Investment views

Quilter – positioned for growth

In a structurally growing market Quilter offers an attractive investment opportunity

The Quick Take

- The UK retirement arena has undergone significant shifts over the past decade, changing how retirees can structure their incomes

- The UK’s high inflation-high policy rate environment of the past few years has weighed on consumer behaviour

- We believe consumer sentiment is set to improve, driving renewed wealth flows and investment activity

- Quilter is a quality company that is excellently positioned to benefit from the coming change in sentiment, supported by a very attractive valuation

Quilter is a key player in the UK wealth space. Their operations span a tied advisor force; an investment platform servicing its tied agents, as well as independent financial advisors; an investment multi-manager; and a high-net-worth wealth offering.

We continue to believe Quilter is an attractive investment owing to 1) the market they play in being a structurally growing market; 2) Quilter being well placed to win; and 3) an attractive valuation.

WHY DO WE VIEW THE UK MARKET SO FAVOURABLY?

Contrasting the current South African (SA) pension fund landscape with that of the UK’s is instructive. Especially given that 30 years ago, South Africa’s system was dominated by defined benefit funds, closely mirroring that of the UK today. Over this period in SA, the market (excluding the dominant Government Employees Pension Fund) aggressively shifted to defined contribution funds. Today approximately 80% of private pension funds in the country operate as defined contribution funds. This move created a headwind to companies servicing the defined benefit market, namely traditional life insurers; and a tailwind to those servicing the defined contribution segment, such as platforms, asset managers and multi-managers.

In the UK today, c. £1.1 trillion in pension fund liabilities sits in defined benefit funds, while c. £600 billion sits in defined contribution funds. Of note is that 90% of defined benefit funds are closed to new members. Assuming the overall national level of pension fund savings as a percentage of GDP holds, one can expect a materially larger defined contribution market in the decades to come. The introduction of auto-enrolment regulations has further expanded the pension market by increasing the number of employees participating in pension funds. This, in turn, creates a much larger asset pool for Quilter to tap into. While Quilter doesn’t operate directly within the defined contribution pensions space, many individuals consolidate their various pension pots as they approach retirement – a stage where Quilter plays a pivotal role.

A further quirk of the UK market was that, up until 2015, retirees were largely compelled to purchase fixed annuities at retirement. For Quilter, this primarily means engaging with individuals during the accumulation phase of their pensions journey. With the 2015 Pensions Freedoms announcement, government upended the investment landscape, scrapping this rule and giving individuals almost complete freedom in their decumulation product choices. This opened up the floodgate to decumulation flows, with people switching from fixed annuities to living annuities and other flexible drawdown products. This, together with the associated increase in advice complexity, has been an immense tailwind to Quilter’s business.

