Investment views

The rise of electric vehicles

A focus on BYD Auto

The Quick Take

- Emergent technology puts companies, such as car makers, on the back foot as they are caught between the need to innovate, but also protect their existing product and profitability

- China dominates the EV space and it will be hard to outpace due to a powerful combination of factors, including cost advantages, scale and know-how

- Protectionism is making it harder for Chinese vehicles to compete in the West

Here in South Africa, many of us are probably weighing up whether our next car will be an electric vehicle (EV) or not. On the plus side, we know it’s the right thing to do for the planet and we may also have some surplus capacity from the newly installed solar panels on our roofs. But on the negative side, with the lack of charging stations and being in a country with a power crisis, we are wondering how we will do the long-distance drives for our annual holidays. And, to be completely honest, we don’t really know where to start looking, as the car brands we know and are familiar with are not the market leaders in the EV race.

This is a classic case of Innovator’s Dilemma – the situation where a new technology comes along, and the incumbent businesses are too slow to react. Initially, the new market is too small to warrant their attention and can easily be ignored. Diverting resources from an already profitable business can significantly lower profits, making it an inherently poor decision. Cannibalising a successful venture with a less profitable one is a challenging move, which is why many corporate executives tend to procrastinate.

However, this delay can be disastrous. Before companies realise it, the world has moved on – like owning a record store in the age of music streaming. Many of today’s auto companies risk ending up obsolete, much like Musica, Kodak, Nokia, and Blackberry.

THE TESLA EFFECT

The successful EV companies are those that don’t have a combustion vehicle business to protect, with the most well-known being Tesla. Whether you love him or hate him, Elon Musk has undeniably revolutionised the entire EV industry. Tesla played a crucial role by pushing the boundaries of innovation and establishing a strong brand halo. Their cars are perceived as both stylish and desirable, which has significantly raised awareness and interest in the EV industry as a whole.

