Investment views

The new scramble for Africa

How economic reforms and the global race for resources are reshaping the continent’s future

The Quick Take

- Africa’s long-term economic prospects are more promising than they have been in years

- A key driver of this positive outlook is the intensifying competition for economic influence between global powers, particularly the US and China

- Reforms aimed at economic diversification and foreign exchange stability further bolster the outlook

- Several well-positioned companies are poised to capitalise on these opportunities while also advancing the United Nations Sustainable Development Goals (SDGs)

In the heart of Africa, where the lush forests of the Democratic Republic of the Congo (DRC) give way to one of the world’s richest deposits of copper and cobalt, a new battleground has emerged in the global competition for resources. This is not just about mining; it’s about who controls the logistics networks that transport these critical minerals to the world. Here, the titans of global economics – China and the United States – are engaging in a strategic contest over infrastructure and influence.

Africa’s investment landscape today mirrors historical narratives of the "Scramble for Africa", where European powers once divided the continent for colonial gain. Now, in a modern twist, this scramble is a reflection of the competing geopolitical strategies of China and the US, with African nations being beneficiaries of this heightened global interest.

COMPETITION FOR CRITICAL RESOURCES AND INFRASTRUCTURE INVESTMENT

China and the US are locked in an intense race for influence, particularly in securing access to commodities vital for the green energy transition. China has declared a comprehensive strategic cooperative partnership with the DRC, symbolising a deepening of ties with a focus on infrastructure. This includes a commitment of up to $7 billion for infrastructure projects over the next two decades, with a focus on expanding the DRC’s road network to connect key mining regions in the east with ports along the Indian Ocean[1]. This is part of the Sicomines deal, a resource-for-infrastructure agreement that allows Chinese companies to extract copper and cobalt in exchange for financing key infrastructure developments in the DRC. The DRC is the world’s biggest producer of cobalt and the third-largest copper producer[2].

Most recently, the 2024 Forum on China-Africa Cooperation (FOCAC) marked a significant deepening of ties, with China pledging $50 billion for development over three years, focusing on infrastructure, clean energy, and industrial projects. This partnership includes strategic military aid, enhanced political solidarity, and a shift towards sustainable investments. While African nations benefit from less stringent loan conditions, there’s an ongoing debate about the environmental impact and the nature of economic engagements. China’s approach aims to foster a mutually beneficial relationship, positioning itself as a key ally against the backdrop of global power dynamics, particularly in contrast to Western development models.

Meanwhile, the US has made a significant investment in the Lobito Corridor project, a major upgrade of the transportation route that connects the Port of Lobito in Angola with the landlocked and mineral-rich regions of the DRC and Zambia. The project includes the construction of approximately 550km of rail line and 260km of main feeder roads, connecting host countries to global markets and through the Atlantic, securing mineral supply chains and establishing a foothold in Africa’s economic future. A commitment of over $1.6 billion in public and private sector financing, including Public Private Partnerships, has already been made towards this project[3]. As part of a broader trip, President Biden’s visit to Angola in October 2024 focuses on deepening US-African ties, emphasising the Lobito Corridor project. This initiative aims to enhance regional connectivity and trade, countering China’s influence in Africa.

Travelling far further north, Moroccan football is undergoing a transformation through strategic investments aimed at leveraging the sport for national development. The centrepiece is the construction of the Grand Stade de Casablanca, set to be the world’s largest football stadium, alongside other infrastructure upgrades for the 2025 AFCON and co-hosting the 2030 FIFA World Cup, with $2bn of investment earmarked in the build-up to the event.

These events are part of a broader vision to enhance Morocco’s global sports profile, boost tourism, and drive economic growth. Investment also extends to talent development, with initiatives like the Mohamed VI Football Academy nurturing local talent. Morocco’s successful World Cup bid with Spain and Portugal marks a historic moment, positioning it as the first North African nation to host this event and showcasing Morocco’s capability to stage world-class international events.

NAVIGATING THE FAT AND LEAN YEARS

The economic landscape in Zimbabwe, Nigeria, Egypt and Kenya embodies the classic cycle of prosperity and hardship – often described as the seven fat and the seven lean years. Since 2017, these countries have faced challenges in their foreign exchange markets, largely due to internal economic policies, global trends, and geopolitical factors. In response, governments have oscillated between currency controls, devaluations, and liberalisation attempts. Each of these countries has partnered with international organisations such as the IMF to implement economic reforms.