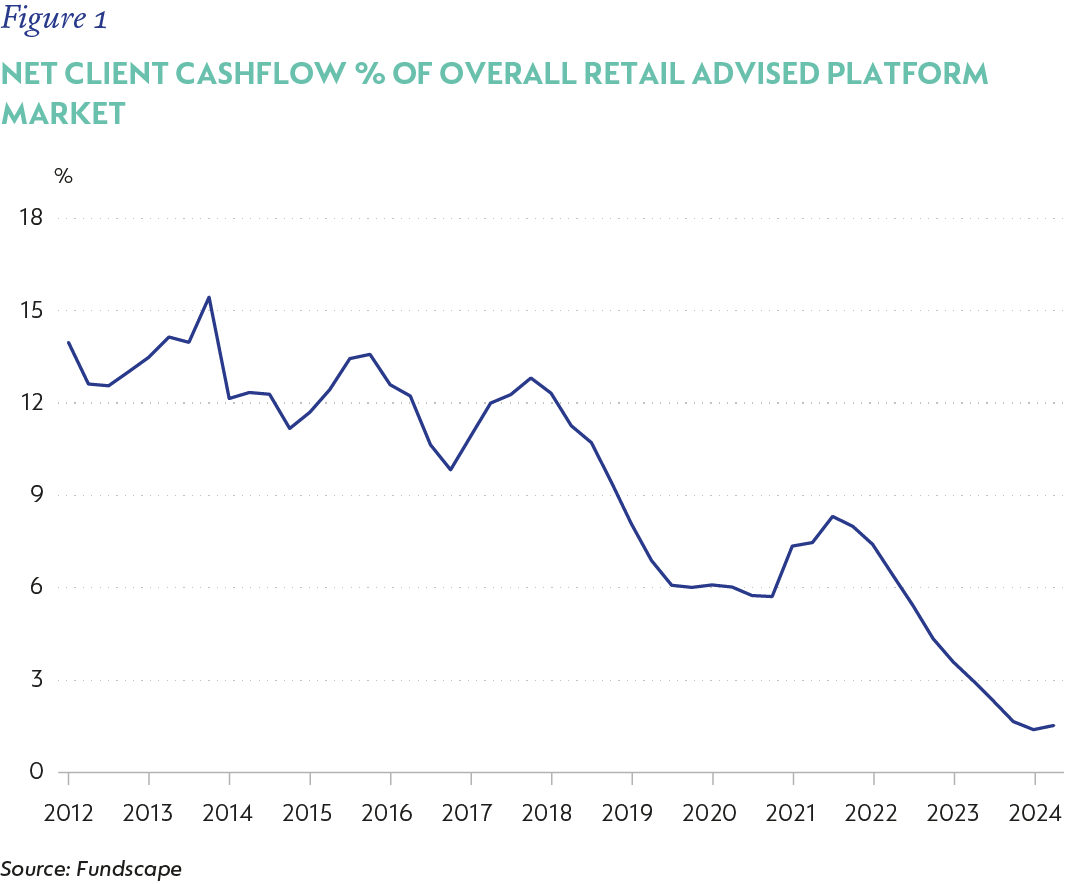

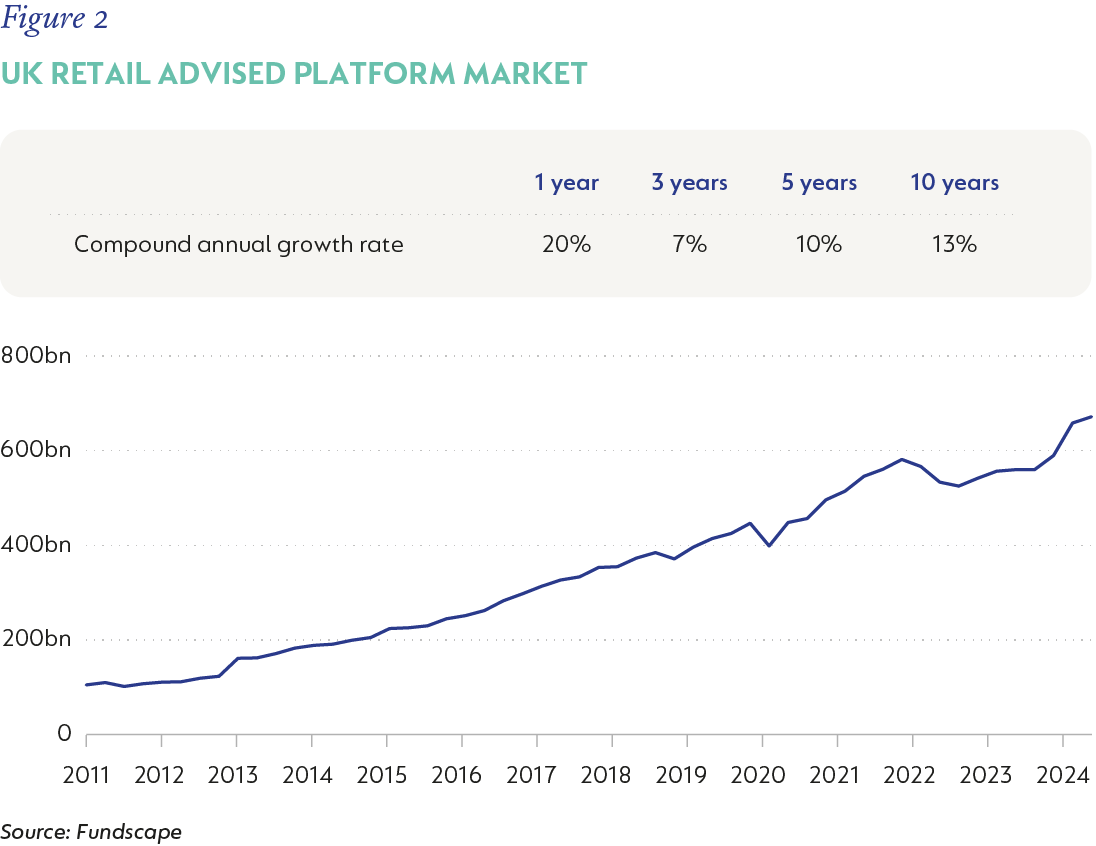

We regard both these strong trends as secular and enduring (illustrated by Figures 1 and 2), which should see above average flows to the industry for a period measured in decades rather than years.

The last three years have seen a marked slowdown in flows activity in the UK wealth space. It is our contention that the slowdown represents a hiccup rather than the end of the secular growth story; which is a large contributor to Quilter’s current attractiveness as an investment.

The years following 2021 were particularly challenging for UK consumers, as inflation surged from under 0.5% to over 11%, and interest rates climbed from near 0% to above 5% between 2021 and 2023. This squeeze on discretionary spend forced consumers to prioritise survival and mortgage payments, significantly reducing wealth flows. High interest rates created an additional headwind, with cash offering a competitive 5% return, prompting many to park their money in the bank rather than invest in equities. Guaranteed annuity pricing was also attractive to retirees, diverting money away from living annuities towards fixed annuities. However, as the interest rate cycle begins to ease and consumer finances recover, we expect a rebound in wealth flows, with growth trends gradually returning to pre-2021 levels.

