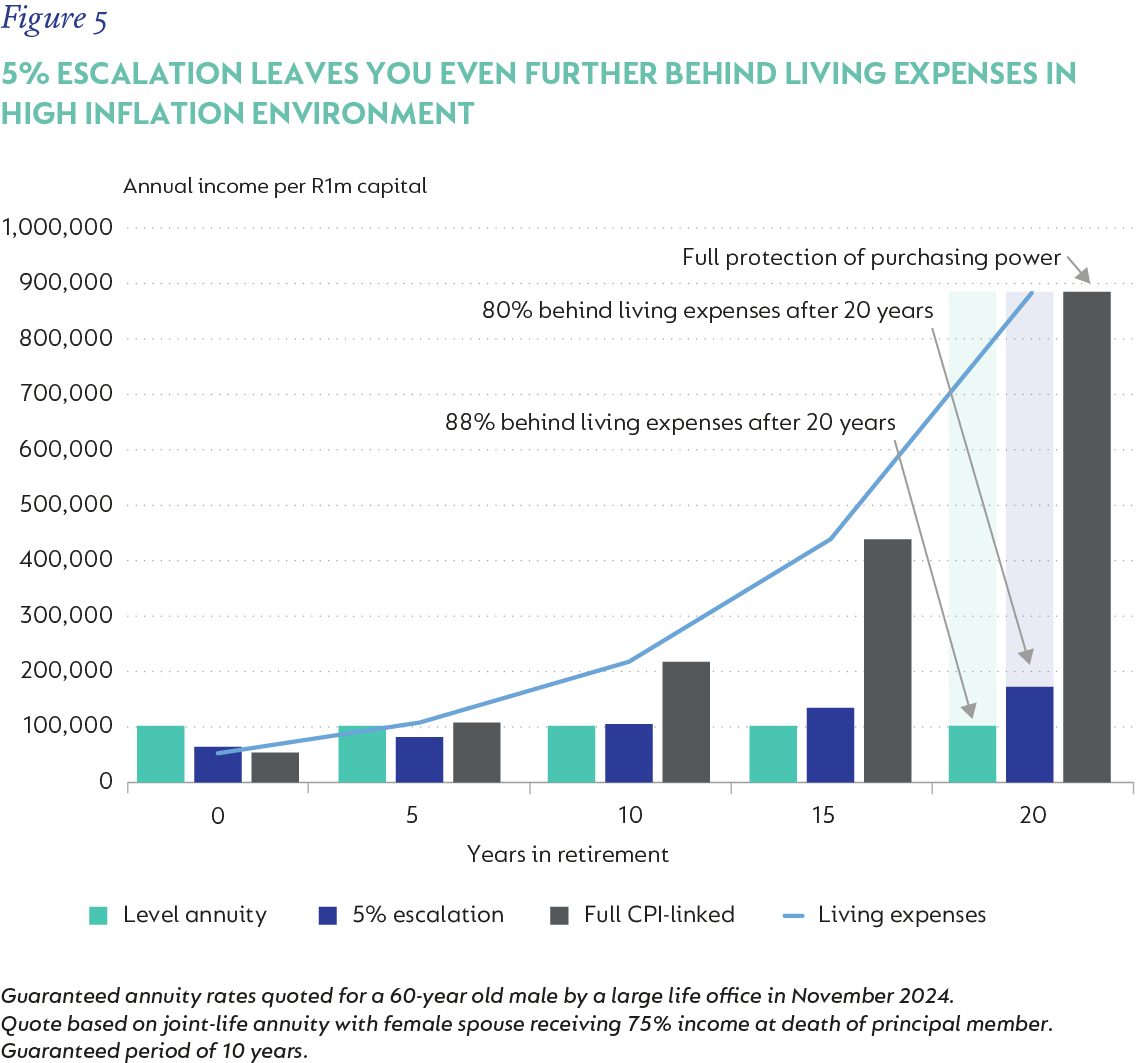

Analysing a purely hypothetical but possible scenario, we found that if inflation were to significantly surprise on the upside (e.g., 15%) and remain elevated over a prolonged period, retirees would face significant challenges. For example, a guaranteed 5% fixed escalation annuity, the most popular option at the time, would leave them falling 78% short of their living expenses after 20 years.