In Nigeria, for example, the fat and lean years played out vividly, with Nigeria’s high oil prices bringing in substantial revenues during the prosperous period. However, poor policy decisions and falling oil prices led to forex shortages, highlighting the consequences of under-preparing for lean times. These lean years forced hard decisions — restructuring debt, reforming policy, and investing in infrastructure — which set the stage for stronger economic growth in the future.

In 2024, Nigeria’s Central Bank (CBN) implemented significant regulatory changes aimed at stabilising the naira and enhancing the foreign exchange market’s efficiency. These included setting price deviation limits for exports and imports at -15% and +15% respectively, aligning with global average prices, to regulate trade-related forex transactions. The CBN also overhauled Bureau de Change operations by introducing new tiers, increasing capital requirements, and enforcing stricter operational guidelines to curb illicit activities. Additionally, banks were mandated to manage their Net Open Position more conservatively, with limits set to prevent excessive foreign currency speculation. These measures reflect Nigeria’s strategy to manage its currency amidst global economic pressures, aiming for a more market-driven equitable forex system while addressing speculative activities and enhancing regulatory compliance.

Significant transformations also occurred in Egypt during the year. In February 2024, the Egyptian government signed a deal to sell the Ras al-Hekma land plot to the Abu Dhabi sovereign wealth fund for $35bn. This put the Central Bank in a very strong position to address the issues in the foreign currency market. In March, they allowed the currency to devalue from EGP31/$ to around EGP50/$. They also raised interest rates by 600bps and announced a $8bn IMF deal[4]. This move cleared the forex backlog, enabling foreign investors to repatriate funds freely at the official exchange rate, which, in turn, has led to an increase in investor appetite.

Similarly, markets across the continent are now being supported by deeper, well-functioning forex markets and heightened investor activity in the form of tender offers and equity raisings[5].