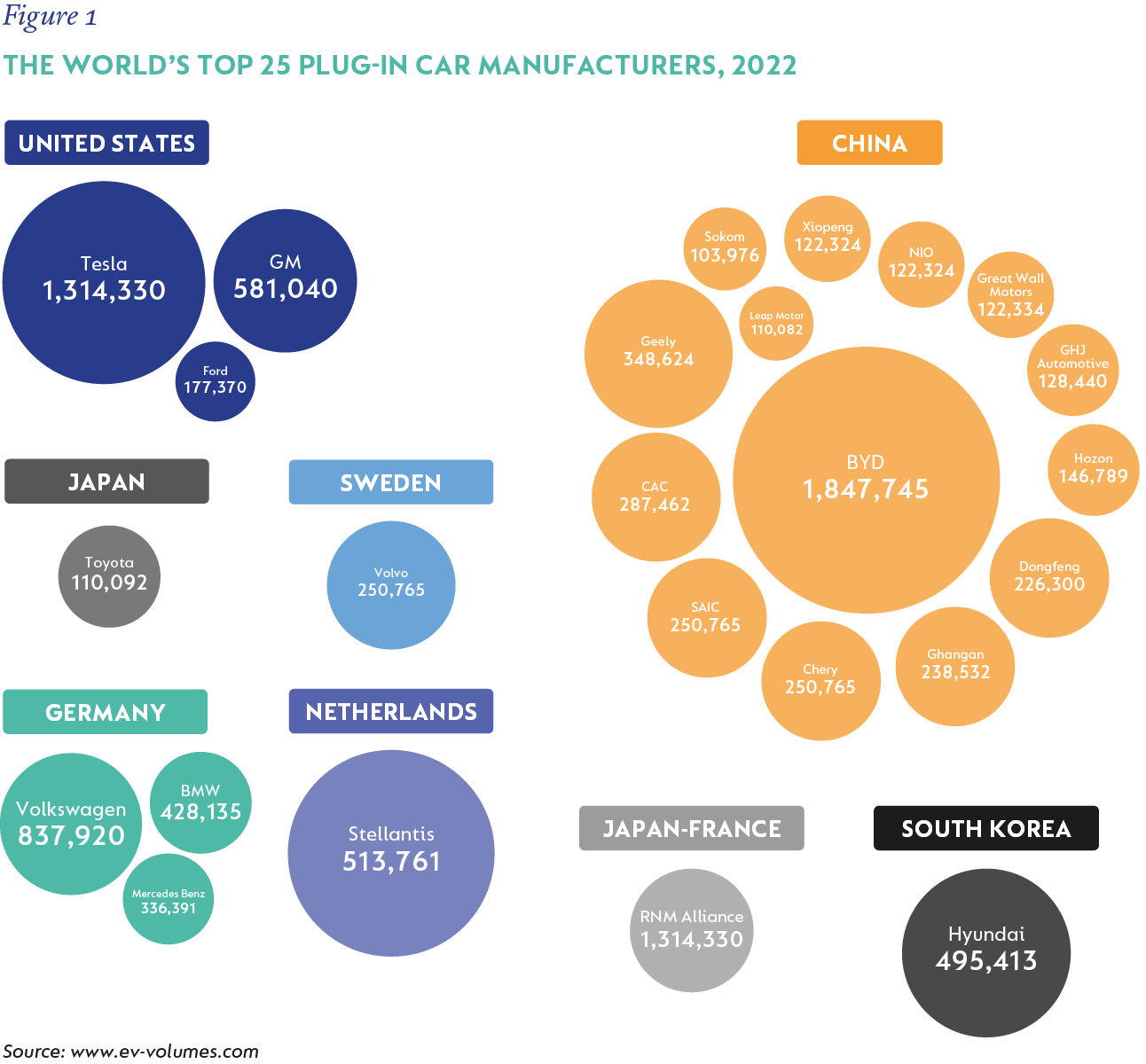

Although Tesla is an American company, most of their cars are produced in their gigafactory in Shanghai. This is because China effectively controls the entire EV supply chain – thanks to early efforts in this nascent industry. Figure 1 shows its significant and ongoing dominance of the EV market.

By the year 2000, China was already a global manufacturing powerhouse, yet they didn’t have a single large domestic vehicle brand. They looked at the vehicle industry carefully, and concluded it would be foolish to try to play catch up in combustion engines – instead, they invested all their efforts in being the leader in EV manufacturing.

In 2009, they initiated financial subsidies to accelerate investment. These subsidies were for both the manufacturing company and the consumer, and served to bolster both the demand and supply side of the equation. Importantly, these subsidies were not just given to Chinese companies, but to all companies investing in the EV industry in China, including Tesla.

To further accelerate adoption, China restricted the number of licence plates available for combustion engines but placed no such restrictions on EVs. And then lastly, China invested heavily in charging infrastructure, now boasting 1 million charging stations throughout the country.

China hasn’t just invested in vehicle manufacturing, though, but in the whole supply chain.