We concluded that purchasing a guaranteed annuity escalating at 5% instead of an inflation-linked guaranteed annuity (which offers full protection of living expenses in moderate and more extreme inflationary scenarios, as illustrated in Figure 2 above) was akin to insuring your car against a fender bender when, in fact, it is the total write-off (not being able to meet one’s living expenses) that one should be insured against in retirement.

WHY ARE WE REVISITING THIS TOPIC?

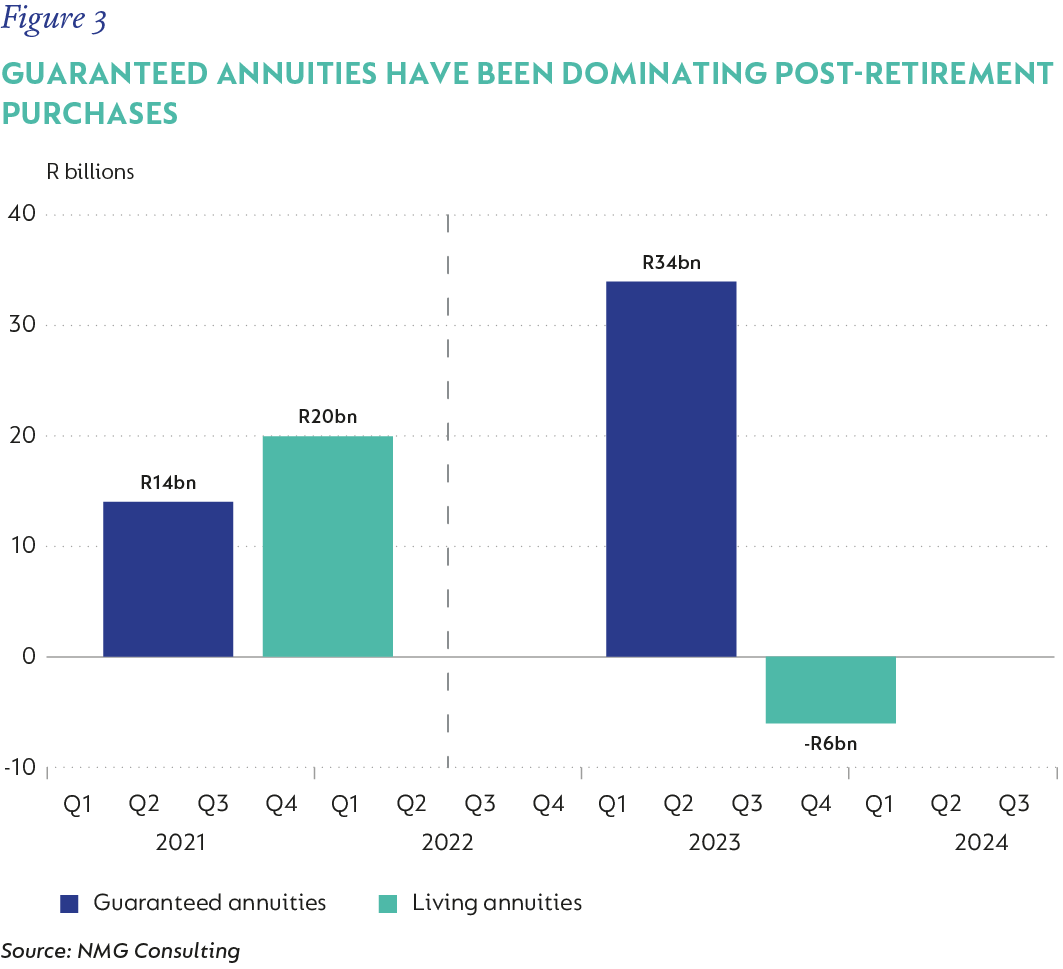

Guaranteed annuities continue to dominate post-retirement income purchases in terms of net flows (see graph below). Between the third quarter of 2022 and the third quarter of 2024, guaranteed annuities experienced net inflows (purchases) of R34 billion compared to living annuities which saw net outflows (net sales) of R6 billion.