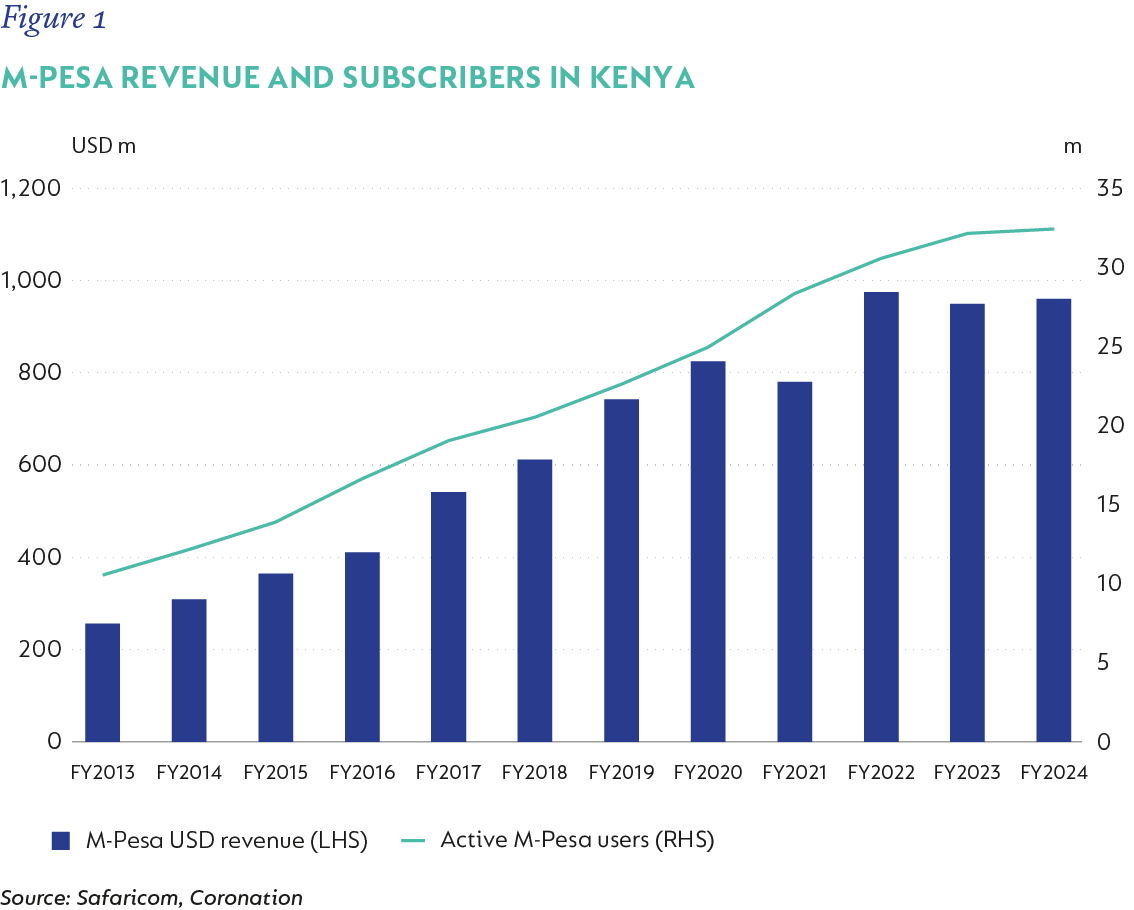

WINNING COMPANIES IN A TRANSFORMING CONTINENT

Amid the competition for resources, associated infrastructure developments and economic reforms, several companies are well-positioned to benefit from these shifting dynamics. The digital revolution is a standout example, particularly mobile money services. Safaricom’s M-Pesa in Kenya has radically transformed financial inclusion, with its active user base growing from 10 million to 32 million users over the past decade – now reaching 60% of the Kenyan population (Figure 1). M-Pesa generates approximately $1bn in revenue annually. This trend is evident across the continent. For example, 45% of Ghana’s population now uses MTN’s mobile money service, and in Egypt, where 70% of the population is unbanked, people are rapidly adopting digital banking solutions. Vodafone Cash in Egypt demonstrates this well. Their active user base grew by more than 50% each year over the past four years. Opportunities created by these developments form part of the investment case for several of the companies that we hold on behalf of clients.

Companies like Zimplats are capitalising on the commodity boom with projects such as their PGM (Platinum Group Metals) upgrade. In 2021, Zimplats announced a $1.8bn investment plan that has led to a 12% increase in production volumes over the past two years. The project also enhances Zimplats’ environmental sustainability through investing in solar power and the construction of a sulphur dioxide abatement plant. This not only enhances local production but also integrates African resources into global industrial supply chains, driving economic resilience and growth.

Investing in Africa presents not just financial opportunity but also a chance to create a positive social and environmental impact. Safaricom and Zimplats are both examples of companies that are making significant contributions to the United Nations Sustainable Development Goals (SDGs). These are not just investments in technology and mining, but also in access to healthcare services, better education opportunities, access to clean water and other social and environmental goals (Figure 2).

BUILDING A MORE RESILIENT ECONOMIC FUTURE

Across Africa, countries are making tough decisions to pave the way for the next period of sustained prosperity. Countries such as Kenya and Morocco are positioning themselves as regional economic hubs by prioritising good governance, technology investment, and regional trade. The pivot towards digital economies is particularly evident in mobile money services like M-Pesa, which have driven financial inclusion and created new economic opportunities.

Africa is witnessing a notable upsurge in economic momentum, fuelled by a combination of internal reforms, increased global interest, and strategic investments that hint at a promising economic trajectory after years of persistent challenges. The continent’s economies are projected to grow, showcasing resilience and recovery. This growth is underpinned by enhanced private consumption, declining inflation, and strategic investments in key sectors like technology, energy, and infrastructure, driven partly by international involvement. From South Africa to Egypt, new business-friendly policies are attracting investments and boosting market performance. African markets are becoming increasingly attractive, underscored by compelling valuations. Capital inflows are rising, not only from commodities but across a broad range of sectors, fuelled by strategic international partnerships and a growing interest in the continent’s economic potential.

This convergence of factors is positioning Africa as an increasingly attractive destination for global investors seeking growth in emerging markets. The continent’s economic narrative is evolving – from one centred on survival to one defined by burgeoning opportunity and sustainable development.

[1] The State Council of the People's Republic of China (www.gov.cn)

[2] Chinese companies to invest up to $7 billion in Congo mining infrastructure | Reuters

[3] AfDB join partners to finance for US$1.6B Angola's Lobito Corridor - FurtherAfrica

[4] Egypt Devalues Currency, Hikes Interest Rates But Will Reforms Stick? | Global Finance Magazine (gfmag.com)

[5] Tinubu begins reforms in Nigeria with naira devaluation (african.business)

Global (excl USA) - Institutional

Global (excl USA) - Institutional