Investment Approach

Coronation is an active manager with a single long-term valuation-driven investment philosophy according to which all products are managed. Our portfolios are constructed from the bottom up and based on extensive proprietary research.

Our investment team conducts research across the local South African market, emerging markets, global markets and frontier markets. This research provides the departure point for constructing portfolios with differing mandates, investment universes and risk tolerance. Our portfolios are often concentrated, reflecting our best investment views.

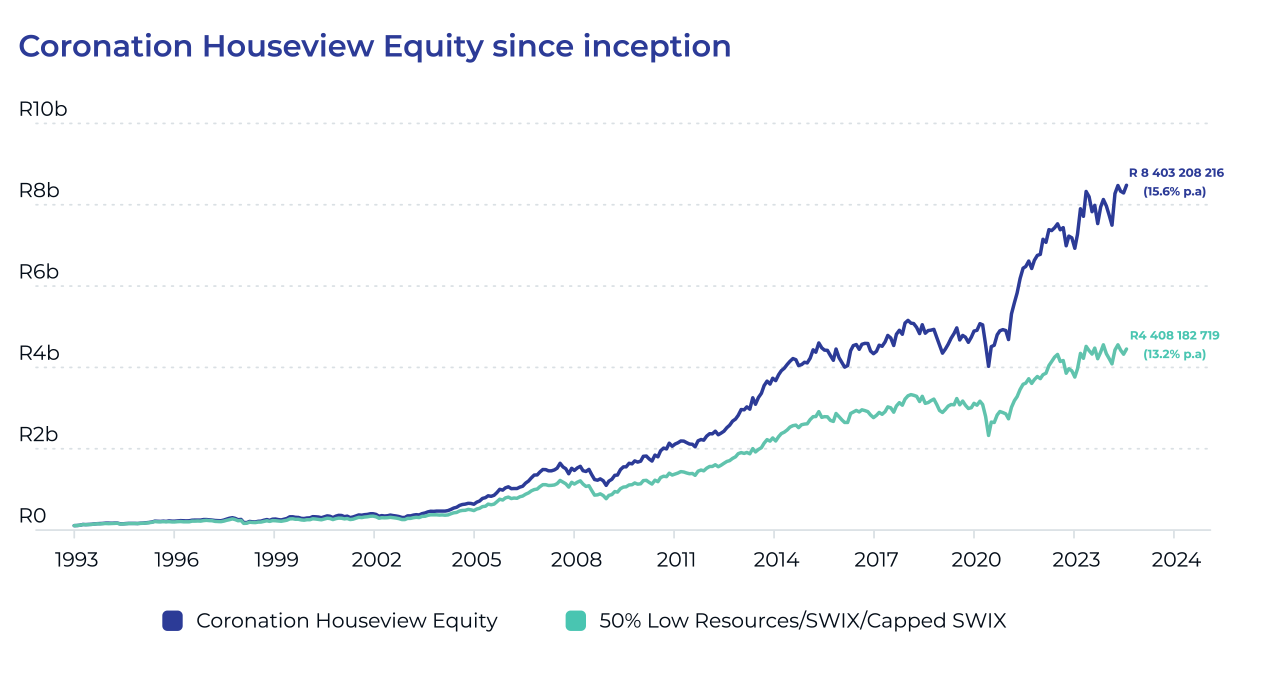

We believe our philosophy and research process is robust and enduring, yet flexible. In periods of unprecedented macro volatility, it has prospered – the acid test of any bottom up, stock-picking investment process. We believe our long-term record of consistent alpha generation is testament to the rigour of our investment philosophy and process. This is demonstrated with reference to the performance of our South African specialist equity strategy (the Coronation Houseview Equity Strategy):

* Growth of R100m investment in the Coronation Houseview Equity Strategy as at end September 2024

Video Channel

Our Approach

The defining feature of our investment philosophy are our long term horizon and commitment to valuation.

Watch VideoResponsible Investment

As stewards of our clients' capital our role is to ensure that the companies in which we invest deliver on their environmental, social and governance responsibilities.

Watch VideoThe performance shown here is for informational purposes only and is meant to demonstrate the performance of Coronation’s longest running strategy. The Houseview Equity Strategy is not indicative of performance that would have been achieved in any other Coronation strategy. Investors should carefully review the materials and disclosures for the strategies they are interested in. The performance shown is gross of fees. Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. The volatility of the CAPI represented above may be materially different from that of the Houseview Equity Strategy. In addition, the holdings in the accounts comprising the Houseview Equity Strategy may differ significantly from the securities that comprise CAPI. The CAPI has not been selected to represent an appropriate benchmark to compare the Houseview Equity Strategy’s performance, but rather is disclosed to allow for comparison of the strategy’s performance to that of a well-known and widely recognized index. The CAPI is constructed in the same way as the JSE All Share Index but constituents with a weight larger than 10% are capped at 10% at each quarterly review. Material facts in relation to the index are available here.

Global (excl USA) - Institutional

Global (excl USA) - Institutional