In addition, fixed escalating annuities still account for the lion’s share of guaranteed annuity purchases. As we argued before, we believe this is because the 5% escalation (at which the escalation is typically set) has been a good proxy for inflation in South Africa in recent years. However, as illustrated earlier, this popular option doesn’t provide the necessary protection against a blowout inflation scenario.

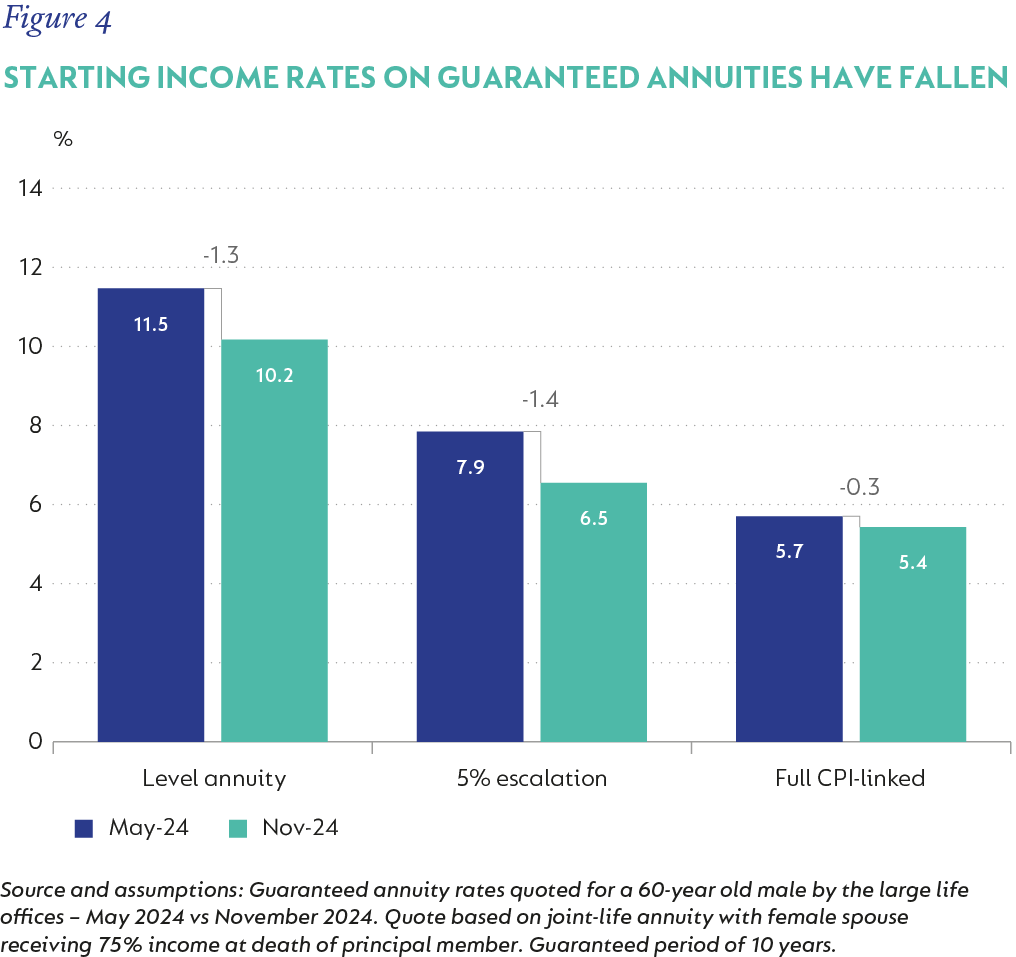

The historically high starting income rates on offer from these guaranteed annuities were a function of the high interest rate environment at the time. This, we believe, provided sufficient comfort to retirees that they could overcome inflation risk in retirement, whilst achieving greater starting incomes than the 5.5% recommended sustainable drawdown rate for investors in living annuities (read more in our Investing for Income and Growth Corolab).