WILL QUILTER BE A WINNER?

We focus here on the UK wealth platform market, Quilter’s key profit driver and largest source of assets under management.

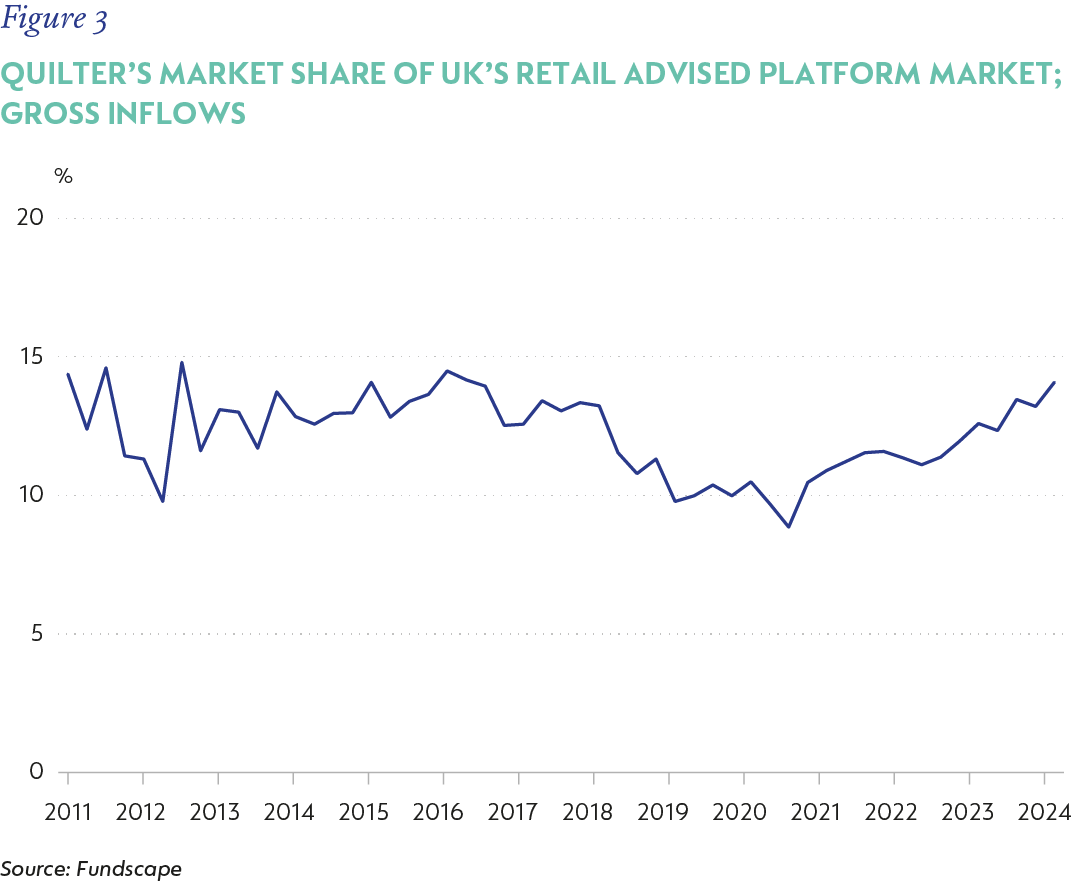

Quilter was one of the first players in the UK wealth platform space. This provided it with scale and incumbency, but also came with the burden of an outdated platform that was creaking at the seams. Quilter’s initial attempt to shift to modernise its platform was famously aborted at a cost of £330 million, before a new provider was selected. The second attempt was ultimately successful. Since early 2021, when the new platform became operational, Quilter has gained meaningful market share (Figure 3). Given the time it takes to convince advisers to shift, coupled with a number of large peers struggling at present, we see Quilter building on this initial momentum and continue to take further market share.

In addition to a new platform, Quilter also has a relatively new CEO in Mr Steven Levin, who we rate highly and have been impressed with his operational delivery in a short space of time.

Lastly, Quilter has shed a number of non-core divisions to go “all-in” on the UK wealth management space. We expect them to benefit from the increased focus.

ISN’T ALL OF THIS GOOD NEWS PRICED IN?

We believe not. Rather, we believe that many market participants have yet to shift their mindset from the low flows environment during the so-called Cost-of-Living crisis to the more buoyant environment we foresee going forward.

UK asset prices in general are depressed. The likely reasons for this include a tougher economic experience on the back of macro factors such as Covid and the Russia-Ukraine conflict, as well as poor sentiment towards the UK on the back of Brexit.

Quilter provides a good example of a company that can grow strongly for a long time despite the overarching country narrative. We believe Quilter offers very good value at 16 times price-to-earnings, and we anticipate strong earnings growth ahead. Should the market fail to fully recognise its value, Quilter presents an attractive acquisition opportunity for any player looking to enter the fast-growing UK wealth management space, thanks to its substantial presence across all key segments of the value chain.

South Africa - Institutional

South Africa - Institutional