BATTERIES DRIVING CHINA’S DOMINANCE

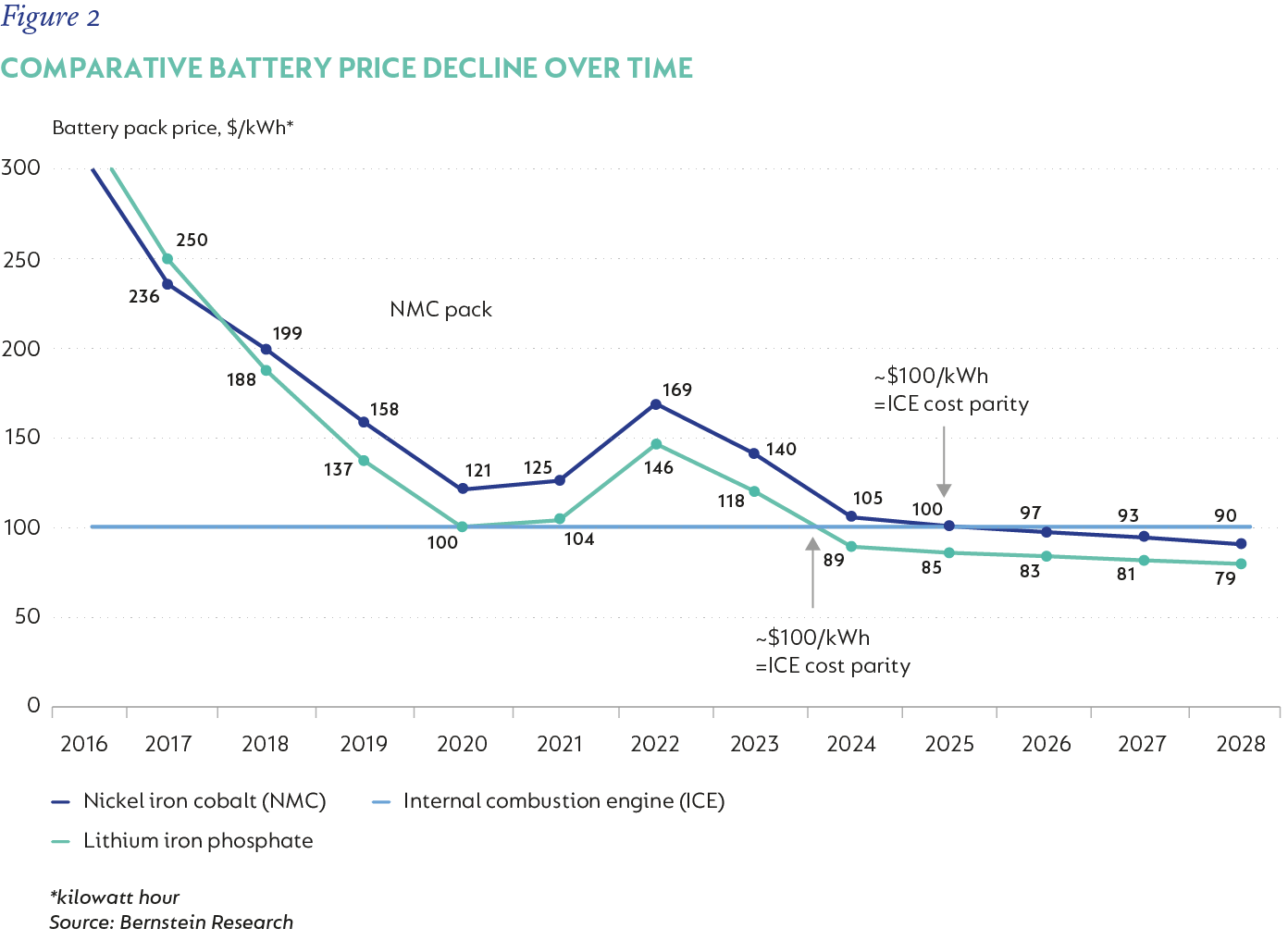

The largest single component in an electric vehicle is the battery, and this is where China is truly dominant. China produces 68% of the world’s batteries and produces between 80%-95% of the components needed to manufacture batteries, including the cathode, the anode, the electrolyte and the separator. Producing the batteries “in-house” gives China a cost advantage relative to other countries. They also largely focus on lithium iron batteries, which are around 15% cheaper to produce than nickel batteries.

Their second cost advantage lies in how efficiently they allocate capital expenditure, which is less than half of that in the EU and less than 40% of that in the US.

These factors, combined with low labour costs relative to the West, and substantial scale, have resulted in the cheapest electric vehicles globally all being Chinese – made by the likes of BYD, Geely and General Motors China.

Figure 2 shows how Chinese EVs have also passed below the critical threshold of ICE cost parity, meaning it is cheaper to own an EV than a combustion vehicle. You aren’t just environmentally friendly by buying an EV in China, it actually makes financial sense too.