WHY IS THIS PROBLEMATIC?

Many investors continue to spend all of their retirement capital upfront in return for a guaranteed starting income that is now much closer to the recommended sustainable income drawdown rate for living annuity portfolios, whilst not fully insuring against inflation risk if an adverse inflation environment is experienced during retirement.

If we re-run our stress test on the performance of guaranteed 5% fixed escalation annuities over prolonged periods of runaway inflation (15%), using the latest (lower) starting income rates (see Figure 5 below), retirees are left even further behind in terms of meeting their living expenses in later years (80% behind in meeting living expenses vs 78% behind six months ago). In other words, they are even less insured against a low-road scenario.

IT IS TIME TO SEEK GREATER FLEXIBILITY WITHIN YOUR POST-RETIREMENT PORTFOLIO

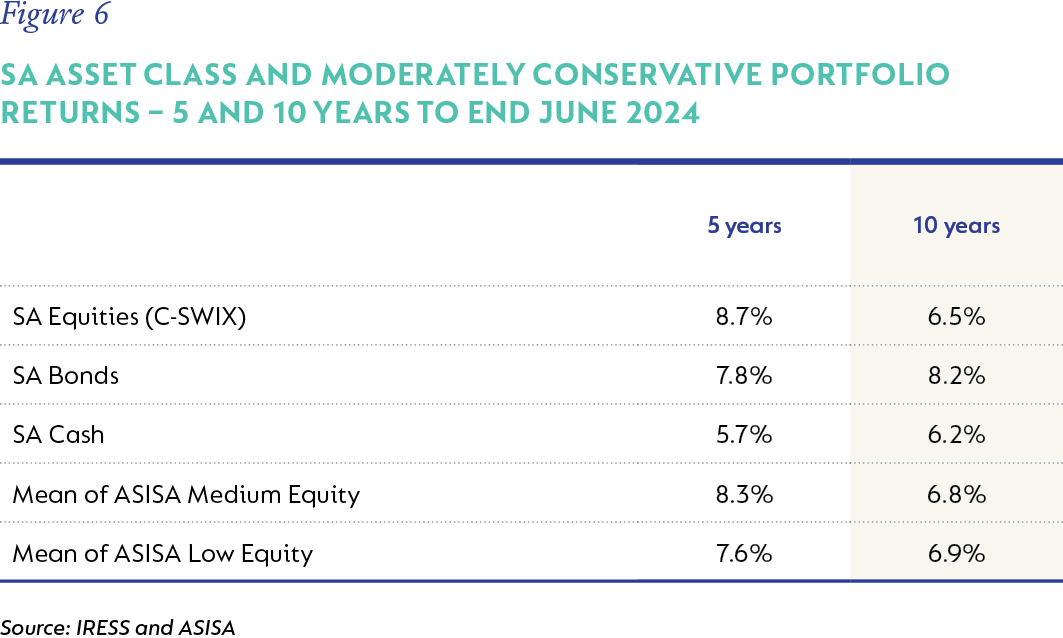

We understand why investors have been favouring guaranteed annuities in recent years. As we noted six months ago, living annuities struggled to meet expectations over the decade to end June 2024, following a period of disappointing returns from SA assets in general and growth assets in particular (as is clear from the table below).

