To deliver superior long-term investment outperformance for the benefit of all stakeholders

The sustainability of our business is tied to responsibly adding alpha to their portfolios & offering world-class products and client service.

Adding investment alpha & growing a sustainable business are multi-decade endeavours. This is rooted in adhering to a long-term strategy, and not reacting to short-term discomfort.

This promotes long-term thinking, which aligns employees with the interests of our stakeholders. This alignment is entrenched in our Remuneration Policy, with XX% of employees on a long-term incentive scheme.

Our people are central to our success. Strong people lead equally strong & cohesive teams. With diversity, equality and inclusion as a core strength, collaboration delivers the best outcomes.

We are a meritocracy that rewards employees for their individual contributions. Our culture of excellence is designed to attract and retain highly-skilled professionals.

We have a fiduciary duty to act with uncompromising integrity. Employees are held accountable for maintaining the highest ethical standards. We know that Trust is Earned™.

and our strategy enables

our core business activities

To deliver investment excellence for the benefit of all stakeholders

directed by our

material matters

to generate long-term

value outcomes

The quality of

our capital inputs

for all our

stakeholders

Of our portfolios have outperformed their benchmarks since in inception

Of since inception value added by our Houseview Equity strategy compared to the benchmark

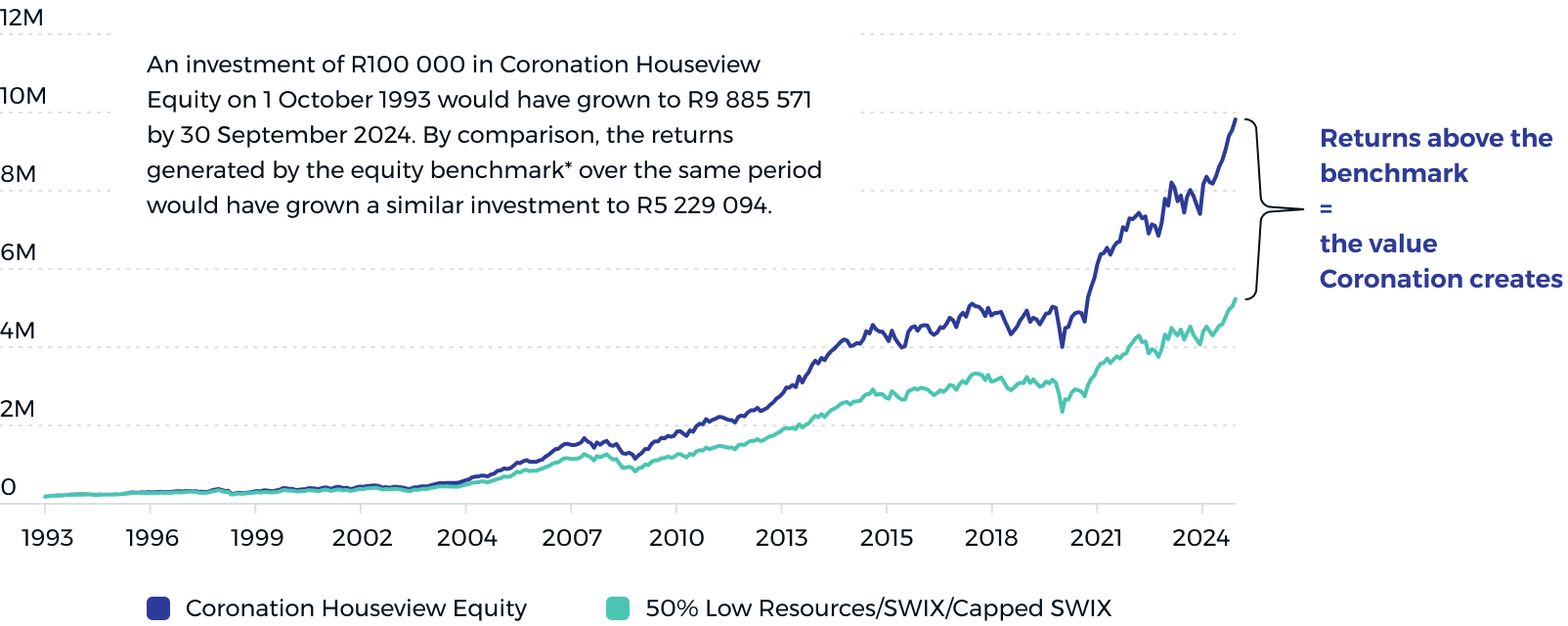

*FTSE/JSE Capped Shareholder Weighted Index from 1 May 2017. Previously 50% Resources (inception to 31 January 2002) and FTSE/JSE Shareholder Weighted Index. (1 February 2002 to 30 April 2017)

of our employees

of our new hires

of our employees

of our new starters

Representing 42% of our total AUM is managed by black investment professionals

B-BBEE contributor as measured by the financial sector code

black IFA practices supported through the ASISA IFA Development Programme

black analysts received financial support to train via the Vunani Securities Training Academy

South Africa-based employees, ownership & AUM as at 30 September 2024.

Enterprise development figures are since project inception.

Back: Saks Ntombela, Neil Brown, Lulama Boyce, Anton Pillay, Madichaba Nhlumayo.

Front: Hugo Nelson, Alethea (Lea) Conrad, Mary-Anne Musekiwa, Alexandra Watson, Phakamani Hadebe.

We integrate material ESG-related risks and opportunities into our investment decision-making process and account for these factors in assessing the long-term value of each of the securities in which we invest.

We engage with investee companies through informed dialogue about the environmental and social impact of their operations, as well as the appropriate governance structures needed to drive long- term business success. Our engagements also explore the effects of external factors on these companies. We advocate for appropriate improvements to mitigate these impacts.

We collaborate with like-minded organisations where we believe that a combined effort will be more effective than individual engagements, including as a means of escalating previously unsuccessful engagement efforts.

We collaborate with industry partners and regulators to promote an investment industry that safeguards the long-term interests of asset owners and benefits the societies in which we operate.

Engagements

Companies

Voting resolutions

Shareholder meetings