The two leaders in the EV race are Tesla and BYD. BYD is the largest, with a 17% share of fully electric vehicles and a significant 35% share of hybrid vehicles globally. They are growing rapidly.

BYD’s success is attributable to four main factors:

- Their focus. BYD only manufactures electric and hybrid vehicles. They are not trying to keep a legacy business alive.

- Their cost advantage. BYD manufactures all their own components, including the battery. They are in fact the world’s second largest battery producer. Their input costs are therefore lower than their peers.

- Their scale. BYD produced three million units in 2023, which is unrivalled. Scale gives them a further cost advantage.

- Lastly, and probably the most important advantage is BYD’s know-how. Their size means they can now spend more on research and development than any other company, further cementing their lead.

Together, these factors give BYD an estimated 15% cost advantage relative to their competitors, allowing them to price cheaper and continue gaining market share, effectively squeezing out the competition.

A key area of their investment has been battery technology. BYD only manufactures lithium iron batteries, which have the advantage of being both safer and cheaper. However, the key disadvantage is that lithium batteries are not as energy dense as their nickel counterparts. This means that you need a much larger battery to power the same car, or the vehicle’s range is going to be much lower.

BYD innovated to solve the problem. They removed much of the packaging in traditional batteries, producing cell-to-pack batteries. And then designed the vehicle so that the battery pack actually forms part of the body of the car. Both of these steps have enabled BYD to take weight out of the vehicle, solving the energy density issue, as lighter vehicles need less power.

As a result, the BYD Han, a fully electric vehicle, boasts a range of over 600 kilometres on a single charge, rivalling many traditional ICE vehicles. The new BYD hybrid vehicles have a range of over 2 000 kilometres, effectively solving the range anxiety problem.

WESTERN PROTECTIONISM

The West is worried about the success of Chinese vehicles and specifically what this means for their own local automotive industries. As a result, both the US and Europe have introduced measures that make it extremely difficult for Chinese cars to compete. In short, the US offers subsidies on cars that are not manufactured in China, and Europe has levied additional import tariffs on cars that are.

With the US and Europe both generally quite hostile to BYD, their expansion has focused on other territories. Their two main hubs outside China are in Brazil and Thailand, serving the Latin American and Australasian markets. The brand has been very well received in these territories and governments have also been supportive.

Within Europe, Hungary has given BYD tax breaks to build a plant that will be operational in 2025, and, recently, BYD has also announced their intention to build a plant in Turkey. These plants will serve BYD’s European needs in the future, whilst allowing them to avoid the additional tariffs.

While BYD currently has a very strong position, new competitors continue to emerge, and this includes tech companies. Both Huawei and Xiaomi have announced EV sedans this year, which are extremely competitively priced, and not much different in aesthetic to a Porsche Taycan. The tech companies undoubtedly have an advantage in software and the infotainment console, but their track record in vehicle manufacturing is poor. In addition, these companies have chosen to focus on higher-end cars, while BYD’s core model line-up is very much focussed on the mass market.

The lower-end market is dominated by two players – Geely and BYD. Geely has, however, chosen to continue investing in both combustion and EVs, which means that they are likely to struggle to remain competitive in the future. Geely’s predicament (the Innovator’s Dilemma) is being acutely felt by many car manufacturers.