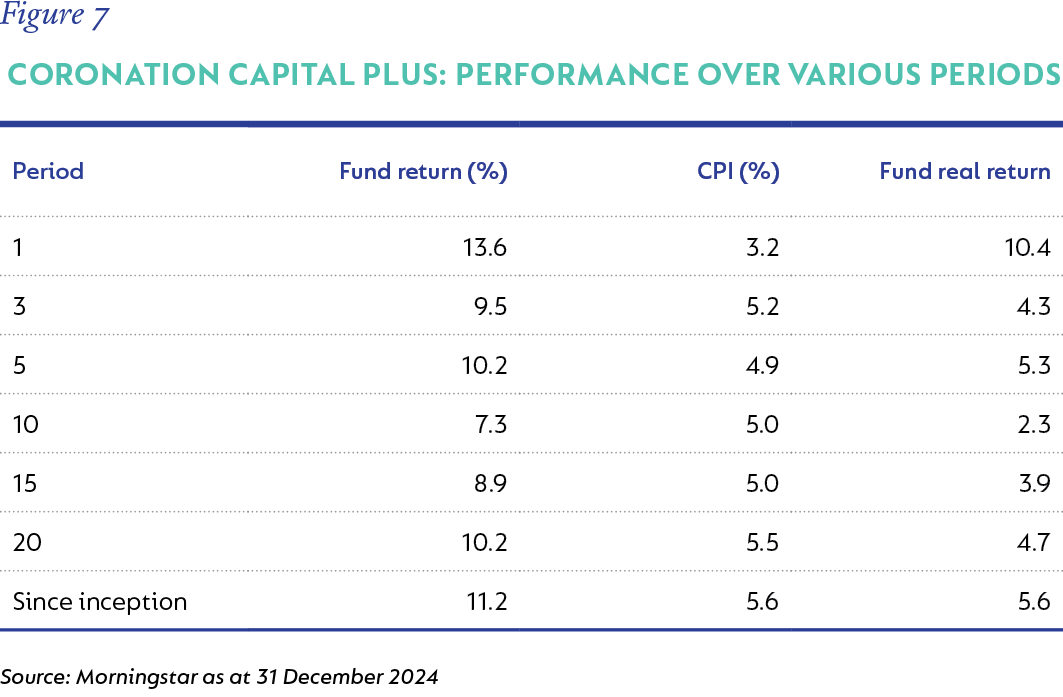

However, growth assets, to which living annuity investors have exposure via their underlying portfolio selection, have since delivered very strong outcomes. This, in turn, has meaningfully improved the medium- and longer-term return outcomes for investors in portfolios that are usually considered for inclusion in living annuities. For example, Coronation Capital Plus, our flagship living annuity portfolio, has outperformed its inflation plus 4% target over the most recent one, three and five years to end December 2024, whilst also comfortably outperforming its target by 1.7% p.a. since inception almost 24 years ago. These figures indicate a significantly better outcome for investors in living annuities in recent years despite the continued preference for guaranteed annuities.

We continue to find good value in specific local and global growth assets, which is supportive of future expected returns. (Readers can read more about our investment outlook in our quarterly commentaries.)

IN SUMMARY

Our analysis in July 2024 showed that in a scenario where inflation surprises on the upside over a prolonged period, level annuities and 5% fixed escalating life annuities will fail to meet living expenses during retirement. Our updated analysis was no different and showed that these two types of annuities left you even further behind in living expenses over the long term given the decline in starting income rates on guaranteed annuities.

It remains our view that living annuities that are prudently constructed with sufficient exposure to growth assets have the best chance of keeping up with rising living expenses regardless of the future path of inflation, thereby giving investors the best chance of overcoming one of the most important risks in retirement.

Living annuities therefore remain an important tool in retirement income planning and we encourage investors, with the assistance of their adviser, to consider all the investment options available to them before making potential life-defining decisions.

To read more about post-retirement investing and how Living Annuities offer investors the additional flexibility to dynamically adjust their income drawdown rates in response to their underlying investment portfolio’s performance, read our Income and Growth Investing-themed Corolab: Investment Guide.

South Africa - Personal

South Africa - Personal