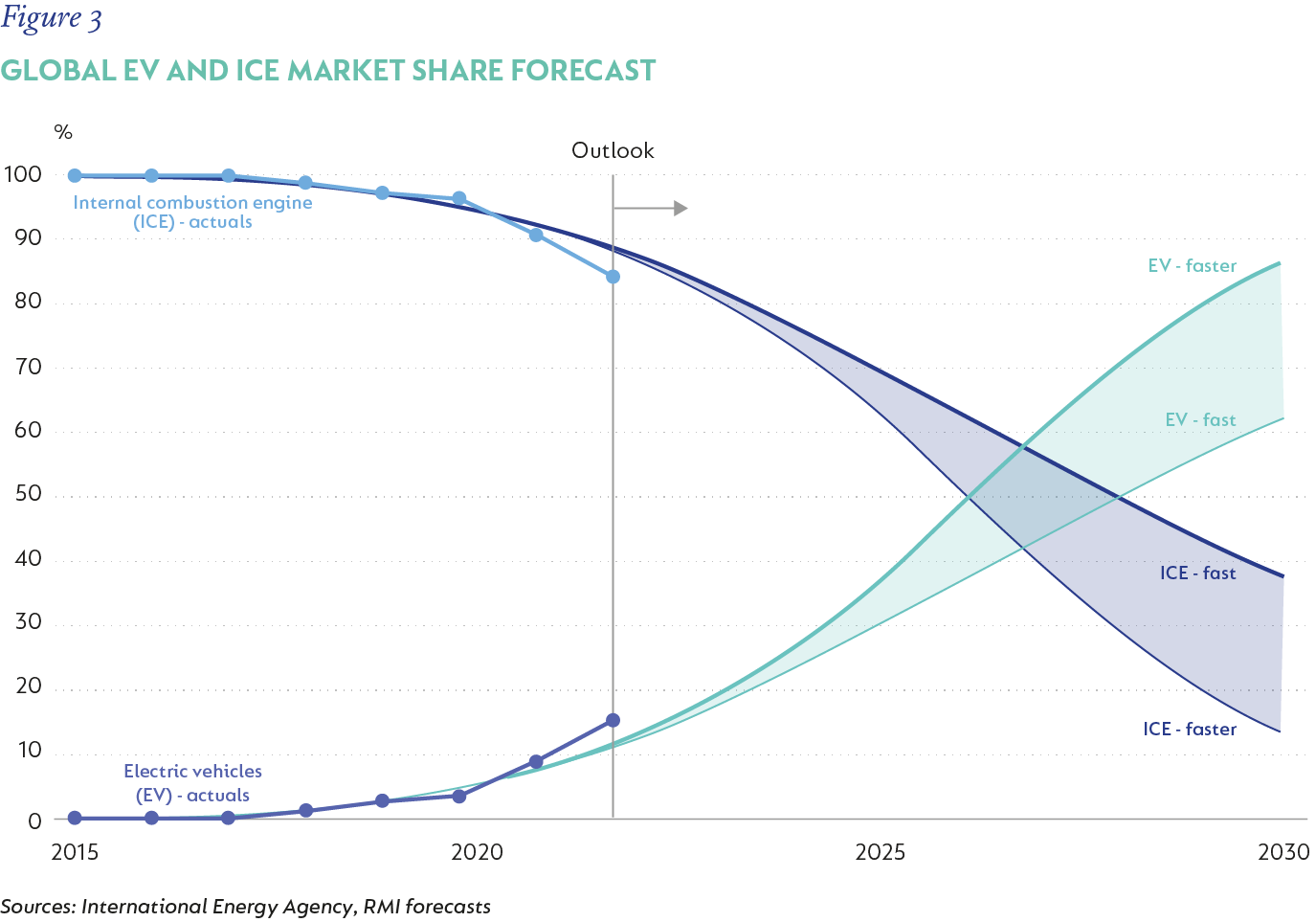

As mentioned earlier, it’s very challenging to actively encourage customers to buy an electric car at a loss when you could be selling a combustion vehicle at a profit. Redirecting marketing dollars to a loss-generating segment is a tough decision for any business. Consequently, many legacy car manufacturers are postponing their shift to EVs. While this may improve their financial statements in the short term, we believe it could be detrimental in the long run. Combustion vehicles have already peaked (Figure 3), and the costs of running combustion vehicle plants will need to be spread over a decreasing number of units, eventually rendering these operations unprofitable. At the same time, insufficient investment in EVs would leave them without a profitable foothold in this emerging market. As a result, many of the vehicle brands we are familiar with today may not survive in the electric vehicle era.

In contrast, we believe BYD is extremely well positioned and will continue to prosper.

Global (excl USA) - Institutional

Global (excl USA) - Institutional